CAPITAL MARKET

Compiled by Tamara Rebeira

SAILING REGULATORY WATERS

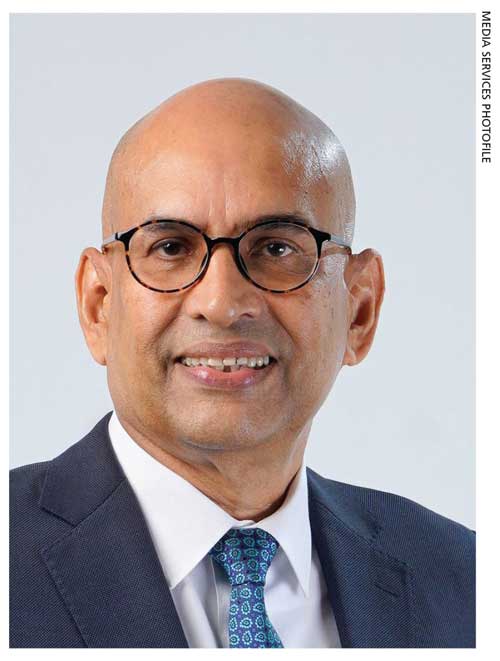

Faizal Salieh evaluates Sri Lanka’s securities regulations and challenges

Q: How do foreign direct investments (FDI) impact Sri Lanka’s securities market?

A: Our capital market has been a frontier market since 2007; it must reach emerging market status sooner rather than later. The economy needs substantial FDIs to support its future trajectory of recovery, growth and stability.

The market mix of foreign and local investors has moved from about 35:65 to 10:90 over the past seven years. Sri Lanka must become a globally attractive destination for foreign investors.

FDI will bring positive sentiment to the market, enhance its performance, increase liquidity and trading activity, and benefit retail and institutional investors. And additionally, it can also enable higher trading volumes, market capitalisation and diversification, transparency, good governance and reporting standards.

The capital market must be positioned to attract quality FDIs, supported by an orderly and enabling environment, consistent government policies, sound governance, timely regulatory enforcements, investor protection, new infrastructure and market development on a par with global standards.

Future initiatives such as the central counterparty system (CCP), demutualising the Colombo Stock Exchange (CSE), and introducing environmental, social and governance (ESG) related sustainable products will help boost foreign investor participation.

Q: What initiatives should regulatory authorities implement to strengthen the securities market?

A: There’s a pressing need for effective regulation and timely enforcement to curb market misconduct and unlawful trading practices, safeguarding market integrity and bolstering investor confidence.

Additionally, enforcing stringent disclosure requirements for listed companies is imperative to enhance transparency and provide investors with comprehensive information.

Strong corporate governance standards must also be implemented and enforced to ensure ethical business conduct, fostering trust among investors and stakeholders. Real-time market surveillance capabilities should be strengthened using advanced technologies to promptly detect and prevent market abuse.

Simultaneously, modernising market infrastructure and access through tech advancements will create a more efficient and accessible trading environment in the future.

Encouraging sustainable finance initiatives and the adoption of sustainability policies by listed companies aligns with global trends and contributes to long-term market stability.

Lastly, initiatives promoting investor education and stakeholder engagement are essential to enhance financial literacy and promote responsible investment practices, ensuring a robust and resilient securities market.

Q: Given the economic and financial challenges, how has the regulatory landscape adapted?

A: Present economic and financial conditions have adversely impacted the capital and financial markets. As such, ensuring market stability and investor confidence is a major challenge. What’s more, steps have been taken to approve the rules for intermediaries and market institutions are strengthening the supervisory function.

Low and stable interest rates are also fundamental to the growth and stability of capital markets. The securities market offers an excellent alternative to local retail and corporate investors for long-term funding needs.

The introduction of the Multi-Currency Board enables local companies to meet funding requirements by issuing foreign denominated securities, and gain exposure to import and export businesses, and hedge currency-related risks.

Q: So what are the main concerns surrounding the securities market?

A: There are crucial challenges and priorities that the country will face this year.

Demutualising the CSE is seen as a key step in enhancing governance, minimising broker influence and elevating investor confidence.

Establishing separate real-time market surveillance systems is crucial for effective monitoring amid digitalisation and increased trading volumes. Digital transformation efforts focus on encouraging stakeholders to digitalise operations and move to cloud-based servers.

Capacity building at both regulator and market intermediary levels is also important, involving investments in human resources and a review of minimum capital requirements.

The proposed establishment of a multi-currency exchange at the Port City Colombo targets foreign investors, aiming to attract foreign inflows and position Sri Lanka as a dynamic global investment destination.

Moreover, initiatives such as reviving real estate investment trusts (REITs), introducing infrastructure bonds and promoting the Empower Board for SME listings are underway.

Product development includes introducing regulated short selling and sustainable bonds, with plans for an ESG index and the regulatory framework for listing ‘sukuks.’

The key focus will be on building capital market awareness at the school level. Including such subjects in the curriculum from Grade 6 to foster financial literacy and create a broad investor base in the long run is an essential step.

The interviewee is the Chairman of the Securities and Exchange Commission of Sri Lanka (SEC).