BUSINESS SENTIMENT

CONFIDENCE BAROMETER NUDGES UP

The business confidence gauge gains some ground following last month’s free fall

“In light of rising debt vulnerabilities in many countries, I strongly endorse efforts to strengthen the debt architecture, and improve the speed and effectiveness of debt resolution,” the IMF’s Managing Director Kristalina Georgieva said, in a statement at the G20 foreign ministers’ meeting in New Delhi in early March.

Sri Lanka for its part is in the process of restructuring its mountain of debt and there’s hope on the horizon that the ongoing negotiations will be fruitful.

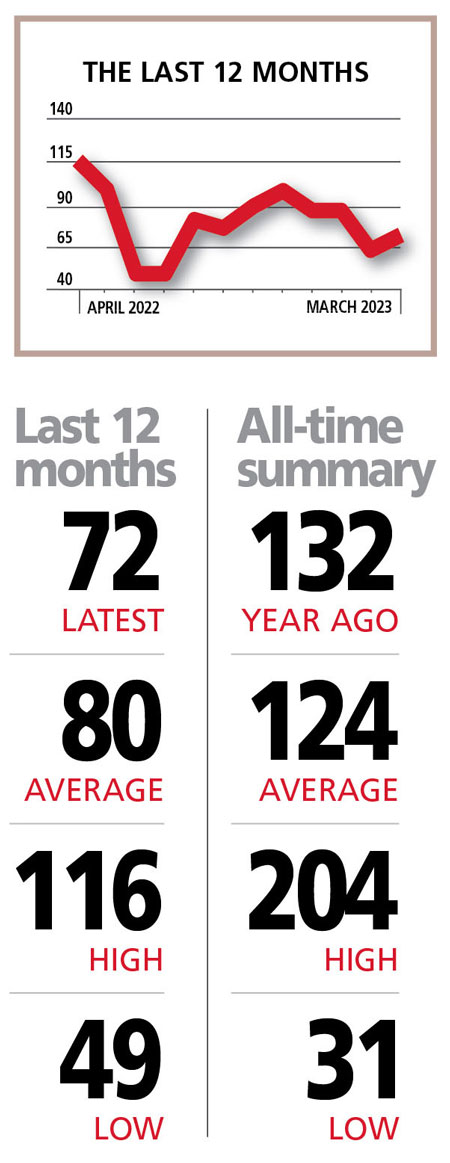

THE INDEX As far as the LMD-NielsenIQ Business Confidence Index (BCI) is concerned, there’s been an improvement of sorts; but one has to go back to the height of the economic crisis – when Sri Lankans stood in long queues for days to refill their fuel tanks and gas cylinders, in April, May and June last year – for a genuine comparison of the barometer’s reading.

In the three months noted above, the index shed 16, 17 and 50 basis points respectively to crash land at 49 on the sentiment scale. And despite clawing its way back up to a range of between 76 and 98 since then, the unique index nosedived by 23 points to register 63 in February.

A month later, in March, the BCI has regained some lost ground to register 72 basis points – the reality however, is that it is a whopping 60 points lower than it was a year ago (132) and 52 notches below the all-time average (124).

Even if we were to compare the March result with the last 12 months, which has been as despairing as any other such term, the index is eight points shy of the average of 80.

On a more positive note, NielsenIQ’s Director – Consumer Insights Therica Miyanadeniya explains that there’s been “a pick up in tourism and migrant worker remittances to the country.”

SENSITIVITIES The uncertainly that surrounds the local government (LG) polls may well be at the top of the list of sensitivities as far as the outlook is concerned; any prospect of poll related violence – and the ensuing political instability – will undoubtedly erode both business and investor confidence.

PROJECTIONS As we said in the last edition of LMD, “the index will fluctuate as business sentiment ebbs and flows between victories and defeats – be it at the polls or any good news that emanates from ongoing debt restructuring talks.”

Miyanadeniya feels that “as the country’s socioeconomic indices continue to improve, the index will gain ground.”

There is also the Extended Fund Facility (EFF), courtesy the IMF, to factor in as Sri Lanka’s country image – and possibly, key ratings – could be a beneficiary following its confirmation on 20 March. Already, we have witnessed a dramatic strengthening of the Sri Lankan Rupee and the jury is out on whether the currency will appreciate further in the short term at least.

The other confidence boosting expectation is the promised restructuring of major state owned entities (SOEs) – promised not only to the people but also the International Monetary Fund.

On the negative side of the sentiment ledger, the unprecedented brain drain, fuel quotas and the monetary burdens that have led to rapidly shrinking disposable incomes will likely continue to undermine business confidence in the weeks ahead.

It is anyone’s guess therefore, as to where the unique index will head in the short term.