ENERGY SECTOR

OIL SUPPLY DEFICIT ON THE CARDS

Samantha Amerasinghe analyses the impact of oil indicators following a pact between leading players

The agreement reached at the 22 June OPEC meeting was a victory for Saudi Arabia and Russia, which have advocated a production increase to alleviate high oil prices. In some ways, it is also a success for US President Donald Trump who has criticised OPEC for inflating the cost of oil.

Saudi Arabia won a deal to lead OPEC in a production increase and is confident that the roughly one million barrel a day (around 1% of global supply) agreement would enable countries with excess production capacity to boost output. The deal was reached despite some opposition from Iran.

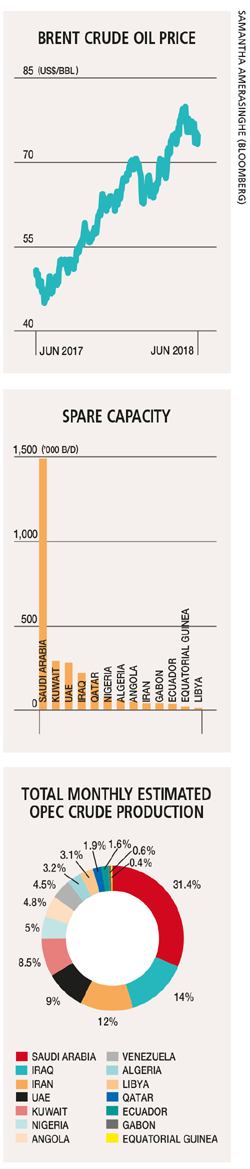

The Organization of the Petroleum Exporting Countries is expected to review the impact of the increase in September. Meanwhile, the US Energy Information Administration forecasts Brent spot prices to average US$ 71 a barrel this year and 68 dollars in 2019.

Oil prices have maintained a strong run that began towards the end of last year. The price of crude oil rose to its highest level in four years, reaching 80 dollars a barrel (up 50% in 12 months) in May, exerting pressure on OPEC and its de facto leader Saudi Arabia to do more to cool the price spiral.

This rally had been stoked in part by the United States’ decision to withdraw from the nuclear deal with Iran and reimpose sanctions on its oil industry. Moreover, the US, China and India had urged OPEC to release more supplies to prevent an oil deficit that would hurt the global economy.

The official agreement that emphasised the deal to raise output is a move back to 100 percent compliance with OPEC’s original decision to reduce output by 1.8 million barrels a day some 18 months ago. However, the drop in supply far exceeded the initial target with unplanned outages in Venezuela, Angola and other participating countries taking the decline closer to 2.7 million barrels a day.

With renewed US sanctions on Iran’s energy exports taking effect later this year and Venezuela’s production predicted to fall further due to the political crisis that has engulfed the country, concerns remain that the supply boost will not be adequate.

The oil supply-demand balance in 2018 appears to be supportive of higher prices. In terms of oil, demand is running ahead of supply, there is no surplus and inventories have fallen sharply.

Oil demand growth should outpace non-OPEC supply growth this year. At the same time, higher absolute prices may cause a temporary fall in demand. The long low oil price cycle, which led to three lost years of investment in many conventional long cycle oil plays, is drawing to a close – although oil experts forecast that non-OPEC supply outside North America will extend its 2017 fall due to the lagged effect of this lost investment.

OPEC and its non-OPEC partners are now receiving greater acknowledgment for market discipline, views of shale oil economics are no longer the most important price setting factor and demand pessimism is considerably less. Last year, the geopolitical context seemed unimportant to traders; this year, lower inventory cover means that geopolitics is once again a key driver.

Inventories have fallen substantially and are currently at their five year averages, which makes them more vulnerable to negative supply shocks. Compliance with the 2016 OPEC and non-OPEC deal has been high, driven in part by deteriorating conditions in Venezuela where production is at a 15 year low. Further losses as a result of renewed US sanctions against Iran could remove one million barrels a day of supply by the end of the year.

The alliance between Saudi Arabia and Russia has been critical to this success, creating a strong and pragmatic approach to maximising oil revenues.

There is reportedly a consensus to continue with output cuts in some form beyond the end of this year. Any easing of production curbs to replace lost Venezuelan and Iranian production is unlikely to cause excess supply; instead, it would reduce spare capacity, remove a buffer from other shocks and risk pushing output beyond sustainable levels.

There are also strong signs of output issues affecting the growth of US shale. The acute localisation of activity in the US – notably around the Permian Basin of Texas and New Mexico – is leading to tight off-take capacity for both oil and gas, which is likely to remain constrained throughout 2018 and 2019. Other bottlenecks include shortages of labour, sand, water, power and road capacity.

The oil market is heading into a supply deficit. And just as it was previously in surplus for three to four years, we expect it to remain largely in deficit for a similar period. This is why OPEC and Russia are likely to tread cautiously.

So-called spare capacity available to deal with unexpected supply outages is at its lowest in years with only Saudi Arabia sitting on more than a few thousand barrels a day of additional production in a 100 million barrels a day market.

If OPEC and Russia raise output too quickly, there could be little spare capacity left as demand continues to rise.

Leave a comment