COVER STORY

Sri Lanka Inc.

Windows of Opportunity

As the recently appointed Managing Director of Brandix Lanka, Hasitha Premaratne will be driving the group’s strategy and transformation journey while overseeing its global business interests.

Since joining the group in 2006, his roles have included Group Finance Director and Chief Strategy Officer, Managing Director of Brandix India and a Director of its subsidiaries and investment ventures – including Teejay Lanka, InQube Global and Best Pacific Textiles Lanka.

In addition to his wide ranging experience in the fields of capital markets, economics, strategic finance, management and research, Premaratne is presently an Independent Director of John Keells Hotels where he is also the Chairman of the Audit Committee.

He previously served on the boards of Bank of Ceylon, the Chartered Institute of Management Accountants (CIMA) – Sri Lanka, and the Sri Lanka Accounting and Auditing Standards Monitoring Board (SLAASMB). He has also served as a committee member of the Ceylon Chamber of Commerce.

In an exclusive interview with LMD – the first since his appointment as Brandix Lanka’s MD – Premaratne outlines the challenges that the apparel industry is facing at present and alludes to a possible turnaround in the fourth quarter of this year.

He also sheds light on how geopolitical tensions between China and the West, and the Indian domestic market’s rapid growth trajectory, may present opportunities for Sri Lanka as it looks to achieve the Export Development Board’s export revenue target of US$ 8 billion.

– LMD

"The opportunity to grow in the shadow of India’s and China’s growth stories is tremendous"

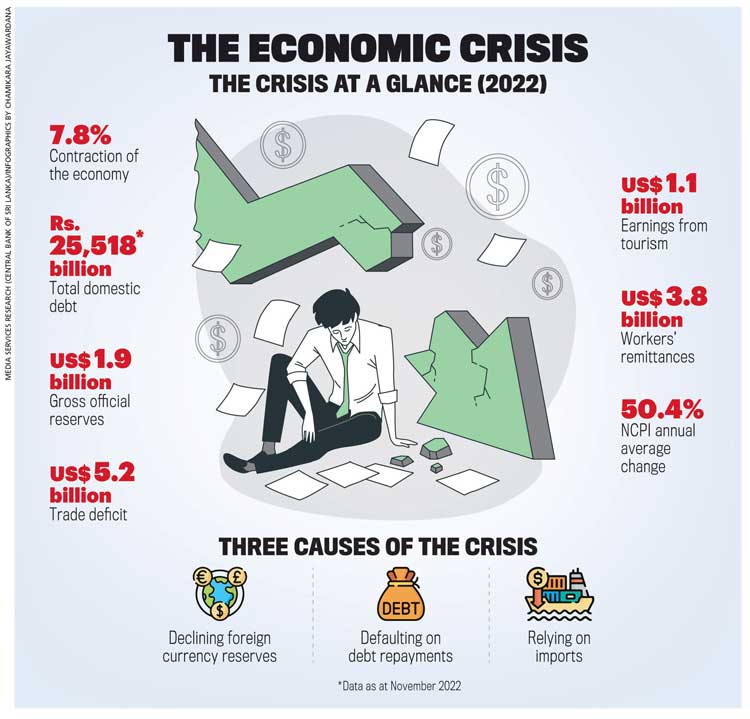

Q: In terms of the big picture, where do you see Sri Lanka’s economy heading in the medium term? And what are the main sensitivities that could derail a possible revival?

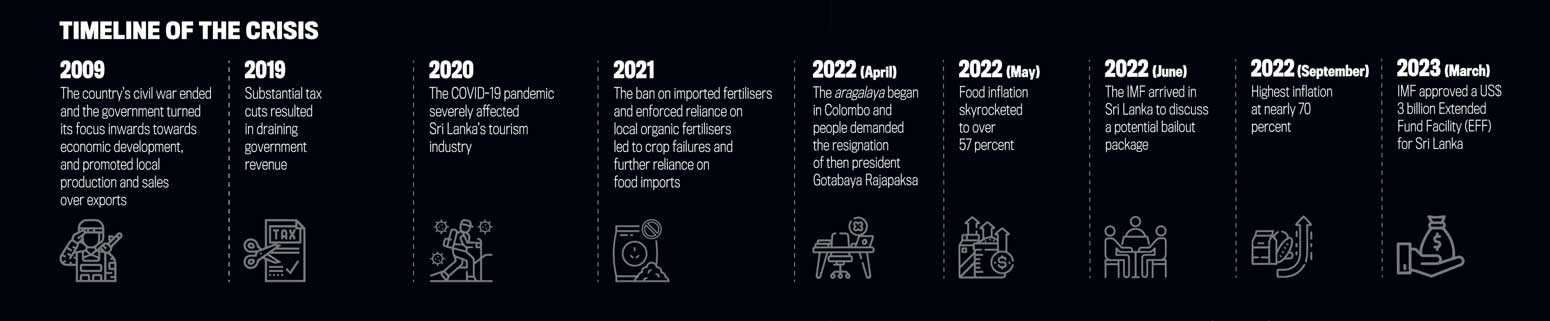

A: We are out of the worst times but it’s going to be a painfully slow recovery – and now that we’re formally in the IMF programme, it is important that we address some of the fundamental economic disparities that led to the crisis.

The good news is that initial steps have been taken since April last year to initiate significant policy shifts that will address these fundamental issues.

Our US Dollar inflows must exceed outflows – that is to say export, tourism and services income, and remittances from overseas should be higher than our imports. We can’t keep printing money to fund a ballooning budget deficit; we must continue narrowing the gap between government income and expenditure so that it doesn’t blow out.

People can’t carry on living on subsidies. Some targeted time bound subsidies are needed but in the long term, we must work hard to earn to cover our expenses.

Our loss-making state-owned enterprises (SOEs) should be turned into profitable entities by improving productivity and efficiency. Continuing to increase prices to offset inefficiencies won’t help; it will not make us competitive in the global context.

"Our US Dollar inflows must exceed outflows – that is to say export, tourism and services income, and remittances from overseas should be higher than our imports"

One of the key factors that could derail the situation would be political instability. We have more work to do and it’s important to continue with this policy framework despite any change of government.

It is important to work towards establishing an independent central bank; but even more so, to ensure that it’s helmed by competent and credible leadership.

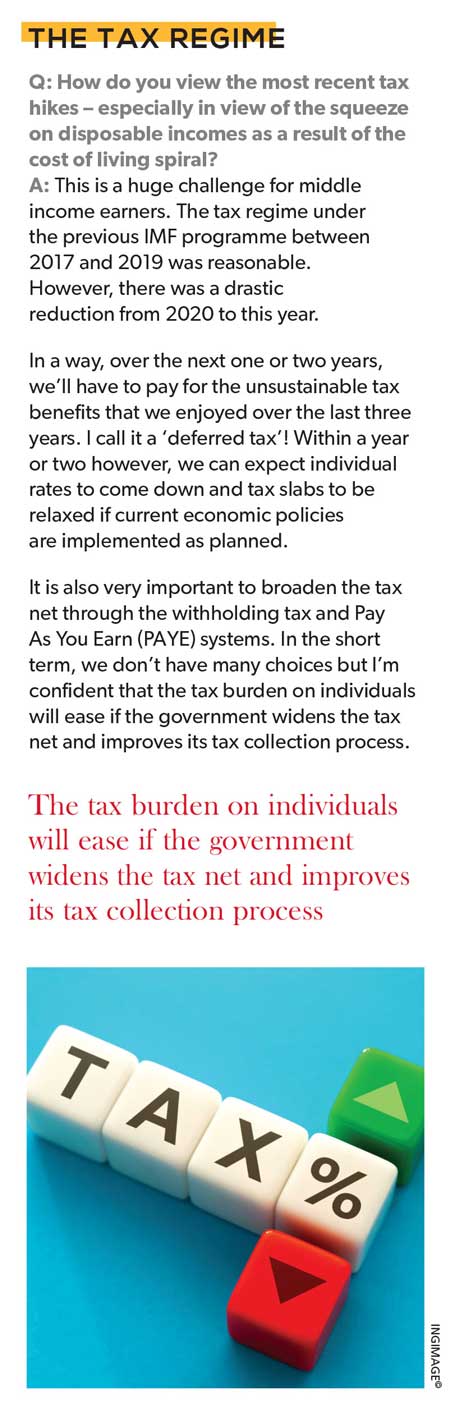

Q: How about the primary macroeconomic indicators such as interest rates, inflation and the value of the Sri Lankan Rupee? Where are they likely to head in the second half of this year?

A: Interest rates are already coming down and will continue to fall to below 20 percent during the second half of this year. Inflation will obviously decrease to single digits due to the base effect.

The rupee will be highly volatile in the first half of the year but we can expect it to fall back to around where it was in January 2023 in the second half as import restrictions gradually ease and economic activity improves due to a reduction in interest rates. One thing is clear – the times of the rupee’s free fall are no more!

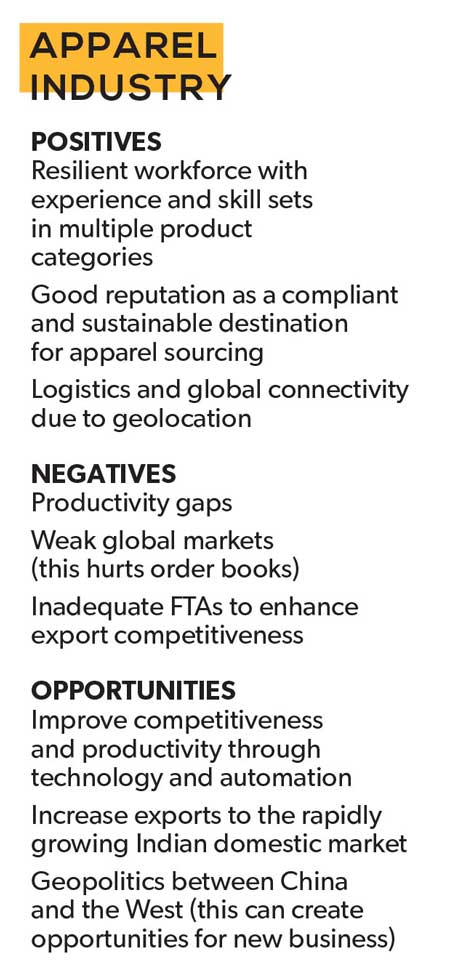

Q: One of the mainstays of the national economy is the US$ 6 billion apparel industry, which is reportedly facing a somewhat lean spell in the wake of global factors. Can you shed some light on this – including what has led to it and when there might be a turnaround?

A: In 2020/21, Western economies also printed money to maintain economic activity during the pandemic, and most consumers stayed at home and enjoyed an online shopping spree. People couldn’t enjoy too many outings due to the lockdowns so what they purchased was stored in their wardrobes.

Likewise, retailers and brands have built up their inventories, assuming that consumer buying will remain robust through 2022/23. As consumer spending fell for various reasons, retailers were stuck with their inventories – and as a result, they have cut down sharply on global purchases. This unprecedented drop in purchasing is being felt by almost all major supplier destinations such as China, Bangladesh, Vietnam and India.

Meanwhile, suppliers are reducing prices to win whatever orders they can and this is bringing prices down sharply. Obviously, this is a double whammy – not only are sales volumes down but selling prices are also falling.

We’re expecting a turnaround towards the last quarter of 2023 but this too will be a gradual recovery. Therefore, it’s going to take a while for us to emerge from this market challenge.

"Interest rates are already coming down and will continue to fall to below 20 percent during the second half of this year"

Q: The Export Development Board (EDB) has mooted an export revenue target of eight billion dollars by 2025. How realistic is this, in view of the global economic slowdown and other sensitivities in key markets?

A: We began this year with a short-term dip but global markets are expected to recover by 2025. Geopolitical tension between China and the West may provide an opportunity for Sri Lanka to become an alternative sourcing destination to deliver a win-win solution to all stakeholders.

Additionally, the Indian domestic market is on a rapid growth trajectory. This is a clear opportunity for Sri Lanka to become a strategic supplier to the subcontinent. Under these circumstances, the target of US$ 8 billion is achievable.

However, there are some prerequisites…

We need to work on securing better terms for our free trade agreement (FTA) with India. At the moment, only eight million pieces are allowed duty-free to India from Sri Lanka annually – this upper limit should be relaxed. Duty-free access to other key markets such as China, Canada and others should also be increased.

Sri Lanka needs to establish a better policy and regulatory environment to attract foreign direct investments (FDIs). We should introduce technology and efficiency to improve productivity so that our cost competitiveness improves. There needs to be innovation to differentiate our product base, develop the fashion design community (both international and local) and embrace novelty.

Q: Brandix Lanka has invested in offshore facilities in countries such as India. What lessons have you learned after entering overseas markets in the context of risks, forex exposure, red tape and other impediments?

A: Our customers often look to mitigate geographical risks, which makes it mandatory for us to establish presence in several countries if we want to grow with them beyond a certain point. In line with its growth strategy, Brandix has gone global since the early 2000s; it now has manufacturing footprints in India, Bangladesh, Cambodia, Haiti and other nations.

We have also set up marketing and design offices in the US, the UK, Canada, Hong Kong and Singapore to provide inspired solutions while sitting closer to customers. Over the last two decades, Brandix has established itself in these markets and taken the Sri Lankan brand overseas.

Establishing bases in new locations is always a challenge as we have to work with different regulatory bodies, unknown market dynamics and diverse cultures. It not only increases costs but brings risks to the brand.

Mitigating such risks has never been easy but a focussed approach to managing these challenges by understanding local dynamics is critical to succeeding in expanding overseas.

We remain committed to our roots in Sri Lanka and continue to invest in the group’s operations here as well.

Q: A growing number of businesses both large and small are expanding their footprint to offshore markets in the hope of mitigating the impact of the multiple crises here at home. How do you view this phenomenon, and what are the pros and cons of pursuing expansion overseas?

A: Overseas expansion provides access to new markets and duty-free sales in addition to cost advantages that enhance competitiveness. It also helps spread the geographical concentration of risk, and access to new resources, infrastructure and a larger talent pool among others. This leads to greater exposure for our teams in Sri Lanka as well.

However, succeeding in a new market is never easy due to cultural differences and regulatory complexities. As a Sri Lankan company, we take great pride in our heritage – and we acknowledge the significance of preserving our local identity while expanding the group’s global reach.

Q: In light of the extreme challenges facing the SME sector, what advice can you offer regarding cash flow management and business continuity?

A: In times like this, SMEs should focus on setting new revenue targets, bringing in fresh customers and keeping their capacities loaded.

A focus on reducing waste and managing costs is crucial. Cash is king in a crisis – and working capital should be tightly managed, by means of stringent debt collection procedures and inventory controls. If SMEs are heavily geared, it would be prudent to proactively talk to their banks with a view to restructuring debts.

Q: When it comes to political stability and the country’s risk profile, where do you stand; or to put it another way, what concerns do you have?

A: Political stability is about policy consistency, irrespective of which political party is in power. A crucial aspect to recovery is maintaining consistency in economic policies.

In the past, we have seen policy reversals for no logical reason when a new government takes charge. It’s important for political parties to align themselves on the continuity of major economic policies to ensure that our commitments are fulfilled.

Currently, this remains a challenge; but if we look at the last few decades and the crisis we’re in today, this is the best time to learn lessons from the past and avoid repeating the same mistakes.

Therefore, we must take a long-term view on economic policies and all political parties should take responsibility to ensure consistency in the key principles.

Q: And finally, where is your crystal ball turning to vis-à-vis Sri Lanka’s longer term prospects? Are you hopeful and if so, why?

A: Yes, I’m hopeful and committed to seeing Sri Lanka overcome this crisis. Of course, a crisis opens opportunities to embrace new thinking and eradicate some of the past sins – it’s vital that we learn from our mistakes and turn the tables on the past.

Our geographical location brings many advantages and if Sri Lanka’s foreign relations are managed well, the opportunity to grow in the shadow of India’s and China’s growth stories is tremendous.

Sri Lanka is a resilient nation and we have demonstrated this regularly. As Sri Lankans, we must rally together to reshape the future and I’m confident our talent pool has the ability to make it happen!

"Geopolitical tension between China and the West may provide an opportunity for Sri Lanka"

Leave a comment