THE LITMUS TEST | 2020/21

SURVIVAL OF THE FITTEST

Sri Lanka’s leading listed entities strived to overcome the local and global challenges brought on by the COVID-19 pandemic

As the COVID-19 pandemic disrupted business activities across the globe, local corporates had to contend with myriad challenges during the 2020/21 reporting year – including lockdowns and ‘travel restrictions’ imposed to mitigate the spread of the virus, in addition to growing concerns about the country’s upcoming debt obligations and limited forex reserves.

Given this scenario, the LMD-Nielsen Business Confidence Index (BCI) was also volatile for much of calendar year 2021 with biz sentiment seeing major declines and noteworthy improvements.

The latest edition of the LMD 100 presents a detailed analysis of how Sri Lanka’s leading listed entities performed amid a difficult financial year 2020/21, although the results display a marked improvement over the previous reporting period.

LEADERBOARD The LMD 100 is spearheaded by export-oriented conglomerate Hayleys, which has strengthened its presence among listed corporates in Sri Lanka.

Meanwhile, capital goods – together with representatives from the transportation, diversified financials, banking, telecommunication services, food, beverage and tobacco, and food and staples retailing sectors – stake their claim to fame as major forces on the LMD 100 Leaderboard for financial year 2020/21.

John Keells Holdings (JKH) was ranked No. 1 in as many as eight of the first 10 years of The LMD 50 (the pioneering precursor to the LMD 100), only to be surpassed by Sri Lanka Telecom (SLT) – a partnership between the Government of Sri Lanka and Malaysian telecom giant Maxis, which went public in 2003.

SLT in turn helmed the rankings for four consecutive years before surrendering its rung at the top of the ladder to the petro giant from neighbouring India – Lanka IOC (LIOC) was The LMD 50’s numero uno until 2009/10 with its reign lasting three financial years.

And Hayleys, which was runner-up to JKH in many of the early years – and pipped the latter to the winning post in 1995/96 and 1996/97 – raced ahead of SLT and LIOC in 2010/11 to occupy second place on the podium.

In terms of the latest LMD 100 hierarchy, Hayleys retains the No. 1 spot with Expolanka Holdings climbing 10 rungs to occupy second place.

LOLC Holdings moves two notches higher to No. 3 while Commercial Bank of Ceylon (ComBank) slips two spots to fourth place with Hatton National Bank (HNB) rounding off the top five in the latest edition of Sri Lanka’s premier listed company rankings.

JKH (No. 6), Dialog Axiata (in seventh place) and Carson Cumberbatch (No. 8) comprise the remainder of the Leaderboard, alongside Bukit Darah and CT Holdings, which are ranked ninth and 10th respectively.

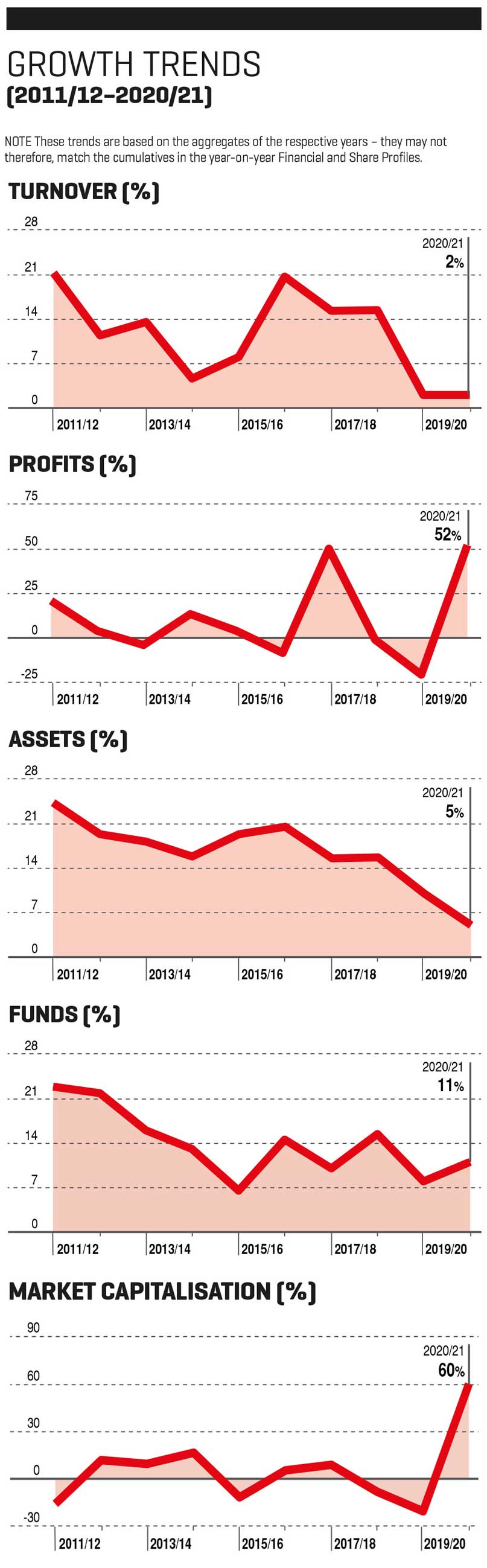

REVENUE STREAMS Aggregate revenue of the island’s 100 largest quoted companies amounted to Rs. 3,854 billion in 2020/21, which amounts to an annual growth of six percent – in the period under review, the official rate of inflation stood at 6.2 percent so the state of the LMD 100’s combined top line isn’t anything to write home about.

In the previous financial year, the aggregate turnover of LMD 100 companies improved by two percent while inflation stood at 3.5 percent.

As many as 49 (versus 50 in the preceding year) LMD 100 entities registered an annual turnover of more than 20 billion rupees in financial year 2020/21 – and furthermore, the 12 highest ranked corporates (Hayleys, Expolanka, LOLC, ComBank, HNB, JKH, Dialog, Carson Cumberbatch, Bukit Darah, CT Holdings, Cargills (Ceylon) and Sampath Bank) surpassed the Rs. 100 billion mark.

Where revenue growth is concerned, Expolanka comes out on top with a massive 112 percent year on year uptick (to Rs. 219 billion), making it the only entity to report a top line improvement in excess of 100 percent for the financial year.

BOTTOM LINES At Rs. 339 billion, the 2020/21 cumulative post-tax profit of the LMD 100 increased by a healthy 45 percent compared to the previous year.

As for other landmarks, the profit after tax of LOLC, ComBank, Ceylon Tobacco Company (CTC), Expolanka, Vallibel One, Hayleys, HNB, and Dialog crossed the Rs. 10 billion in financial year 2020/21.

However, 11 (versus 17 in the prior year) of Sri Lanka’s LMD 100 companies ended financial year 2020/21 in the red – viz. Laugfs Gas, Aitken Spence, Browns Group, Ambeon Capital, Ambeon Holdings, Colombo Dockyard, Renuka Foods, Browns Investments, HNB Finance, Aitken Spence Hotel Holdings and Merchant Bank of Sri Lanka & Finance.

Among the movers and shakers are Expolanka (tax-paid profit up by a whopping 3,497%), Nawaloka Hospitals (3,033%), Alumex (2,626%), Printcare (1,036%) and Kelani Valley Plantations (1,022%).

TAXATION On average, an LMD 100 entity forked out 1.1 billion rupees in taxation for 2020/21, which represents a hike of nine percent compared to the previous year’s tax bill.

The Leaderboard accounts for 30 percent of the combined taxes of the LMD 100 in 2020/21 as the top 10’s payout increased by 22 percent (versus a decrease of 29% in 2019/20) to under 35 billion rupees.

Similar to previous years, CTC’s contribution to state coffers during the period was the highest among the nation’s listed companies on account of a tax charge of nearly Rs. 10 billion.

ASSET VALUES The largest listed entities in Sri Lanka enjoyed a seven percent appreciation in total assets from the previous year, which is below the uplift in asset values recorded in both 2019/20 and 2018/19.

As always, the banking sector holds sway in the LMD 100’s asset related rankings as it represents more than 50 percent of the combined portfolio of assets of the premier listed entities in Sri Lanka.

ComBank continues to be at the forefront of balance sheet strength with Rs. 1,762 billion in assets at 31 December 2020, followed by fellow private sector banking giants HNB (Rs. 1,371 billion) and Sampath Bank (Rs. 1,149 billion).

Meanwhile, Expolanka is ahead of the pack for highest percentage gain in asset values among the top 100 – its total assets of 68 billion rupees reflected an 89 percent appreciation from the end of the preceding year. Dipped Products is next in line on the back of a 62 percent uplift in asset values in 2020/21.

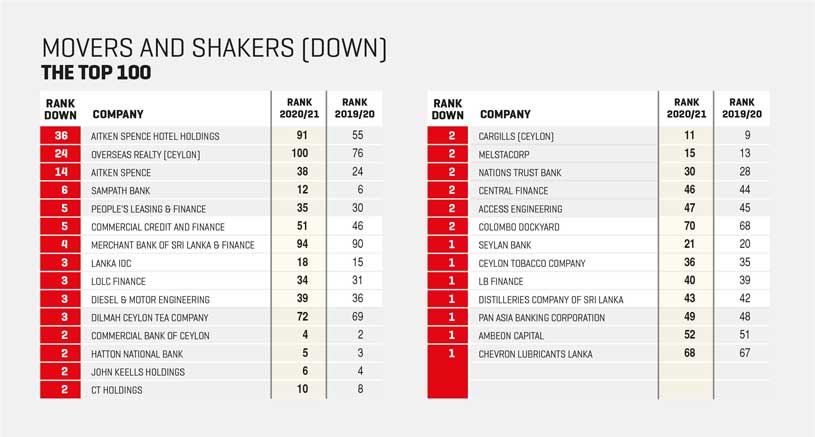

MOVERS AND SHAKERS Lanka Tiles made the most notable progress in the climb up the listed company rankings by moving 30 spots in the top 100 list to No. 63. Browns Investments also achieved a similar distinction by jumping 24 places up the LMD 100 scale to 76th place.

In sum, as many as 56 of the island’s largest corporate entities climbed up the LMD 100 ladder.

SECTOR RANKINGS Capital goods lead the way among the leading listed companies in Sri Lanka with their cumulative income representing nearly 20 percent of the LMD 100’s combined revenue and 22 percent of shareholders’ funds in the period under review.

The food, beverage and tobacco sector follows as the second largest player in the LMD 100 with an aggregate income of Rs. 680 billion and a share of nearly 18 percent of cumulative revenue in the 12 month period.

What’s more, the sector accounts for 17 percent and 13 percent of LMD 100 profits and shareholders’ funds in 2020/21.

INVESTOR YARDSTICKS JKH leads the way with a market capitalisation of Rs. 196 billion at 31 March 2021 and is followed by CTC, which registered a market cap of 184 billion rupees at the end of the LMD 100 financial year 2020/21.

As for aggregates, the LMD 100’s combined market capitalisation increased by 46 percent (to Rs. 2,634 billion) between 1 April 2020 and 31 March 2021.

Marking a rise in the tally versus the preceding financial year, 17 of the island’s 100 leading listed corporates maintained an equity value in excess of 50 billion rupees at the end of 2020/21.

The top five (CTC, JKH, LOLC, Dialog and ComBank) accounted for a little under a third of the LMD 100’s combined market cap.

THE FUTURE In December, the Ceylon Chamber of Commerce held the Sri Lanka Economic Summit 2021 under the theme ‘Springboard for Revival: Opportunity to Reset,’ bringing together policy makers, business leaders and leading international experts representing important economic sectors.

During the two day forum, speakers shed light on the need to reset Sri Lanka’s export portfolio and pursue aggressive diversification in growing sectors.

Additionally, it was pointed out that the country should leverage free trade agreements (FTAs) and also be established as a technology hub while regaining its foothold as a leading tourist destination.

Additionally, it was pointed out that the country should leverage free trade agreements (FTAs) and also be established as a technology hub while regaining its foothold as a leading tourist destination.

Later in December, Fitch Ratings downgraded Sri Lanka’s long-term foreign currency issuer default rating to ‘CC’ from ‘CCC,’ noting that this reflects its view of the increasing probability of a default in the coming months given the country’s worsening external liquidity position. The rating agency explained that this is underscored by the free fall in foreign exchange reserves against a backdrop of high external debt payments and limiting financing inflows.

Additionally, Fitch states that it will be difficult for the government to meet its external debt obligations in 2022 and 2023 without new external financing sources.

It maintains that “Sri Lanka’s external finances are further challenged by a persistent current account deficit, resulting in downward pressure on the exchange rate. We estimate that the deficit widened to about 5.7 percent of GDP in 2021 and expect it to remain at about four percent in 2022 before falling to 2.1 percent by 2023.”

“Sri Lanka’s economic performance is likely to weaken in 2022 as the challenging external position and exchange rate pressure will have knock on effects on economic activity,” Fitch says, projecting that growth will slow to two percent during the year from 3.6 percent in 2021 before recovering to 4.3 percent in 2023.

As for international affairs, the IMF’s World Economic Outlook (WEO) published in October points to a somewhat slower global recovery as momentum has been weakened by the pandemic. Given this, the international financial institution marginally revised its global growth projection for 2021 down to 5.9 percent from six percent although the 4.9 percent growth for 2022 remains unchanged.

“This modest headline revision however, masks large downgrades for some countries. The outlook for the low-income developing country group has darkened considerably due to worsening pandemic dynamics. The downgrade also reflects more difficult near-term prospects for the advanced economy group in part due to supply disruptions,” the IMF explains.

The agency elaborates: “The differential recovery speeds across economy groups are likely to leave long-lasting imprints. The pattern of emerging market and developing economies suffering larger medium-term damages compared to advanced economies on average… persists in the latest projections.”

Moreover, it says that “as recoveries proceed, the risks of derailments and persistent scarring in heavily impacted economies remain so long as the pandemic continues.”

“The baseline forecast is subject to high uncertainty regarding the evolution of the pandemic, outlook for inflation and associated shifts in global financial conditions. The balance of risks suggests that growth outcomes – over both the near and medium term – are more likely to disappoint than to register positive surprises,” the IMF cautions.