THE ECONOMY

ECONOMIC REFORM PRIORITIES IN 2018

Shiran Fernando recaps the key trends of 2017 to project the economic outlook for the year ahead

Reflecting on what I wrote 12 months ago in the January 2017 edition of LMD, it would appear that some of the key themes and trends mentioned have panned out during the course of the year.

To this end, I noted that “both on the local and global front, there are many moving pieces in 2017 that make predicting the outlook a difficult exercise. But there’s reason to be optimistic as the domestic macroeconomic picture takes a turn for the better.”

Considering what transpired last year, it is evident that despite the challenges, the macro picture has seen a significant degree of stability particularly in the second half of 2017. As a result, moving into 2018, the economy can build on this stability.

ECONOMY UNFOLDED The needle was moved on certain reform priorities of the government last year while some have been implemented at least at a policy level. These include the new trade policy, development of a national export strategy, regaining GSP+, and the new Inland Revenue Act, Foreign Exchange Act and Securities Exchange Act.

There have been other initiatives that will see tangible benefits in 2018 such as improving the investment climate and trade facilitation by the Board of Investment (BOI).

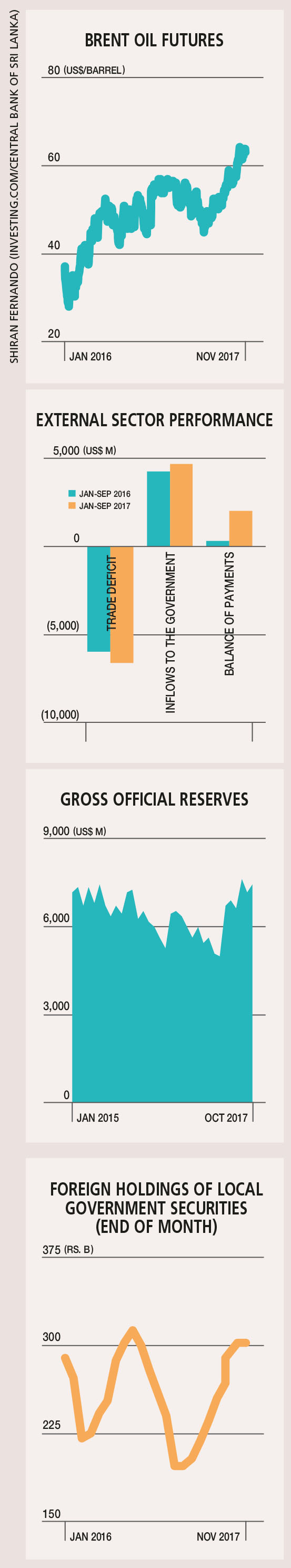

More importantly, some macro numbers have improved – in particular on the external front. Gross official reserves increased from US$ 6 billion at the end of 2016 to 7.4 billion dollars by October 2017 while the balance of payments stood at a surplus of US$ 2 billion for the first nine months of 2017.

FUTURE PROSPECTS There’s significant potential to build on the macro stability achieved in 2017. The ratings outlook upgrade from ‘negative’ to ‘stable’ indicates that Sri Lanka would be able to build on the reform momentum in the next 12 months.

One key aspect of the reform plans would be to ease the pressure resulting from bundling external debt, which is expected from 2019 onwards.

To this end, policy makers are aiming to formulate a Fiscal Liability Management Act in the early part of this year. According to the Governor of the Central Bank of Sri Lanka (CBSL), this act will include provisions enabling the government to borrow over and above the ceiling specified by the Appropriation Act that is utilised for debt servicing.

Raising this ceiling will help CBSL in particular create a buffer to refinance some of the debt beyond the next 12 months.

GROWTH EMPHASIS Growth has been rather lacklustre in recent quarters largely owing to adverse weather conditions impacting agriculture. The reform process and policy uncertainty haven’t helped either.

With Budget 2018 being in line with past policy documents (such as Vision 2025 and the prime minister’s Economic Policy Statement in 2017), the policy direction is less hazy than it has been in recent years.

Therefore, businesses will have an opportunity to drive their initiatives forward and explore new avenues that will come about as a result of the reforms. Growth will need to be led by exports and with investments being more broad based and not limited to a few sectors or products.

GLOBAL MARKETS In the first quarter of 2017, Sri Lanka witnessed the adverse impact of unfavourable investor sentiment towards emerging markets, which continued from the last three months of 2016. Foreign holding outflows from the local bill and bond market were a key reason for the rupee’s depreciation in the first quarter of last year.

But since then, foreign inflows have returned on a consistent basis, easing pressure on the currency and boosting reserves. This turn in inflows and outflows in emerging markets is difficult to predict with at least two cycles in a calendar year being witnessed in recent years.

And this volatility is expected to continue depending on the investment climate in global markets. However, with the new Chairman of the US Federal Reserve expected to continue with gradual increases in policy rates, we could witness some degree of policy predictability.

POTENTIAL RISKS In the last few years, Sri Lanka has benefitted from lower oil prices. However, the price of oil at the end of November had doubled compared to what it was at the beginning of 2016.

While it has yet to seriously derail the external outlook, further increases in the price of oil could weigh negatively on the country’s fuel import bill. And this could be exacerbated if Sri Lanka were to experience adverse weather conditions as it did last year.

MEDIUM-TERM VIEW While the focus should be on delivering the tangible benefits of the reform process for the benefit of the masses during 2018, the future thrust should also be on maintaining macroeconomic stability leading up to 2020… and indeed, beyond.