CORPORATE INSIGHTS | 2019/20

THE FIGHT FOR SURVIVAL

Sri Lanka’s business houses begin to feel the effects of a pandemic like no other with the fallout of events on the ground adding insult to injury

As the 2019/20 financial year drew to a close, all other concerns were seemingly cast aside as the coronavirus pandemic threatened to pose a grave risk to humanity – and it threatened to wipe out businesses in the process with devastating consequences for economies the world over.

Sri Lanka was not spared with the Central Bank of Sri Lanka (CBSL) publication titled ‘Recent Economic Developments: Highlights of 2020 and Prospects for 2021’ emphasising that the local economy “encountered renewed challenges amidst the outbreak of COVID-19.”

The report reveals that reflecting the combined effects of the spread of COVID-19 locally and introduction of lockdown measures, a slowdown in global economic activity and adverse weather conditions in the country, the economy contracted by 1.6 percent year on year in the first quarter of 2020, according to provisional estimates of the Department of Census and Statistics (DCS).

“Subdued demand conditions and well anchored inflation expectations helped maintain inflation broadly within the target range… although a transitory acceleration was observed due to the rise in food prices,” CBSL states.

The Central Bank says it eased monetary policy and continued an accommodative stance, supported by muted inflationary pressures and well anchored inflation expectations, “with a view to minimising the economic impact of the spread of COVID-19 and the resultant containment measures.”

In response to the reduction in policy interest rates and surplus liquidity maintained in the domestic money market, market interest rates declined appreciably in 2020. Reserve money, which expanded gradually and peaked in mid-April, fell substantially thereafter as a result of the reduction in the Statutory Reserve Ratio (SRR) in June.

Credit flows to the private sector are set to accelerate in the near term and stabilise thereafter, while the Central Bank projects inflation to be maintained within the desired range of between four and six percent over the medium-term horizon.

Meanwhile, CBSL maintains that “Sri Lanka’s external sector, which experienced heightened vulnerabilities at the onset of the COVID-19 pandemic, recovered to a great extent thereafter, supported by timely policy measures.”

According to the Central Bank, “the deficit in the trade account contracted notably compared to the same period of 2019, reflecting the impact of the large reduction of merchandise imports that outpaced the decline in merchandise exports during the period from January to August 2020.”

The deficit in the trade account contracted in the eight months ended 31 August 2020 versus the corresponding period of the previous year as the expenditure on imports reduced more than the decline in exports. However, inflows to the financial account remained modest in the first half of 2020, indicative of the dampened sentiments in global financial markets and slowdown in global economic activity amid the pandemic, while gross official reserves declined during 2020 up to September but remained at adequate levels, as revealed by CBSL.

On the fiscal front, policy measures in 2020 focussed on mitigating the impact of the COVID-19 outbreak, amidst the delay in presenting the national budget for 2020 caused by developments in the political sphere.

Not surprisingly, the Central Bank discloses that the fiscal sector recorded subdued performance in the seven months ended 31 July 2020 compared to the same period of 2019, with the pandemic impacting revenue and expenditure, and the settlement of unpaid bills spilling over from the previous year.

And the budget deficit was financed through domestic sources while foreign financing recorded a net repayment during the period between January and July 2020.

CBSL is of the view that “the Sri Lankan economy is expected to rebound in 2021 as evidenced by the fast recovery of activity since the relaxation of the lockdown in May 2020 although a resurgence of COVID-19 cases as observed in October could affect the momentum to some extent.”

Despite the heightened vulnerabilities amidst the COVID-19 pandemic however, the Central Bank reiterates that Sri Lanka’s external sector is expected to show resilience over the medium term provided that appropriate policies are implemented without delay.

And following the inevitable expansion of the fiscal deficit and debt levels in 2020, “performance of the fiscal sector is projected to improve over the medium term, supported by the envisaged recovery of economic activity,” the monetary authority affirms.

To sum up, CBSL stresses that achievement of the projected medium-term macroeconomic path is contingent upon implementing the identified reforms in the period ahead with long-term growth and macroeconomic stability remaining “key priorities that Sri Lanka must balance in its march towards shared prosperity.”

Whereas the future is as yet uncertain, the leading listed entities in the island will have to find ways and means to counter the effects of the pandemic, and other challenges that crop up along the way.

In this latest edition of Sri Lanka’s pioneering rankings, the LMD 100 highlights the performance of the 10 leading listed corporates, which together make up the illustrious Leaderboard.

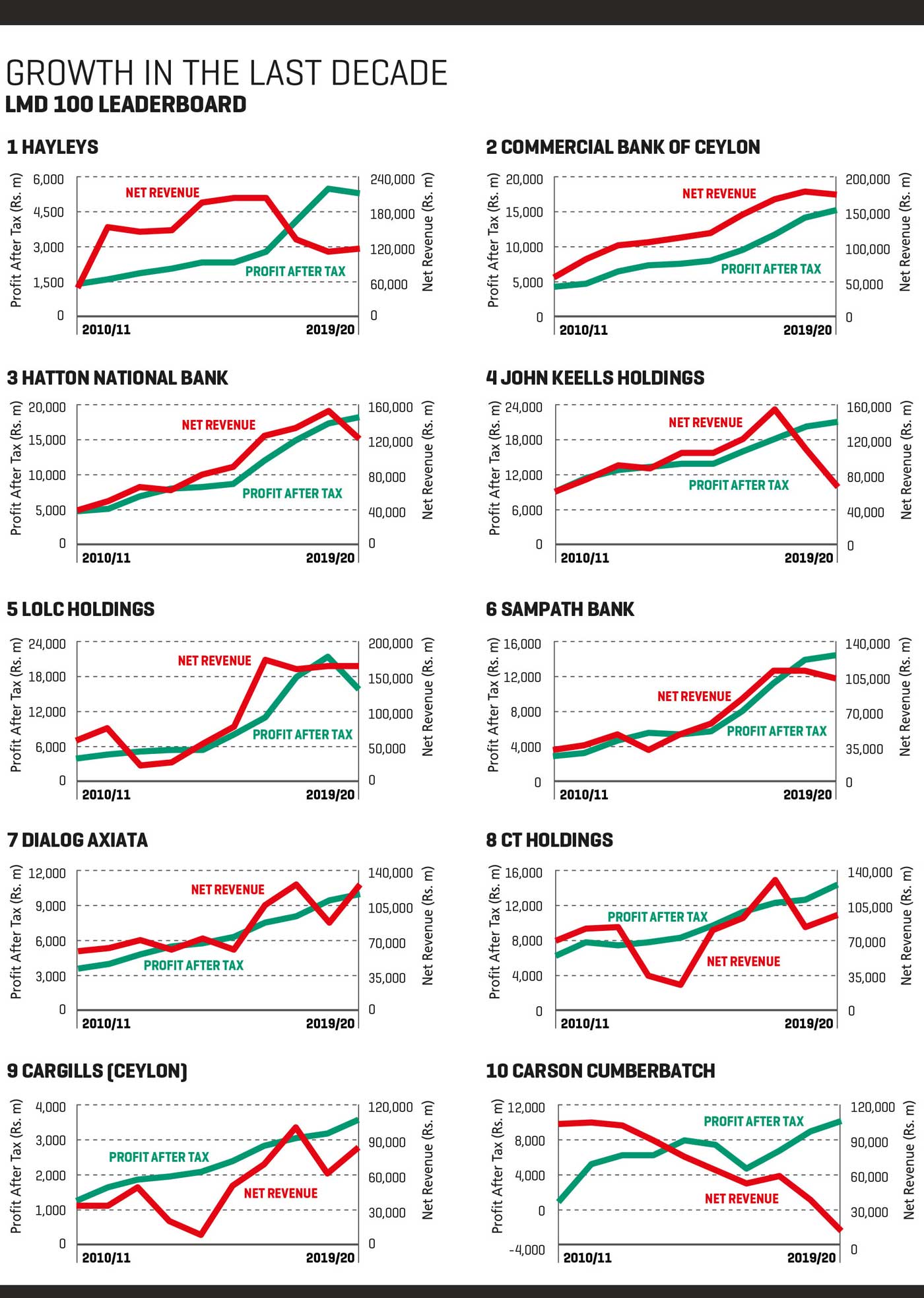

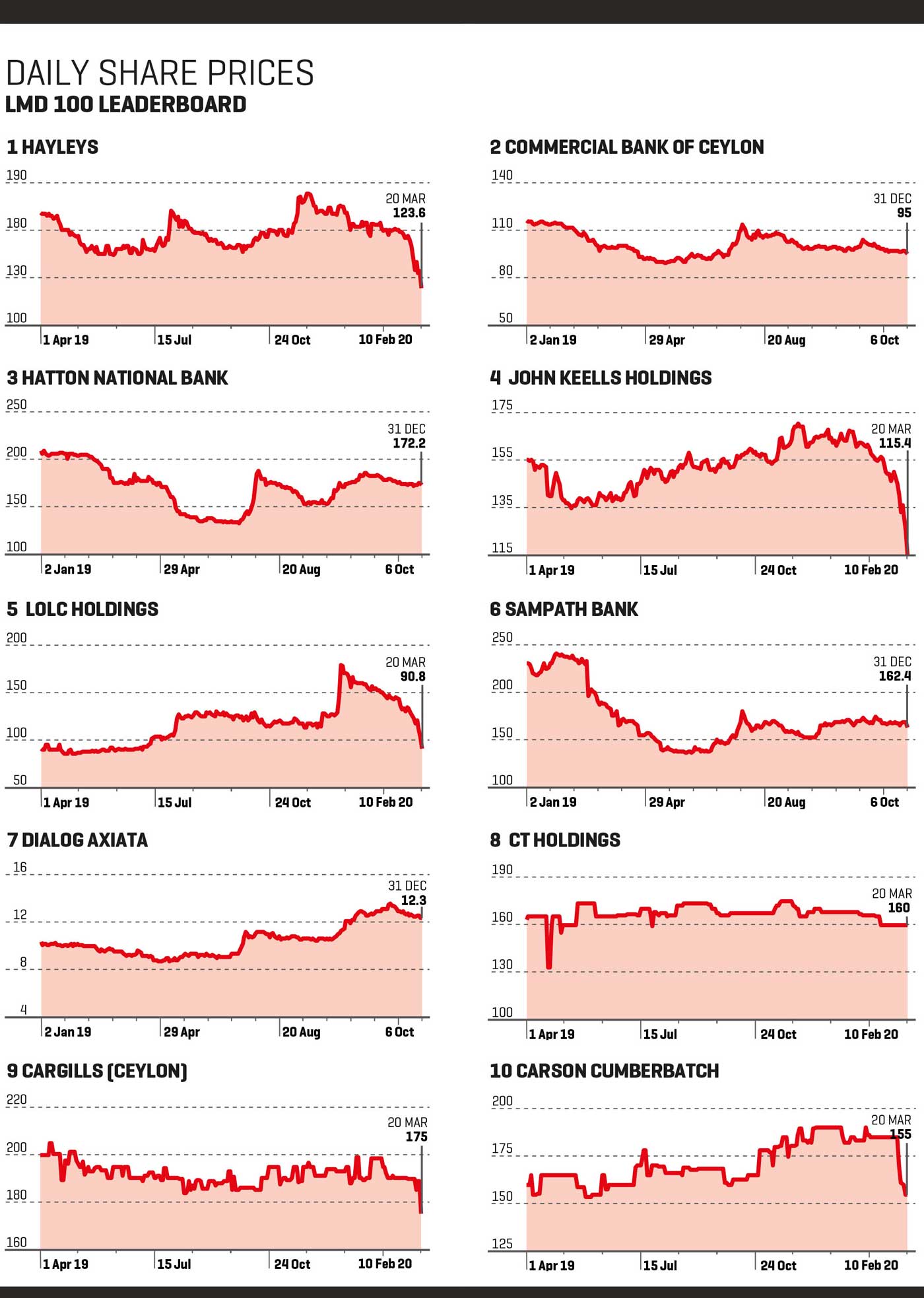

Hayleys continues to be the highest ranked corporate in the LMD 100 thanks to a consolidated revenue of Rs. 210 billion for the year ended 31 March 2020 despite its top line contracting by four percent year on year.

Nevertheless, the leading conglomerate’s profit after tax (PAT) expanded by five percent from the prior year to 2.9 billion rupees in the year under review.

In a communiqué issued to coincide with the release of the group’s 2019/20 annual report, Hayleys noted that profitability was upheld by the performance of the group’s export oriented businesses countering the weaker performance of sectors that were directly impacted by the Easter Sunday attacks and the COVID-19 pandemic.

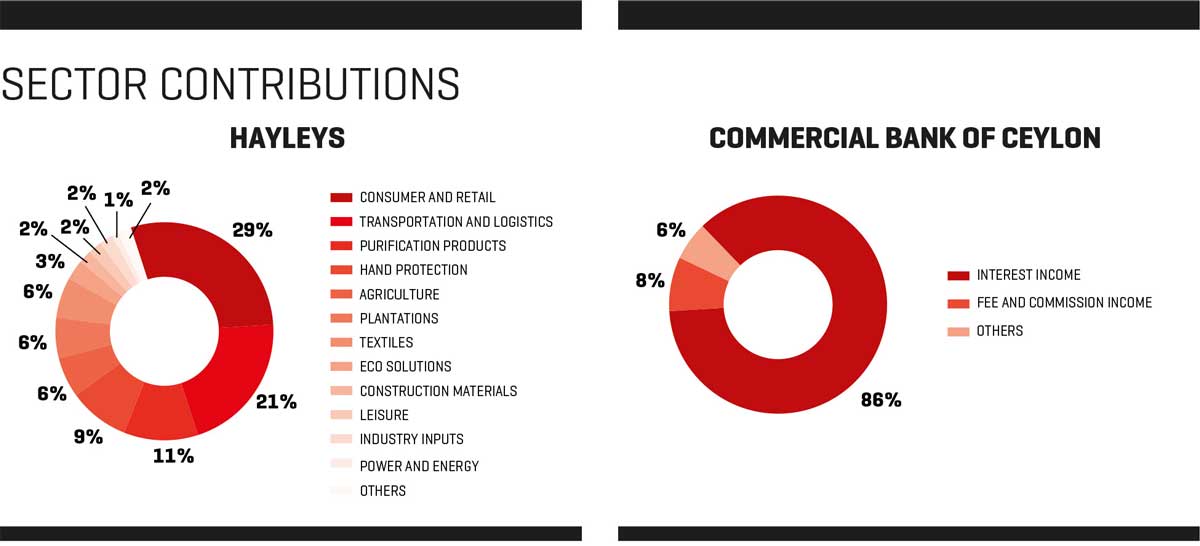

Hayleys’ diversified operations, which encompass eco solutions, hand protection, purification products, textiles, construction materials, plantations, agriculture, consumer and retail, leisure, industry inputs, power and energy, transportation and logistics, include 180 companies across five continents.

The group derives a little over half of its revenue from the domestic market while the balance comes from exports.

In the 2019/20 financial year, a lion’s share (29%) of the group’s revenue stemmed from the consumer and retail sector, which owns and operates consumer durables player Singer (Sri Lanka), and represents the global brand Procter & Gamble.

Transportation and logistics accounted for slightly over a fifth of Hayleys’ turnover in the period under review. Eleven percent of the group’s top line reflects the contribution of purification products, which relate to the manufacture of coconut shell-based activated carbon, as well as water and waste management solutions.

In Hayleys’ 2019/20 annual report, Chairman and Chief Executive Mohan Pandithage asserts that the conglomerate “has delivered a resilient performance in arguably the most challenging year in its 142-year history,” while primarily attributing the revenue decline to “the adverse impacts of the terror attacks and the pandemic, and weak global trade.”

He elaborates: “It is rare to have single black swan impact operations in one year but in Sri Lanka, we experienced two major black swan events marking the beginning and end of the year. Consequently, days of lost productivity and sales were among the highest recorded in over a decade, exacerbated by weak economic conditions and limited policy options to manage a growing balance of payments and trade deficit.”

“Hayleys Group has increased the rigor of its monitoring and review processes, to facilitate early identification of challenges and opportunities, together with an organisation-wide initiative to rationalise costs. We are eager to get over the worst and move beyond restoring normalcy to a new growth paradigm, seizing opportunities and adapting to thrive in a world that has reset after the pandemic,” he reiterates.

Having recorded nearly Rs. 151 billion (up 8% compared to 2018) in income for the year ended 31 December 2019, Commercial Bank of Ceylon (ComBank) secures second place in the latest LMD 100. This means that ComBank has moved up one spot from its ranking in the prior year. Meanwhile, the bank’s bottom line of 17.4 billion rupees in 2019 reflects a year on year decrease of two percent.

ComBank’s main business segments comprise personal banking, corporate banking and treasury, as well as international operations in Bangladesh, the Maldives, Italy and Myanmar.

In the calendar year under review, ComBank generated 86 percent of its revenue by way of interest income, and eight percent from fees and commissions.

Chairman Dharma Dheerasinghe, commenting on ComBank’s financial results in 2019, states that “the bank mobilised all its experience and wisdom to build the necessary resilience to turn in an admirable performance given the adverse conditions that prevailed.”

In addition, he points to ComBank’s noteworthy achievement for the year in becoming “the first private sector bank to cross the Rs. 1 trillion milestone in deposits.”

ComBank also expanded its digital footprint in the year under review by adding new digital products, services and partnerships, “to cater to the evolving requirements and expectations of our customers, along with major initiatives to digitalise and centralise our operations,” Dheerasinghe reveals.

Managing Director and Chief Executive Officer Sivakrishnarajah Renganathan places the marginal decline in group PAT within the context of “depressed economic growth, an unfavourable credit environment, escalating non-performing assets and the rising impairment charges.”

Highlighting ComBank’s strategy of viewing digital innovation as a “transformation change agent,” he notes that the Flash Digital Banking app “showed encouraging growth during 2019 following our rollout of the Sinhala and the Tamil versions of the app, making it Sri Lanka’s first trilingual mobile digital banking platform.”

The app “enables customer on boarding to financial planning and all other services required by a retail customer, and represents the unique and imaginative possibilities of digital innovation,” according to ComBank’s CEO.

Another leading representative of the banking sector, Hatton National Bank (HNB) is placed at No. 3 in the 2019/20 edition of Sri Lanka’s leading listed entities. Its consolidated income rose by four percent on an annual basis to surpass Rs. 145 billion for the year ended 31 December 2019.

HNB’s post-tax profits however, recorded only 15 billion rupees (down 22% year on year) for the calendar year.

Reviewing the performance of the bank, Chairman Dinesh Weerakkody observes “early signs of transformation such as the growth in digital transactions, improved turnaround times of a number of processes and the readiness of the leadership of the bank to up their game.”

“It is important that we keep our eyes on our vision and our enabling strategies with more diligence, and exercise more vigilant oversight on key initiatives for growth as headwinds from the operating environment are likely to be significant,” he maintains.

Weerakkody underscores the fact that as a domestic systemically important bank, “HNB will continue to seek ways to foster inclusive growth, enhance productivity and build resilience to support growth of the country’s financial sector while delivering value to stakeholders.”

Interest income accounted for 86 percent of HNB’s top line in 2019 while fees and commissions, and insurance premiums, registered seven and six percent respectively.

“High levels of uncertainty, a convergence of risk factors and the terror attacks on Easter Sunday combined to paint a bleak business landscape in 2019, necessitating a prudent revision of aggressive growth plans,” HNB’s Managing Director and CEO Jonathan Alles explains.

He goes on to note that “the bank exercised a cautious approach towards loan growth and the interest rates declined during the year with the introduction of the deposit rate cap in April 2019, which was subsequently replaced by the lending rate cap in September 2019.”

“We launched our future fit structure on 1 January 2020. [The] operations vertical, which is the core of business, ensures that the bank is on a strong platform in terms of risks management and compliance, and on this platform the bank would be driving business growth under the two verticals: retail banking and wholesale banking. Thereon, the focus would be on business transformation including IT and digital to ensure that the bank is future ready,” he informs.

And in terms of the future outlook, Alles notes: “We will also look beyond our shores for lucrative opportunities for growth with due diligence to ensure alignment with the bank’s long-term strategy.”

John Keells Holdings (JKH) climbs to fourth place (from No. 5 in 2018/19) in the latest LMD 100 rankings. But whereas the highly diversified group’s top line rose by three percent year on year to Rs. 140 billion, PAT slumped by 40 percent to 9.7 billion rupees in 2019/20 from Rs. 16.2 billion in the preceding year.

The group’s main sources of revenue include its retail, transportation, leisure, consumer foods and financial services segments.

With regard to the conglomerate’s retail business, which accounts for nearly half (47%) of consolidated revenue, Chairman Krishan Balendra remarks: “During the year under review, the supermarket business outperformed the market, increasing its market share in terms of revenue primarily driven by the… footfall growth following the rebranding in 2018/19, significant outlet expansion, and various product and process improvements implemented by the business.”

In the transportation segment, profitability was impacted by the group’s ports and shipping business, South Asia Gateway Terminals (SAGT), which became liable for corporate income tax during the year under review.

Balendra also notes that “the performance of SAGT was further impacted by flat volumes compared to the previous year due to the disruptions in port operations as a result of the COVID-19 pandemic and due to the industrial labour dispute in September 2019.”

As for the leisure sector, he attributes the decline in profitability in part to “the negative impacts to Sri Lanka’s leisure business as a result of the Easter Sunday terror attacks in April 2019 and the resultant adverse travel advisories from key source markets in the immediate aftermath of the incident.”

He continues: “Whilst the tourist arrivals to the country had recovered close to pre-incident levels, the developments with the global spread of COVID-19 derailed this momentum.”

Meanwhile, the group’s consumer foods segment witnessed an increase in profitability over the course of financial year 2019/20 “mainly on account of the performance of the beverage business and the impulse segment of the frozen confectionery business,” Balendra notes.

And when it comes to JKH’s financial services arm, which includes Nations Trust Bank, he concludes that “a key focus of the banking sector will be to manage liquidity particularly given the debt moratorium announced by the Central Bank.”

A 27 percent year on year decline in revenue – to Rs. 130 billion – lands LOLC Holdings (LOLC) in the number five spot of the 2019/20 LMD 100. On the other hand, the conglomerate’s post-tax profit of 19.8 billion rupees reflects an increase of one percentage point compared to the prior year.

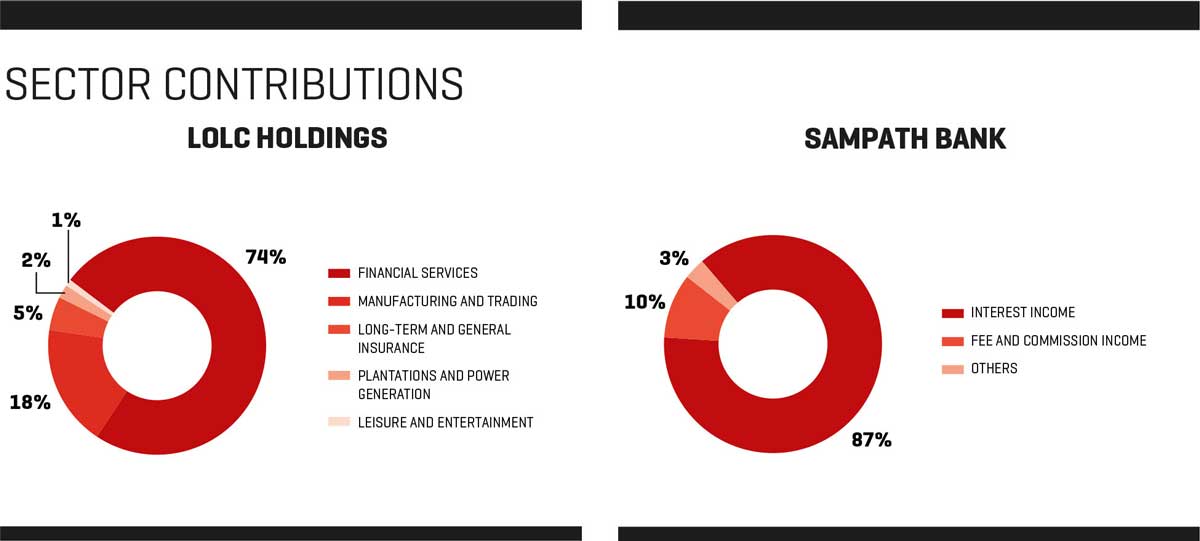

Financial services accounted for most (74%) of the group’s revenue in the period under review. This sector includes three local financial services institutions – viz. LOLC Finance (LOFC), Commercial Leasing & Finance (CLC) and LOLC Development Finance (LODF).

In the group’s 2019/20 annual report, Deputy Chairman Ishara Nanayakkara contends: “LOLC’s local operations performed to the best of their ability against a backdrop of multiple shocks to the economy, consisting of the Easter Sunday attacks in April 2019, followed by the Presidential Election [at the] end of 2019 and then the outbreak of the COVID-19 pandemic in March 2020.”

With regard to the latter development, he remarks that it “did not impact the year under review in any significant manner although it will cast a shadow on how the local and global economy will recover in the next financial year.”

The year under review also involved expansion into new overseas markets for LOLC’s financial services business – i.e. in the Philippines, Nigeria and Zambia.

As for LOLC’s other major operating segments, manufacturing and trading contributed to 18 percent of its consolidated revenue in 2019/20, while long-term and general insurance accounted for five percent. Meanwhile, plantations and power generation, as well as leisure and entertainment, made a contribution of two percent and one percent to the conglomerate’s top line respectively.

Looking ahead, LOLC’s Group Managing Director and CEO Kapila Jayawardena predicts that “the short to medium-term prospects for the leisure business will remain under pressure due to the challenges posed by the pandemic.”

“Our foray into new markets such as Malaysia, India, Africa, Vietnam and South America are in their embryonic stages. The group will continue to focus on the SME and microlending sectors, and look to harness the dividends from its overseas investments, and continue to empower more entrepreneurs in Sri Lanka and across the shores through our unique microfinance model,” he concludes.

The trio of banks on the LMD 100 Leaderboard is completed by Sampath Bank, which retains its No. 6 ranking from the prior year. Although the bank’s top line expanded by three percent to almost Rs. 126 billion, post-tax profits decreased by seven percent for the year ended 31 December 2019 – dropping to 11.7 billion rupees.

Chairman Prof. Malik Ranasinghe acknowledges that “the banking and broader financial services industry came under pressure, as earnings potential declined on the back of poor advances growth, slower retail volumes and low interest rates reducing the net interest margins. The burden of higher NPLs [non-performing loans] proved to be a major stress factor that negatively affected the confidence as well as the profitability of the sector in 2019.”

He reveals that the bank increased its reliance on robotics and automation “to drive the ongoing transformation of our internal process architecture. We also took the first steps to introduce the use of AI and data analytics to boost our analytical capabilities, which will help us as our operating environment becomes increasingly complex and unpredictable in the near future.”

Reflecting on the year that was, Managing Director Nanda Fernando opines that “after a rapid expansion during the past three years, we stepped back from the aggressive growth path we had been pursuing and declared 2019 to be a year of consolidation.”

“Having made a conscious decision to scale back on aggressive lending activities in 2019, in light of the weak credit demand, we then turned our attention towards managing credit quality,” he comments.

When it comes to the focus on alternative markets, Fernando remarks: “Challenged by the drop in credit demand along with our own conservative approach towards lending, we were compelled to look elsewhere for potential opportunities, which led us to focus on developing offshore lending activities through our FCBU [foreign currency banking unit] segment.”

And with regard to the realm of digital excellence, he points out: “We find more and more customers migrating to digital channels with over 94 percent of our routine transactions now being performed digitally.”

Dialog Axiata remains unmoved in the 2019/20 rankings to occupy seventh place in the latest list of Sri Lanka’s leading listed entities. The telecommunications company’s revenue amounted to almost Rs. 117 billion in 2019 (up 7% year on year) while also witnessing a 44 percent hike in PAT, which stood at 10.7 billion rupees for the period in review.

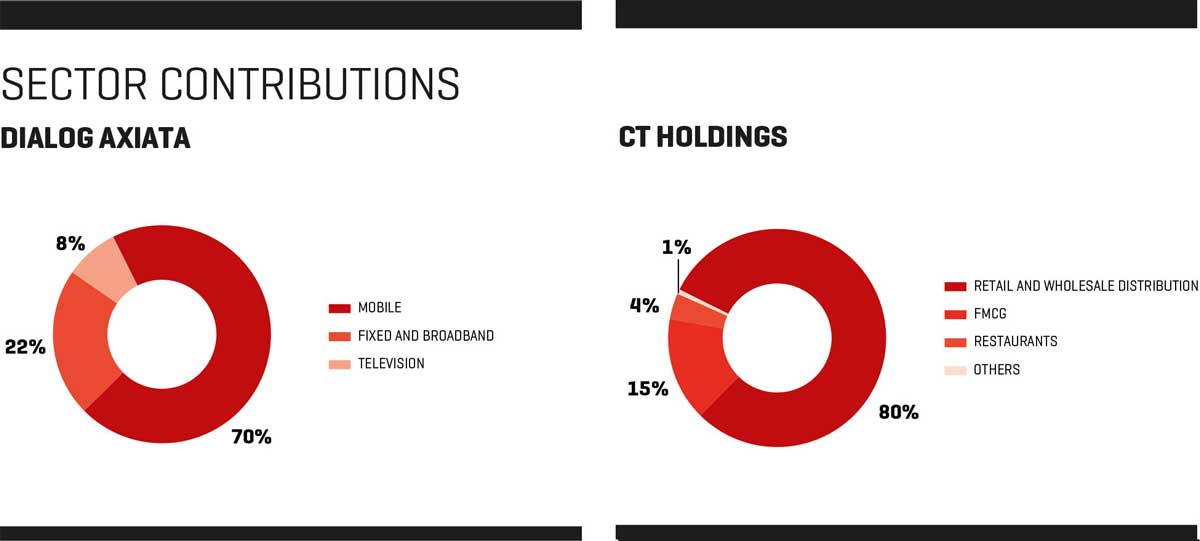

In the year ended 31 December 2019, Dialog’s mobile, fixed and broadband, and television business segments contributed 70 percent, 22 percent and eight percent respectively to the group’s consolidated turnover, while boasting a subscriber base of 14.9 million Sri Lankans.

Chairman Datuk Azzat Kamaludin discloses: “We have continued to invest in developing the digital infrastructure in Sri Lanka, which includes developing cloud migration infrastructure with the establishment of the Dialog cloud enterprise services with a dedicated data centre for cloud ready corporates.”

Moreover, he asserts that “consistent performance has enabled Dialog to remain a key contributor to state revenues where we remitted Rs. 33.3 billion in total to the Government of Sri Lanka (GOSL) during the financial year ended 31 December 2019.”

In line with the vision of the government in creating a technology-based society that promotes IT entrepreneurship and digital inclusivity, Dialog directly invested in ventures to foster an enabling environment for local entrepreneurs in fields including agriculture, transportation and its Digital Innovation Fund, and at 31 December 2019, had invested a cumulative US$ 2.7 billion since 1995, according to Kamaludin’s statement in the telecom giant’s 2019 annual report.

Meanwhile, Group Chief Executive Supun Weerasinghe informs shareholders that digitisation of the retail space was a key focus area during 2019 “with ‘Retail Hub’ enabling our 25,000 strong retail partners to the Retail Hub digital platform to perform key operations previously done manually.”

“We will continue to accelerate digitisation across all dimensions of our business including upskilling our team with digital skills and leveraging the power of analytics to complete the transformation to a digital telco,” he affirms.

As for the future outlook, Weerasinghe is of the view that the COVID-19 pandemic led to a market downturn in Sri Lanka, which is expected to have an adverse impact.

“Dialog’s strategy will focus on building value at the core, synergies in convergence, common market operations and technology, focussing on mobile data leadership, capturing greater market share and monetisation of home broadband offerings, driving enterprise growth via connectivity and ICT platforms, digital transformation and analytics at scale,” he maintains.

The No. 8 slot in the 2019/20 LMD 100 goes to CT Holdings whose revenue (nearly Rs. 108 billion – up 13% year on year) was derived from retail and wholesale distribution, fast-moving consumer goods (FMCG) and restaurants business segments.

As for retail and wholesale distribution (which accounts for 80% of its consolidated revenue), the sector operates supermarkets under the names of Cargills Food City and Cargills Food City Express, as well as Millers.

Meanwhile, the group’s 2019/20 annual report asserts that “the growth seen in the FMCG sector over the past two to three years constitutes one of the significant success stories within the group. Such growth and expansion firmly positions the subsidiary Cargills as a food company comparable to other leading local and multinational food companies operating in Sri Lanka.”

The dairy sector is said to constitute the largest and most profitable sub-sector in the FMCG sector, and operates three processing plants in Banduragoda, Mulleriyawa and Hatton, marketing products under both the Kotmale and Cargills Magic brands. Other FMCG sector constituents include agrifoods, convenience foods and confectionery.

In terms of restaurants, CT Holdings holds the franchise for the KFC and TGI Fridays chains. The group notes that revenue growth in this segment was achieved “largely through expansion while same store growth was below par for the year.”

Entertainment and banking and financial services make up its ‘other revenue’ segment, which works out to one percent of the aggregate sum.

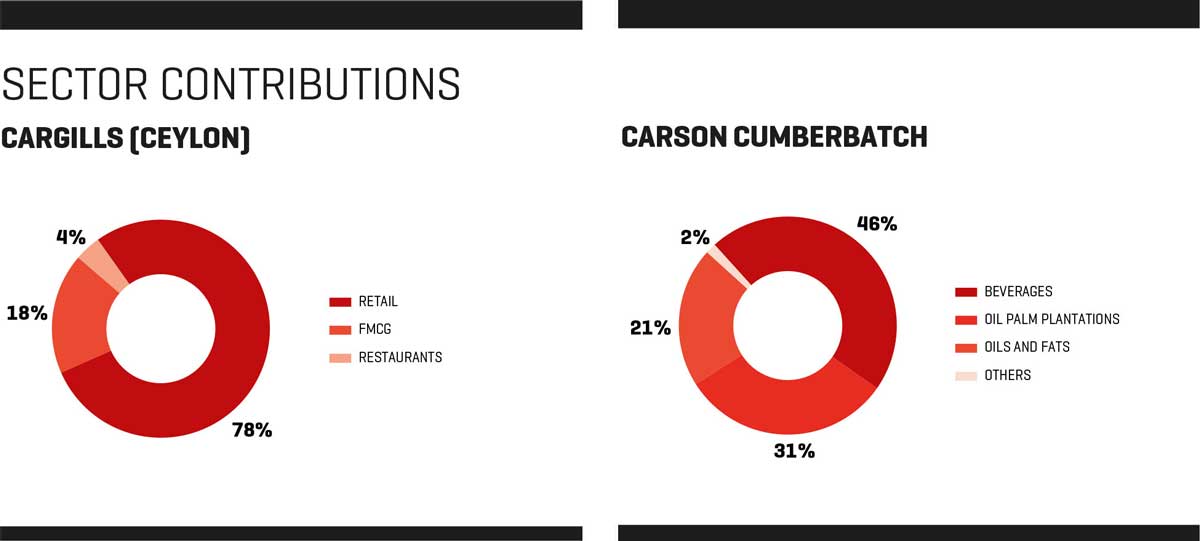

A 13 percent year on year increment in revenue to over Rs. 107 billion enables Cargills (Ceylon) to advance by four notches – to ninth place – in the LMD 100 for financial year 2019/20. Meanwhile, its bottom line expanded by 36 percent year on year to register nearly 2.8 billion for the period under review.

As part of his message in the group’s annual report, Chairman Louis Page points out that the year marked a significant milestone for the group as it celebrated 175 years of being in business.

He goes on to note that “while this financial year was not without its challenges, for instance the unfortunate events of Easter Sunday and the outbreak of the COVID-19 pandemic, we remained committed to serving our country when needed the most, backed by the strength and resolve shown by our people.”

Furthermore, he outlines the expansion of the group’s retail network whereby it grew to 411 outlets during the year with the 400th outlet being opened in the third quarter, corresponding with the 36th anniversary of opening the first outlet in 1983.

“In the group’s continuous bid to drive technological advancements and improve productivity, construction of the centralised logistics centre is going as planned. Despite the temporary setback posed by the COVID-19 pandemic in the latter part of the fourth quarter, the retail segment witnessed notable growth throughout 2019/20,” Page maintains.

He attributes robust growth achieved in the FMCG sector to be primarily driven by the dairy sub-sector performance, adding: “Cargills established itself as the leading milk collector in Sri Lanka within the third quarter, sourcing approximately 150,000 litres a day. Moreover, the dairy segment materially augmented its brand positioning by diversifying its cheese, butter, ice cream and flavoured RTD [ready to drink] milk categories.”

But according to the Chairman of Cargills, “the positive performances recorded by the other two operating sectors were juxtaposed with the restaurants sector performance, which lagged behind. While the overall year on year consumption has been favourable, the restaurants sector was severely impacted by the Easter Sunday events and the gradual recovery was further affected by the outbreak of COVID-19 in the concluding weeks of the fourth quarter.”

Meanwhile, following a challenging year for Cargills Bank, the listing deadline has been deferred to June 2021 and the capital raising to meet the bank’s enhanced regulatory requirements deferred to December 2022, Page reveals.

He discloses that “presently, management is being further strengthened by external consultants to fast track the business model, which will allow the bank to operate the way it was intended to. Pushing ahead, I am cautiously optimistic about the bank’s future prospects.”

Profit constraints are a focal point for Carson Cumberbatch, which rounds off the top 10 of the LMD 100 for 2019/20. The diversified group posted a loss of almost Rs. 2.5 billion for the financial year under review compared to a PAT of 1.1 billion rupees in 2018/19.

Nevertheless, its revenue for the period grew by nine percent year on year to Rs. 106 billion.

Nearly half (46%) of the group’s revenue is derived from the beverages segment where “demand conditions were clouded by… economic adversities, leading to volatility in tourism and low discretionary spending in the local market. [The] Immediate impact of COVID-19 was felt by the sector in the form of zero sales due to the imposition of curfew in the country during the last month of the year,” as emphasised by Carson Cumberbatch’s Chairman Tilak De Zoysa.

He points out that “apart from the volumes, the excise duties on both mild and strong beer varieties were upwardly revised in the months of March 2019 and December 2019, hiking up the beer prices.”

But despite the local market adversities, De Zoysa stresses: “The beverage segment was able to achieve ambitious progress in the export market during the year under consideration.”

As for the oil palm plantations segment (31% of revenue), the business is said to have been impacted by two consecutive years of low prices in the industry for global crude palm oil (CPO) with De Zoysa adding that “adverse weather led to a decrease in crop at our mature plantations, impacting the fresh fruit bunch (FFB) production for the year.”

And there’s the oils and fats segment, which accounts for slightly over one-fifth of Carson Cumberbatch’s top line. In this regard, its Chairman observes: “Declining CPO prices were restricting the price potential of palm kernel input prices of the sector. However, the oils and fats sector managed to increase its specialty fats volumes sold during the year.”

Nevertheless, he acknowledges that “the pandemic induced lockdown during the final quarter of the year deprived the sector of reaching the expected sales target for the period as various countries reacted in different magnitudes with port disruptions including in the key Gulf Cooperation Council (GCC) region. Accordingly, demand for the discretionary nonessential items such as chocolates and ice cream slumped during the final quarter of the year.”

In cumulative terms, while revenue has remained largely flat with a mere one percent increment compared to 2019/20, the LMD 100 Leaderboard has been severely pegged back when it comes to its aggregate bottom line, which has declined by 11 percent year on year for the period under consideration.

The operating environment in the financial year that followed inflicted its own pains as the nation and world at large witnessed the damning effects of a widespread pandemic that persists in early 2021 as well.

Even with all eyes on the expedited rollout of vaccines and a potential lifting of lockdown restrictions in parts of the world, corporates would do well to hold on to their hats as the sheer impact of the pandemic becomes clearer as the year progresses.