BUSINESS SENTIMENT

INDEX CLIMBS TO A 12-MONTH HIGH

Corporate executives are seemingly energised by the unfolding infrastructure boom

In a report released in early October, the International Monetary Fund (IMF) stated that Sri Lanka’s economic momentum continues to be positive, whilst projecting that GDP growth would remain at five percent, in both 2016 and 2017. The global lender of last resort also noted that its US$ 1.5 billion Extended Fund Facility (EFF) – which was approved in June – looks to strengthen public finances, to facilitate the country’s development agenda.

In a report released in early October, the International Monetary Fund (IMF) stated that Sri Lanka’s economic momentum continues to be positive, whilst projecting that GDP growth would remain at five percent, in both 2016 and 2017. The global lender of last resort also noted that its US$ 1.5 billion Extended Fund Facility (EFF) – which was approved in June – looks to strengthen public finances, to facilitate the country’s development agenda.

India is being hailed as the fastest-growing economy in the region, with the IMF projecting growth of 7.6 percent in fiscal years 2016/17 and 2017/18. Its growth has benefitted from major improvements in trade – an area which Sri Lanka is looking to tap into, through an Economic and Technical Cooperation Agreement (ETCA) with its giant neighbour.

To this end, Prime Minister Ranil Wickremesinghe, who spoke at the recent India Economic Summit, reportedly announced that the ETCA between India and Sri Lanka would be signed by the end of the year.

But the ETCA is not without its detractors, with some claiming that it would lead to a dilution of Sri Lanka’s labour and services sectors. Whether this is true remains to be seen, as the terms of the agreement have yet to be released to the public, in full.

Despite these and other concerns, the LMD-Nielsen Business Confidence Index (BCI) reflects a much-improved macroeconomic climate, as evidenced by an uptick in corporate sentiment.

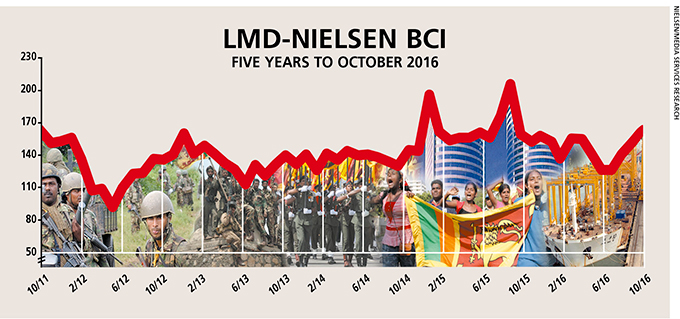

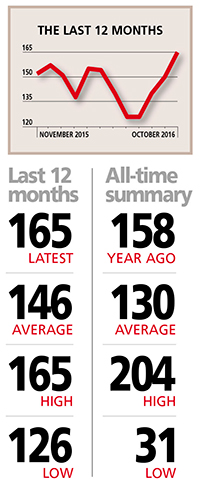

THE INDEX The biz sentiment gauge has continued its upward trend for the third consecutive month, surging by a notable 15 basis points (to 165) in October. This is the BCI’s highest level in 2016, and represents a 12-month peak. In fact, the unique index has gained a whopping 39 points since July.

THE INDEX The biz sentiment gauge has continued its upward trend for the third consecutive month, surging by a notable 15 basis points (to 165) in October. This is the BCI’s highest level in 2016, and represents a 12-month peak. In fact, the unique index has gained a whopping 39 points since July.

As Nielsen’s Managing Director Sharang Pant points out, “action on the investment and infrastructure front is a key reason for the upswing, as it brings the hope of more employment opportunities and an increase in consumption.”

Pant explains that “there’s a visible revival of mega infrastructure projects, while the press is full of advertisements for massive housing and commercial projects. This has helped shore up sentiment amongst businesspeople and consumers alike. Global funding is already coming in, or being promised, for some of these initiatives.”

“A large number of business leaders feel that the economic and business outlook is strong, for the coming months. They are, however, cautiously optimistic about the upcoming budget. And they expect inflation and tax rates to be addressed immediately, as these remain concerns…,” he adds.

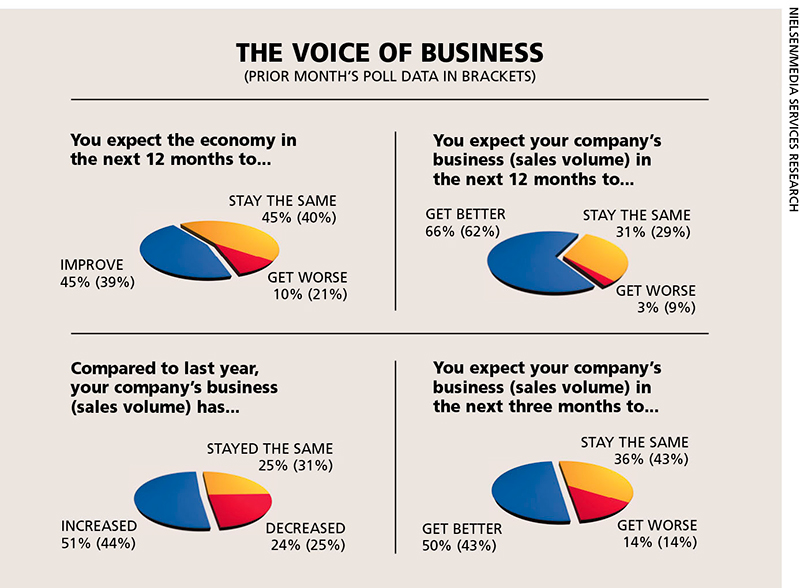

THE ECONOMY There is also a noteworthy improvement in the economic outlook, with only 10 percent of businesspeople (versus 21%, in September) stating that the economy ‘will get worse’ in the coming 12 months. Moreover, at least four-in-10 respondents expect economic conditions to improve, and a similar number envision more of the same in the future.

One respondent asserts that “the economy seems to be moving in the correct direction,” and another is “hopeful that the economy and business operations will improve.”

On the contrary, a corporate executive interviewed by Nielsen contends: “With the current state of the economy, and with so much uncertainty, many businesses seem to be reluctant to invest.”

BIZ PROSPECTS Two-thirds of the survey sample believe that business (i.e. sales volumes) ‘will get better’ in the next 12 months, whereas a mere three percent state that sales volumes will deteriorate over this period. Another 31 percent expect the status quo to be maintained.

As for the next three months, half of those polled anticipate improved business, compared to 36 percent and 14 percent of poll participants who expect sales volumes to ‘stay the same’ or ‘get worse,’ respectively.

INVESTMENT There are mixed sentiments with regard to the prevailing investment climate – 35 percent (up from 24%, in the prior month) of the sample population view investment conditions in a positive light, whereas 38 percent describe the climate as ‘fair’ and the naysayers account for 27 percent of respondents to the exclusive monthly survey.

“There are so many new projects commencing, especially in real estate and highways. This will create more investment opportunities, which may result in business operations improving in the future. And the Government needs to provide incentives and encourage businesses to invest,” a businessperson emphasises.

Referring to Budget 2017, one executive points out that “if the Government can provide tax relief via the upcoming budget, it will be beneficial to businesses; and this would help boost both the economic and investment climate.”

SENSITIVITIES Indeed, the forthcoming government fiscal policy brief appears to be top of mind among biz folk. And this, coupled with concerns about rising interest rates and the Value Added Tax (VAT) rate hike, is among the key sensitivities cited in business circles.

SENSITIVITIES Indeed, the forthcoming government fiscal policy brief appears to be top of mind among biz folk. And this, coupled with concerns about rising interest rates and the Value Added Tax (VAT) rate hike, is among the key sensitivities cited in business circles.

At the same time, it is the view of one businessperson interviewed by Nielsen that “the Government seems to have overpromised on many of its proposed policies.”

PROJECTIONS In the previous edition of the BCI, we noted that, although the outlook appeared to be downbeat, the hype created by Sri Lanka’s upbeat development agenda may fill any void in business sentiment – and this seems to be the case, with the latest index going a step further, by registering yet another gain.

However, we continue to be cautious about the future trajectory of the BCI, factoring in the potential impact of any adversely perceived policy measures proposed in Budget 2017, its passage through the House and what eventually turns out to be the reality, when the new provisions are gazetted.

And if Sri Lanka were to return to a period of political instability, as many rumblings in the media and beyond seem to suggest is a possibility, the wheels of fortune – as far as the BCI is concerned – could shift into reverse gear.