BUDGET 2022

OPTIMISTIC TARGETS

Shiran Fernando analyses the various proposals put forward in the national budget for the coming year

In the lead up to the maiden budget proposals delivered by the finance minister on 12 November, expectations were riding high with some believing it would be ‘nontraditional,’ and others saying it may be growth and development oriented.

Regardless of these expectations, the economy is at a challenging point with a low level of reserves and substantial external debts to be repaid. As such, we explore how Budget 2022 delivered against these expectations and what the proposals could mean for the economy.

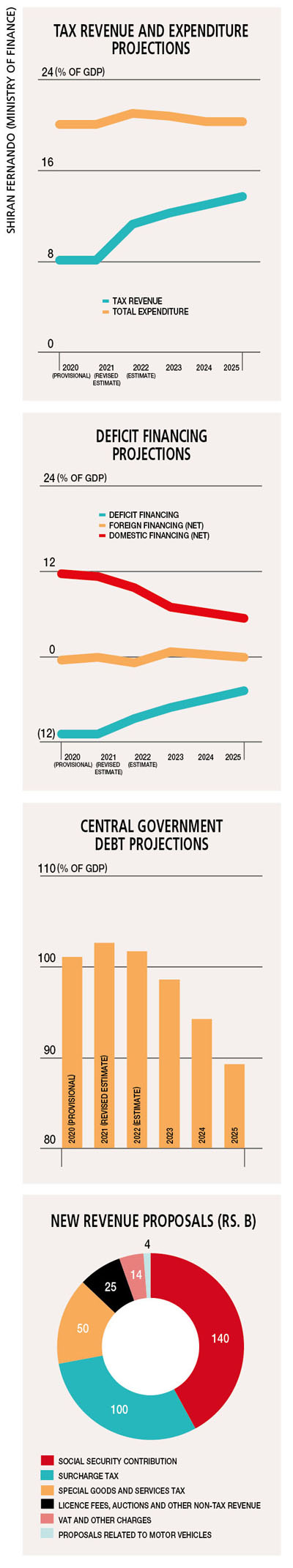

TAX REVENUE The national budget for 2022 forecasts a 50 percent rise in tax revenue, driven by proposed new taxes, growth in economic activity amounting to between five and six percent, and improved tax administration.

This projected growth in tax revenue is expected to come from new taxes such as the surcharge tax and the Social Security Contribution (SSC).

The former is similar to the 2015 ‘super gains tax,’ which was retrospective in nature and taxed 25 percent of taxable income exceeding Rs. 2 billion. It is expected to bring in 100 billion rupees or about 30 percent of the proposed new tax revenues. The tax is anticipated to impact more than 60 companies with taxable incomes exceeding the stipulated sum in the 2020/21 period.

And the other significant new tax proposal is the SSC, which is expected to be in the form of a revenue tax of 2.5 percent for those with a turnover of Rs. 120 million and above. Although there is a lack of clarity about the applicability of the tax at the time of going to print, it is akin to the recently abolished Nation Building Tax (NBT).

The SSC is expected to impact businesses that operate on thin margins and could also be cascading in nature where the end tax may be borne by consumers. This is projected to bring in 42 percent of the proposed new revenue.

Meanwhile, the remaining new taxes are to come from an increase of three percent from the existing VAT on financial services, a consolidation of taxes as a ‘special goods and services tax’ (similar to the proposal announced in Budget 2021 but not implemented), revenue from the auctions of 5G, licence fees and proposals related to motor vehicle accidents.

Compared to previous budgets, these proposals are implementable. However, the overall projected growth of tax revenue is highly optimistic and surpasses past budget forecasts.

In particular, taxes on external trade, and goods and services, and income tax are expected to grow by 21 percent, 59 percent and 68 percent respectively. If these targets are achieved, revenue would be higher than what it was pre-pandemic – and the highest on record.

EXPENDITURE TARGETS Total expenditure is expected to rise by 525 billion rupees next year, driven by growth in public investment by the government while recurrent expenditure is also anticipated to rise.

Public investment is projected to be 5.1 percent of GDP but it’s unlikely this will be achieved. Last year as well, 5.4 percent of GDP was budgeted for 2021 but the estimate is now 3.5 percent.

Over the years, budget statements have overstated the expectations of the government’s capital expenditure, which has then been curtailed during the year to maintain the budget deficit.

The growth in recurrent expenditure is expected to be driven by the proposed intake of 50,000 graduates while extending the retirement age to 65 in the public sector.

While these measures would seem to expand the sector, there is also a focus on curtailing expenditure by minimising the cost of fuel, electricity, mobile phones and new office infrastructure, as well as better fiscal management by individual ministries and state institutions.

ECONOMIC SECTORS The budget includes many promising proposals related to soft reforms in terms of digitalisation, trade facilitation and improving the ease of doing business in particular by encouraging more entrepreneurs to set up operations by waiving the registration fee.

Despite the impact of the pandemic and rising cost of living, no substantial handouts were announced but targeted relief is to be provided to micro, small and medium enterprises (MSMEs), and other segments of the economy whose livelihoods have been impacted by the pandemic.

EXTERNAL RISKS Similar to this year, the budget deficit is expected to be financed largely by domestic sources given the lack of foreign financing available. This is likely to put upward pressure on interest rates.

While there was a focus on the need for fiscal consolidation and an improvement in reserves, the budget did not address the country’s immediate forex needs and how Sri Lanka will finance its external debt. As such, the opportunity to address the concerns of credit rating agencies and foreign investors has been missed.

However, the budget’s success will depend largely on its careful implementation with growth and managing the external deficits being prioritised.

Leave a comment