COVER STORY

STATE OF BUSINESS

THE LONG ROAD AHEAD

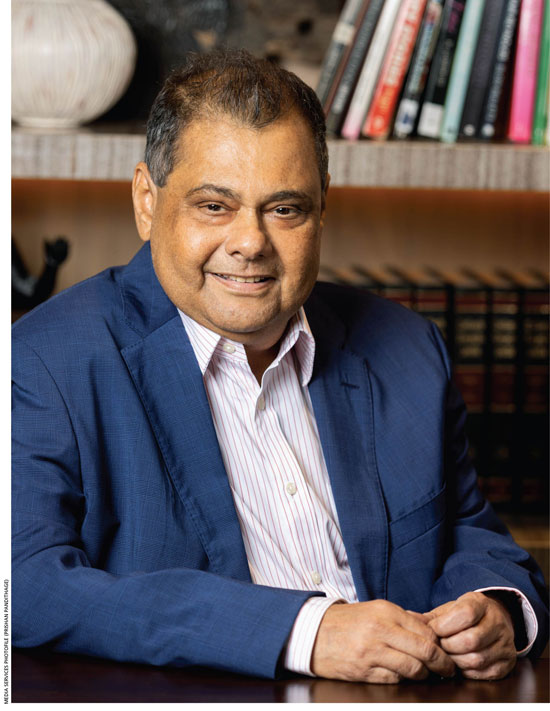

Having played a part in the family business since its inception Behman (Tito) Pestonjee has been instrumental in the Abans Group’s growth over the years. He is credited with overseeing its expansion from one store to more than 500 across Sri Lanka through his leadership of the conglomerate’s operations division among others.

As Managing Director of the diversified group today, Pestonjee manages its sourcing, marketing and sales functions, as well as business partnerships – and he is known to exude a management style that revolves around pragmatism and execution. Additionally, he serves as a director of many of Abans’ subsidiaries.

Pestonjee was conferred an Order of Merit by the South Korean government in 2018 in recognition of his efforts in the retail arena, and maintaining bilateral relations between the East Asian nation and Sri Lanka.

He notes that Abans continues to operate with the vision of its founder – his trailblazing mother Aban Pestonjee – as its guiding principle by empowering customers and stakeholders to enjoy a better way of life.

In today’s environment, this encompasses the latest cutting-edge technologies, and energy efficient and environmentally-friendly products, as the group looks to become more lifestyle oriented going forward.

In this exclusive interview with LMD, Pestonjee points the way towards an economic revival and the island’s long-term prospects.

Pestonjee also sheds light on the challenges impacting business – such as high interest rates, taxation, inflation, currency volatility and political instability – as well as the need to ensure sustainability and pursue overseas expansion.

– LMD

“Due to prevailing interest rates, carrying excess inventory could drive retail pricing to uncompetitive levels and reduce demand further”

Q: In your assessment, what are the imperatives as far as Sri Lanka’s economy is concerned – meaning, what steps need to be taken for us to head in the direction of an economic revival in the medium term?

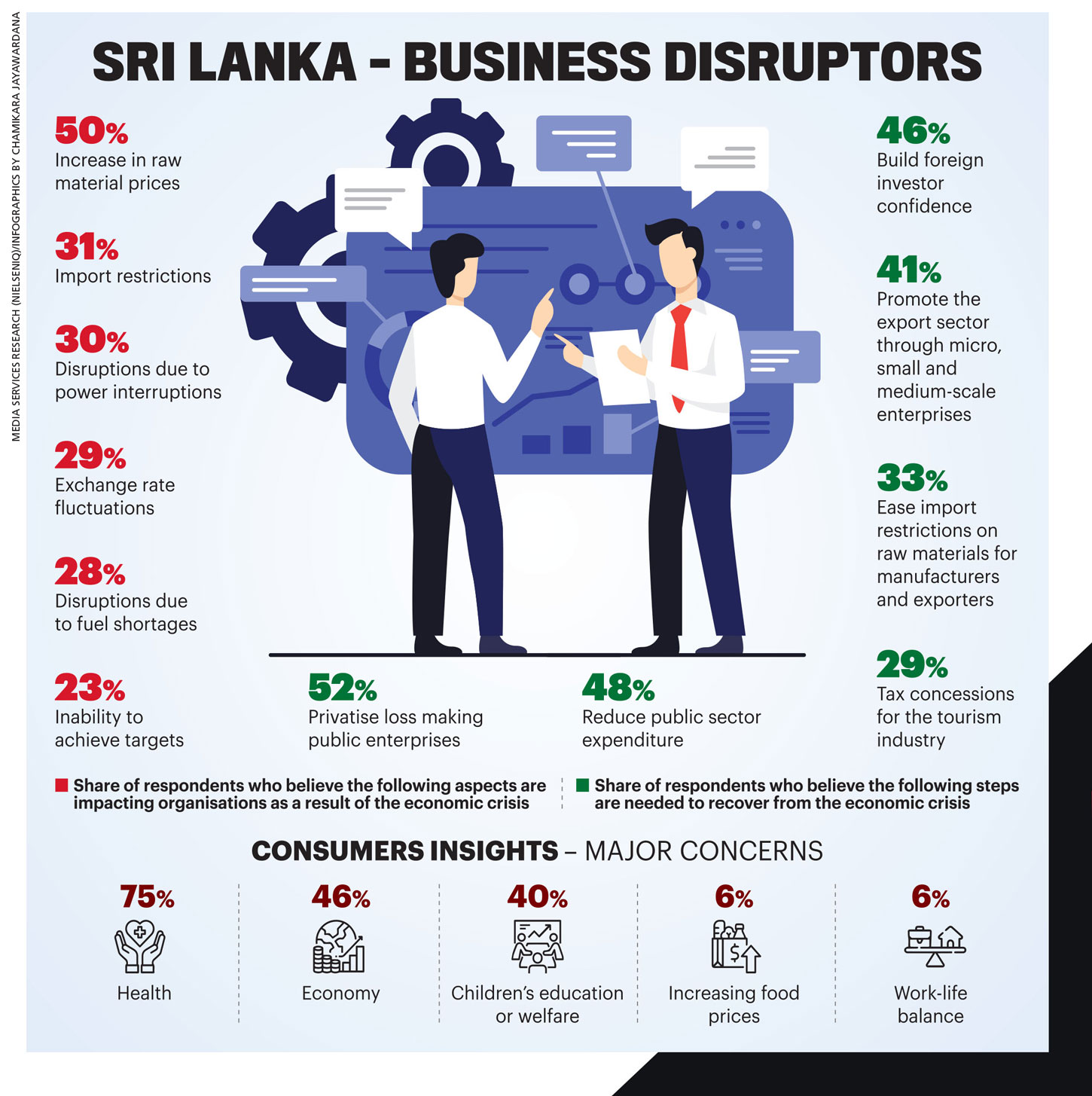

A: Sri Lanka is certainly in the midst of a crisis and economic revival is key for businesses to stay afloat. The consumer durables sector and apparel industry have been badly hit due to the downturn with temporary restrictions on all categories of imports except mobile phones and IT products.

The depreciation of the Sri Lankan Rupee, the foreign exchange crisis, a sharp spike in interest rates, inflation climbing to 80 percent year on year not long ago and the fuel crisis, as well as substantial hikes in duties, surcharges, taxes, and corporate and personal income taxes, have considerably increased operational costs of doing business in the country.

Well thought out long-term policies and political stability are the need of the hour to build positivity within and outside Sri Lanka.

Q: How are high interest rates, taxation and inflation affecting business – especially in the context of diversified groups such as Abans?

A: The cost of goods has increased by up to 80 percent compared to the previous year in most categories. Operational costs have more than doubled, which has led to a sharp fall in demand.

The Abans Group invested substantially in modernising retail space, building mono-branded stores, opening large stores in luxury malls, running shops across the country and backward integrating with large manufacturing facilities with the expectation of recovering its investments over five years.

However, this has changed drastically with the sharp decrease in demand.

Our expansion plans and investments were frozen over the past 12-18 months, and we don’t see such investments coming into the business in the short and medium terms.

Q: What steps do importers need to take to ensure business sustainability in the prevailing environment, given the restrictions that have been in place, currency volatility and political instability?

A: Importers need to be extremely cautious about external factors and the macro environment. ‘Sell-through’ quantities have declined substantially and in some cases, the drop is more than 70 percent year over year.

Due to prevailing interest rates, carrying excess inventory could drive retail pricing to uncompetitive levels and reduce demand further. Both the depreciation and appreciation of the rupee significantly impacts importers in terms of profitability with pricing formulas having to change frequently.

Inventory sold on cash, credit and hire purchase terms may lead to substantial losses as these goods would have been passed on to third party resellers and end consumers.

“With the improved political and financial stability over the past six months, the consumer goods sector may be able to recover to an extent in the second half of this year”

Q: What expectations do you have for the consumer goods sector, and where do you see it heading in the second half of this year and beyond?

A: The government needs to consider lifting temporary suspensions on imports soon so that the consumer goods sector can move forward. Given the 120 day window for goods to move through the supply chain to reach retail outlets, orders must be placed immediately for the next Christmas season.

With the improved political and financial stability over the past six months, the consumer goods sector may be able to recover to an extent in the second half of this year – although the real turnaround would only take place after 2024 with an improvement of the macro environment.

Q: How about city tourism and the hospitality sector in general – what trends are you seeing, and what’s the outlook for Colombo and Sri Lanka in general?

A: For the tourism industry and hospitality sector to improve, the government must ensure a continuous supply of fuel and uninterrupted electricity.

Many hotels across the island are in need of electronics, appliances and air conditioning as they were not operational for nearly 36 months – especially properties along the coast. But due to the import restrictions, they are unable to cater to this need.

And with the tourism industry taking off, rural markets will begin to have a better money supply and see a much needed improvement in disposable incomes. Along with improvements in the market come business tourism and traveller centric improvements, which are urgently needed for Colombo’s star class and business traveller hotels to return to some sort of normalcy.

“For the tourism industry and hospitality sector to improve, the government must ensure a continuous supply of fuel and uninterrupted electricity”

Q: How can Sri Lanka improve its ease of doing business ranking in order to attract investors – what are the most urgent needs?

A: The country must remove red tape to avoid corruption, establish firm long-term policies and formulate a proper GDP growth strategy.

Q: A growing number of businesses, both large and small, are expanding their footprint to offshore markets in the hope of mitigating the impact of the multiple crises here at home. How do you view this scenario, and what are the pros and cons of pursuing expansion overseas?

A: Expanding to overseas markets suddenly is easier said than done – especially in the consumer durables retail sector.

Entering many South Asian markets can be very challenging due to market dynamics, backward integration, brand principal policies, local government restrictions and moving investment funds overseas.

But in the longer term, expanding to overseas markets is a must for local companies to diversify the risk of doing business in one market.

Q: How is the e-commerce sector faring and how is your group taking advantage of the shift in buying patterns especially among the likes of Generation Z consumers?

A: E-commerce has witnessed a major decline in the number of transactions in the aftermath of the pandemic and as markets open up once again.

Given that Sri Lanka’s market is small, and access to stores is much easier than in many large economies such as India, China and the US, customers tend to keep visiting stores.

And with the road network improving in the country, many luxury malls coming up and the modernisation of retail spaces, even the younger generation tends to visit stores after conducting extensive research online.

As a retail company, we’re continuously driving towards an omni-channel strategy to ensure that we offer customers a seamless experience both online and offline.

“In the longer term, expanding to overseas markets is a must for local companies to diversify the risk of doing business in one market”

Sri Lankans young and old tend to seek better offers and substantial discounts rather than convenience when purchasing online. I believe this is the reason for the shift to e-commerce not taking place as anticipated. These characteristics are common among many other developed smaller markets such as Singapore and Hong Kong as well.

Q: As far as the labour force is concerned, where are we? What steps should the private sector take to cushion itself against the brain drain and the needs of the younger generation?

A: The brain drain can’t be abated until the country’s economic situation stabilises. Presently, the private sector faces many challenges with key and non-key staff moving overseas.

Recruiting replacement staff with little or no experience is becoming extremely expensive. To ensure business continuity in the future, businesses will need to push towards digitally transforming every aspect of their organisations. All manual processes need to be completely automated for businesses to work with a much lower head count at the same level of efficiency.

The private sector will have to invest substantially in retaining talent by absorbing the income tax increases, and providing higher transport and fuel allowances, and through pay increments.

“The brain drain can’t be abated until the country’s economic situation stabilises”

Q: And last but not least, how do you view Sri Lanka’s long-term prospects? Are you hopeful – and if so, why?

A: My family has done business in this country for more than five decades, and seen many dips and spikes in the economy during this time. As in the past, Sri Lanka will emerge from this crisis – and we’ll certainly see better prospects in the medium and long terms.

Sri Lankans have been very resilient, put our past behind us and moved forward with positivity. In the past, when Sri Lanka came out of the war, tsunami and other natural disasters, the market improved significantly for a considerable period of time.

As a businessperson, I will always push towards future-proofing the organisation to face challenges while remaining relevant to customers.