BANK OF CEYLON

Q: Given Sri Lanka’s highs and lows since independence, what has been the formula for the island’s resilience?

A: Human resources is the strongest element that brings about resilience in Sri Lanka. Driven by a strong religious and cultural background that encourages patience and tolerance, the Sri Lankan people have what it takes to reach the island’s development goals.

Bank of Ceylon (BOC) too has developed itself as a strong and resilient corporate citizen. Our corporate values – which include being customer-centric; respecting all forms of diversity; committing towards a high level of ethics, governance and professionalism; focussing on agility and innovation; and being accountable for our actions – have given us the capacity to improvise according to the situation and support Sri Lanka.

Q: What is the role of corporates in reviving the island’s economic and social landscape?

A: As a state-owned entity, BOC plays a pivotal role in energising the country’s socioeconomic development elements.

The bank infuses businesses and individuals with financial power to create value.

We enrich the state’s income, assist in timely decision making and act as a channel for the government to carry out livelihood development at the grassroot level. BOC focusses on key sectors that help the country’s long-term economic development such as agriculture, export-oriented sectors and fisheries, to name a few.

Bank of Ceylon also assists in public funded infrastructure development projects and works towards enhancing digital financial inclusion throughout the country. The bank helped build a robust payment and settlement system via a physical and digital infrastructure facility. Furthermore, the bank helps monitor fund allocation within the economy for better fiscal and monetary decision making at a macroeconomic level.

BOC has also established a special unit to revive and rehabilitate businesses that have been adversely affected by the prevailing economic conditions. We have helped many enterprises that were on the verge of discontinuing their operations, to restructure and make a comeback. This has marked the beginning of a new credit culture where the system has been transformed into a more sustainable win-win model.

Q: What were the most significant mileposts on the bank’s journey?

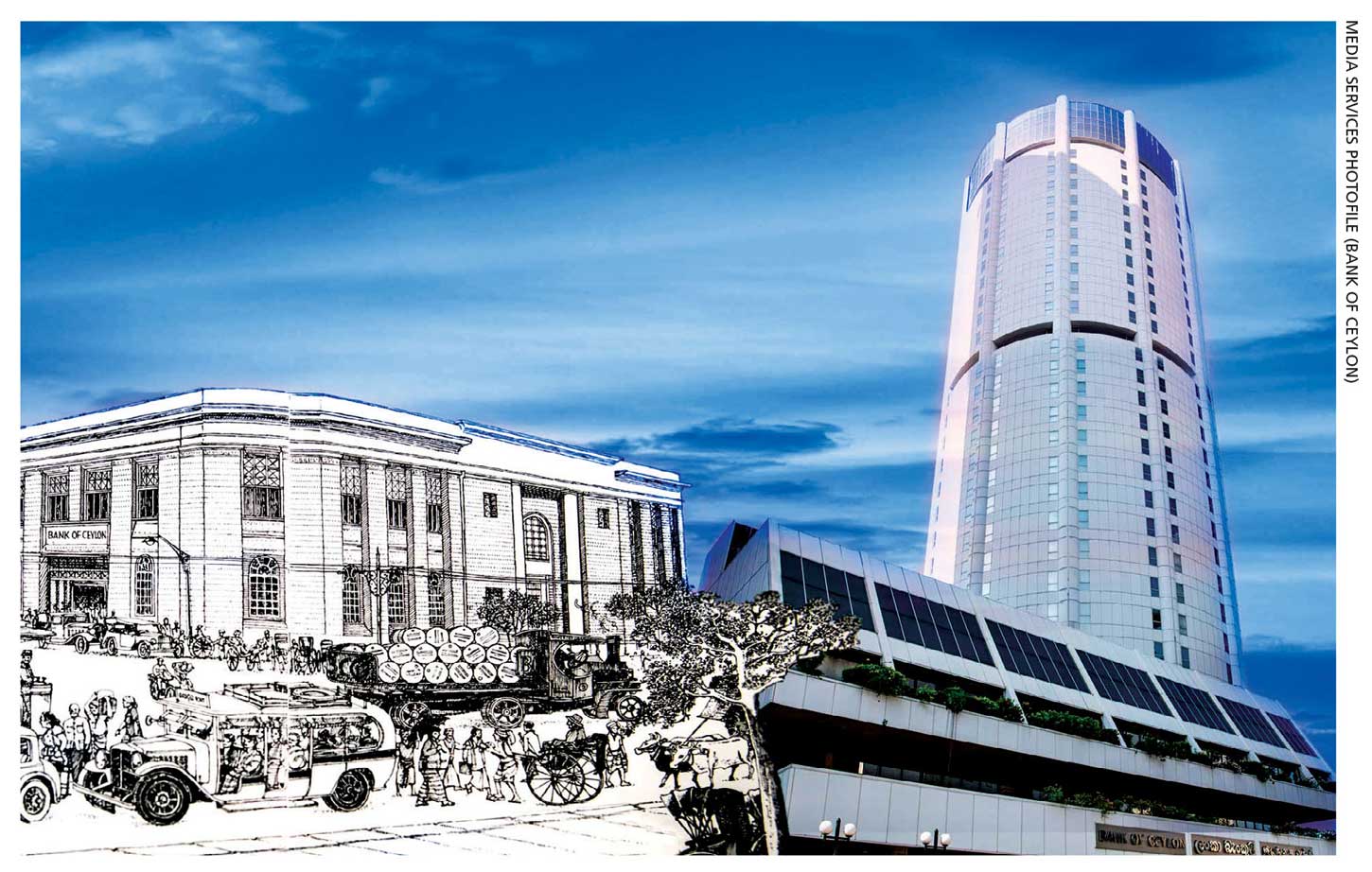

A: BOC celebrated 83 years of pioneering the local banking and financial services sector during which it has had a profound impact on the country’s economy.

After repeatedly posting the highest sector profit before tax, the bank issued an international bond worth US$ 500 million – a first for Sri Lankan banks in 2012, and issued its second 500 million dollar international bond the following year. Last year, the bank’s balance sheet expanded with over Sri Lankan Rs. 4 trillion in assets, 3 trillion rupees in deposits and in excess of Rs. 2.5 trillion in gross loans and advances.

According to the UK’s The Banker magazine, BOC sits among the Top 1,000 banks in the world. Further, Brand Finance Lanka declared Bank of Ceylon as the No.1 banking brand in the country for the 14th consecutive year in 2022. We also won the Best Service Provider of the year 2022 and the Best Banking Service Provider of the year 2022 awards at the SLIM-Kantar Peoples Awards 2022.

The bank has over 2,000 customer touch points locally plus a subsidiary in London and branches in Chennai, Male, Hulhumale and Seychelles. We maintain an international correspondent bank and exchange house network comprising over 850 institutions globally. BOC also hosts a large network of common switch ATM/CDM/CRM across the country, which assists both customers and non-customers.

Q: How has BOC embraced change?

A: Digital transformation was a significant move by the bank in early 2014 as a response to the changing preferences of customers towards digital technology and the need to preserve the natural environment.

This has helped us build a sustainable model, which incorporates our essential operational objectives and brings them in line with sustainable value creation. BOC has also incorporated the principles of sustainable banking and the environment, social and governance (ESG) framework, in order to align its operations and value chain with community responsibility.

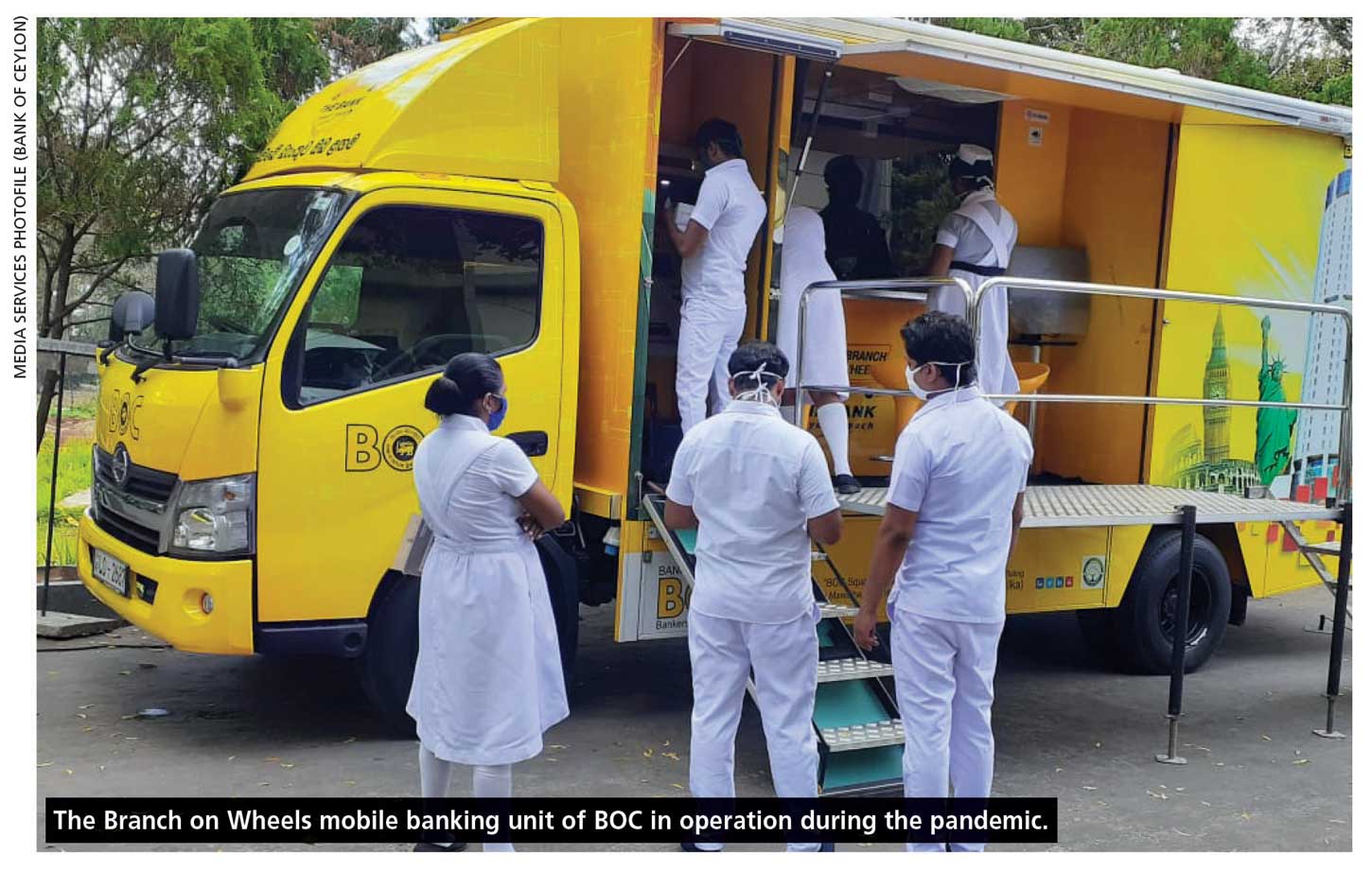

Financial inclusion and expansion were driven through initiatives such as the BOC Connect agent banking service and BOC Branch on Wheels – a mobile branch concept – both of which were timely and vital, during the pandemic and fuel crisis.

Social responsive initiatives that focussed on encouraging entrepreneurship included the Export Circle, SME Circle and Business Revival and Rehabilitation Unit (BRRU), while the International Circle initiative focussed on encouraging inward remittances.

Q: How have your digital initiatives been recognised?

A: We take pride in driving digital transformation, and enabling financial and digital inclusivity across the island. We strive to bring banking closer to everyone including the unbanked population through convenience and security, by building their trust in the banking system.

Our efforts were rewarded when we won the Overall Gold Award for Excellence in Interbank Digital Payments at the LankaPay Technnovation Awards 2022. At the same ceremony, our BApp mobile application won Most Popular Digital Payment Product of the year 2021. Other awards include Best Bank for Retail Payments, Bank of the Year for Financial Inclusivity and a Merit award for the Best Common ATM enabler of the Year.

BOC celebrated 83 years of pioneering the local banking and financial services sector during which it has had a profound impact on the country’s economy

Telephone 2204444 I Email info@boc.lk I Website www.boc.lk