CORPORATE SUSTAINABILITY

BEST PRACTICES

Investing in sustainability is an advantage – Kiran Dhanapala

Sustainability has clear advantages for organisations that consciously embed it. These are cost savings and higher revenue, as well as intangibles such as enhanced brand value, customer loyalty, higher staff retention and productivity, stimulating innovation, mitigating risks and so on.

It can be challenging to explain this to senior management – especially a chief financial officer (CFO). Since CFOs are trained to be mostly short-term financially oriented, how do you convince them that investments in carbon neutrality will yield significant benefits?

It can be challenging to explain this to senior management – especially a chief financial officer (CFO). Since CFOs are trained to be mostly short-term financially oriented, how do you convince them that investments in carbon neutrality will yield significant benefits?

The concept of value has broadened to account for the intangible rather than an emphasis on physical capital as in the past. Such assets include brands, customer data, business and sustainability plans, software algorithms, trade secrets and the like.

This accounts for about 90 percent of the S&P 500’s total assets, having risen from 17 percent in 1975. Intangible benefits also include natural capital issues in addition to pollution prevention and mitigating technologies.

A fundamental challenge is that many analyses measure only financial costs and most of the benefits are often not monetised or have few commonly accepted and used metrics of measurement. There are several ways to monetise the various benefits of sustainability.

Another challenge is that sustainability and accounting professionals talk different languages – especially metrics. For example, ROI vs GHG reported separately enhances the feeling of separateness.

Further, sustainability initiatives often have poor monitoring across the various units that are responsible for different benefits and some may be left out altogether by those who are unable to count these as being advantageous.

Different approaches are being adopted for tracking sustainability benefits and values. One is the use of environmental valuation methods to quantify environmental and health benefits – e.g. the benefits from reduced morbidity and mortality expected from reduced ambient air pollution associated with fossil fuel burning (especially transport).

Another tool that focusses on accounting for social aspects of sustainability is the Social Return on Investment (SROI).

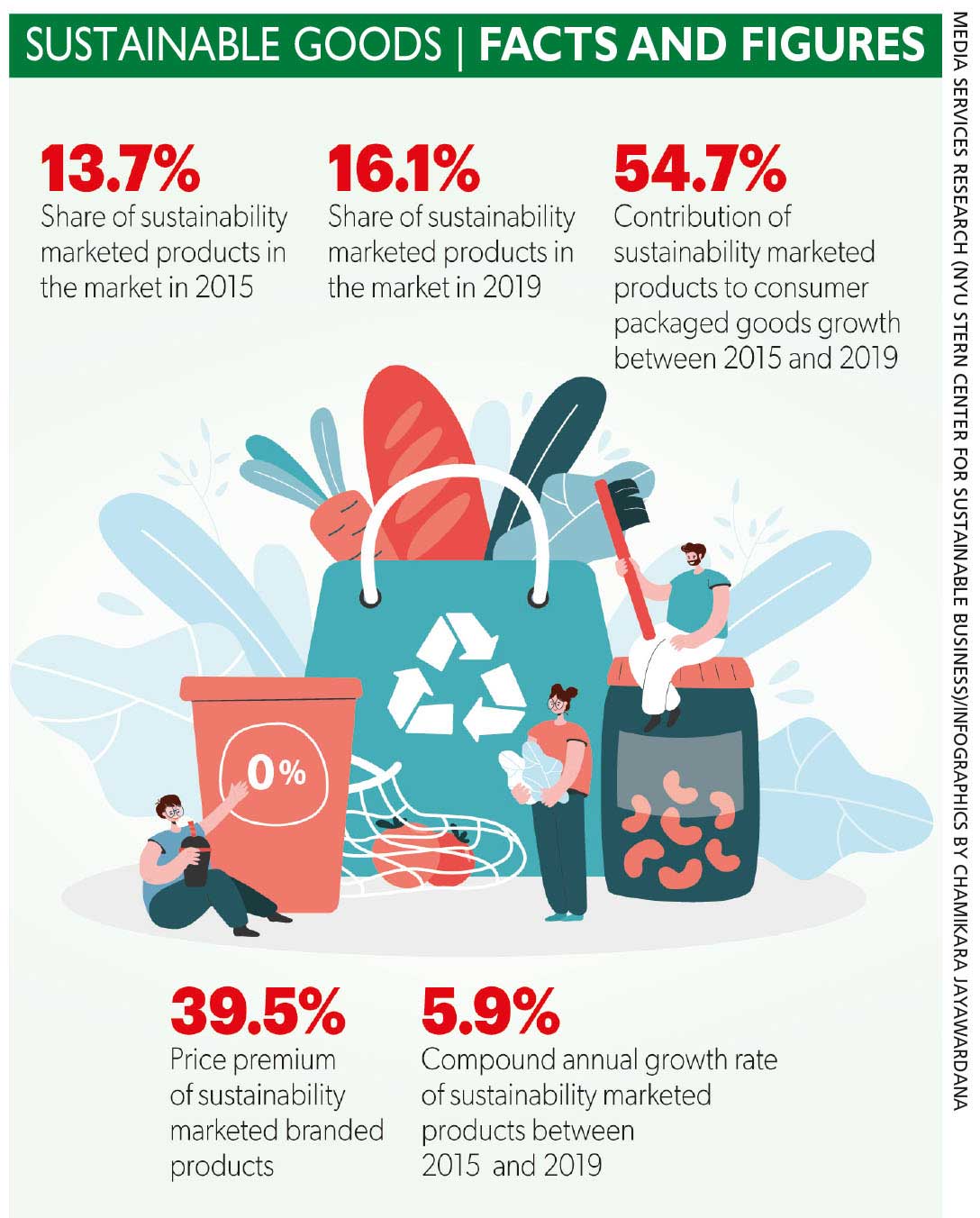

New York University’s Stern Center for Sustainable Business has developed interactive tools to track the financial benefits that accrue from sustainability strategies followed by companies.

This approach finds there are nine drivers or mediating factors of corporate financial performance supported by sustainability strategies – innovation, operational efficiency, sales and marketing, customer loyalty, risk management, employee relations, supplier relations, media coverage and stakeholder engagement. The analytical tool is cross-departmental and implemented in a step-by-step process.

The tool is known as Return on Sustainability Investment (ROSI) and has been used by entities across sectors to identify the benefits associated with their sustainability strategies. It identifies material sustainability strategies and the changes in corporate practices from strategies, and quantifies them through the nine ROSI mediating factors.

Firstly, identify the material sustainability strategies for the sector and company – e.g. waste management for a motor manufacturer.

Secondly, for each sustainability strategy, identify material changes in actual business practices such as improving waste management means, and practices to recycle paint and solvents.

Thirdly, assess potential and realised financial and social benefits of these practices for each of the nine mediating factors. In the case of recycling paint and solvents for example, reduce product purchases and reduce waste disposal costs, and generate revenue through selling recycled materials.

Fourthly, quantify the benefits such as the percentage of manufacturing waste recovered and reused.

And lastly, convert both tangible and intangible benefits into monetary values. For instance, use the weighted average unit cost of recovered materials compared to the cost of reused materials against brand new investment to arrive at the return on investment (ROI).

The ROSI method has been applied to several diverse sectors with quantified results. In the car manufacturing industry for instance, the 16 sustainability strategies and practice changes that boosted one or more mediating factors contributed to new revenue or reduced costs, or both; and for one company, it amounted to over US$ 5 billion in net benefits in a year.

Further, for a North American power producer transitioning to clean energy, seven major sources of benefits were identified and quantified. The expected effects on four of them were valued and found to contribute an estimated 30 million dollars to the value of the company.

Investors are increasingly using the SDGs, as well as environmental and social impact indicators; and this prompts greater use of the same in companies including by CFOs.

Leave a comment