COLLABORATIVE COVER FEATURE

ON THE CUSP OF A NEW ERA AT HNB

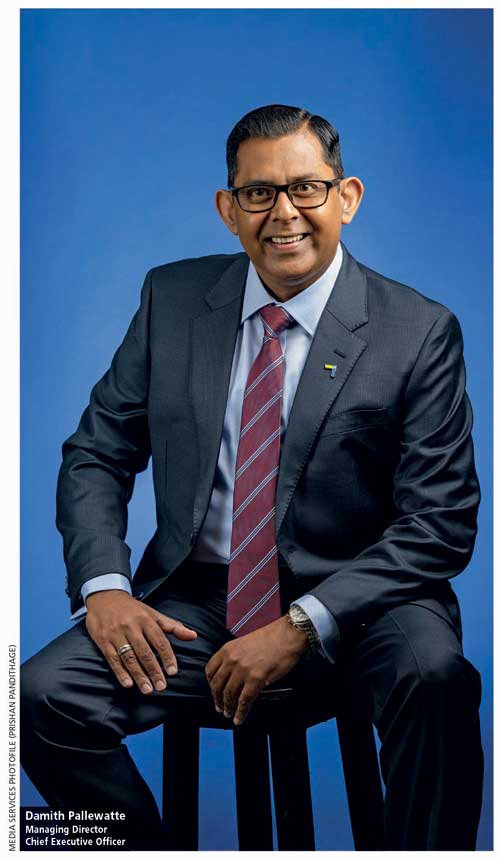

DAMITH PALLEWATTE

Managing Director

Chief Executive Officer

Damith Pallewatte, the newly appointed Managing Director and Chief Executive Officer of Hatton National Bank (HNB), steps into the role during a time of both challenges and opportunities. With a background rich in financial expertise and strategic leadership, Pallewatte discusses the evolving landscape of Sri Lanka’s banking sector in this exclusive interview.

As the financial services industry grapples with economic fluctuations and regulatory shifts, his vision for HNB promises to address these pressing issues. And Pallewatte provides insights into the challenges he foresees, his strategic priorities and how he plans to steer the bank through these transformative times.

Q: What is your vision for HNB over the next five years? And how do you plan to achieve it?

A: As an institution that’s over 136 years old, Hatton National Bank stands at the intersection of legacy and innovation. Although the bank is privately held, I recognise its national obligation to enhance the financial wellbeing of citizens and connect our customers to global opportunities.

My vision for the next five years is to distinguish our signature banking offering by ensuring convenience, financial inclusivity and fostering a culture of financial literacy across all demographics. Achieving this vision hinges on several strategic pillars, foremost among these being the enhancement of customer experience.

In this rapidly evolving landscape, HNB must remain ‘future ready,’ leveraging technology not merely for its own sake but as a vital utility that simplifies and enriches customers’ lives.

Sustainability will be integral to our growth strategy. My ambition extends beyond banking: HNB aspires to be a diversified financial services leader. While the bank’s foundation is robustly domestic, we envision expanding our horizons and exploring opportunities to establish a meaningful presence in at least three international markets in the next five years.

Together with my team, I intend to navigate this transformative journey and position HNB as a truly global institution that is dedicated to fostering prosperity for our customers and the communities we serve.

Q: Can you describe your leadership style – and how you intend to inspire and motivate your team?

A: My leadership style is rooted in passion, persuasion and a commitment to a shared vision. I prioritise setting a clear direction that aligns with our goals, ensuring that my team feels inspired and empowered to bring that vision to life.

Understanding that people are at the heart of our success, I firmly believe in nurturing and upskilling staff by providing ample training opportunities, thereby fostering an environment where we can collectively thrive.

As a seasoned risk manager, I embrace change and see opportunity in transformation. I recognise that leading a legacy institution such as HNB comes with its challenges, particularly in cultivating agility and innovation.

It is paramount that we not only adapt to change but actively drive it, enabling every member of our team to rally around a cohesive strategy that reflects our aspirations. I am inherently a risk and change seeker because half my career was spent as a risk manager – so that helps me identify and mitigate risks.

Motivating a diverse team requires more than directives; it hinges on demonstrating tangible results and creating value that resonates with their experience and commitment. With approximately 30 percent of our staff boasting over 20 years of service, we draw strength from that wealth of knowledge.

Yet, we must remain vigilant in guiding them through the digital transition, ensuring that our evolution aligns with industry advancements and the economic landscape.

Moreover, as stewards of a systemically important financial institution, we bear a greater responsibility to reimagine our role in driving value across various sectors of the economy.

Q: What are your plans for advancing your organisation’s digital transformation and enhancing technological capabilities?

A: HNB has taken significant strides in its digital transformation journey and our focus remains on enhancing our technological capabilities. Since launching our own QR enabled payment app ‘SOLO’ in 2019, users have grown to an active base of over 300,000 to date. We see SOLO eventually becoming a digital marketplace, discerning micro and small enterprises.

Additionally, our digital banking app, which started with 20,000 users four years ago, now serves over 1,000,000 users, clearly reflecting its alignment with customer convenience. We continue to impact customer behaviour to drive digital engagement.

We’re already enabling 80 percent of all our fixed deposits to be opened digitally, showcasing the impact digitalisation has on customer behaviour and how we have met their core needs. Moreover, 90 percent of our approximately 20 million monthly transactions occur digitally, which is a testament to our success.

The next phase of our digitalisation focusses on enhancing customer engagement through evolving advanced technology in customer relationship management and data analytics, to gain deep insights into customer needs and business growth opportunities, and develop predictive capabilities.

We have recently upgraded our core banking system to boost efficiency and productivity. We’re also transitioning to a new credit card platform that offers advanced solutions, similar to those in developed markets, which were previously unattainable.

Our sophisticated transactional banking platform (TXB) – launched in April 2024, which will reshape digital ecosystem among corporates, emerging corporates and SMEs – has already on-boarded 40 percent of corporate clients. We aim to reach 75 percent by December, targeting full portfolio on-boarding to be completed in 2026.

We are also focussing on supporting our emerging corporates and SMEs in the export sector by collaborating with the country’s only B2B platform ‘Cord360,’ which facilitates international market access and virtual matchmaking of buyer-seller opportunities.

Our envisaged next generation trade finance solution, which will come on board in the next few quarters, will seamlessly integrate with our TXB and Cord360 to provide end-to-end digital solutions for all corporates, emerging corporates, and small and medium-size enterprises.

Taking a further stride in making our banking offering completely digital, we have introduced non-face-to-face self on-boarding for personal customers, allowing them to open accounts and complete transactions using their phones – this is rapidly gaining traction among young customers.

Looking ahead, we’re keen to explore the potential of launching a fully digital bank, contingent on regulatory support and availability of necessary regulatory provisions.

Data is increasingly becoming the most valuable asset in the banking sector, and we are investing heavily in data analytics and AI to predict business trends, manage customer relationships and assess performance of loan portfolios.

We believe that integrating the bank’s digitalised platforms into a unified data structure will enable us to deliver personalised, meaningful and efficient services to our valued customers, ultimately establishing HNB as an integral part of the solution for customers’ life cycle of needs.

Q: How do you plan to improve customer satisfaction and ensure your organisation meets the evolving needs of its clients?

A: Ensuring customer satisfaction is paramount, and our strategy revolves around creating an experience that compels them to return and recommend HNB to others. This begins with empowering and engaging our employees.

Convenience is a critical factor. We provide convenience in multiple facets while digital offerings provide the ultimate convenience by segmenting our customers and offering tailored solutions. Our Club and Priority Banking services for high net worth individuals provide them with the convenience to stay aligned with their chosen service offerings.

In addition, we conduct independent customer surveys to gain insights and operate a centralised complaint management system, overseen by a dedicated Customer Experience Officer.

Moreover, we utilise the net promoter score (NPS) to gauge the likelihood of our customers recommending us to others. We set clear targets for our frontline and support staff based on this score, driving accountability and excellence in providing superior customer experiences.

Finally, internal communication plays a vital role. By recognising and rewarding exemplary service, we foster a culture where exceptional customer care is the standard.

Q: What are your thoughts on CSR – and how will you integrate sustainability into the bank’s operations?

A: Corporate social responsibility is about creating a meaningful impact on both people and the environment, while fulfilling our obligations to shareholders and stakeholders. At HNB, we take this responsibility seriously, managing our CSR initiatives through a dedicated trust.

While our lending guidelines objectively ensure sustainability in financing, we have identified key focus areas to create a meaningful impact on society.

The HNB Sustainability Foundation has been instrumental in supporting the Apeksha Hospital’s cancer counselling centre in Maharagama since 2007, offering professional counselling services to patients and their families to overcome the trauma of a cancer diagnosis.

We’re pleased to see the progress we have made at the Kanneliya Forest Reserve, which has been transformed into a replenished source of life and is home to multiple species in the country’s environmental ecosystem.

Further, HNB became the first banking institution in Sri Lanka to achieve carbon neutrality across all its operations – including all 254 branches and the head office. This achievement was recognised by the Sri Lanka Climate Fund (SLCF) and led to gaining the prestigious ISO 14064 certification.

In our efforts to revive the economy at the grassroots level, HNB allocated Rs. 40 million as a grant fund from the year 2020 for 400 microfinance entrepreneurs, under its flagship ‘Oba Venuwen Api’ initiative.

Established by the HNB Sustainability Foundation, the grant provided up to Rs. 100,000 in financial assistance to selected microfinance customers, enabling them to strengthen their businesses and work towards achieving SME status.

Sustainability is deeply embedded in our fundamental operations too – especially at the grassroots level. Through holistic microfinance initiatives such as ‘HNB Sarusara,’ we empower farmers to upscale themselves to ‘agriprenuers’ with access to modern agricultural technologies.

HNB was the first private sector commercial bank to enter the micro-SME (MSME) sector to foster growth and wealth creation in Sri Lanka’s rural economy as far back as 1989. Through its extensive network of ‘Gami Pubuduwa’ officers, the bank cultivated trust and long-lasting relationships with entrepreneurs, providing vital advisory services and training programmes to enhance financial literacy, strengthen enterprises and facilitate export opportunities.

We are also passionate in our support for renewable energy financing in alignment with the country’s vision to source 70 percent of its energy through renewable sources by 2030.

HNB takes pride in being a pioneering financial institution to embark on a journey towards improvising sustainable renewable energy generation capacity with noteworthy investments in the renewable energy sector in Sri Lanka.

Simultaneously, our project finance unit – which supports both greenfield and brownfield projects of different scales, and other lending units – embraces a strict framework of Environmental and Social Management System (ESMS), accredited by multiple multinational organisations, ensuring we only engage in projects that meet rigorous environmental and social standards.

Q: What strategies will you implement to enhance your risk management practices and ensure financial stability?

A: Risk management is a subject close to my heart, having spent 15 years of my career in this field. The landscape of risk has evolved significantly, making some of the traditional defences and mitigations obsolete.

Our first priority in risk management is to stay current and understand the new risks we face today, to fine-tune mitigation strategies. We understand that risk is only one side of the coin. Therefore, our focus is on the risk-return formula without looking at risk in isolation.

Digital transformation – while a powerful tool – has introduced a plethora of new risks, particularly in the realms of cybersecurity and data protection.

To navigate these evolving risks, we’re investing heavily in upgrading technology, upskilling people and reengineering processes, to safeguard ourselves and our customers.

Risk originates at the front line where transactions take place, not in the risk management department. Therefore, we believe it is important to embrace a culture of recognition of collective effort to manage risks. Accordingly, we continuously upskill our people, raise awareness and ensure that everyone understands their role in managing risk.

Financial stability is intrinsically linked to effective risk management. It’s about sustaining growth and profitability while creating value for our stakeholders. To achieve this, we must ensure that our risk-return equation is balanced and aligned with the bank’s growth objectives.

Q: How do you plan to foster innovation within the bank – and what new growth opportunities do you see for Hatton National Bank?

A: Innovation is crucial; yet, one of the common barriers to it is the fear of failure. At HNB, we are committed to creating an environment where it’s safe to fail – not recklessly but within a structured framework that encourages responsible experimentation.

To truly embed innovation, we must shift from top-down directives to bottom-up ideation. And so we’re adopting an agile approach, allowing us to course correct in real time while on the move. Our newly established ‘Innovation Studio’ is a testament to this approach.

Our workforce – with over 40 percent being under the age of 30 – brings a fresh perspective and natural inclination towards innovation. To support them with their energy and novel ideas, we’re in the process of introducing a ‘pilot pod’ – a curated space where new ideas can be tested and refined before rolling them out across the bank.

As for growth opportunities, despite the economic challenges of recent years, we see immense potential for HNB. We are particularly optimistic about sectors such as exports, manufacturing, healthcare, agriculture and education, all of which are poised for revival. We are also keen on opportunities that emerge in Port City Colombo, which will portray Sri Lanka as a future investment hub for foreign investors.

Moreover, our commitment to the SME and microfinance sectors, which are embedded in the bank’s roots, remains strong. HNB’s presence in diversified sectors – manifested by our group/subsidiary portfolio spanning insurance, investment banking and non-bank financial services – positions us uniquely to capitalise on these opportunities.

As a Domestic Systemically Important Bank (D-SIB), we see potential opportunities in the industry for larger banks to emerge through consolidation – and we remain observant of such opportunities to strengthen the financial system in the next phase of Sri Lanka’s economic resurgence.

The tightening of regulations by the Central Bank of Sri Lanka in certain areas such as prudential limits on large exposures will likely drive demand towards capital markets, presenting significant prospects for our investment banking arm.

Insurance is also an under-leveraged sector with immense growth potential especially when coupled with our investment banking capabilities.

While embracing its journey to become the beacon in Sri Lanka’s financial services industry, HNB envisions a banking offering that will create inclusive global economic growth.