BUSINESS SENTIMENT

BIZ CONFIDENCE NUDGES DOWN

Sentiment wanes as businesspeople weigh the pros and cons of the new regime

The trade deficit contracted marginally in November with both imports and exports declining, according to data released by the Central Bank of Sri Lanka (CBSL). In the first 11 months of last year, the trade deficit contraction compared to the corresponding period of the previous year is attributed to a major drop in expenditure on imports along with a marginal increase in earnings from exports.

Moreover, CBSL reveals that “although tourist arrivals decreased on a year on year basis in November, a continued recovery is seen in the tourism industry. Workers’ remittances declined (year on year) in November and have recorded a cumulative decline during the first 11 months of 2019.”

The Central Bank adds: “Meanwhile, the financial account of the balance of payments was augmented with the proceeds of the seventh tranche of the IMF’s Extended Fund Facility (EFF) programme and net foreign inflows to the government securities market.”

It continues: “However, the Colombo Stock Exchange (CSE) recorded a net outflow during the month.”

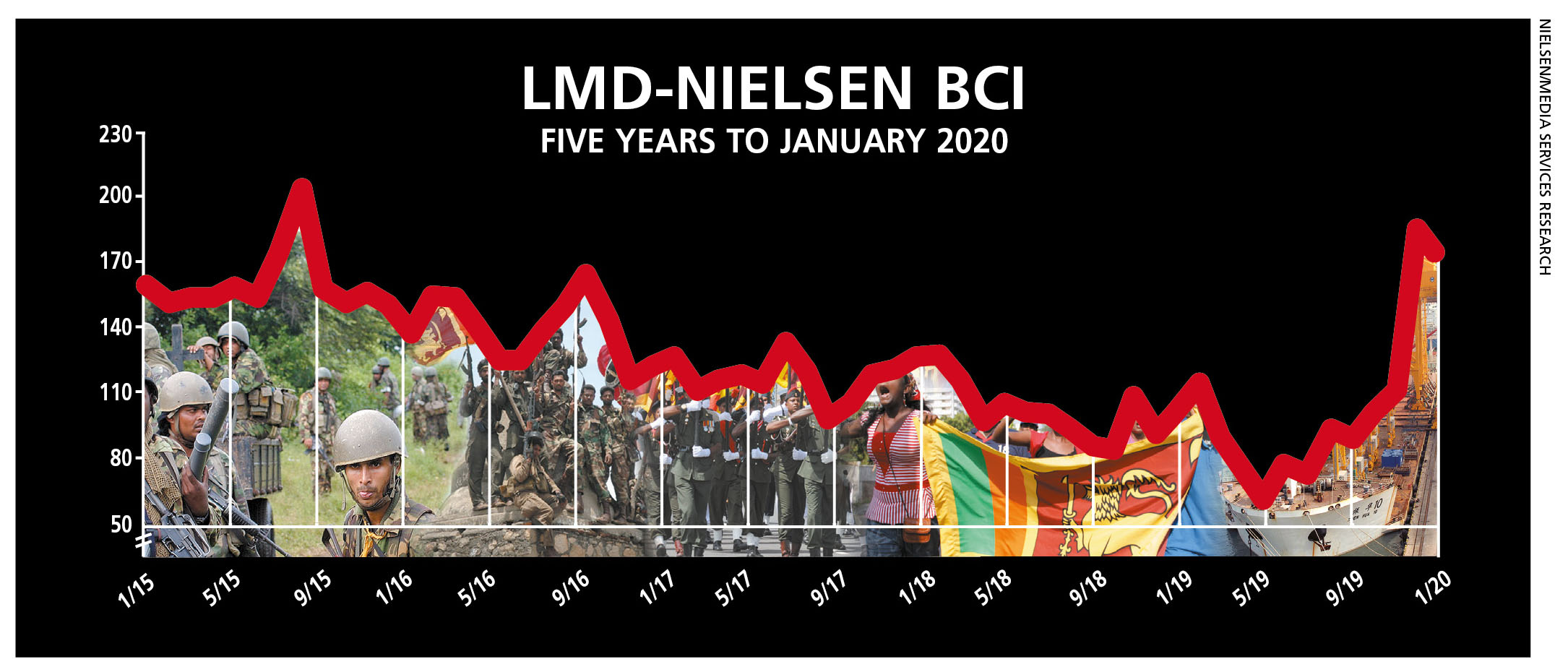

Meanwhile, turning to the latest LMD-Nielsen Business Confidence Index (BCI), the substantial uptick in confidence following the outcome of the presidential election has reversed course to some degree.

THE INDEX The BCI declined by 12 basis points to register 174 in January (compared to 186 in the previous month). Nevertheless, the index continues to stand tall in the context of its range over the last five years and sits comfortably above the all-time average (127).

In addition, it is worth noting that the BCI stood at a meagre 101 a year ago.

Commenting on the latest index, Nielsen’s Director – Consumer Insights Therica Miyanadeniya observes: “Following the initial euphoria brought about by the election of a new president, the enthusiasm of businesspeople seems to be waning somewhat.”

SENSITIVITIES Taxes continue to be high on the agenda when it comes to the most pressing business issues facing Sri Lanka – despite that is, the concessions announced recently – followed by inflation and political interference respectively.

Meanwhile, brain drain is an emerging issue as a greater number of corporate executives point to it being a cause for concern.

As for the nation in general, it is the economy that’s top of the mind among those surveyed with poor infrastructure as well as the prevailing political culture also warranting a mention.

PROJECTIONS In the wake of the previous month’s high jump so to speak, we noted that the direction of the index in the coming months would largely depend on developments leading up to the general election, as well as how the corporate sector perceives the caretaker government’s policies and actions.

Miyanadeniya reiterates that in terms of the future trajectory of the index, “as the country settles down after the presidential election, the next few months, as we approach the general election, will determine the course of the BCI.”

So it remains to be seen if the spurt of optimism among corporates will hold in the near term.