BANKING SECTOR

MONETARY AFFAIRS

NAVIGATING MULTIPLE CRISES

Dinesh Weerakkody provides an assessment of the state of the banking sector

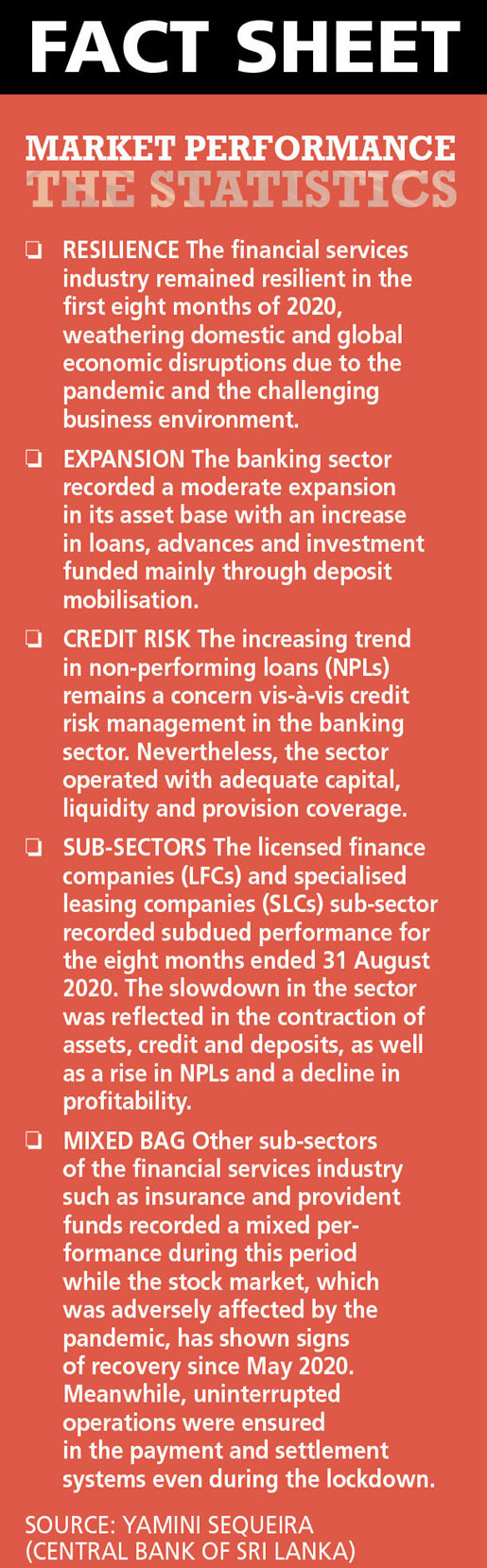

The banking sector has been affected by the slowdown in the economy resulting from the impact of the Easter Sunday attacks in 2019 and the COVID-19 pandemic since March 2020. The sector’s non-performing assets (NPAs) more than doubled over the last 24 months and credit costs also rose markedly to record close to 1.5 percent.

This also impacted loan growth and fee income generating activities of banks. Loan growth, which was averaging between 15 and 20 percent, dropped to single digits; and the fall in interest rates especially in 2020 resulted in margins contracting by around 100 basis points during the year.

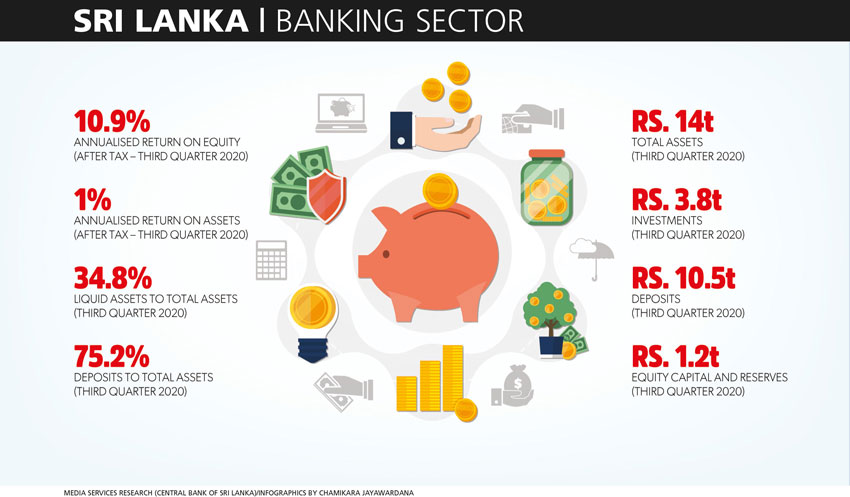

Despite the drop in profitability, the sector remains resilient since most banks have strong capital bases – and they have recorded modest returns despite the challenges.

LOOKING BACK Commenting on his assessment of trends in the banking sector and the wider economy this year, Dinesh Weerakkody says: “We anticipated 2020 to have ended with negative growth in the economy for the second time post-independence. However, it’s expected that the economy will recover in 2021 with a projected growth of approximately four percent on the back of the lower base in 2020.”

With such anticipated growth and the consequential increase in the demand for loans, interest rates are also likely to edge up – and this will lead to better interest margins in the banking sector, he adds.

Weerakkody continues: “Nevertheless, a critical factor would be the ability of borrowers to service loans post-moratoria, which will determine the trend for NPAs and credit impairments in the sector.”

“With authorities remaining hopeful of combatting the rise in COVID-19 cases and bringing it to more manageable levels this year, and given the expected growth of the economy, we are optimistic that most customers will recover by March and loan recovery rates will be strong,” he adds.

To surmount the fiscal challenges ahead, Weerakkody notes that an accommodative monetary policy has already been adopted by the Central Bank of Sri Lanka (CBSL) with both the statutory reserve ratio (SRR) and interest rates being reduced to the lowest levels in history.

The low interest rates will help stimulate the economy, which has taken a severe beating over the last few years due to the reasons mentioned above and underlying political uncertainty, although it’s unlikely to be the only factor in driving growth.

Weerakkody states: “However, I believe an initiative to roll out an effective vaccine for COVID-19 could be a catalyst to kick-start the economy. CBSL will need to watch its monetary policy closely once the economy takes off to curb trends that can fuel a rise in inflation, and exert pressure on external reserves and forex rates.”

NEED FOR CHANGE In Weerakkody’s view, a major challenge for the banking sector is the time taken for recovery and difficulties in initiating legal action against wilful defaulters; to maintain a strong financial services industry, it’s paramount that the country’s legal system supports the recovery effort.

He also feels that the experience of the pandemic further underlines the need for larger and stronger banks in the country, with strong capital bases to weather storms and achieve economies of scale for cost efficiency and productivity. Weerakkody advocates sector consolidation “as a strong and big balance sheet that would help.”

Commenting on the state of play in the microfinance sector, he opines: “Microfinance is a difficult sector given the interest cap imposed and exertion of political pressure where prominent figures discourage borrowers from making repayments coupled with the vulnerability in weather patterns.”

on the state of play in the microfinance sector, he opines: “Microfinance is a difficult sector given the interest cap imposed and exertion of political pressure where prominent figures discourage borrowers from making repayments coupled with the vulnerability in weather patterns.”

“If the formal sector deprives finance to this market segment, the dependents will be driven to high cost informal moneylenders – and that will drag them further into indebtedness and poverty,” Weerakkody warns.

As for technology adaptation, he notes: “The data that banks have must be harnessed to create e-commerce solutions that enable faster and smarter decisions, and customised solutions. Today, unlike ever before, banks need to offer innovative financial solutions leveraging on deep-rooted expertise, agile operational models and digital capabilities.”

The capacity for local banks to raise debt capital in overseas markets has been hampered due to our sovereign credit rating being lowered by practically all rating agencies. Responding to this challenge, Weerakkody asserts that “the downgrading of the country will certainly make it more difficult and expensive for banks to obtain foreign funding.”

RESET BANKING Assessing the strengths of the banking sector, he cites high penetration levels compared to the region; resilience, stable liquidity and capital levels; and relatively strong and sound regulations as major positive factors.

On the other hand, Weerakkody points to the existence of too many small banks, pressure on asset quality, narrowing interest margins, a hierarchical structure and weak bench strength as inherent weaknesses that need to be addressed.

Nevertheless, it’s pertinent that the banking sector maintained healthy capital adequacy ratios (CARs) throughout 2020, reporting a Tier 1 CAR of 13.1 percent and a total CAR of 16.4 percent at end June 2020 – above the minimum regulatory requirements.

In its study of Sri Lanka’s banking sector in 2020, a report by KPMG perceives two key trends: firstly, with remote working likely to remain higher than it was pre-COVID, banks may need to reset some of their protocols and policies around access management in ways that increase flexibility without compromising security. They’re also likely to seek more secure video-conferencing services.

Secondly, the study anticipates “an increase in banks moving sections of their IT operations to cloud environments. For this to happen, cloud operators will need to meet the very specific and stringent extra security requirements that banks are likely to demand. We expect the will to be there on both sides to make this work. This may be phased and gradual but is likely to be a trend over the coming years.”

The study also notes that “alongside all the other pressing issues of supporting customers and providing liquidity, cybersecurity and skills will remain a top concern and priority for banks for the future.”

The interviewee is the Chairman of Hatton National Bank (HNB)