THE ECONOMY

COUNTING THE COST OF OUTLIERS ON THE ECONOMY

Deshal de Mel tracks key trends of the economy in the first half of 2016 and prospects for the remainder

Second quarter GDP growth took a turn for the worse this year, declining to 2.6 percent, compared to the corresponding period of 2015. Several factors weighed down growth in the second quarter of 2016, particularly the floods in May, which had a material impact on both the agriculture and industry sectors.

The agriculture sector contracted by 5.6 percent, and had a 17 percent negative effect on economic growth in the second quarter of this year – rice (-17.9%), tea (-12.2%), rubber (-8.2%) and fisheries (-7.8%) were the major drags on aggregate GDP growth from the agriculture sector.

While the decline in rice and vegetable production can be attributed to the floods, the dip in tea and rubber has been influenced by the general downturn experienced by these sectors, in recent times. Moreover, the agriculture sector comes off a very high base, as rice (70.1%), vegetables (32.2%) and fruits (22.3%) experienced exceptional growth last year, driving agriculture sector growth to 10.4 percent in the second quarter of 2015.

INDUSTRY SECTOR The industry sector also suffered as a result of the floods, as several establishments in the Western Province were adversely affected by the weather conditions in May.

Accordingly, the sector grew by only 2.2 percent in the second quarter of 2016, which is quite a weak follow-up to the 3.9 percent growth recorded in the second quarter of last year.

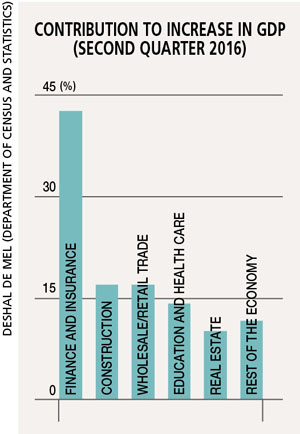

The likes of food and beverage manufacturing (0.4%); apparel (0.9%); and chemical, rubber and plastic products (-7.4%) contributed to the weak performance. The construction industry, however, continued to recover, following a weak 2015, growing by 6.9 percent and contributing 17 percent to the increase in GDP during the period.

SERVICES SECTOR The finance and insurance sector grew by 14.6 percent and contributed a hefty 42.5 percent to national GDP growth.

Other services that witnessed strong growth were education and health care, which rose by a combined nine percent and contributed 14 percent to the uplift in GDP. The services sector grew by 4.9 percent, and was the major driver of growth during the quarter.

TRENDS OVERVIEW The broad growth trends of the first half of this year largely followed the patterns of the second quarter, with growth dominated by finance, construction, wholesale and retail trading, and personal services.

Aggregate growth for the first half of 2016 was a disappointing 3.9 percent, dragged down by performance in the second quarter.

GROWTH PROSPECTS The outlook for the second half of 2016 isn’t optimal, as macroeconomic conditions are not conducive to growth. It is likely that the prevailing elevated interest rates will continue through the rest of this year, and credit growth in the second half is also likely to moderate.

And with probable tax increases leading up to the national budget, consumption in the economy is likely to be constrained.

GDP growth in the fourth quarter is likely to receive a boost on a technicality, due to the low base in the fourth quarter of last year. Sectors such as agriculture, transport and trading are expected to experience a statistical upswing, while construction will likely perform well on its own accord.

These factors will probably lift GDP in the fourth quarter of this year significantly above its 2015 figure of 2.5 percent, and drive up full-year GDP growth to between 4.5 and five percent in 2016.

EXTERNAL SECTOR Sri Lanka’s external sector continued to struggle in the first half of 2016: exports contracted by 5.8 percent, with industrial, agricultural and mineral exports languishing in negative territory.

The apparel industry has been the single positive driver of export growth, with a 4.5 percent expansion in the first half of this year. Even in apparel exports, the last two months have been rather weak (4.6% and 1.4% contractions in May and June, respectively), and economic weakness in Britain and the EU is likely to hamper exports through the rest of the year.

On the import front, consumer imports (-8.7%) declined sharply, in response to the policy environment of higher interest rates and tightening macroeconomic conditions. Intermediate goods imports remained flat, but there was an increase in the import value of fuel in June, as volumes picked up even though prices remained low.

The import of investment-related goods increased substantially, with machinery and equipment (20.1%) and building materials (23.2%) imports rising sharply in the first six months of 2016. This is indicative of future investment growth, and bodes well for economic activity, going forward.

TRADE BALANCE While the trade deficit expanded by 2.2 percent in the first six months of the year, the current account of the balance of payments was supported by strong growth in earnings from tourism (16.2%) and a moderate rise in remittances (5.3%).

The capital account of the balance of payments has witnessed an improvement, as foreign investment has returned to Sri Lankan Rupee-denominated fixed-income and equity markets since April.

With the Government also successfully tapping the global bond market and obtaining a syndicated loan, the external sector should remain fairly stable in 2016, feeding into rupee stability as well.