THE GOLD STANDARD

THE COOL AURIC HEDGE FUND

Taamara de Silva weighs the appeal of gold for investors the world over

While its origins can be traced back to the Stone Age in the form of ring-shaped amulets, our love for and association with gold will only continue to strengthen. This may be due to the fact that gold is a precious metal – soft, dense, lustrous and brilliant.

Let’s find out why…

Apart from its role as a metal, gold is one of the oldest mediums of exchange in existence. In fact, the ancient Greek philosopher Aristotle believed that a currency must be durable, divisible, consistent and convenient in addition to possessing value in itself. Gold meets all these criteria.

Yet, when it comes to the global economy with an estimated value of US$ 2.9 trillion, gold remains one of the most complicated assets to assign a price to. Unlike investments such as shares, currencies and other commodities, the value of this metal isn’t determined by the fundamentals of physical supply and demand. Instead, gold plays a dual role as both a commodity and currency.

In a world dominated by complex financial instruments, money printing and an abundance of access to credit, gold stands its ground as a highly liquid yet scarce asset. What’s more, it is no one’s liability! The commodity is largely purchased as a luxury item as much as an investment and is related to the strong emotions that we tend to associate with expensive material goods.

In short, it’s a worldly possession.

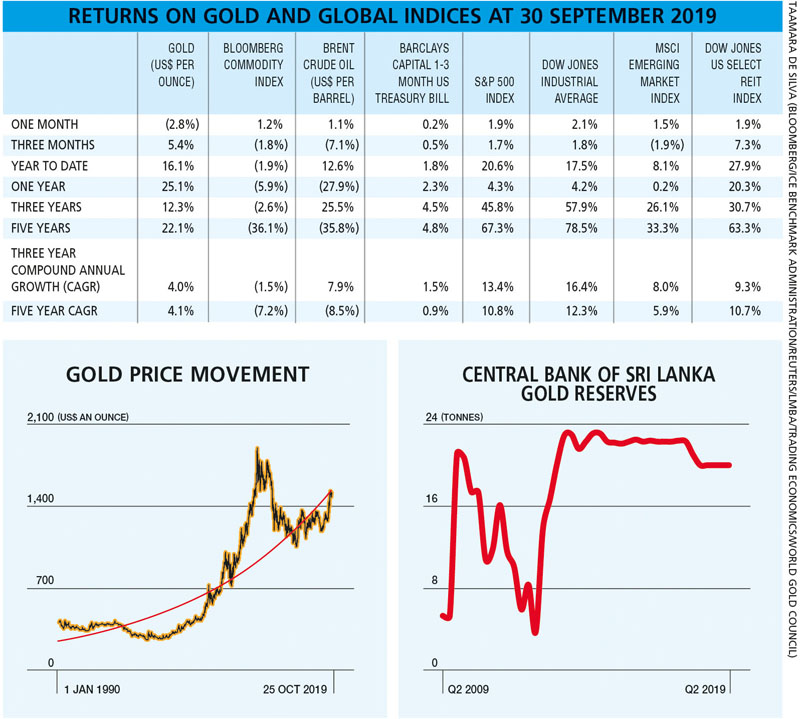

From an investment perspective, gold has provided an annual return of almost 20 percent to date. In fact, the performance of the precious metal over the past 30 years has continued on an upward trajectory, peaking in 2011. However, it is important to compare the returns of gold against a basket of other global indices so that one can identify its comparable returns.

While it is undisputed that the commodity has served as a stable source of long-term returns since the 19th century, the last five years have proved to be exceptionally good for gold as a diversifier that can mitigate losses in times of market stress.

By virtue of its dual nature as a luxury item in addition to being an investment, the long-term price of gold is supported by income growth. Furthermore, research indicates that when stocks rally, their correlation to gold can increase, which is driven by the wealth effect as well as expectations of higher inflation.

Global investors are drawn to the commodity because of its low correlation to most mainstream assets.

An example of this phenomenon was observed in the 2007/08 financial crisis when widely recognised portfolio diversifiers such as hedge funds, broad commodities and real estate holdings were sold, alongside shares and other risk based assets.

But this was not the case with gold. And for this reason, it reigns supreme as a hedge against systemic risk and stock market pullbacks.

Over the past century, the commodity has greatly outperformed all major currencies as a store of value. Instances when major economies defaulted, sending their currencies spiralling down, have resulted in investors flocking to buy gold. One of the reasons for this robust performance lies in its availability, as there has been little change in the supply of gold over time.

The amount of gold produced through mining has increased by approximately 1.6 percent over the past two decades. In contrast, fiat money can be printed in unlimited quantities to support monetary policies, leading to unprecedented levels of depreciation and volatility.

Central banks across the globe share similar sentiments with there being a continuous push to increase their individual gold reserves. For instance, the US Federal Reserve holds an estimated 75 percent of its foreign exchange reserves in gold.

Meanwhile, the Bank of England refers to gold as a ‘war chest,’ citing the commodity’s ability to be mobilised in times of crisis.

It is also a belief among many central banks that gold holdings can be activated in an emergency. The outcome is that across the world, gold is perceived as the ultimate contingency against unforeseen events and even a form of insurance.

On the local front, the Central Bank of Sri Lanka has also maintained gold reserves of almost 20 tonnes in recent times, the value of which stood at nearly US$ 927 million at the end of September.

This accounts for approximately 12 percent of the country’s foreign exchange reserves, which hovered at around 7.6 billion dollars at the time.

In Sri Lanka, gold is used more as a store of wealth, and a hedge against inflation and currency volatility. Especially in times of political turbulence, the commodity has acted as a safe haven, which is another reason for gold being a sought after asset.

With the local currency expected to depreciate further in the future despite measures taken by the Central Bank to stabilise the rupee and maintain interest rates, it may not be a bad idea to take a position in gold as we head into a challenging 2020!

Leave a comment