OIL GEOPOLITICS

NO QUICK FIX FOR THE OIL GLUT

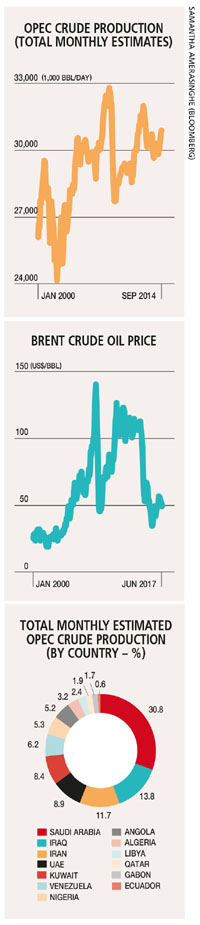

Samantha Amerasinghe ponders the fate of black gold’s three-year global supply glut

Oil prices have fallen sharply following the 25 May Organization of the Petroleum Exporting Countries (OPEC) meeting in Vienna at which the cartel agreed to extend its production cuts into 2018.

This move underlines OPEC’s intent to end a three-year supply glut that has had a detrimental impact on oil prices and the global energy industry.

The outcomes from the meeting did not surprise the market, which responded positively to strong rhetoric, and the solidarity displayed by Saudi Arabia and Russia 11 days before the meeting. But the reaction to the OPEC meeting suggests that some traders were seeking more.

The agreement reflects efforts by the cartel’s de facto leader Saudi Arabia and Russia – the most important producer outside OPEC – to garner support for a nine-month extension.

Once deemed unthinkable, a longstanding partnership between Saudi Arabia and Russia has offered some hope to oil-dependent producers in their battle against the oversupply created by the rise of the US shale industry. The two countries have pledged to rebalance the global oil market to help oil-dependent producers who have seen their budgets decimated due to the steep fall in oil prices since 2014.

Saudi Arabia and Russia pump one in every five barrels of crude oil and together are spearheading the drive to maintain supply cuts at roughly two percent of global demand, split between 24 OPEC and non-OPEC countries. They believe that if this target is met, it will shrink swollen

oil inventories that built up during the downturn.

Prices fell rapidly once the prospect of deeper cuts or a longer time frame was ruled out. Interestingly, following all the deal-making and executions involving 22 countries over the past year, the net result has been a year-on-year price rise of only US$ 1.72 a barrel.

OPEC’s efforts to eliminate the supply glut since the cuts came into force at the beginning of this year have taken much longer than the cartel anticipated.

In fact, according to the International Energy Agency (IEA), global inventories rose in the first quarter and are only beginning to display signs of declining. This is partly due to a resurgent US shale industry, which has transformed America into a major oil producer during this decade.

Much of the current oil price dynamic reflects a market that is trying to test the true economics of shale. Saudi Arabia’s energy minister is confident that the rebound in shale production would not thwart efforts by global producers to drain the market of a surplus.

Some experts like consultants Wood Mackenzie say the extension could ultimately increase the price of oil to 60 dollars a barrel by the end of this year. But on the flipside, this would also boost US shale or the so-called ‘tight’ oil that it estimates could grow by 950,000 barrels a day next year.

Over the past six months, OPEC has attempted to present a unified front amid deep-seated political disagreements between some member states. Iran for instance has supported the supply deal despite tensions with Saudi Arabia over Yemen and Syria, and its nuclear deal with the US.

Since January when the cuts came into effect, the US shale industry has demonstrated that it can thrive in a world of US$ 50 for a barrel of oil. American companies have adapted by curtailing costs and accelerating drilling, and look set to increase global consumption by as much as one percent next year.

This is a massive amount in an industry that can suffer from small swings in the supply-demand balance. The oil alliance between Saudi Arabia and Russia clearly underlines that US shale is here to stay, and they need to figure out how to adapt to its growth.

Both Saudi Arabia and Russia have much to gain from this alliance. The former is pushing through a radical transformation of its economy, looking to reduce dependence on its main resource oil in the future.

Saudi Arabia is using the initial public offering of its state energy giant Saudi Aramco as a means to generate higher oil revenues to pave the way from a political and financial standpoint. Russia is also seeking stability ahead of its important election in March 2018.

Despite the positive steps from the oil alliance, some traders remain sceptical about the price of black gold stabilising at above 50 dollars a barrel. They also see Russia as an opportunist and being in it for only the short term to reap the benefits of higher prices for now but with long-term intentions to expand its energy industry.

Are OPEC and its allies possibly underestimating US shale growth?

Oil traders believe so.

They think that over time, some countries’ compliance with the production cuts could weaken – so a deeper cut for a shorter duration might have been a better outcome for all. The largest threat is that production could flood back into the market when the deal ends in nine months’ time. Much ambiguity remains about what might transpire thereafter.

All we know for now is that Saudi Arabia and Russia have vowed to do “whatever it takes” to balance the oil market. And there are no quick fixes.

Leave a comment