CORPORATE INSIGHTS | 2022/23

THE YEAR OF RECKONING

Sri Lanka’s corporate titans navigate the turbulence by garnering

higher revenues but their bottom lines come under pressure

Global economic growth will slow even further in 2024 due to high interest rates and energy prices, and a slowdown in the world’s top two economies, a number of leading banks say. They warn that geopolitical risks, and the wars in Ukraine and Gaza, could also contribute to a worsening global financial outlook.

World economic growth could slow to 2.6 percent in 2024 from 2.9 percent in 2023, according to a Reuters poll forecast cited by the World Economic Forum (WEF).

Meanwhile, the Central Bank of Sri Lanka’s annual report underscores the unprecedented challenges the economy faced in 2022, marking one of its most demanding years since independence.

The report highlights the severe economic hardships that triggered public anxiety and political upheaval.

While the corrective measures implemented had an immediate impact on the population, they were deemed necessary to shield the economy from potentially devastating consequences such as hyperinflation, a deeper collapse of economic activity and a disconnection of the country from the global community – with far-reaching implications for the people and businesses alike.

In the near term, the country has managed to shift towards a more stable equilibrium with a focus on restoring socioeconomic stability. The Central Bank anticipates that the envisaged assistance from international financial institutions will begin to materialise, providing additional support for the ongoing recovery efforts.

The report acknowledges the success of policy measures and reforms, citing a notable return to a disinflation path following a historic peak. Moreover, the exchange rate – having experienced a sharp depreciation in the first half of 2022 – stabilised and even appreciated in early 2023.

These positive indicators signal progress in steering the economy towards a more resilient and balanced state, setting the stage for a recovery.

The envisaged normalisation of foreign exchange flows and completion of the debt restructuring process during 2023, and sweeping reforms in the public sector, are expected to pave the way for the country’s progress although there are multiple sensitivities on the horizon.

However, the substantial increase in lending rates in 2022 posed a significant challenge to the public and business, exacerbating the burdens of the cost of living spiral. In response to these economic dynamics, the Monetary Policy Board of the Central Bank implemented reductions in both the Standing Deposit Facility Rate (SDFR) and the Standing Lending Facility Rate (SLFR) over the past several months.

The board says it reached such decisions following careful analysis of current and expected developments in the domestic and global economy – and with the aim of achieving and maintaining inflation at the targeted level of five percent over the medium term, while enabling the economy to reach (and then stabilise) at the potential level. Meanwhile, the announcement of a postponement of local government elections, coupled with political turmoil, brought about a sense of uncertainty. And while progress has been made in the discussions with the IMF, the lingering uncertainty continues to be a matter of concern.

Monitoring the ongoing developments in these talks therefore, is crucial for gaining insights into the trajectory of Sri Lanka’s economic future.

Amid these challenges, the Ceylon Chamber of Commerce, in its Outlook Report, offers a hint of optimism, suggesting that economic growth is poised for improvement in 2023 compared to the notable contraction experienced in 2022.

The report anticipates a carry-over of the slowdown from 2022 into the first half of 2023, particularly due to easing consumption resulting from the higher tax regime.

Notwithstanding the sensitivities there are and the economic balancing act, a palpable sense of hope persists. Demonstrating resilience and a determination to thrive, businesses have adapted to new norms and innovative ways of working, showcasing their ability to navigate and overcome unprecedented crises.

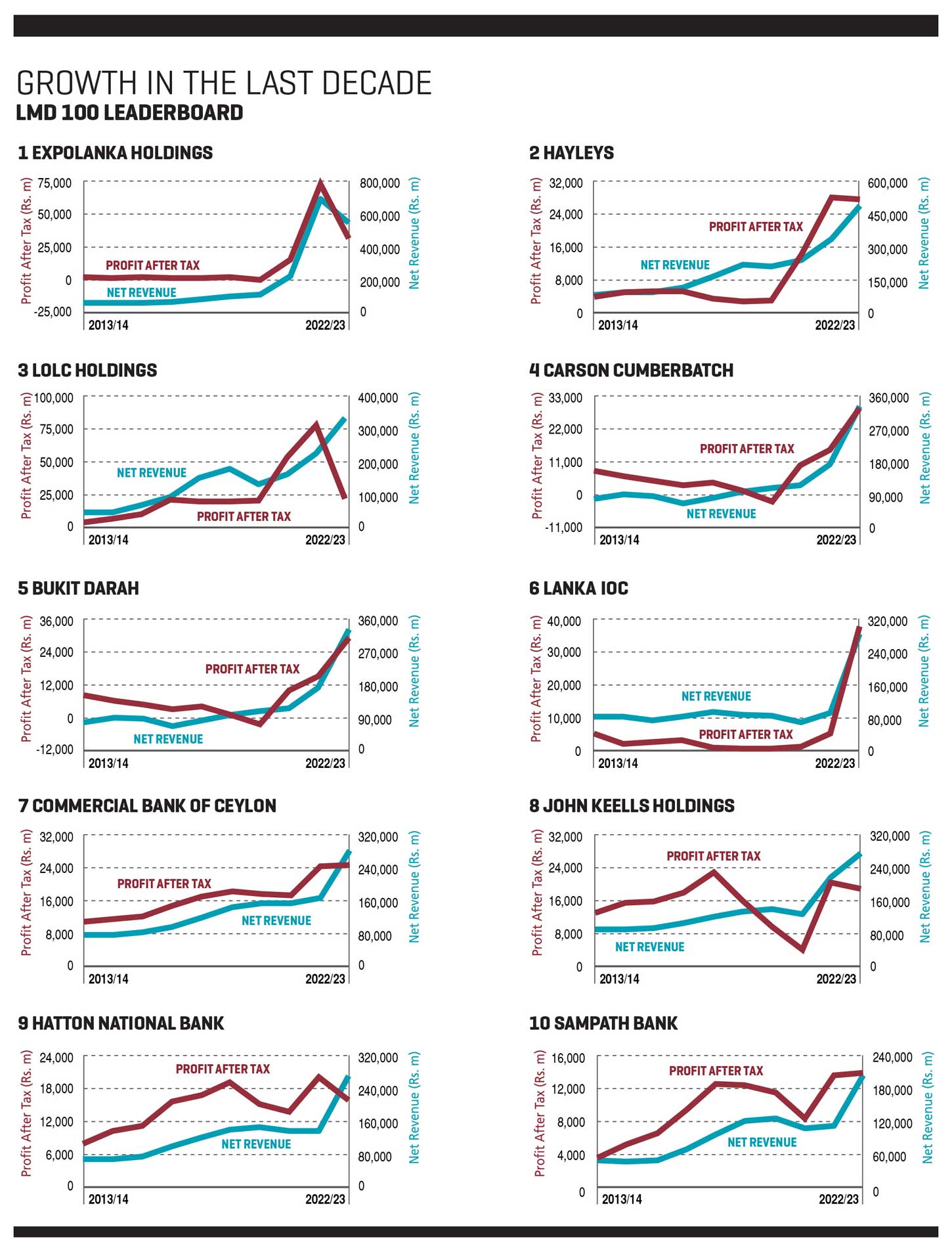

Accordingly, the financial year under review concluded on a positive note, marked by a resurgence of business confidence. Several LMD 100 corporates achieved exceptional if not highly commendable revenue growth, showcasing the resilience and adaptability in the face of one of the most challenging periods in recent history.

The other side of the coin however, is the fact that Sri Lanka’s leading listed companies have had to absorb a squeeze on profits as the cost of doing business continues to be sky high.

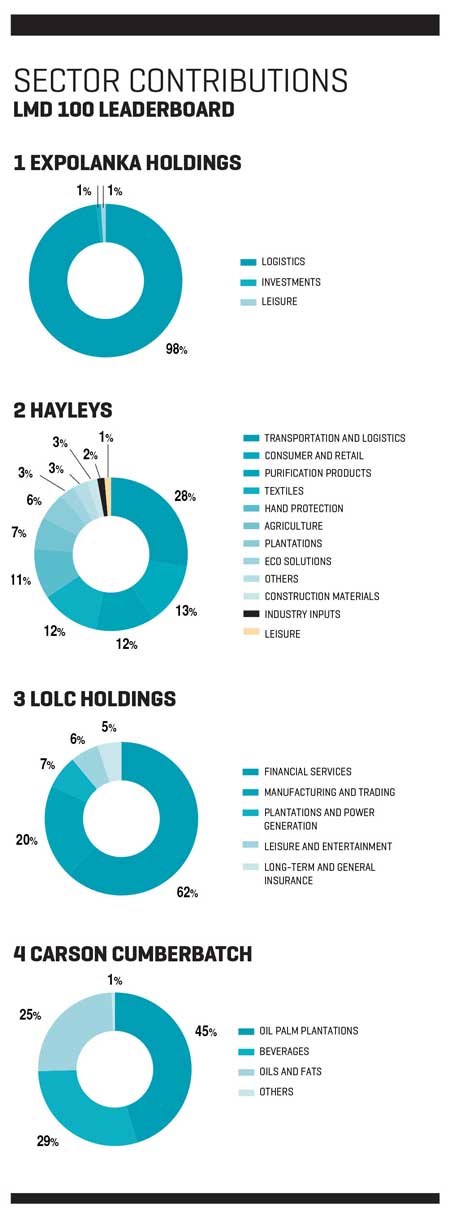

In this context, we turn our focus on the top 10 listed companies, shedding light on their performance as they occupy positions on the prestigious Leaderboard of the LMD 100 for financial year 2022/23.

Despite reporting a lower turnover than in the previous financial year, Expolanka Holdings remains at the helm of the Leaderboard with a top line exceeding Rs. 546 billion. This accomplishment solidifies its status as the undisputed champion among the nation’s listed companies.

As explained in the conglomerate’s integrated annual report for 2022/23, Expolanka attributes the strength of its financial results to effective implementation of the group’s long-term strategic plan. Additionally, the ability to remain agile and adaptable, expanding its customer base, enhancing services and building stronger partnerships across the globe contributed to its continued success, the report asserts.

It adds that the organisation’s approach to business goes beyond the numbers and the group’s holistic outlook encompasses the strength of the brand, the reliability of the governance framework and policies, and its long-standing commitment to sustainability.

Expolanka says it is poised to maintain its focus on the long-term journey, strategically developing synergies and capitalising on opportunities to complement its core business while positioning itself for future growth aligned with a potential global economic recovery.

Acknowledging the ever-evolving business landscape, the conglomerate reaffirms its commitment to effective alignment with market conditions, efficient cost management and expansion of its core logistics business.

The group is set to explore strategic growth opportunities in diverse markets and trade lanes, aiming to broaden its industry exposure, enhance its customer portfolio, streamline internal efficiency, and leverage technology and sustainability to streamline its operations.

Executive Director and Group CEO Hanif Yusoof says that driven by a clear vision, Expolanka has positioned itself among a select group of Sri Lankan entities with a global presence spanning 39 countries. Over 92 percent of the group’s revenue and in excess of 73 percent of its profit after tax (PAT) is now generated from foreign markets.

He elaborates: “Expanding our footprint in the global freight forwarding and logistics landscape remains a key strategic priority, and we will actively pursue suitable opportunities for both organic and inorganic growth. While consolidating our presence in the US market, we will also focus on expanding our footprint in Europe and Asia, capitalising on emerging markets and further strengthening our global reach.”

Chairman Bokuto Yamauchi adds: “The trade and logistics industry as a whole has seen a slowdown with factors such as retail overstocking, inflationary fears, reduced consumer spending and geopolitical tensions contributing to a challenging operating environment. However, we view these challenges as short-term cyclical changes.”

Securing the second position in the LMD 100 rankings, Hayleys achieved a consolidated revenue exceeding Rs. 487 billion for the financial year ended 31 March 2023. Despite this impressive feat, the conglomerate faced a decline in its PAT from the previous year, settling at 27 billion rupees for 2022/23.

As a capital goods conglomerate, Hayleys boasts a highly diversified portfolio with 62 percent of its income derived from exports and other foreign exchange earnings. Its remaining revenue is generated from the domestic market where Hayleys is a key player.

In the group’s 2022/23 annual report, Chairman and Chief Executive Mohan Pandithage notes: “The strength of the group’s financial profile against the tide validates strategic interventions in recent years to strengthen business resilience through pursuing increased diversification of earnings, optimising working capital cycles, and realigning the debt profile to mitigate exposure to fluctuations in interest and exchange rates.”

Securing third place in the listed company rankings, LOLC Holdings reported a top line of Rs. 333 billion. However, the conglomerate absorbed a 72 percent drop in PAT compared to the previous year to nearly 22 billion rupees.

Deputy Chairman Ishara Nanayakkara asserts in the group’s 2022/23 annual report that “the LOLC Group continues to enhance its value proposition for employees, customers, communities and shareholders. We are unwavering in our pursuit of expanding on a global scale while concurrently fostering economic growth. Our unwavering ambition is to exemplify an enterprise that not only unlocks equity and inclusion but does so in a manner that is sustainable.”

Advancing to No. 4 on the coveted Leaderboard, Carson Cumberbatch earned an income exceeding Rs. 330 billion for the financial year ended 31 March 2023. This marks a substantial increase of 94 percent compared to 2021/22. Additionally, the group generated a post-tax profit of 29 billion rupees, representing a notable 94 percent increase from the prior year.

Climbing one spot to secure fifth place in the 2022/23 LMD 100, Bukit Darah reported a PAT exceeding Rs. 28 billion for the financial year. This marks a substantial rise compared to slightly under the 15 billion rupees it reported in financial year 2021/22. In addition, the group’s consolidated turnover rose substantially, surging by 94 percent to reach Rs. 330 billion.

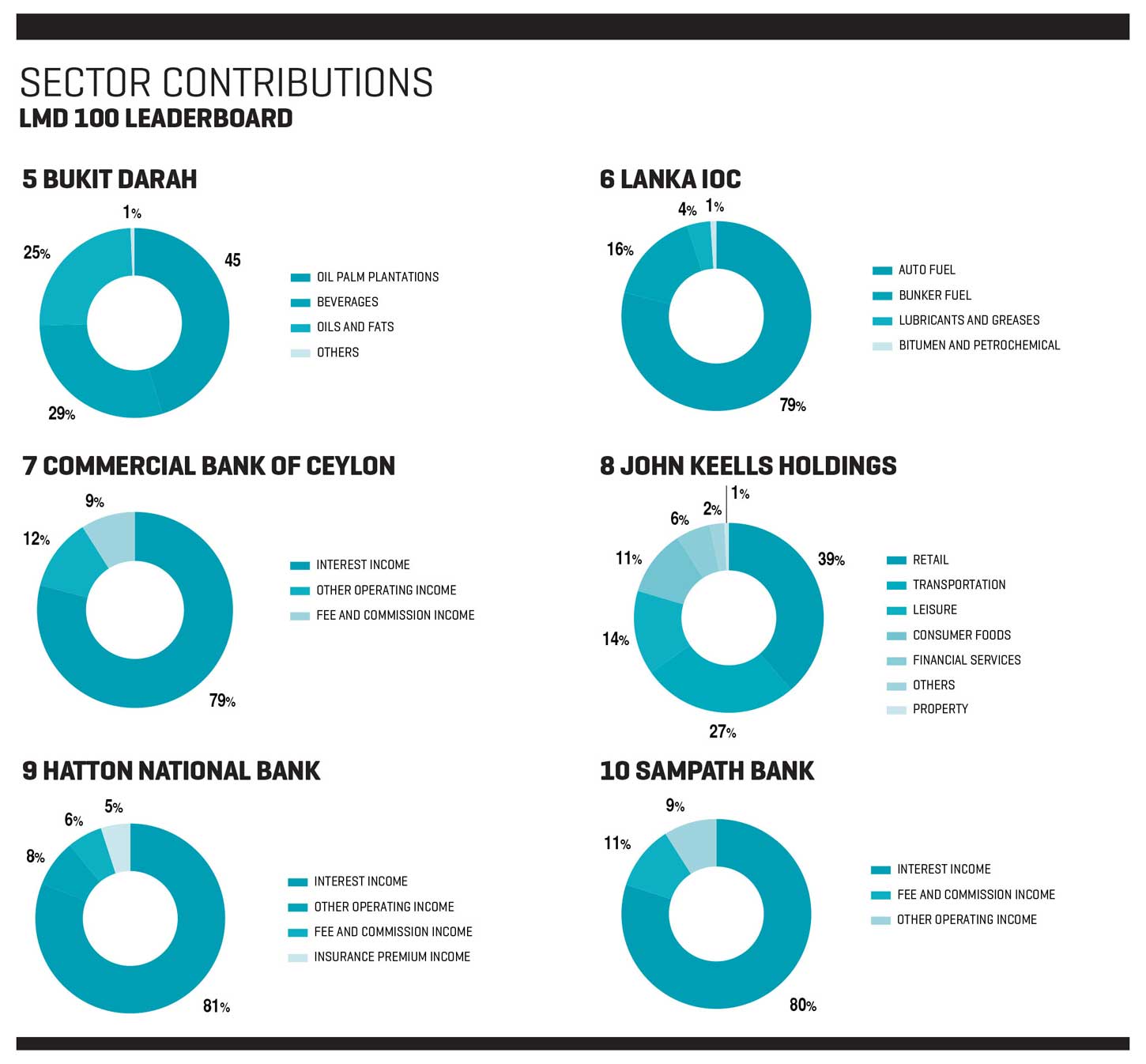

Entering the top 10, Lanka IOC (LIOC) claims the sixth spot with a recorded revenue of Rs. 281 billion for 2022/23, showcasing an extraordinary spike in its top line of 213 percent. The energy company has taken an impressive leap, ascending 10 places from 16th position in 2021/22. LIOC also achieved a remarkable upside of 682 percent in its PAT compared to the prior year, to reach 37 billion rupees to become the most profitable LMD 100 company.

Maintaining its seventh place is Commercial Bank of Ceylon (ComBank). The bank reported a profit after tax of marginally in excess of Rs. 24 billion and an income of nearly 280 billion rupees for the year ended 31 December 2022.

John Keells Holdings (JKH) slips from fourth position to eighth in the 2022/23 LMD 100 rankings. For the year ended 31 March 2023, JKH recorded a consolidated top line of Rs. 276 billion, reflecting a 27 percent increase compared to 2021/22, while its after-tax profit declined by eight percentage points to slightly under 19 billion rupees.

The LMD 100’s ninth and 10th positions are held by two private sector commercial banks – Hatton National Bank (HNB) and Sampath Bank respectively.

HNB made a notable entry into the top 10 (a.k.a. the Leaderboard) from 11th place in the LMD 100 for the financial year 2022/23. Its income nearly doubled (to in excess of Rs. 270 billion) and the bank’s bottom line exceeded 15 billion rupees.

And Sampath Bank improved its ranking by two notches in the LMD 100. It reported a PAT of over Rs. 14 billion (that’s slightly higher than in the preceding year) and a top line surpassing 206 billion (reflecting an 82% spike) for the period under review.