ECONOMIC OUTLOOK

EXTERNAL HEADWINDS THREATEN DOMESTIC ECONOMY

Shiran Fernando picks the key takeaways for the year ahead

Year 2016 was another period of adjustment for the domestic economy amid more policy inconsistency and changes in the world economy. In particular on the latter, we’ve seen how traditional outcomes and odds have been defied with the Brexit vote and the US presidential election outcome.

Both on the local and global front, there are many moving pieces in 2017 that make predicting the outlook a difficult exercise. But there’s reason to be optimistic as the domestic macroeconomic picture takes a turn for the better.

FISCAL TAKE While the general public and certain industries may feel the pinch from specific budget measures, Budget 2017 is fiscally responsible in relative terms compared to recent years.

The VAT debacle has demonstrated how difficult it is to plod along by increasing tax collection through indirect taxes. Therefore, the shift in focus in most revenue proposals has been to collect more taxes from direct measures such as the revision of corporate, withholding and PAYE taxes that will constitute 43 percent of the projected additional government income in 2017.

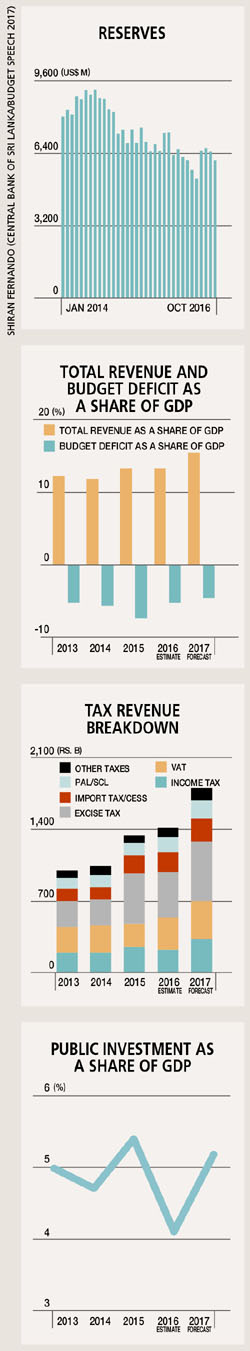

FOCAL POINTS The success of Budget 2017 will require careful implementation, which is an aspect that Budget 2016 lacked. And non-implementation could further backtrack reform that is anticipated through the International Monetary Fund (IMF) programme. While the emphasis is on the budget deficit of 4.7 percent of GDP, it is more prudent to foresee growth in tax revenue this year. This is because public investments (i.e. capital expenditure) can be reduced significantly during the course of a year to meet budget deficit targets.

This has been a historical practice, as seen in Budget 2016 when we saw a repeat of it with the forecast for public investment being 6.9 percent of GDP, and the estimated figure in the latest budget being revised down to 4.1 percent of GDP for 2016.

It remains to be seen if the estimate of 5.2 percent of GDP for 2017 will be realised this year or downgraded further to meet the deficit target.

STABILITY Setting Sri Lanka’s fiscal trajectory on track is a key priority to ensure macroeconomic stability. Both the rise in interest rates – with monetary policy being tightened by the Central Bank of Sri Lanka (CBSL) – and currency adjustments since September 2015 highlight the impact that fiscal and external imbalances have caused.

A more fiscally responsible budget that places emphasis on revenue generation augurs well for balancing the pressure of borrowing to finance deficits.

IMF REVIEW Although the Government of Sri Lanka secured a US$ 1.5 billion Extended Fund Facility (EFF) arrangement from the IMF, there are periodic reviews that determine the disbursements from this facility.

With the country passing the first review in mid-November, the IMF released US$ 162.6 million of the facility, bringing with it a drawdown of 325.1 million dollars since the programme was approved on 3 June last year.

The review stated that Sri Lanka’s performance so far was “broadly satisfactory” and acknowledged that the country was experiencing a period of “challenging circumstances.” According to the IMF review, the reintroduction of VAT amendments and new income proposals will help strengthen revenue mobilisation.

RESERVES A key aim of the IMF programme is for the CBSL to build up its dollar reserves. Since August 2014, reserves have been very volatile – ranging from a high of US$ 9.2 billion in August 2014 to a low of 5.2 billion dollars in June 2016.

Since the IMF programme was secured and with the successful issue of the dual-tranche 1.5-billion-dollar sovereign bond in July 2016, Sri Lanka’s reserves increased to US$ 6.6 billion by end-August 2016.

But due to debt outflows in the next two months, reserves fell to six billion dollars by 31 October 2016. This trend has been highlighted by the IMF with the review statement mentioning that reserves were “below comfortable levels.”

THREATS While the domestic story is looking more positive compared to recent years, the quest for stability could be derailed by what goes on in the external environment, in particular in the light of political and policy uncertainty in the US. There are other uncertainties that could also arise such as the fallout from the Brexit vote.

In the lead-up to the US Federal Reserve meeting in December – with speculation over a policy rate hike, which eventuated – emerging market inflows to local debt markets turned into outflows for most countries. Inflows are crucial to ensure that there is less pressure on a currency to depreciate at a time when foreign direct investments and bilateral loans are slowing down.