CRUDE OIL MARKET

BLACK GOLD UNDER PRESSURE

Samantha Amerasinghe analyses the global demand and supply scenario for oil

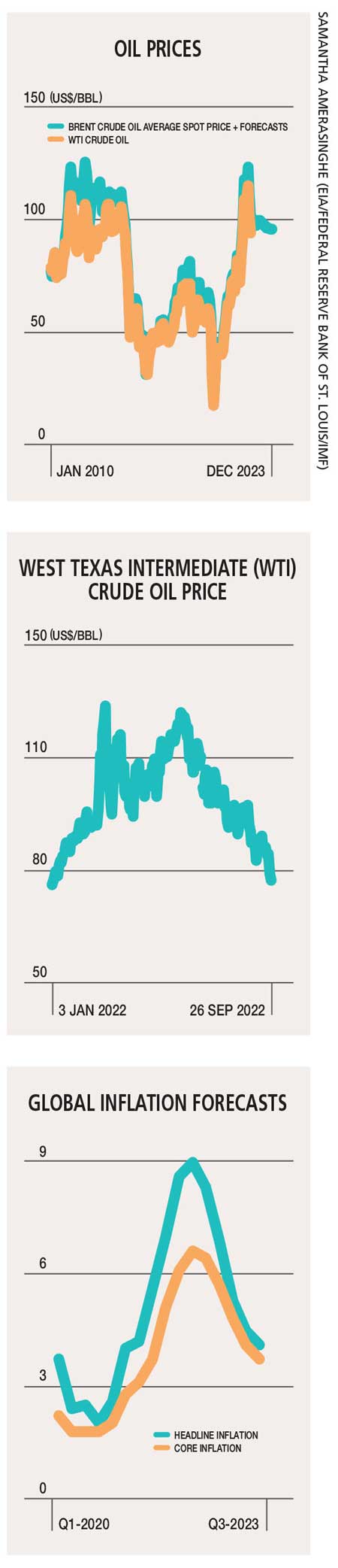

The price of oil tumbled in September amid fears of a global recession, which presented new challenges for the international market. When Russia invaded Ukraine earlier this year, energy experts predicted that the price of oil could reach US$ 200 a barrel. But prices have been lower than when the war began – after dropping more than 30 percent in barely two months and retreating to below US$ 100 a barrel in September.

Let’s consider the upside and downside risks to oil prices, and assess the outlook for 2022/23.

Many factors – such as the extent of production cuts by Russia (the world’s second largest oil producer) and major OPEC members, impact of the G7 oil price cap, and prospect of a nuclear agreement with Iran – are pulling oil prices in different directions.

The war in Ukraine has disrupted the global market with EU sanctions banning Russian crude set to begin in December along with a plan by G7 countries for a Russian oil price cap to tighten supply. The European Union has banned imports of all seaborne Russian crude oil and petroleum products, which make up 90 percent of the bloc’s current oil imports from Moscow.

Furthermore, interest rate increases by central banks in many oil consuming countries to curb inflationary pressures have raised fears of an economic slowdown that could hurt demand for liquid gold.

So persistent headwinds from surging inflation and shrinking financial conditions worldwide remain a significant downside risk for oil demand.

The Institute of International Finance (IIF) has projected that oil prices may hold steady at around 90 dollars a barrel in 2022 and decline slightly in 2023.

However, upside risks include larger than expected OPEC production cuts next year, a substantial reduction in Libya’s oil production should violence escalate and Moscow’s threat to reduce the sale of oil to the EU in retaliation to the European Union’s plan to cap Russian crude oil prices.

Downside risks to prices include the rapid pace of growth in US oil production, potential renewal of the coordinated release of petroleum from strategic reserves (which expires in November) and an impending agreement on a new nuclear deal with Iran.

The agreement could increase Iran’s oil exports to the market by about 1.5 million barrels a day (mbd) in a few months but hopes have receded following the recent response from Iran and an immediate US rejection.

Weaker than expected demand indicates that the oil market is likely to remain in surplus for the remainder of 2022 and early next year, and this will limit the upside in oil prices. Given that inventories are at historically low levels, prices will likely remain elevated.

Limited OPEC spare capacity and uncertainty over how Russian flows will evolve once the EU ban comes into full force should also limit the downside in the medium term.

It isn’t surprising that Russian oil production has proved resilient this year despite the sanctions. To some extent, this is due to the redirection of oil supplies not being constrained by existing pipeline infrastructure – unlike natural gas. Russian oil production has been rising, following modest declines in the first quarter of this year.

While sanctions on Russia cut off 1.8 mbd of oil imports to Europe, the US and Japan, it was able to increase its oil exports to India, China (the top importer of oil) and Turkey by 1.4 mbd.

Its exports of oil to India, at heavily discounted prices, surged in the second quarter of 2022 to about US$ 14 billion. Russian oil imports by China also increased, accounting for a third of Russia’s oil exports in the second quarter this year.

In 2023, Russia may face more challenges in exporting oil. This is because in early September, in an effort to limit the upward pressure on global oil prices, G7 countries agreed to place a price cap on Russian crude and petroleum products.

However, the cap may not be too detrimental as several major oil importers in Asia could simply sidestep it by choosing to import Russian oil outside the G7 price cap mechanism.

As global oil faces headwinds, the IIF expects growth in global demand for crude oil to be 1.9 mbd this year, of which 0.8 mbd is related to the substitution between natural gas and crude oil.

In 2023, even with a modest increase in substitution from natural gas to oil, global demand growth could decelerate to 1.6 mbd. Most European countries are likely to increase their use of oil in power generation by raising their oil imports from the US, Canada, Kazakhstan, Norway, and Iraq.

Nevertheless, the projected decline in demand for oil by most advanced economies could be partly offset by an increase in imports by China (supported by the expected expansionary monetary and fiscal policies), India and other major emerging economies.

Leave a comment