US FISCAL POLICY

TRUMP’S TAX REFORM IN LIMBO

Samantha Amerasinghe takes stock of the new US president’s agenda for tax reform

President Donald Trump’s much-awaited tax proposals were light on detail and broadly in line with what the markets expected. His ‘one-page plan’ set out to simplify the tax code by lowering taxation.

Republicans hope this will help achieve stronger GDP growth (around 3%) and spur job creation. They also remain hopeful that the tax cuts will partly ‘pay for themselves.’ But Trump’s tax plan appears to be rather unrealistic and too ambitious. While it lays out ambitious targets for cuts in personal and corporate taxes, the plan has left many policy questions unanswered.

The chief question is how the tax cuts would be paid for.

Estimates suggest the measures could reduce revenue by trillions of dollars over the next decade but the lack of detail makes it difficult to assess their fiscal impact. The real challenge will be in implementation. And more importantly, it remains uncertain how much of Trump’s tax measures can be expected to be passed in Congress.

Notable points in Trump’s tax plan are the promised significant reduction in the corporate tax rate (from 35% to 15%), simplification of personal income tax brackets to three (10%, 25% and 35%) from seven, closure of tax loopholes except for deductions on mortgage payments and charitable donations, a move to a ‘territorial’ system to tax business on revenues and costs incurred in the US, and the imposition of a one-time tax on overseas profits to induce companies to repatriate overseas earnings onshore – which in effect is to locate their headquarters in the United States.

American companies have an estimated US$ 1.2 trillion in cash outside the country – funds they would not want to bring back home as they would be taxed at 35 percent under the existing system.

American companies have an estimated US$ 1.2 trillion in cash outside the country – funds they would not want to bring back home as they would be taxed at 35 percent under the existing system.

Trump’s tax plan is being viewed with caution by the investor community. Many believe it isn’t feasible in its current form and unlikely to be passed by Congress. The Republican Party would need almost a unanimous decision to push through the reforms. This would be difficult to achieve given that some Republicans have expressed apprehension over larger deficit-fuelled spending. Moreover, Trump’s tax plan does not deviate much from his campaign promises.

It would greatly reduce marginal tax rates on individuals and businesses, increase standard deductions to nearly four times current levels and curtail many tax expenditures. His proposal would cut taxes at all income levels although the largest benefits in both dollar and percentage terms would go to the highest-income households.

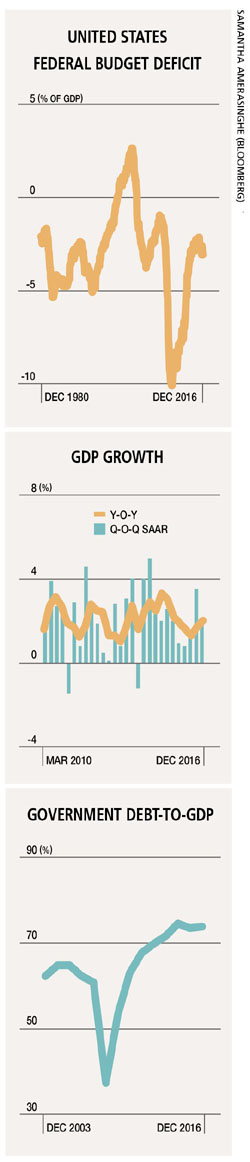

The plan would reduce federal revenues by an estimated 9.5 trillion dollars over its first decade before accounting for added interest costs or considering the impact of macroeconomic feedback. Unless it is accompanied by substantial spending cuts, the plan could increase national debt by nearly 80 percent of GDP by 2036, offsetting some or all the incentives offered by the tax cuts, according to the US-based think tank Brookings Institution. As expected, the tax plan did not include a border adjustment tax on imports – this was prized by House Republicans. Trump never really supported the idea as he remains fearful of inflation and a stronger dollar. The interest deduction on corporate debt appears to remain uncurbed as there’s no mention of it while there is also no change in Medicare or Medicaid (‘entitlement spending’).

So why does Trump’s plan look too ambitious?

Firstly, despite US Treasury Secretary Steven Mnuchin’s assurance, the tax cuts appear too deep to be offset by lower deductions.

As a result, they will grow the deficit sizeably especially because the assumption of three percent growth looks somewhat unrealistic too.

Moreover, an end to the state tax deduction will be particularly controversial in high-tax states like New York and California, and it’s likely to face strong resistance.

It remains to be seen whether what Trump administration officials call ‘one of the broadest revamps of the tax system in history’ will be implemented in its current form. The lack of detail may frustrate some in Congress and undercut support for the plan.

For instance, the proposal to reduce income tax brackets to three does not specify what the new slabs will be. The one-off tax rate on offshore corporate profits is also notably absent. This lack of detail makes it difficult to form a complete picture of how these proposals may be funded – a sticking point for political support from both Democrats and fiscal conservatives within the Republican Party.

The House Republicans agree ‘80 percent’ with the plan but it’s unclear whether the budget hawks on their side will accept a proposal that increases both the deficit and debt without addressing entitlement spending.

Trump’s tax plan is likely to be much diluted in the coming months with some back and forth with Congress. And it’s difficult to picture the corporate tax rate dropping to 15 percent by the end of this year. The end result is likely to be much more modest.

In the meantime, the deadline for implementation is gradually shifting from summer to the ‘end of the year.’

Leave a comment