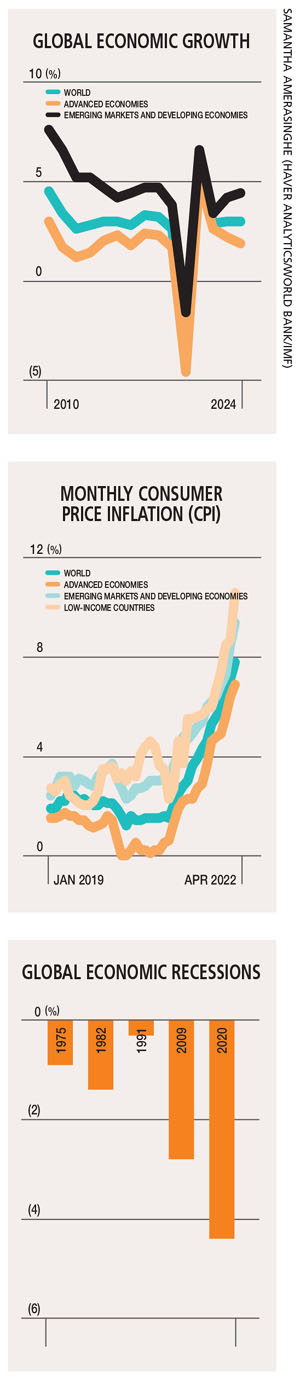

ECONOMIC MELTDOWN

MOUNTING RISK OF RECESSION

Samantha Amerasinghe weighs the lead up to an imminent recession in the US

The spectre of recession is once again rearing its ugly head… and Google searches for ‘recession’ are soaring. It seems that almost no one believes that the US economy can achieve a soft landing in the face of the current inflation battle.

In his testimony to Congress in June, Chair of the US Federal Reserve (Fed) Jerome Powell observed that the path to a soft landing is becoming “more and more challenging,” and bringing down inflation without driving up joblessness will be “significantly more challenging.”

Boom and bust cycles have been inescapable for capitalist economies in general but some countries have fared particularly well in avoiding busts over the past few decades. For example, Australia experienced the longest run (almost 29 years) of economic growth by any country in modern history until the pandemic led to a huge contraction in 2020.

And while Australia didn’t go into recession for almost three decades, the US had two. The first was mild – it was brought about by the dotcom crash and 9/11 terrorist attacks. However, the second was the devastating Great Recession of 2007/18, better known as the global financial crisis. America has suffered 12 recessions since 1945.

There are several commonly used definitions for a recession. It is often described as two consecutive quarters of declines in quarterly real (inflation adjusted) GDP or monthly business cycle peaks and troughs designated by the National Bureau of Economic Research (NBER), and used by economists to define periods of expansion and contraction.

Despite rumours about an imminent US recession, unemployment remained historically low at 3.6 percent in early July and job growth was strong. However, America’s track record is ominous.

As former US Treasury Secretary Larry Summers opines, whenever inflation rises above four percent (it’s now at a 40 year high) and unemployment dips below four percent – indicating that the economy is running hot – the US suffers a recession within two years if these thresholds are breached.

The pandemic, supply chain disruptions and the Russia-Ukraine war have led to a dark turn in animal spirits. Fear and pessimism abound, and tremendous uncertainty has crept into decisions that are based on our animal spirits – decision making on investments, savings and spending.

According to the Keynesian school of thought, the solution to temper the animal spirit is for the government to step in with fiscal stimulus that will provide the confidence needed to get the economy chugging along again.

Clearly, the mood and consumer sentiment began to improve when governments worldwide stepped in with huge fiscal stimulus rescue packages to stabilise the economy.

Nonetheless, consumer sentiment (at its lowest level in over a decade) and animal spirits have not recovered to pre-pandemic levels in large part due to the persistence of the pandemic, supply chain problems, global instability and inflation.

Other economists believe that government mismanagement of the economy is the cause of recessions rather than animal spirits per se. There is a growing chorus that fiscal policy has been stoking global inflation amid mounting recession concerns.

The Fed has in the past been blamed by economists for causing the Great Depression due to its pursuit of tightening monetary policy at a time when it should have printed money, rescued banks and stabilised the economy when the stock market crashed.

Once again, many are blaming the Federal Reserve for mismanaging the country’s money supply and leading it down the recession path. President Joe Biden’s US$ 1.9 trillion spending package (American Rescue Plan) could well have been the trigger for jumpstarting inflation in an already overheated economy.

But to be fair, it was difficult to predict how the economy would fare during the pandemic. Nevertheless, now that the inflation genie is out of the bottle, the Fed will be compelled to raise rates even further to a level that curbs spending and sparks a recession.

Other experts argue that governments are not responsible for the current economic malaise and point to supply side shocks (another historic source of recessions) as the main culprit. The pandemic itself has been a huge disruptor and lockdowns in China continue to hurt manufacturing. Furthermore, the Russia-Ukraine conflict and fallout in energy markets has also caused massive disruption.

If it isn’t already here, the warning signs are flashing that a recession is near. Darkening animal spirits, hawkish Fed policy, COVID-19 uncertainty and high oil prices all signal that a recession is looming, despite low unemployment and continued job growth.

It seems a fair bet that interest rates will climb quite a bit higher with more hawkish policy makers hinting that the central bank will need to increase rates to 3.5 percent by the end of this year.

Just how high rates may go is anyone’s guess. So Americans need to fasten their seatbelts because a bumpy recession ride is approaching.

Leave a comment