THE GREENBACK

The US Dollar has weakened considerably due to uncertainty surrounding President Donald Trump’s tariff policies that have caused global investors to become jittery and clouded the outlook for the American economy.

Many experts expected the dollar to strengthen in Trump’s second term on the back of his policies for tax cuts that were expected to spur economic growth, and tariffs that were expected to reduce demand for foreign imports and thus boost the value of the greenback.

THE WORLD’S RESERVE CURRENCY

Samantha Amerasinghe considers the implications of a weakening US Dollar

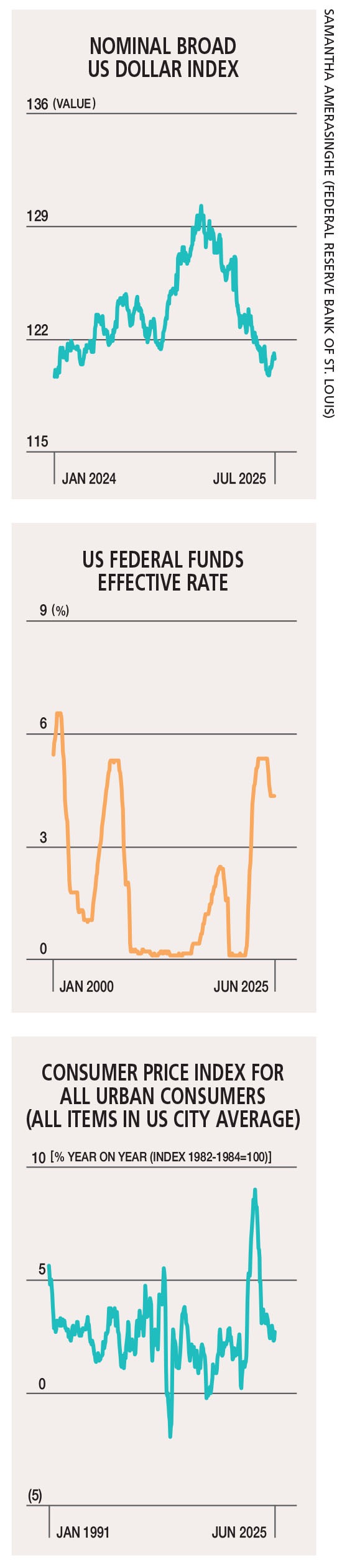

However, the dollar is having its worst year in decades. In the first half of 2025, the world saw it continue its precipitous decline and hover around levels not seen since 2022. Though it seems to be rebounding from previous lows, risks remain.

The weakness that’s been seen in the dollar due to the uncertain policy environment brought about by Trump’s tariffs clearly highlights that its status as a strong currency and safe haven for investors has been dented.

Two key factors are eroding the dollar’s status.

First is increased polarisation in the US, which is leading to governance concerns and undermining its status and role as a global safe haven. Second is the positive developments outside America that are boosting the credibility of alternative currencies.

This decline is reflecting a crisis of confidence in the United States – US assets have become less appealing, and its tariff policy and Trump’s constant flip-flopping has created an uncertainty that has dominated markets this year.

The US Dollar index, which measures the greenback’s strength against six major foreign currencies, was down nearly 10 percent for the year at the time of writing. This has had knock on effect on economic growth and inflation.

Trump’s Liberation Day tariffs prompted Asian investors to bring capital back to the world’s manufacturing powerhouses in Asia and boost their currencies, after years of parking trillions of dollars in US assets such as Treasuries.

Moreover, the weakness of the dollar may also reflect new doubts about the currency’s safe haven status. Heightened concerns about foreign investors demanding higher yields to hold US debt due to worries about the deficit have already emerged.

Foreign investors buying American debt want a strong dollar to maximise returns on their investments. If there is waning demand for the dollar, Treasury yields could rise, and increase the cost of borrowing for both the US government and consumers.

The dollar showed monthly gains in June with a strong run of US economic data – annual inflation at 2.7 percent topping expectations and a labour market holding up better than feared. This suggests that the economy has shrugged off tariffs while casting doubt on the case for further interest rate cuts by the US Federal Reserve a.k.a. the Fed.

However, investors remain cautious as many of the risks that drove the dollar to its worst start to the year since 1973 remain. Trump’s attacks on the Fed’s independence could undermine the currency if they escalate further, and it seems increasingly likely that steep tariffs on many US trading partners are set to come into force in the coming months.

Meanwhile, the love-hate relationship with the US Dollar was a hotly debated topic at the World Economic Forum’s (WEF) Annual Meeting in Davos.

The dollar’s dominance continues to be questioned due to financial fragmentation and global debt concerns. An expert panel expects its dominance to continue for the foreseeable future but gradual diversification could necessitate greater global collaboration in the years ahead through the creation of new financial ties and infrastructure.

This would form part of a long-term strategy to reduce dependence on the dollar, known as de-dollarisation. It encompasses areas that relate to the longer-term use of the dollar such as transactional dominance in forex (FX) volumes or commodities trade, denomination of liabilities and share in central bank FX reserves.

Even though the United States’ share of world exports and output has declined over the past three decades, the transactional dominance of the dollar is still evident in forex volumes, trade invoicing, cross border liabilities denomination and foreign currency debt issuance.

A leading economist recently highlighted that China’s share of trade invoiced in renminbi has grown from 20 percent a decade ago to 56 percent today, emphasising the rapid pace of change.

Although the Federal Reserve maintains credit swap lines with many advanced economies, the existing system often underserves developing nations. Meanwhile, China has established around 40 bilateral currency swap lines with developing countries. This is one example of the shift away from dollar dominance.

Undoubtedly, the greenback remains the number one currency in most transactions in the world and is still the most liquid currency.

And even though its status as a strong currency and safe haven for investors has temporarily diminished, and its dominance is starting to decline at a faster pace than in previous years, economists believe that its status as the world’s reserve currency is secure.