UNITED KINGDOM TO FACE ‘EXPLOSIVE’ DEBT LEVELS

The UK must raise taxes or cut spending to steer the country away from an “explosive” debt path, the government’s spending watchdog has warned.

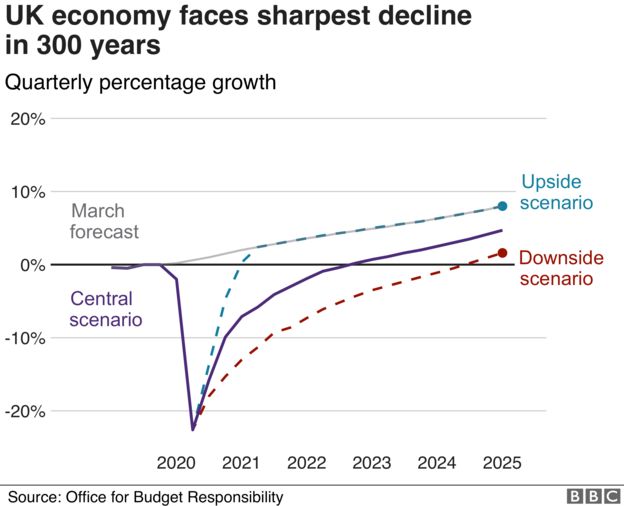

The Office for Budget Responsibility (OBR) said the economy was on course to shrink by 12.4% in 2020, with borrowing set to rise to a peacetime high.

This would mark the biggest economic decline in 300 years.

Official data showed the economy grew by 1.8% in May, a month after suffering the biggest contraction on record.

The OBR said the coronavirus pandemic had “materially altered” the outlook for the public finances.

It said the government would need to re-impose austerity measures to fix some of the permanent damage caused by the crisis, as well as pay for the costs of an ageing population.

Growing debt pile

The OBR said the government was on course to borrow £372bn this year to pay for the shortfall between tax revenues and public spending.

This includes extra borrowing to pay for the chancellor’s £30bn package unveiled last week to protect jobs and boost the economy, and will push the UK’s total debt pile to 104.1% of gross domestic product (GDP).

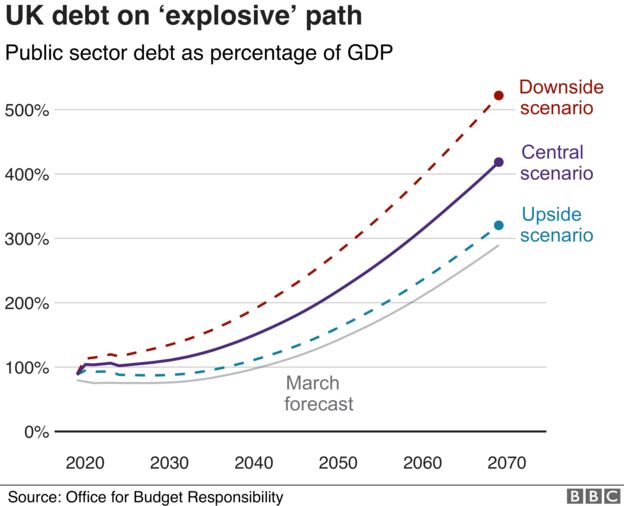

Without more tax rises or spending cuts, UK debt would start to dwarf the size of the economy, growing to more than 400% of GDP in 50 years’ time.

Its Fiscal Sustainability Report said: “In almost any conceivable world there would be a need at some point to raise tax revenues and/or reduce spending (as a share of national income) to put the public finances on a sustainable path.”

Robert Chote, the OBR’s outgoing chairman, said calls for more spending on the National Health Service (NHS), or a bigger benefits bill if unemployment remains, could create “several additional sources of pressure on public spending”.

He also said taking away a temporary £20-a-week boost received by seven million families on universal and working tax credits would be difficult.

Slower recovery

The fiscal watchdog warned that economy would not get back to its pre-crisis size until the end of 2022, while unemployment was likely to rise to a record 12% by the end of this year, falling back to 10.1% in 2021.

The OBR’s central projection assumes a slower recovery than the watchdog outlined in April, with a coronavirus vaccine found in about a year.

The watchdog said an “early vaccine or effective treatment would allow most activities to resume much as they were before the virus”, allowing the economy to recover more quickly, with no “enduring economic scarring”.

However, the OBR’s most pessimistic scenario, where no vaccine is found and social distancing measures continue “indefinitely”, would lead to a “significant” loss of business investment.

In this worst case scenario, unemployment would rise to four million, up from 1.3 million in 2019, while the UK’s high streets would be left permanently scarred as shoppers stay away.

“The virus is likely to have significant effects on people’s expectations and behaviour”, the OBR said.

It added that a “substantial rise in business indebtedness” would “weigh on investment and innovation and to result in more business insolvencies”.

As coronavirus has battered the UK economy, a raft of businesses have announced closures and thousands of workers are set to lose their jobs.

This is despite the government having pumped billions of pounds into schemes to support workers’ wages and loan guarantees for business.

Tough choices

With the UK’s debt pile set to grow substantially, Mr Chote said policymakers faced tough choices.

“In practice, no government could allow net debt to persist for long on these explosive paths, as it would find it hard to finance its mounting deficits,” he said.

He said getting the UK’s debt share back down to around 75% of GDP would require tax rises or spending cuts of about £60bn in today’s money every decade for the next 50 years.

This equates to around half the austerity imposed on the UK after the financial crisis.

Andy King, an official at the OBR, noted that this would mean either reducing the quality of UK healthcare or raising taxes significantly.

He said that while the question of how realistic decades of austerity was “not one for us”, he added: “Saying that it would be difficult is certainly true”.