BUSINESS SENTIMENT

RENEWED CONFIDENCE ALBEIT MODEST

Businesspeople are seemingly turning a blind eye to the dirty business of politics

In recent times, Sri Lanka has witnessed a series of so-called ‘agitation campaigns’ that were presumably aimed at gaining the attention of the powers that be. Some have come in the wake of industry shakeups and legal rulings while others have pointedly protested against individuals in seats of power or simply sought to regain citizens’ inalienable rights.

Allegations of foul play by those who were previously in charge and say they want to regain power ‘in the interest of the people’ have also been bandied about.

No matter the objective or objectives, these (mostly highly politicised) campaigns could also serve to stall an economy that’s desperately in need of a kick-start.

All the same, the corporate sector doesn’t appear to have lost heart. This is evidenced by the outcome of the latest LMD-Nielsen Business Confidence Index (BCI) survey, in which there’s been a slight improvement in sentiment.

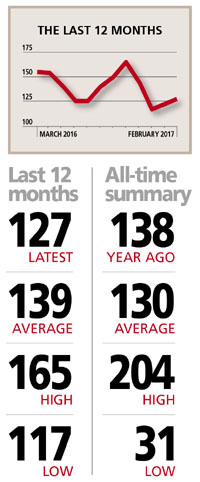

THE INDEX The positive note on which 2017 took off, as the BCI nudged up by six basis points to 123, has continued in February with the index inching up another four notches to 127. But the confidence barometer remains below its 12-month and all-time averages of 139 and 130 respectively. It’s also 11 points shy of where it stood a year ago.

Nielsen’s Managing Director Sharang Pant observes: “The negative sentiment on the economy seems to be gradually diminishing … Businesses seem to have adjusted to the new tax regime and are willing to stick to their plans.”

However, he also points out that “the overall investment climate is still seen as cautious to negative… The upward movement of interest rates and inflation is seen as a deterrent to the cost of doing business. However, the investment climate has improved marginally over December 2016. These reasons are seen holding up foreign investors.”

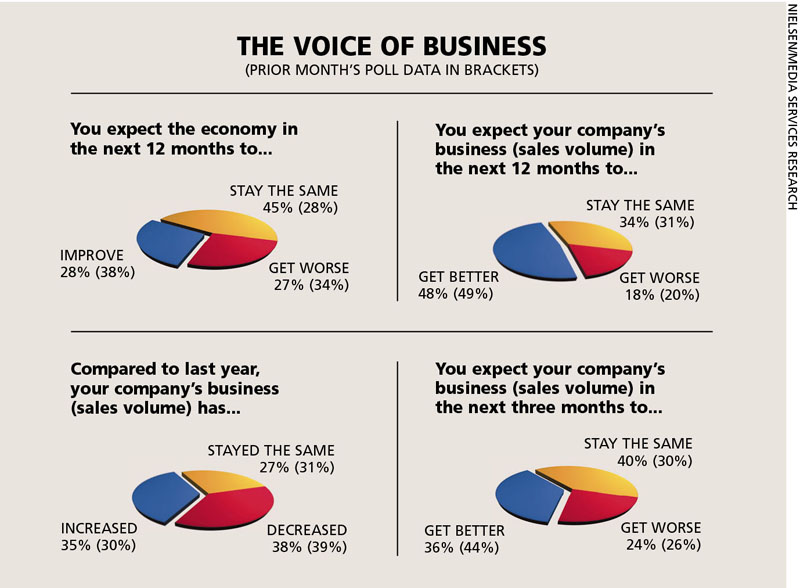

THE ECONOMY A smaller proportion of respondents (27%) believe that the economy will be worse off in the coming 12 months – this number was higher at 34 percent in the previous month.

The majority (45%) of those surveyed are of the view that the Sri Lankan economy will ‘stay the same’ while 28 percent (versus 38% in January) expect economic conditions to improve in the 12 months ahead.

BIZ PROSPECTS More than four-in-five respondents feel their business volumes will remain the same or improve in the next 12 months – this percentage stood at about 70 percent at the end of 2016, indicating a reasonably healthy shift in the last two months.

There is a similar movement in the short-term forecast with marginally over 75 percent of survey participants expecting a decent performance in the first quarter of 2017. “Our company’s business outlook for the year looks good,” reveals a businessperson spoken to by the pollsters.

But this view is contradicted by an executive who says that “with the current economic situation, it is hard to see from where our business will grow and develop in the coming few months.”

INVESTMENT Less than a quarter of the survey sample view the current investment climate in a positive light, whereas slightly over a third continue to feel that this is not a good time to invest. An albeit-slim majority (41%) of those consulted by Nielsen state that the prevailing investment conditions are simply ‘fair.’

“Although there are many foreign investors interested in investing in our economy, they seem to be hesitant due to the investment climate not being properly managed by the government,” claims one corporate executive.

Echoing these sentiments, another respondent maintains that “the proposed investment plans do not seem stable and the strategies implemented to attract investors are poor.” Another remarks: “Foreign investments seem to be coming up now but the investment plans made by the government and their decision-making processes aren’t right.”

SENSITIVITIES Members of the biz community point to poor government decision-making particularly with respect to investments as a key sensitivity affecting the business outlook.

To this end, a businessperson laments that “due to taxation issues on imports, we have had to delay an investment that was to be implemented in November last year to May this year. This is mainly due to poor decision-making by the government.”

Meanwhile, another business executive points out that “there seems to be an unnecessary increase in political interference.”

WORKFORCE According to the latest BCI survey, a noteworthy majority (76%) of corporate executives say their organisations will look to maintain their present workforce in the coming six months. Less than a fifth of those surveyed say they plan to increase their staff cadre over the same period while seven percent expect to reduce employee numbers.

PROJECTIONS In last month’s edition of the BCI, we speculated about the possibility of the index having bottomed out while conceding that this could also be a case of the calm before the storm.

Judging by the results of the latest survey however, it would seem that a mild recovery in sentiment is in the works – provided of course that there’s better direction from the state and a cap on the extent of political interference in business, which some may say is wishful thinking!

But most of all, Sri Lanka Inc.’s prospects hang in the balance as the country’s politicians (across parties, within parties and from any other place one can think of) wrangle over just about everything under the sun, jockeying for positions that reap rich rewards… usually at the expense of the very people who vote them into power.