POST BALANCE SHEETS | 2020/21

BOTTOM LINES RISE

Sri Lanka’s leading listed entities show signs of growing profits even as the country faces challenges on a number of fronts

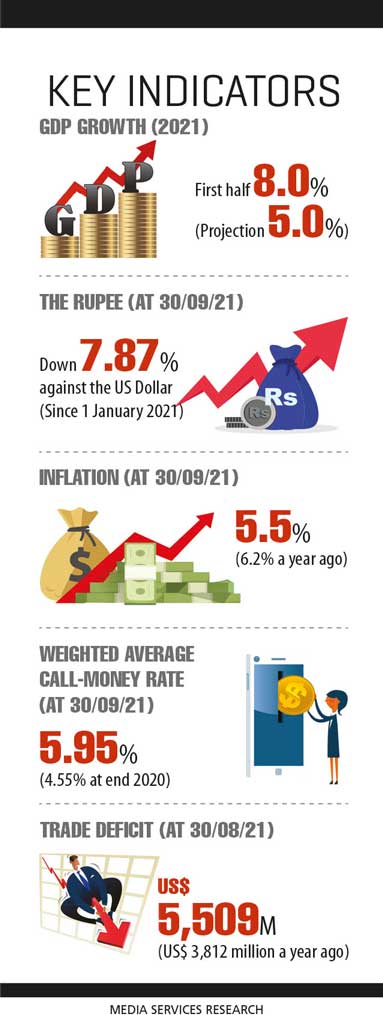

The national economy contracted by 1.5 percent year on year to Rs. 2.5 trillion in the third quarter of 2020, according to the Department of Census and Statistics. While being the number one contributor to GDP (57%), the services sector shrank by 1.6 percent – this was largely due to disruptions in the transportation of goods and passenger services, and other personal service activities.

Industry and agriculture followed with contributions of nearly 30 and nine percent to GDP respectively in the third quarter of 2021.

Where the external sector is concerned, the Central Bank of Sri Lanka (CBSL) reports that Sri Lanka’s trade deficit narrowed in October. However, during the first 10 months of 2021, the country’s balance of payments is estimated to have recorded a deficit of US$ 3,261 million compared to 2,083 million dollars in the corresponding period of the previous year.

Where the external sector is concerned, the Central Bank of Sri Lanka (CBSL) reports that Sri Lanka’s trade deficit narrowed in October. However, during the first 10 months of 2021, the country’s balance of payments is estimated to have recorded a deficit of US$ 3,261 million compared to 2,083 million dollars in the corresponding period of the previous year.

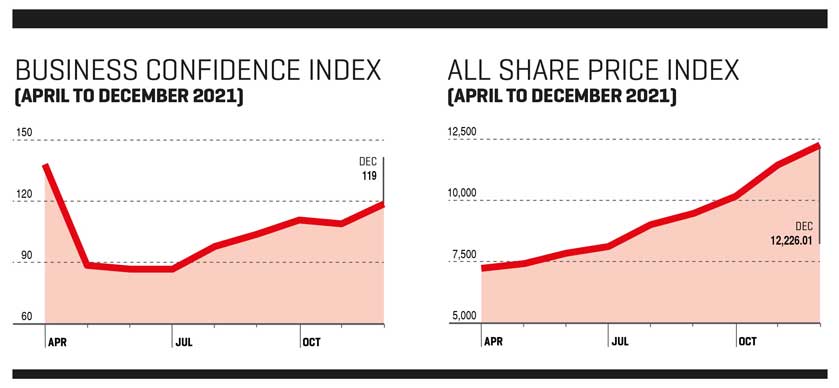

BUSINESS SENTIMENT The LMD-Nielsen Business Confidence Index (BCI) fluctuated throughout calendar year 2021. Having climbed to its highest point of 138 in April, it plummeted by nearly 50 basis points the following month (to 89) against a backdrop of yet another wave of the pandemic, following the Avurudu festivities.

After reaching the lowest point (of 87) during the year, the index grew for most of the second half of 2021 to reach triple digits by September.

In December, the unique confidence barometer stood at 119, which was 10 basis points higher than in the previous month; this in fact, was the highest of the index since April 2021.

Notably, the latest BCI survey was conducted in the first week of December – which was the first following the presentation of Budget 2022 in parliament – with corporates seemingly expressing optimism for the new year as they look to recover from a turbulent year.

In a recent edition of LMD, NielsenIQ’s Director – Consumer Insights Therica Miyanadeniya stated: “As business, people and the nation look forward to a better year, business confidence is likely to continue rising as corporates formulate new strategies to salvage and improve on what was lost due to the pandemic in 2021.”

CONSUMER CONFIDENCE Meanwhile, the Consumer Confidence Index (CCI) declined by a single basis point from the previous month to reach 30 in December, in contrast to a pronounced improvement in business sentiment.

Consumers continue to appear pessimistic about future employment prospects, the state of their personal finances and being able to purchase what they need.

BUDGET 2022 The national budget for 2022 was presented to parliament in November with a focus on improving the country’s infrastructure while providing relief to vulnerable communities in line with the ‘Vistas of Prosperity and Splendour’ policy framework of the government.

As part of Budget 2022, new taxes are to be introduced – including a one time surcharge tax of 25 percent on individuals or companies with taxable incomes exceeding Rs. 2 billion for 2020/21 and a Social Security Contribution (SSC) on liable turnover in excess of 120 million (at 2.5%).

As part of Budget 2022, new taxes are to be introduced – including a one time surcharge tax of 25 percent on individuals or companies with taxable incomes exceeding Rs. 2 billion for 2020/21 and a Social Security Contribution (SSC) on liable turnover in excess of 120 million (at 2.5%).

With fiscal proposals focussing on corporates with high revenue thresholds rather than small and medium size organisations, the government is looking to reduce the budget deficit to 8.8 percent from the 11.1 percent recorded in 2020 and eventually achieve a balanced budget, highly ambitious as this sounds.

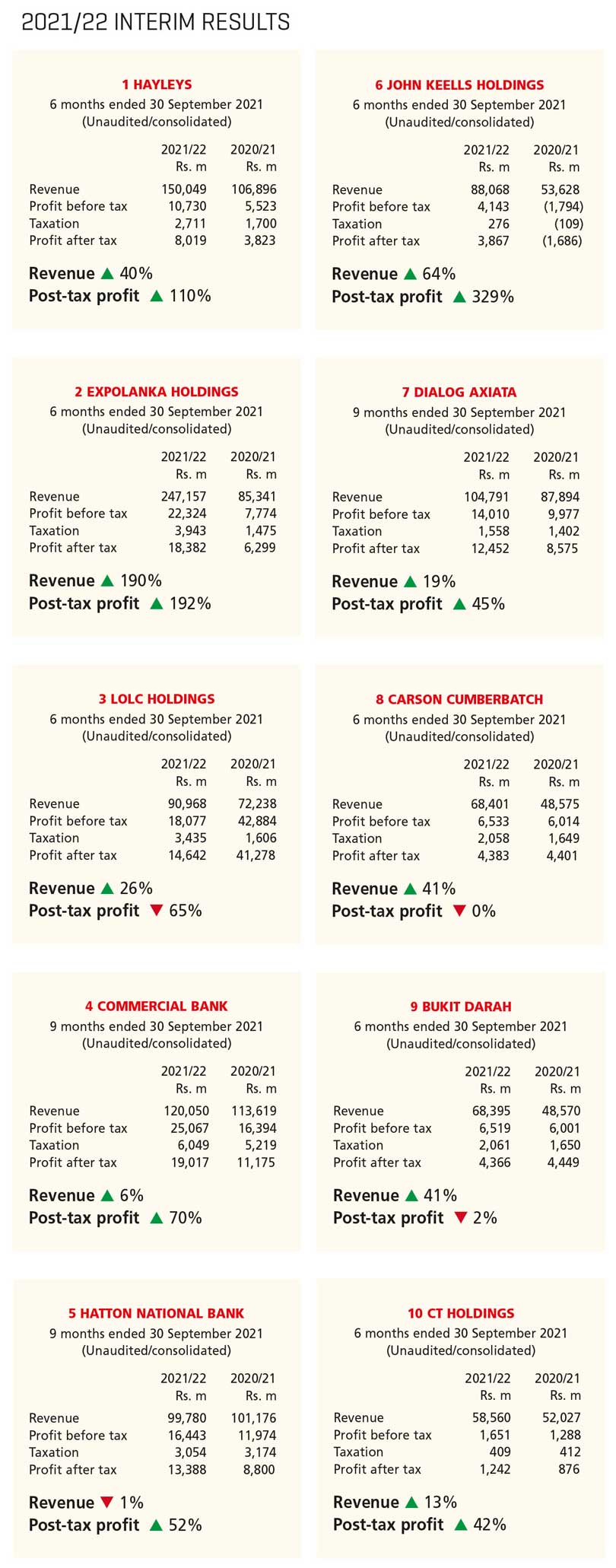

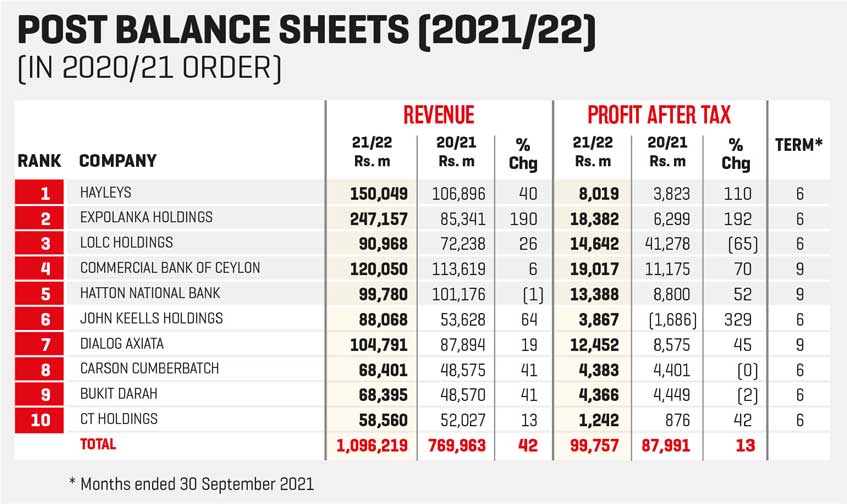

INTERIM RESULTS The latest interim results of the LMD 100 Leaderboard (for the period ended 30 September 2021) suggest there will be a healthy uptick in revenue in financial year 2021/22.

This is based on the premise that the combined revenue of the 10 leading listed entities grew by a whopping 42 percent year on year (to around Rs. 1,096 billion), which is a marked improvement over the LMD 100’s 2020/21 cumulative top line increment (6%).

Meanwhile, aggregate profit after tax (PAT) of the top 10 reflects an increase of 13 percent (to nearly 100 billion rupees) compared to the corresponding period in the previous year.

What’s more, all but one of the leading lights are so far in the black in financial year 2021/22 (similar to the results in the prior year). On the other hand, three LMD 100 Leaderboard companies have had to contend with a profit contraction during this time.

While first placed Hayleys has reported a substantial 40 percent hike in consolidated revenue for the first half of 2021/22 to reach Rs. 150 billion, its bottom line expanded by as much as 110 percent year on year to eight billion rupees in the six months ended 30 September 2021.

While first placed Hayleys has reported a substantial 40 percent hike in consolidated revenue for the first half of 2021/22 to reach Rs. 150 billion, its bottom line expanded by as much as 110 percent year on year to eight billion rupees in the six months ended 30 September 2021.

Hayleys’ Chairman and Chief Executive Mohan Pandithage comments: “We expect our export-oriented businesses to maintain their growth momentum while the strong rebound of our domestic businesses seen in the second half of the year is expected to continue in 2021/22. Our optimism is demonstrated by continued investments in expanding our operations and driving increased economic value.”

Expolanka Holdings’ income grew by 190 percent from a year back (to more than Rs. 247 billion) in the six months ended 30 September 2020. What’s more, its profits surged by 192 percent year on year to register in excess of Rs. 18 billion.

In its interim financial statements for the period, the LMD 100’s second ranked entity notes that “macro environment conditions have remained dynamic with supply chain disruptions continuing to remain.”

The conglomerate says it “remained firmly focussed on the core fundamentals of its business operations, delivering strong volume growth whilst adopting proactive procurement strategies supported by operational efficiencies.”

Meanwhile, LOLC Holdings (LOLC) reported a 26 percent expansion in its top line for the six months ended 30 September by surpassing 90 billion rupees. However, its bottom line registered a 65 percent year on year decline with post-tax profits falling to less than Rs. 15 billion.

Meanwhile, LOLC Holdings (LOLC) reported a 26 percent expansion in its top line for the six months ended 30 September by surpassing 90 billion rupees. However, its bottom line registered a 65 percent year on year decline with post-tax profits falling to less than Rs. 15 billion.

For the first nine months of calendar year 2021, Commercial Bank of Ceylon’s (ComBank) reported a consolidated income of 120 billion rupees (up 6% year on year) while its bottom line rose by 70 percent year on year (to Rs. 19 billion).

With regard to its performance at the end of the third quarter of 2021, ComBank states that it achieved equitable growth despite a slowdown in key contributors and attributes this growth to cost efficiencies.

As for Hatton National Bank (HNB), revenue declined by one percent year on year to over 99 billion rupees for the nine months ended 30 September 2021. Meanwhile, its tax-paid profit increased by 52 percent from the prior year to register Rs. 13.4 billion.

Stressing the importance of a resilient business model and continued focus on sustainable financial results, HNB cites one example of its performance: “Despite periodic disruptions to business activity in 2021 owing to lockdowns, the bank was able to grow fee and commission income by 22.8 percent year on year to 6.7 billion rupees.”

“HNB group companies were also profitable during the nine month period, complementing the group profit before tax and PAT of Rs. 16.4 billion and 13.4 billion rupees respectively while profit attributable to the shareholders rose to Rs. 13 billion,” it adds.

John Keells Holdings (JKH) reported a top line in excess of Rs. 88 billion (up 64% year on year) for the first six months in 2021 while its after-tax profit grew substantially by 329 percent year on year (to almost 3.9 billion rupees).

Chairman Krishan Balendra explains the impacts of the third wave of COVID-19 in Sri Lanka and restrictions imposed to contain the spread of the virus on performance: “The resultant curtailing of movement caused a slowdown in business activity and dampened consumer sentiment, exerting pressure on group performance during the quarter – particularly during the month of September.”

“However, since the end of the quarter, most of the restrictions have been eased – including restrictions on inter-provincial travel – and business activity has shown a strong recovery momentum,” he adds.

Moreover, he notes that the relaxation of health restrictions on arrivals to the island should benefit Sri Lanka: “This is a significant step for setting the stage for the reopening of the country for tourism, which will be a key catalyst to drive recovery momentum particularly in the context of the positive impact it will have on foreign exchange earnings.”

And the telecom giant Dialog Axiata saw its consolidated revenue expand by 19 percent to nearly Rs. 105 billion for the nine months ended 30 September 2021. Its after-tax profit also grew by 45 percent year on year (to 12.5 billion rupees).

Dialog says the group “sustained consistent performance in the third quarter of 2021 to record growth across all key business segments – namely mobile, fixed line, digital pay television, international and tele-infrastructure.”

And in the nine months ended 30 September, its capital expenditure was directed in the main towards investments in high-speed broadband infrastructure in a bid to expand Dialog’s leadership positioning among the widest and fastest networks in Sri Lanka.

Carson Cumberbatch generated a consolidated revenue of over Rs. 68 billion (up 41% year on year) for the first half of financial year 2021/22 while its half-yearly post-tax profit remained largely the same to register slightly less than 4.4 billion rupees.

Carson Cumberbatch generated a consolidated revenue of over Rs. 68 billion (up 41% year on year) for the first half of financial year 2021/22 while its half-yearly post-tax profit remained largely the same to register slightly less than 4.4 billion rupees.

“The profit performance is predominantly weighed up by the successful top line expansion across the majority of business sectors across the group rather than being boosted by non-cash unrealised gains,” it states.

Group entity Bukit Darah was also in the black in the first half of financial year 2020/21 with a profit after tax of nearly Rs. 4.4 billion (against a PAT of almost 4.5 billion rupees in the corresponding period of the prior year). Moreover, its turnover increased (by 41% year on year) to more than Rs. 68 billion.

And lastly on the 2021/22 LMD 100 Leaderboard, CT Holdings enjoyed a hike in revenue of 13 percent year on year (to Rs. 59 billion) whereas its bottom line grew to over 1.2 billion rupees after tax – versus a profit of Rs. 876 million in the corresponding period of 2020/21.

BUSINESS OUTLOOK Based on the interim financial statement disclosures at 30 September 2021, it could well be that Expolanka would be in contention to occupy the top spot in next year’s LMD 100 rankings while nine of the top ten have enjoyed upward momentum during this period.

Meanwhile, the tussle for the most profitable listed entity next year may be between Expolanka and LOLC.

That being said, the trajectory of the 2021/22 LMD 100 rankings would depend on how the nation tackles the outbreak of potential COVID-19 variants in addition to the slew of economic challenges and how the top lines of leading corporates are impacted by these developments.