THE EXCHANGE RATE

RUPEE VALUE AND THE BUDGET DEFICIT

Shiran Fernando evaluates the performance of the Sri Lankan Rupee in the year to date

The Sri Lankan Rupee has weakened this year, continuing the trend since it was floated against the US Dollar in September 2015. According to the Central Bank of Sri Lanka (CBSL), the rupee weakened by nine percent against the dollar in 2015, 3.8 percent last year and 2.6 percent in the first seven months of 2017.

This year however, the currency shed value for different reasons compared to those of the past.

DOLLAR WEAKENING In terms of the performance of the greenback in key dollar indices, there was strength in 2016 and previous years on the back of the US Federal Reserve raising key policy rates and an improvement in the outlook for the economy.

When the US Dollar strengthens, opposite pressure is exerted on currencies against which it is benchmarked. This has had an impact on most emerging and Asian market currencies, which weakened in 2015 and 2016 in particular.

However, this year has seen the dollar weakening and losing some of the ground it gained in 2016 on the back of political uncertainty in the US, and less expectations of the speed of reform – particularly fiscal reform. By end-July, the dollar was in its fifth straight month of decline.

ASIAN CURRENCIES Another important factor for a currency like the Sri Lankan Rupee is how its peers and regional currencies are faring. In 2015, most currencies in Asia and the emerging markets weakened due to a strengthening dollar as well as large outflows.

Countries such as Malaysia that were riddled by political scandal and lower oil prices saw a steep decline in the value of their currencies.

MARKET FACTORS In the early months of this year, the domestic currency came under pressure due to outflows from the local bill and bond markets. Since then however, there has been a steady stream of inflows to the market.

But with the reserves target set by the International Monetary Fund (IMF) and guidance in moving away from the currency being managed, CBSL has allowed the rupee to adjust to market conditions over the better part of this year. The Central Bank was a net purchaser of dollars in the market between March and June, adding to the weakening of the local currency.

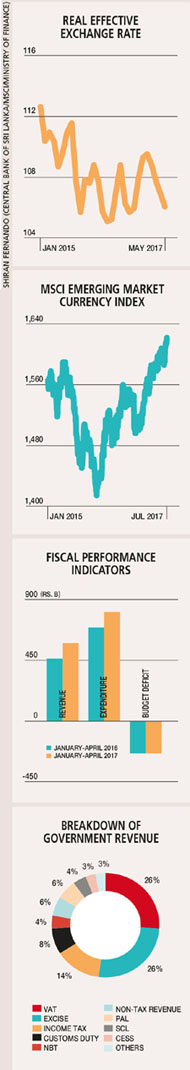

The Governor of the Central Bank has also stressed on many occasions that the currency is overvalued especially when compared against a basket of currencies. The reference point to this remark is the Real Effective Exchange Rate (REER) that indicates the rupee is overvalued by six percent, according to the most recent data published by CBSL.

Overall, against the backdrop of dollar performance and the domestic outlook, we may continue to see a similar trend in the rupee value for the remainder of this year.

FISCAL PERFORMANCE Switching to another key indicator of the economy, data released in the Mid-Year Fiscal Position Report for 2017 by the Ministry of Finance indicates further improvement in revenue performance.

Tax revenue increased by approximately 25 percent in the January-April quarter compared to the corresponding period of last year. The major driver of this was higher tax collections through Value Added Tax (VAT).

The impact of the VAT changes implemented in full in the last quarter of 2016 was visible in collections during the first four months of this year. This component of revenue has jumped from Rs. 80 billion in the first four months of last year to 153 billion rupees in the same period of 2017.

And the rise in revenue enabled the government to increase expenditure during the period. Public investment saw a substantial increase of nearly 33 percent in the first four months of 2017; and despite the higher expenditure, in absolute terms the budget deficit remained the same as last year.

It remains to be seen whether the higher expenditure can be maintained given that the government is aiming to reduce the budget deficit to 4.6 percent of GDP this year from the 5.4 percent recorded in 2016.

STATE ENTERPRISES The weak performance of some key state-owned enterprises (SOEs) is a point of concern.

Losses incurred by the Ceylon Petroleum Corporation (CPC), Ceylon Electricity Board (CEB) and SriLankan Airlines in the January-April period have offset profits recorded by other SOEs to a large extent. The impact of the drought as well as delays in moving to a market based pricing formula and restructuring these entities are among the reasons for this.

While fiscal performance so far has been commendable, progress will need to be maintained to achieve the projected targets.