COVER STORY

TECHNOLOGY IS KEY TO DIVERSIFICATION

Over the past decade, the tea industry has navigated diverse challenges. The 2015 ban on glyphosate, though lifted subsequently, had ripple effects in critical markets such as Japan and impacted high grown tea production.

Thankfully, initiatives are underway to rebuild confidence in the Japanese market since it is crucial for Sri Lanka’s high grown tea.

The Middle East, particularly Iraq, remains a significant market for low grown teas. Despite sanctions, Iran shows promise through an oil for tea barter agreement. In Europe, a discernible shift towards flavoured and herbal teas is impacting traditional tea consumption. And the preference for iced tea limits demand for high quality teas in North America, which is a major tea importer.

Sri Lanka faces intense competition, notably from Kenya, which is the world’s largest tea exporter. Climate change, labour shortages and the recent ban on chemical fertilisers further challenge the industry.

Chairman of the Sri Lanka Tea Board Niraj De Mel provides a comprehensive overview of the outlook for the tea industry, and sheds light on key markets and emerging trends that are shaping its trajectory.

Consumer preferences in tea are undergoing a notable transformation particularly among the younger generation, says De Mel. He notes: “Efforts to promote Ceylon Tea are geared towards capturing the attention of global youth. Current consumers often view it simply as tea, regardless of origin.”

Drawing inspiration from the success of marketing wine, Ceylon Tea is being positioned as a versatile beverage that’s suitable for different water compositions worldwide.

He explains: “To showcase tea diversity, a strategic emphasis is being placed on teas from specific regions such as Nuwara Eliya and Dimbula. The goal is to present Ceylon Tea not simply as a beverage but an experiential product with a rich history and distinctive flavour.”

Acknowledging challenges arising from changing consumer habits, De Mel underscores the need for collaboration among tea producing countries. “The industry must unite to promote tea as a standout beverage in a market crowded with diverse options such as water, milk, beer, soft drinks and coffee,” he says.

In discussing advancements, De Mel notes the influence of countries such as Japan and China on progress in tea varieties, packaging methods and innovative presentation.

“Sri Lanka’s tea exporters often import cost-effective and visually appealing Chinese packaging materials. While preferring local packaging, Japan has seen an increase in packaged tea exports from Sri Lanka due to rising costs,” he points out.

In terms of tea varieties, the Tea Research Institute (TRI) has played a pivotal role.

He explains: “Extensive research has led to the development of new varieties, transitioning from the initial 20 series to the current 5000 and 6000 series. These varieties are adapted to diverse environmental conditions while ensuring resilience to changing weather and soil characteristics, and balancing quality and productivity.”

As for sustainability initiatives, De Mel advocates for the implementation of cutting-edge technology from overseas to improve productivity and address worker shortages.

“The current approach is quite inadequate – especially on tea plantations and in factories. There is a critical need for the adoption of more advanced technology in both the tea fields and processing facilities,” he says.

De Mel also acknowledges limitations arising from the prevalence of online tea sales and impact of e-commerce especially in overseas markets.

“The challenge lies in the economic viability of courier services compared to the value of tea. Despite slow progress on online consumer sales, the tea auction system has successfully transitioned to an electronic platform,” he points out.

Summing up, he notes: “While challenges persist in key markets and consumer preferences, the industry is adapting to emerging trends, advancements and sustainability initiatives with a focus on securing the future of the global tea market.”

MYRIAD AVENUES TO PROMOTE TOURISM

The Sri Lanka Tourism Development Authority (SLTDA) is strategically promoting the island’s cultural richness and diverse offering; it is promoting themes such as the sea, nature, wildlife, heritage, culture and wellness.

Sri Lanka’s compact size and varied attractions position it as an ideal destination for international travellers with different preferences and durations of stay.

Chairman of the SLTDA Priantha Fernando highlights several key aspects of the island’s tourism strategy: “Sri Lanka is being promoted in myriad ways that include 17 or 18 diverse themes such as sea, sun, sand, nature, wildlife, heritage, culture and wellness. Notably, there is a significant emphasis on marine tourism.”

With approximately 52,000 rooms, the hospitality sector plays a crucial role. Acknowledging its role, Fernando says the aim is for a “phased approach, accommodating a mix of tourists including high end travellers, backpackers and leisure visitors.”

He adds: “Notably, these high end properties are performing exceptionally well with some boutique establishments commanding prices above US$ 500 a night. This demonstrates healthy occupancy rates.”

Sri Lanka is dedicated to environmental conservation and sustainable tourism. The country acknowledges the importance of prioritising sustainability and emphasises its commitment to preserve, conserve and manage natural resources effectively.

Sustainable tourism units have been established in all provinces, and they work to benefit local communities including fishermen, farmers, and small and medium-size enterprises. Plans to develop over 5,500 attractions underscore Sri Lanka’s dedication to sustainable practices.

And efforts are underway to promote visits by tourists to historical landmarks with a particular focus on sustainability initiatives.

Fernando notes: “Sigiriya, which is a popular tourist site, is preparing to become the first certified sustainable destination. Challenges associated with over-visitation are being addressed through comprehensive management strategies to regulate the flow of visitors and sustain an ecological balance.”

SLTDA also recognises the promising prospects for adventure tourism – especially in tourist source markets such as Australia and Europe.

“Strict guidelines for adventure service providers focus on safety measures. Despite the active promotion of diverse adventure offerings, limited insurance coverage for certain activities has been duly noted – and discussions with insurance companies are underway to provide comprehensive coverage for adventure tourists by the end of the year,” he assures.

Meanwhile, the Sri Lanka Tourism Promotion Bureau (SLTPB) is actively leveraging digital marketing and social media, to engage influencers and travel bloggers. Fernando explains that “after a 15-year hiatus in digital marketing, a recent global campaign that focusses on inclusivity is targeting nine identified markets initially.”

He adds: “The strategy aims to extend to emerging markets and utilise digital platforms for widespread impact. Plans to host 1,000 influencers and bloggers throughout the year highlight the recognition of third party endorsements in promoting the destination.”

After a 15-year hiatus in digital marketing, a recent global campaign that focusses on inclusivity is targeting nine identified markets initially

EMPOWERING THE SME SECTOR

The Federation of Chambers of Commerce and Industry of Sri Lanka (FCCISL) stands as a beacon of support for Sri Lankan businesses, playing a multifaceted role in advancing their interests and bolstering competitiveness in the global arena.

President

Federation of Chambers of Commerce and Industry of Sri Lanka

Through a range of initiatives and programmes, FCCISL directly impacts over 25,000 business units, representing a diverse array of sectors across the country – it counts a nationwide membership of 63 chambers of commerce and business associations in all 25 districts of Sri Lanka.

FCCISL’s President Keerthi Gunawardane says: “FCCISL plays a crucial role in the issuance of Non-Preferential Certificates of Origin (COO) to Sri Lankan exporters. Non-Preferential COOs certify that goods being exported originated from a particular country without implying any preference or special treatment in trade agreements.”

The chamber’s process encompasses authorisation, verification, issuance, support and guidance. “Overall, FCCISL plays a pivotal role in facilitating the export process for Sri Lankan businesses by issuing non-preferential Certificates of Origin, thereby enabling them to access international markets and comply with trade regulations,” says Gunawardane.

FCCISL plays an active role in advocating for policies and regulations that favour local businesses, by way of direct representation and advocacy.

He explains: “Through direct engagement with government bodies and policymakers, FCCISL lobbies for favourable trade agreements, tax policies and regulatory frameworks. By disseminating crucial information and updates directly to member businesses, the chamber ensures that its constituents remain informed and empowered to make strategic decisions.”

“Moreover, FCCISL facilitates networking opportunities and industry-specific events, providing a platform for businesses to forge valuable connections and collaborations,” he adds.

Recognising the importance of continuous learning and development, FCCISL offers a plethora of training programmes and workshops, which are geared towards enhancing the skills and capabilities of local businesses.

“Covering areas such as technology adoption, innovation, quality management and export procedures, these initiatives equip businesses with the tools they need to thrive in an ever-evolving landscape,” Gunawardane elaborates.

Facilitating market access and promoting international trade opportunities are central tenets of the chamber’s mission, he notes: “Through trade missions, exhibitions and business delegations, FCCISL helps Sri Lankan businesses showcase their offerings on the global stage, expanding their reach and fostering international partnerships.”

“Additionally, by engaging with international organisations and foreign chambers of commerce, FCCISL advocates for the interests of Sri Lankan businesses in the global arena, opening doors to new avenues of growth and collaboration,” he adds.

FCCISL also places a special emphasis on fostering entrepreneurship and supporting small and medium-size enterprises (SMEs).

“From startup incubation programmes and mentorship schemes, to access to funding opportunities and advisory services, FCCISL provides a comprehensive support system tailored to the needs of SMEs, empowering them to navigate challenges and scale their businesses effectively,” he affirms.

Gunawardane continues: “Overall, FCCI- SL’s initiatives and programmes are aimed at empowering businesses of all sizes and sectors, fostering economic growth and contributing to the development of a vibrant and dynamic business ecosystem in Sri Lanka.”

At its core, he assures that the chamber is committed to driving economic development and prosperity for Sri Lanka.

“Through rigorous policy research, analysis and advocacy, FCCISL strives to shape policies that are conducive to business growth and development. By addressing systemic challenges, promoting innovation and advocating for a conducive business environment, FCCISL contributes to the overall economic well-being of the nation,” Gunawardane asserts.

In essence therefore, FCCISL serves as a steadfast ally and an advocate for Sri Lankan businesses, working tirelessly to empower them, facilitate their growth and enhance their competitiveness in the global landscape, paving the way for a brighter and more prosperous future for all.

Overall, the FCCISL plays a pivotal role in facilitating the export process for Sri Lankan businesses by issuing non-preferential Certificates of Origin

DIVERSIFY TO ENTER HIGH END MARKETS

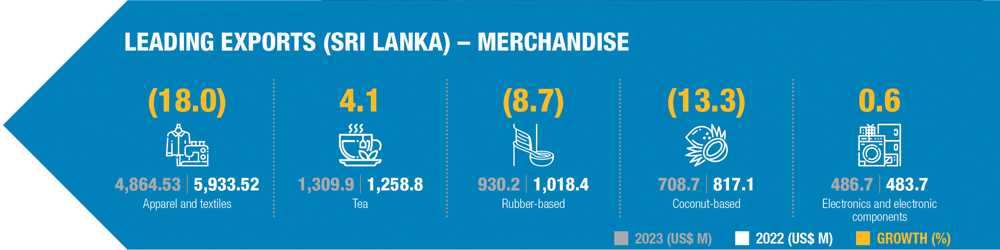

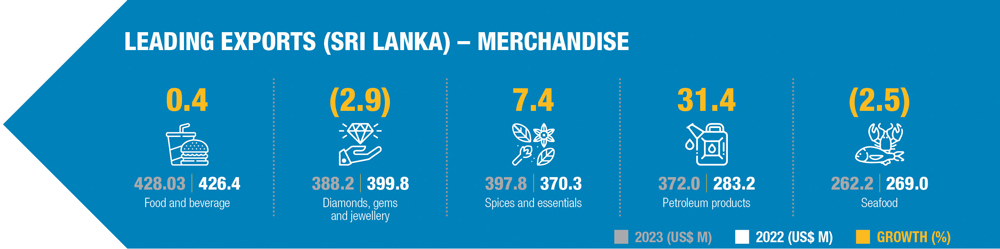

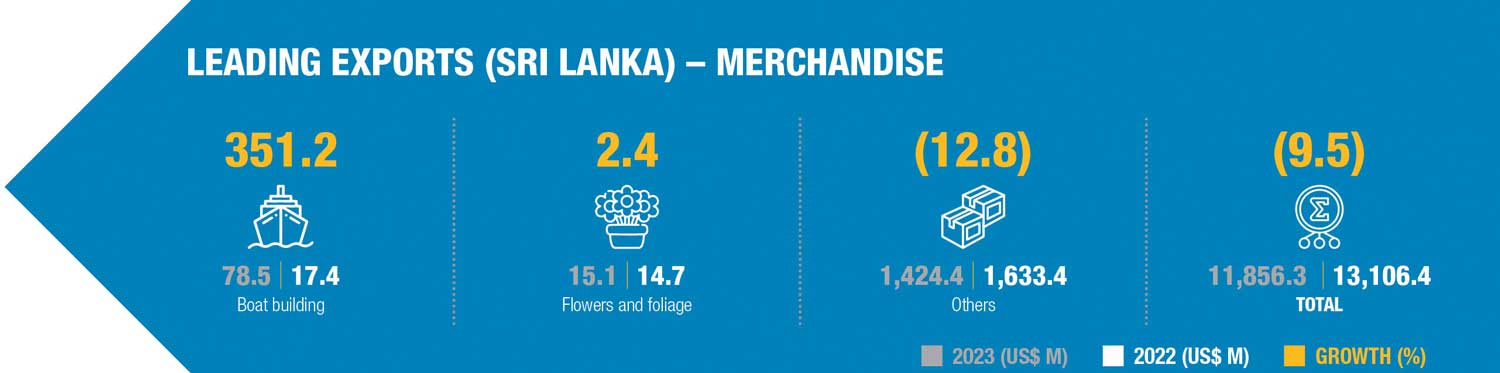

Sri Lanka’s export sector is dominated by tea and garments; they account for 60-70 percent of total exports. However, there is a pressing need for diversification into the high end electronic and equipment markets, where demand and profit margins are higher.

Chairman

Ceylon Chamber of Commerce

The lack of progress in diversification has led to a major foreign exchange problem for Sri Lanka. To enter high end markets, the country faces challenges in terms of technology acquisition, R&D and financial investments.

Chairman of the Ceylon Chamber of Commerce Duminda Hulangamuwa says: “Sri Lankan companies may find it challenging due to the associated costs and lack of technological know-how. One suggested approach is to begin manufacturing components for high end products such as automobile parts and electronic components, as a more feasible and less resource intensive entry point.”

Despite the historical success of export promotion zones in the late 1970s, he points to the lack of specific export policies and consistency among various governments.

He notes: “Every government talks about improving or expanding exports at the basket. But we are unable to reach the high end of exports. Entrepreneurship is required for that locally. People must take risks, and collaboration is necessary between foreign and local investors.”

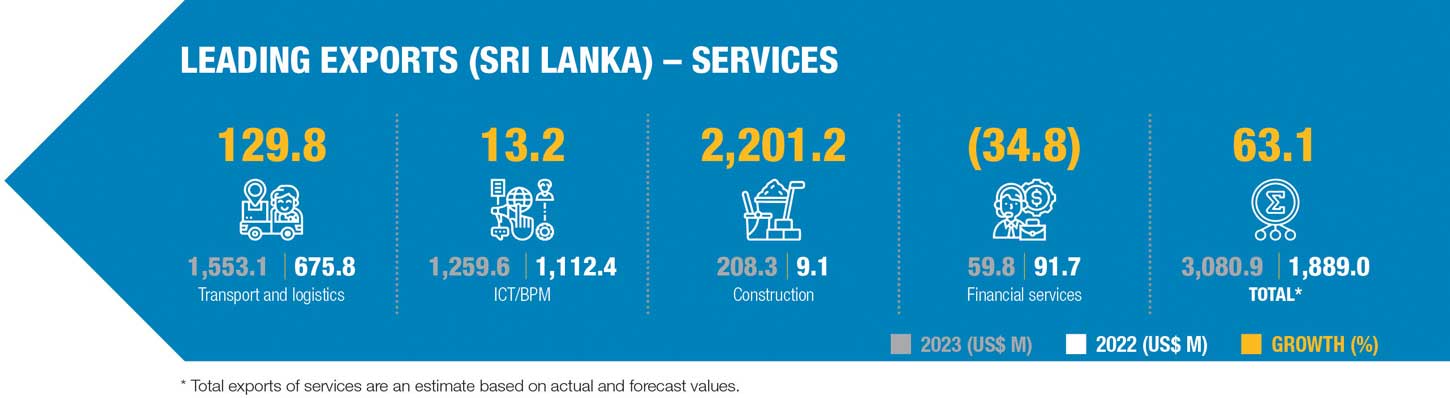

Hulangamuwa underscores Sri Lanka’s potential in the export of services especially in business process outsourcing (BPO) and leveraging the country’s large pool of accountants. He also cites the potential of shipping and logistics along with tourism.

He explains: “Sri Lanka’s advantage is largely in the export of services. We must work on encouraging more BPO operations in the country. And we have a large number of accountants in Sri Lanka who can earn dollars, and earn the same salaries they’d get if they work overseas. And we’re very good at shipping and logistics.”

“And of course, the biggest potential Sri Lanka has is the export of tourism. Your subject is ‘Made in Sri Lanka’ and I believe that tourism is very Sri Lankan for me,” he adds.

Hulangamuwa recommends starting by manufacturing components before progressing to full-scale production of high end products such as electronics where a long-term strategy and substantial investments are deemed necessary.

He says: “Despite past successes in opening the economy, the current challenge is to leapfrog into high end markets that require strategic investments, technology acquisition and collaboration with foreign investors.”

Hulangamuwa underscores the importance of leveraging trade agreements for cost advantages in international markets and notes the success of the free trade agreement (FTA) with India. He says that an “equal footing in trade agreements with partner countries is crucial.”

The chamber actively supports businesses entering new international markets through trade delegations, matchmaking and joint ventures. Its chairman emphasises the increasing global focus on sustainability, the environment, customers and employees.

“Adherence to international standards related to carbon emissions, energy sources and fair labour practices is becoming crucial for gaining access to international markets,” he points out.

Sri Lanka faces challenges in diversifying its export sector as it requires strategic investments, policy consistency and international collaboration.

To this end, the chamber head avers: “The chamber offers extensive support to both its members and other businesses seeking to enter new international markets. Despite disruptions in recent years, efforts have resumed and they include trade delegations from India, and upcoming visits by delegates from Thailand, Belarus and Pakistan.”

He sums up: “The chamber actively promotes sustainability in the export sector as it recognises global trends towards environmentally-friendly practices and sustainable economic development. Compliance with environmental standards is crucial for exports such as tea and fish going to the EU.”

Your subject is ‘Made in Sri Lanka’ and I believe that tourism is very Sri Lankan for me

LEVERAGING INNOVATION

In the dynamic landscape of international trade, exporters continually seek avenues to expand their product offerings and tap into emerging markets. However, navigating these territories requires strategic planning and a deep understanding of market dynamics.

President

National Chamber of Exporters

National Chamber of Exporters (NCE) President Jayantha Karunaratne believes that market research is important in exploring new opportunities: “It is very important to understand market requirements, consumer behaviour, product availability, quality, packaging and the competition.”

He also underscores the importance of understanding local regulations, taxes and cultural intricacies, and specific generic market favouritisms: “Market visits and participating in exhibitions serve as platforms to explore opportunities, and understand and study business prospects.”

“Innovations and strategic partnerships are also important factors. Strategic partnerships will provide specific details of market behaviour, trade patterns and other regulatory aspects,” Karunaratne explains.

On the strategies that exporters can employ to enhance their online visibility and reach a global customer base, he notes: “Search engine optimisation is the best. Use social media channels and have an active presence on social media platforms.”

He also emphasises the need to focus on country specific events.

“Leveraging e-commerce platforms and AI, and cultivating strategic partnerships with local online firms enable exporters to enhance their online visibility. The use of innovative websites and understanding consumers also provide strategic advantages,” he explains.

Government export promotion programmes offer valuable resources and incentives for exporters. By actively participating in exhibitions, trade fairs and promotional events, exporters can showcase their products and access financial incentives to expand.

Karunaratne states that it is critical to learn and understand regulations in target markets to stay abreast of international trade regulations: “Thorough market research provides insights into regulatory frameworks, customs procedures and trade barriers in target markets. Understanding regulatory requirements minimises compliance risks and facilitates smoother trade operations.”

“Collaborating with trade associations and government agencies enables exporters to advocate for policy reforms and address trade barriers. Engaging in economic diplomacy fosters bilateral cooperation and promotes a conducive environment for international trade,” he adds.

Additionally, currency fluctuations pose significant risks to exporters, impacting profitability and competitiveness.

“Currency hedging tools help exporters minimise losses by mitigating the impact of adverse exchange rate movements. Hedging strategies such as forward contracts and options provide stability and predictability in foreign exchange transactions,” he points out.

Karunaratne elaborates: “Close monitoring of currency trends and risks enables exporters to proactively manage currency exposures. Collaborating with importers and financial institutions to analyse currency risks and develop risk mitigation strategies is essential for safeguarding against volatility.”

“Diversifying currency exposure across multiple markets and currencies reduces reliance on any single currency,” he adds.

“Collaborating with export development authorities such as the Export Development Board (EDB) provides access to market intelligence, promotional events and financial assistance programmes. Leveraging government resources enhances market penetration and competitiveness,” Karunaratne says.

He continues: “Engaging in Ministry of Foreign Affairs programmes and diplomatic initiatives fosters bilateral cooperation and increases market access. By leveraging embassy networks and diplomatic channels, exporters can address trade barriers and promote Sri Lankan businesses on the global stage.”

Technological innovation is imperative for exporters seeking to improve product quality and operational efficiency.

“Exporters need to be innovative and use technological innovation to be competitive. Most markets demand innovative products, quality and competitive prices, and consumers are seeking new products and experiences,” he observes.

He stresses that “using technology is important at all levels – from production to marketing and distribution, and more. Data analytics and AI solutions provide actionable insights into consumer preferences, market trends and supply chain dynamics. By leveraging predictive analytics and machine learning algorithms, exporters can optimise decision making and tailor their offerings to meet evolving customer demands.”

By embracing these strategies and innovations, exporters can capitalise on new opportunities, expand their global reach and achieve sustainable growth in emerging markets.

Collaborating with trade associations and government agencies enables exporters to advocate for policy reforms and address trade barriers

UNCONVENTIONAL ENTRANTS

Secretary General

Joint Apparel Association Forum

Sri Lanka’s apparel industry is poised for growth this year, driven by strategic shifts in brand dynamics, technology collaboration, adaptability to post-COVID challenges and a steadfast commitment to embrace sustainable practices.

Secretary General of the Joint Apparel Association Forum (JAAF) Yohan Lawrence sheds light on the industry’s future while cautioning about unconventional entrants.

He observes the changing landscape in the apparel industry and says: “New entrants and international brands in the apparel industry are increasingly adopting innovative strategies for growth in 2024. Unlike traditional brick and mortar stores, new brands stress agility with short orders, quick turnarounds, and a strong focus on responsibility and sustainability.”

“Sri Lanka distinguishes itself with a unique selling proposition as it has established a favourable reputation for compliance with labour standards, environmental practices, sustainable manufacturing and circular design. This resonates well with the values of newer generation brands and contributes to the industry’s growth potential,” he adds.

Lawrence explains: “The apparel industry faced challenges adapting to shifts in consumer behaviour towards casual and athleisure wear. Although there was a post-pandemic increase in purchases, key markets such as the US, UK and EU experienced reduced global demand. This led to a focus on smaller buys and shorter lead times to meet changing customer preferences.”

Highlighting these partnerships that extend beyond sourcing, and emphasising collaborative efforts in manufacturing methods, innovation and trend adaptation, he notes that “the spirit of openness in these collaborative efforts ensures a cohesive supply chain operation that ultimately leads to the creation of innovative products.”

He adds: “Brands and manufacturers in Sri Lanka closely collaborate on innovation and technology, often jointly investing in machinery – particularly for technical apparel. These enduring partnerships contribute to making Sri Lanka a compelling choice for innovative products.”

The regulatory environment is not overlooked, and Lawrence acknowledges the importance of compliance with labour standards and environmental regulations: “The apparel industry is impacted by comprehensive local and international labour standards with Sri Lanka scoring on compliance including the Garments without Guilt certification.”

Anticipating upcoming legislation, he explains: “The global shift towards transparent and sustainable practices is reflected in forthcoming legislation such as the EU Strategy for Sustainable and Circular Textiles, Digital Product Passport and the Corporate Sustainability Reporting Directive. These regulations demand environmental tracking throughout the product life cycle, and present challenges and opportunities.”

The acceleration of online retail, which was catalysed by the pandemic, remains a pivotal factor. Lawrence envisions a growing trend in online channels with retailers enhancing their offerings for seamless online shopping experiences.

He says: “The growth of online retail in the apparel industry continues to thrive. And the challenges lie in capturing and maintaining customer attention in the digital marketplace.”

Considering market dynamics, Lawrence notes the historical trend of the global apparel industry moving to locations with competitive advantages.

He explains: “Sri Lanka, though holding a small global market share (1-2%), seeks to remain relevant and competitive by focussing on a compelling offer beyond cheap manufacturing. This includes product design, raw material innovation, value addition and improved logistics.”

Efforts by the government to protect existing market access programmes and pursue new free trade agreements, especially with India and China, are acknowledged.

“While it’s no longer a cheap manufacturing base, Sri Lanka focusses on offering a compelling package beyond simply stitching. Government efforts to protect existing market access programmes and explore new free trade agreements with countries such as India and China demonstrate a commitment to remaining competitive,” he adds.

Lawrence says that joining the Regional Comprehensive Economic Partnership (RCEP) is a hopeful prospect: “The Asia-Pacific region provides proximity to raw materials and manufacturing facilities while certain African countries have the advantage of duty-free access to the US.”

Acknowledging challenges in the Asia-Pacific and African regions, Lawrence urges Sri Lanka to continually innovate and ensure relevance in the global race for apparel manufacturing supremacy.

Brands and manufacturers in Sri Lanka closely collaborate on innovation and technology, often jointly investing in machinery, particularly for technical apparel

Leave a comment