BRAND VALUE

Innovation and brands

Ruchi Gunewardene and Shemara Stephens assess Sri Lanka’s standing in the context of global innovation

In late 2020, the 13th annual edition of the Global Innovation Index (GII) was released by the World Intellectual Property Organization (WIPO), presenting the latest global innovation trends and ranking 131 countries.

The publication determines the metrics and methods that capture the richness of innovation in nations across the world.

The publication determines the metrics and methods that capture the richness of innovation in nations across the world.

With many governments putting innovation at the centre of their growth strategies to drive economic progress and competitiveness – especially in the context of post-COVID recovery – this report is an invaluable source of information.

The definition of innovation as set out here has broadened; it is no longer restricted to R&D laboratories and published scientific papers. According to WIPO, innovation could be and is more general and horizontal in nature, including social, business model and technical innovation.

As for the methodology used for the latest report, it includes capturing a total of 80 indicators grouped under seven pillars – viz. institutions, human capital and research, infrastructure, market sophistication, business sophistication, knowledge and technology outputs, and creative outputs.

Sri Lanka’s performance is not particularly encouraging, being placed towards the bottom of the index, ranked 101st of 131 nations that were benchmarked.

THE ROLE OF BRANDS According to the report, on average, firms that invest more in innovation also invest more on brands as this is an important way to derive returns on their R&D investments.

To move up the global value chains and increase the possibility of capturing greater profit margins, companies in low and middle-income economies increasingly seek to develop their own brands or acquire them from abroad.

As a result, global branding investments approached half a trillion dollars and account for a growing share of GDP – the equivalent of around a third of global R&D.

In this context, GII included brand value as one of its indicators for the first time. The results of Brand Finance’s public study of the 5,000 most valuable and strongest brands in the world were used to create this. The values of the most valuable brands in each economy are added and scaled by GDP to rank the countries.

SRI LANKA’S BRAND VALUE Sri Lanka finds itself higher on the index in the brand value indicator, being ranked 55th.

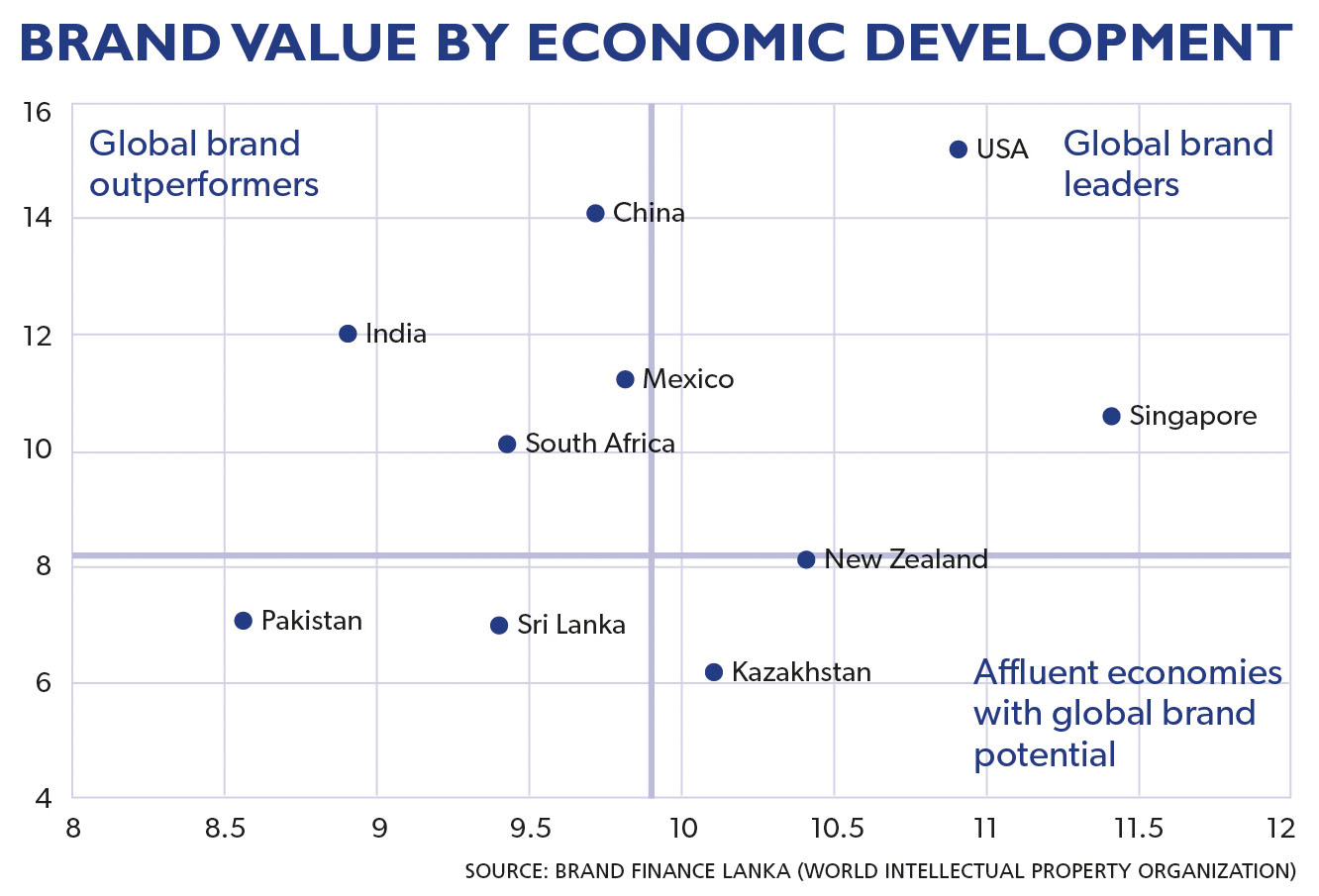

When the level of development of a country is plotted against its share of brand value in the top global brands, Sri Lanka falls in the lower left quadrant. What this means is that the country belongs to the middle and low-income economies group, and has brands that make it into the top 5,000 ranking but their value is relatively low.

Nations such as the US and Singapore in the top right quadrant are global brand leaders because of their high brand value. India – with a lower GDP than Sri Lanka – has a higher proportion of valuable brands and is ranked No. 31, making it a global brand outperformer.

China, Mexico and South Africa are similarly clustered as outperformers. While Sri Lanka scores higher than Kazakhstan in this index, it’s not too far behind New Zealand, which is a smaller country but with a much higher income.

This suggests that Sri Lanka has immense potential for the expansion and growth of local brands, which can help improve the brand value ranking in this index.

EXPORT BRANDS AND INNOVATION To make headway in the realm of brands with a relatively small economy, Sri Lanka has no option but to look outward to expand through a more global reach.

The importance of brands in global marketing goes beyond consumer goods such as Dilmah, which is relatively well known on the world stage. For businesses that sell products or services to other businesses (B2B), brands play a significant role.

Sri Lanka’s US$ 1 billion companies MAS Holdings and Brandix Lanka are two great examples. It is no coincidence that both these companies are heavily reliant on innovation to drive their global businesses, without which they would not have succeeded in this highly competitive market.

Extensive innovation is taking place across multiple industries in Sri Lanka, which can benefit from stronger brands. These include the IT industry, specialised products for global manufacturers and even innovative ventures taking new technologies to developing countries in the African continent by many enterprising Sri Lankan companies.

Extensive innovation is taking place across multiple industries in Sri Lanka, which can benefit from stronger brands. These include the IT industry, specialised products for global manufacturers and even innovative ventures taking new technologies to developing countries in the African continent by many enterprising Sri Lankan companies.

WHAT THIS MEANS The inclusion of brand value in GII demonstrates international recognition of the importance of brands for value creation – especially in supporting economic recovery, and the growing consensus around the need for reliable and independent intangible asset valuations.

The point is that while companies build innovation capabilities, brands should not be neglected. Building brands requires consistency and investment over the long term. For B2B brands, this is not only about investing in trade fairs to acquire new customers but building a brand from within through employee engagement and actively establishing points of relevant differentiation with customers.

Sri Lankan companies need to use brands for global reach and customer impact, thereby harnessing even more value through their world-class innovations.