THE INFLATION DEBATE

A TRANSITIONARY OUTLOOK?

Samantha Amerasinghe assesses the prevailing global inflation environment

Concerns about inflation potentially rearing its head have reverberated through global markets. And with it, the transitory versus sticky or ‘here for longer’ inflation debate has been garnering a great deal of market attention in recent months.

This is not surprising, given that prices are rising in every corner of the world.

Two key questions frame the great pandemic inflation debate, the first of which is whether inflation would in fact return. The answer is clear-cut: it has returned… and with considerable vigour.

Two key questions frame the great pandemic inflation debate, the first of which is whether inflation would in fact return. The answer is clear-cut: it has returned… and with considerable vigour.

Nonetheless, while inflation has been appearing in a number of goods, the gyrations are exaggerated due to consumer demand returning before supply chains can revert to pre-pandemic capacity.

The market has put all its chips on ‘transitory’ but is there reason to believe that inflation might be longer lasting?

A recent Financial Times article written by Sebastian Mallaby (the Paul A. Volcker Senior Fellow for International Economics at the Council on Foreign Relations) – in which he cites Alan Blinder’s view on inflation in the 1980s that “rising prices were more like a bad cold than a cancer…” – is a case in point.

Blinder’s view involves three arguments that ring true in today’s context.

The first is the notion that price spikes will prove transitory. This is because supply chain bottlenecks – notably in semiconductors – will iron themselves out, governments are continuing to withdraw fiscal stimulus measures, and generous furlough subsidies and unemployment insurance are coming to a grinding halt (if they haven’t already), pushing workers back into the workforce.

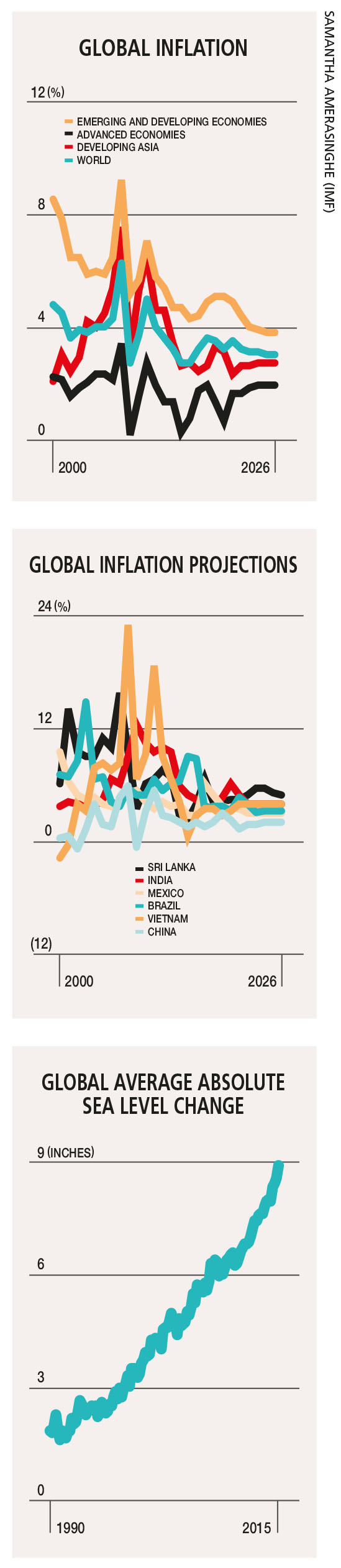

And the second argument suggests that a little inflation might actually be welcome as the world economy transitions to a ‘new normal’ where profound structural changes (i.e. the accelerated shift to e-commerce, remote working and transformations in the energy system brought about by climate change demands) are taking place. This view was widely espoused at the US Federal Reserve’s recent Jackson Hole Economic Symposium.

Moreover, there’s the jobs and inflation tradeoff. Interestingly, research presented at the symposium suggested that even when unemployment hits rock bottom, labour force participation keeps rising. This suggests that central bankers should put raising interest rates on the back burner even if it means risking inflation.

The third argument is that the Fed is unlikely to repeat past mistakes. It would have to be years late in responding for any semblance of the 1970s inflation debacle to rear its ugly head.

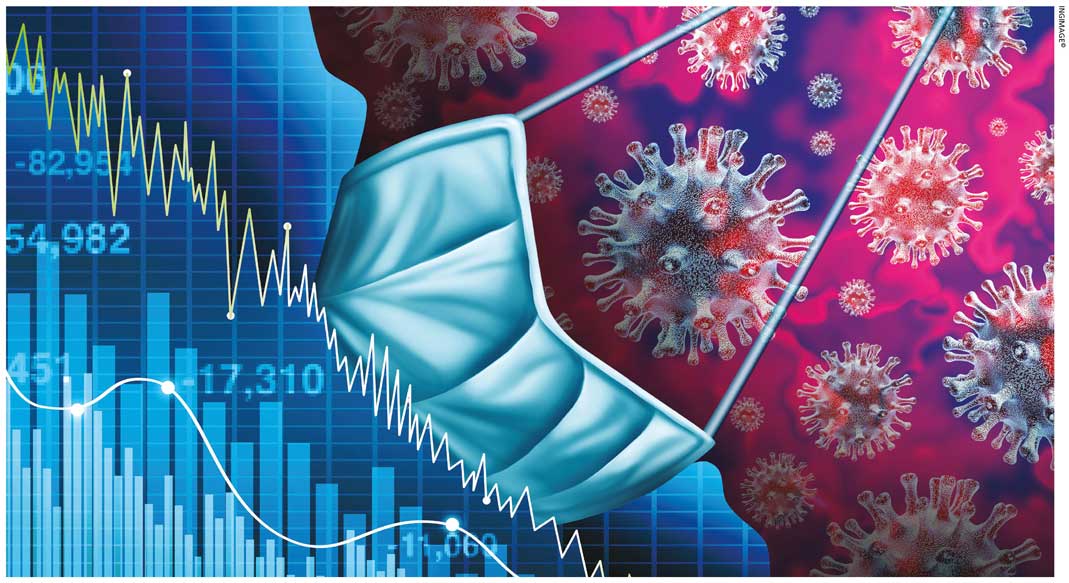

So the bottom line is that there’s no need for central banks to push the panic button yet. However, the current inflation picture in many emerging market (EM) countries suggests otherwise.

EM countries are experiencing rapid increases in inflation following the COVID-19 driven disinflationary shock last year. Soaring food and energy prices have pushed inflation to uncomfortably high levels. Inflation rates in Russia, Brazil and India are well above central bank targets, and growth has recovered despite the obstacles posed by the pandemic.

For most EMs, a combination of the jump in commodity prices, a rebound in domestic demand as economies reopen, supply bottlenecks and logistical issues have driven inflation. Many appear to be temporary.

However, economic policy has been tightening in much of the world. Resurgent demand as vaccinations accelerate and lockdowns end – along with insufficient supply – have led to rising inflation, leaving policy makers with no option but to scale back emergency stimulus measures.

But growth concerns are mounting with the spread of the highly contagious Delta variant – policy may normalise just as economic growth loses momentum.

In many EMs such as Brazil, Mexico and Russia, central banks have raised interest rates several times this year. Many richer countries (e.g. South Korea and New Zealand) are following suit but larger advanced economies’ central banks (the Reserve Bank of Australia, Bank of England and European Central Bank) are holding back until late next year although they have already begun unwinding asset purchases.

Higher inflation typically leads to a rate tightening cycle, but US Federal Reserve Chair Jerome Powell has repeatedly stressed that it will allow inflation to run somewhat hotter than the central bank’s two percent target as the economic recovery gains traction.

Although a rate hike from the Fed isn’t expected until mid-2022 at the earliest, the sheer amount of debt accumulated by governments around the world will likely cap how high rates can ultimately go as the higher cost of debt service would strain many of them and the overall financial system. Nevertheless, the Fed is expected to begin reducing its monthly asset purchases soon.

The arguments for inflation being transitory seem reasonable enough. However, Powell’s description of inflation as transitory is being seriously questioned.

Many experts argue that inflation is likely to persist over the medium term for these reasons: excessive levels of debt; record fiscal deficit spending combined with record monetary stimulus; the deglobalisation of supply chains (which should prove to be inflationary as labour input costs increase); rising energy prices; rising wages; and finally, dollar depreciation.

In my view, the world is not staring down a new long-term inflationary environment but there are good reasons to believe inflation might not be as transitory as we think.

Leave a comment