ECONOMIC OUTLOOK

PATH TO RECOVERY

Shiran Fernando analyses the sensitivities surrounding the economic outlook for 2023

Sri Lanka has endured poor economic growth for more than a few years – and 2022 is expected to record the worst GDP contraction in its history. The economy contracted by 7.1 percent in the first nine months of 2022 with the full year’s figure expected to be between eight and nine percent.

A shortage of essential goods and services owing to the lack of dollars as a result of the sovereign debt crisis manifested itself in economic activity slowing down. Inflation also surged in 2022 with food inflation peaking at almost 95 percent and headline inflation reaching nearly 70 percent.

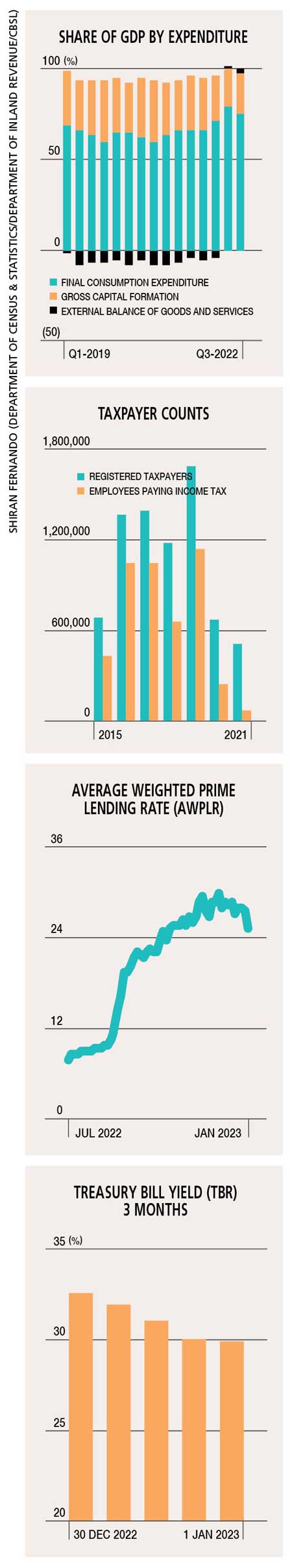

NET EXPORTS Despite the economic crisis, exports were a bright spot – from a net export (i.e. exports less imports) point of view – and contributed to growth for the first time in the second and third quarters of 2022. This is expected to be the same for the fourth quarter of last year.

With a focus on managing imports at current levels, such a trend can continue in 2023 if exports don’t fall sharply due to a slowdown in key markets.

INVESTMENT In 2022, most businesses were either in a ‘watch and wait’ situation or survival mode as the macroeconomic environment worsened and interest rates shot up to 30 percent since the investment climate wasn’t favourable due to uncertainty surrounding the political situation.

As a result, investment was a key drag on growth with government spending on infrastructure slowing down. This applied to the private sector as well.

This trend can reverse in 2023 if dual factors come into play.

One is the positive environment created by the potential formalisation of the IMF programme, and because it will be a catalyst for support from other multilateral and bilateral lenders.

This will send a signal to investors that Sri Lanka is on the road to reform and the worst is over. In such a scenario, many assets will look attractive, given the devaluation of the currency and ideal baskets to invest in from a return-risk perspective.

The second factor is the impact that a decline in interest rates will have on investment. At present – with interest rates at 25-30 percent – the medium to long-term investment prospects seem unfavourable.

Businesses, particularly SMEs, are finding it difficult to refinance their working capital at these high rates. For most businesses that are leveraged on debt, revenue streams or cash flows are being used to repay interest costs. This difficulty can be eased with the gradual lowering of interest rates.

In the first four weeks of this year, three-month Treasury bills declined from 32.6 percent at the end of 2022 to 29.9 percent by the fourth week of January. Similarly, the Average Weighted Prime Lending Rate (AWPLR) fell from 27.2 percent to 25.2 percent during the same period.

If the AWPLR falls below 20 percent and settles at 15-17 percent in the first half of 2023, it will provide a positive impetus for investment and eventual growth.

CONSUMPTION While exports and investment should be the key drivers of long-term sustainable growth, consumption in the near term will be a key factor given that household consumption accounts for 60-65 percent of GDP.

With increases in the cost of living, aggregate demand declined and consumption fell in 2022. However, the falls in the second and third quarters of last year were not as steep as the overall decline in GDP, highlighting a more resilient consumer sentiment than one would think.

This year will see fresh challenges for consumers with the revised tax regime – although it probably wouldn’t be as steep as most are expecting it to be. This is due to the fact that less than 15 percent of the working population will pay direct taxes such as Pay As You Earn (PAYE) or income tax.

In 2019, under the previous tax regime – where the threshold was above Rs. 100,000 for monthly income to be taxed – there were 1.1 million tax files, which is around 13 percent of the working population.

Following the revisions in 2021, the number of tax files reduced to a mere 67,687. This erosion of the tax base was a key trigger for the economic crisis. The adoption of a more stringent tax regime will no doubt have its difficulties for households but it is a requirement to widen the net to at least 1.5 million tax files.

As consumers adjust in the first half of the year to direct and indirect tax hikes, household consumption will likely contract. However, with the easing of inflation and interest rates, there will be a bounce back commencing in the second half of 2023.

Growth will also be supported by sectors such as agriculture and tourism, which were impacted negatively over the past few years. There are already positive signs for these sectors.

Leave a comment