TRADING SHARES

THE BUSINESS OF LISTING

Taamara de Silva contends that businesses should not choose to list hastily

The meteoric ascent of Facebook has become the gold standard for young entrepreneurs striving to take their innovative ideas from the dorm room to a Silicon Valley office and on to an IPO.

IPOs can be viewed as a means for private companies to raise capital by offering shares to the public. Shares typically trade at a premium to what the original investors poured into the business, providing them with an opportunity to cash out and reap the benefits.

Most companies go public to raise additional capital without the associated risks, restrictions and cost of debt, and not forgetting the constraints of venture capitalists. While this influx of cash can be used to expand, diversify and seek merger and acquisition opportunities, it also helps lower the company’s gearing and reduces risk.

Public companies have a better acceptance vis-à-vis visibility and credibility. This can easily be leveraged to attract top tier talent, retain employees through stock options, and negotiate favourable terms with suppliers and customers.

Investors too will benefit from the liquidity of their investments since they can sell their shares in the secondary market. Depending on the performance of the company, projected earnings and potential business opportunities, the share price can increase and create more value for shareholders.

If you are tempted to take your company public, you’re not alone. For many entrepreneurs and family business owners, the question that needs to be answered is when and at what point should they list their companies.

And this is easier said than done. The decision of whether or not to float a company on the stock exchange is a monumental one since it can be a costly and exhaustive process. It also doesn’t mean that an IPO is the finish line. Far from it, in fact!

When it comes to an IPO, it really boils down to size, preference and timing. Most successful medium-size IPOs are revenue conscious these days – they’re lean businesses that can turn a profit through a viable product or savvy operations. A poorly timed IPO can end up being extremely detrimental to a company’s financial growth and stability. The legal, procedural and financial challenges of IPOs can also have a massive bearing on the company and its stakeholders.

It is possible that the transition from private to public will be expensive since lawyers, investment bankers and accountants need to be involved. Taking a company public would result in making its data and information available for public scrutiny. Stringent standards, periodic audits and public reporting will follow.

The pressure to move fast and focus on the stock price is deeply entrenched in corporate culture since maximising shareholder value becomes a fiduciary duty of the CEO and senior management.

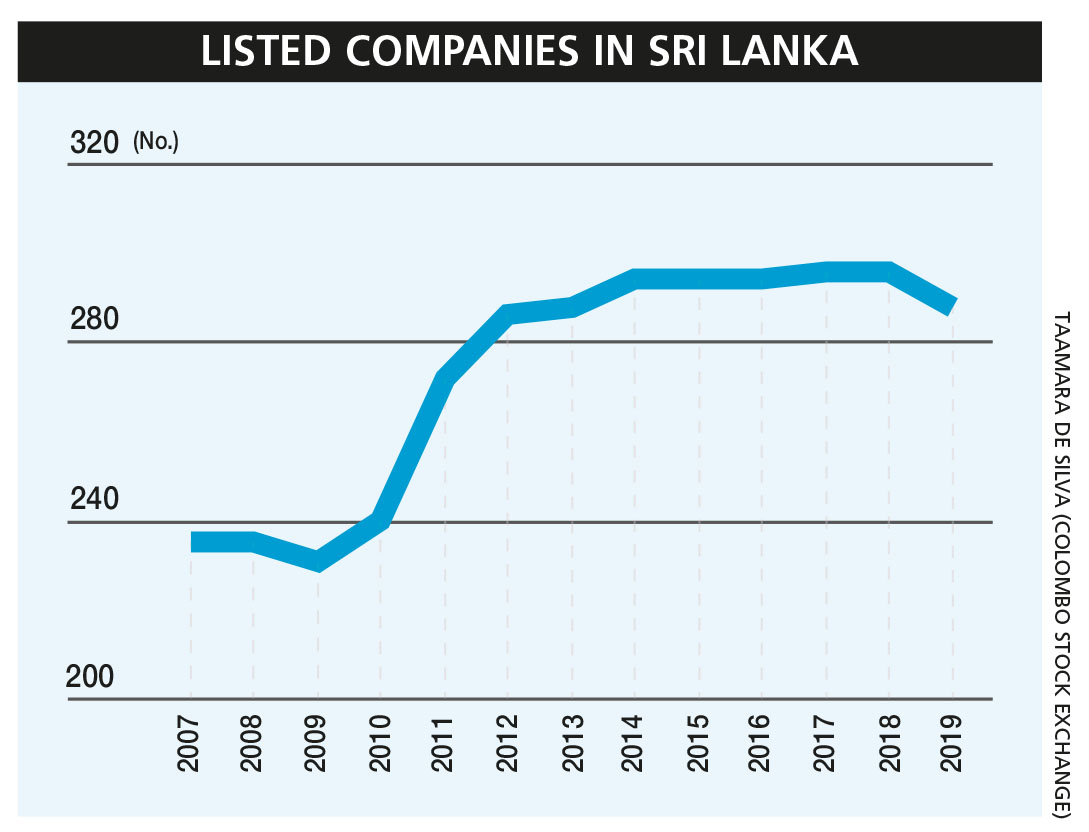

Meanwhile, the Colombo Stock Exchange (CSE) marked its 35th anniversary with a commitment to address efficiencies related to new listings. The bourse has only 285 entities listed and is lagging behind most of its regional peers. Growth in new listings has also been rather subdued over the past few years.

However, new listings are expected through this year’s national budget. Accordingly, companies listed on the CSE before 31 December 2021 will not only receive a 50 percent tax concession for the 2021/22 financial year but also enjoy a 14 percent corporate tax rate for the following three years.

The CSE has also expanded the eligibility criteria for the initial listing of shares on the Main Board and Diri Savi Board, enabling a wider spectrum of companies to qualify for listing.

SMEs are recognised as the backbone of the Sri Lankan economy and estimated to account for over 75 percent of the total number of enterprises.

They provide 45 percent of national employment and contribute to approximately 52 percent of GDP. Identifying them as a priority segment, the CSE introduced the Empower Board, which is a novel and compelling avenue for SMEs to access a deep pool of foreign and local capital.

The revision of rules by the CSE in November brought sweeping changes to IPO timelines. And the basis of allotting shares is to complement the country’s rapidly developing commercial landscape, which comprises multiple business models and segments. The revisions are also directed at improving efficiency of the listing process.

While this environment might be an ideal opportunity for a company looking to list, the pros and cons of an IPO must be carefully weighed – now more than ever before.

Ultimately, whether an entrepreneur should take his or her company public depends on the circumstances that only the individual truly understands since taking a mid-size company public is an arduous task. And if recent market struggles prove anything, IPOs are far from being a golden ticket to glory, which leaves us wondering if a lucrative IPO is the ultimate goal for entrepreneurs.