MOST VALUABLE CONSUMER BRANDS

PROFILE

BOC

Q: How did your bank navigate the challenges posed by the economic crisis?

A: Over its 80 years of existence, BOC has built a resilient financial and operational infrastructure, which is capable of absorbing a considerable level of economic shock.

As the leading banking institution and a state-owned entity (SOE), BOC had to shoulder the revival of the economy by being part of the government’s and Central Bank of Sri Lanka’s (CBSL) strategic initiatives to infuse working capital, stabilise interest rate movement and manage the country’s foreign reserves.

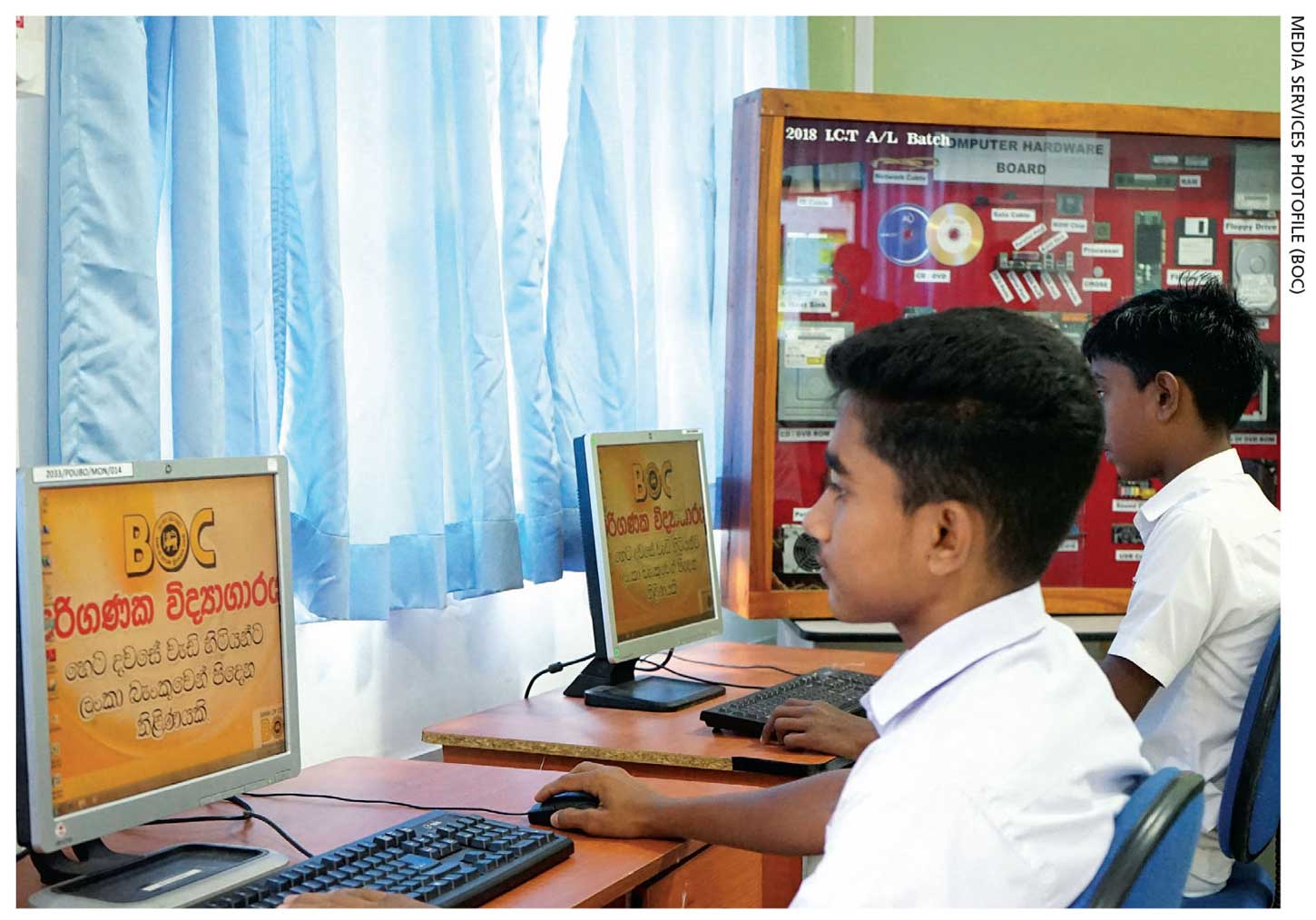

Also, it had to bring innovative low-cost involving delivery channels to reduce overall transaction costs whilst managing its own sustainable growth.

The bank is also inculcating the saving habits and facilitating financial inclusion to ensure that all Sri Lankans alike can achieve their financial goals.

Q: Tell us your brand history in brief, and brand strengths and growth potential of your bank…

A: Human capital is the most prominent strength in any organisation. Our employees understand the purpose of the brand and perform in line with the brand purpose, which has enabled us to provide maximal benefit for all our stakeholders.

The government lends the bank, being an SOE, stability and security. Over time, the brand has accumulated strong financial and operational capacity, which has enabled it to expand across the banking and financial services landscape.

BOC has marked its presence in every corner of this island – with over 2,000 customer touch points; has branches in Chennai, Male, Hulhumalé and the Seychelles; and a banking subsidiary in London.

The bank has developed a strong international correspondent network comprising 800 foreign banks and partnering financial institutions that have enabled it to become the leader in foreign trade in Sri Lanka. And the bank’s asset base exceeds Rs. 4 trillion while it is reputed as the highest profit earner in the banking sector for years.

BOC has incorporated green banking and nurtured a culture that is conscious of sustainable growth. Its total infrastructure including technology is constantly updated in response to evolving industry trends.

The bank has empowered many individuals and businesses by fulfilling their banking needs conveniently and securely, winning their trust and loyalty as the No. 1 banking brand in the country, which was named ‘Best Banking Services Provider’ for the third consecutive year at the SLIM-Kantar People’s Awards 2023. These strengths at the core of the bank enable us to make the best of any situation.

The brand identifies how effectively it responds to stakeholder needs and what the direction of the brand’s growth should be

Q: What was the impact of the external environment on brands and branding?

A: The external environment is the source of inspiration for the brand to grow sustainably. With continuous feedback, the brand identifies how effectively it responds to stakeholder needs and what the direction of the brand’s growth should be. The environment decides how much the brand resonates with the wants and needs of the market, and its level of acceptance.

Q: What role can brand investments play in accelerating business recovery in the prevailing corporate environment?

A: The prevailing corporate environment requires brands to maintain their presence among intended stakeholders to ensure sustainability. BOC, which has strong stakeholder relationships especially with customers, requires investment on awareness building, maintaining stakeholder relationships as a corporate citizen, and communicating brand strengths to maintain trust and confidence in the brand.

Q: What is the impact of branding on sustainability and growth?

A: Branding, sustainability and growth always add value to a business and its stakeholders. As an impact of branding, our stakeholders understand the values and the purpose BOC stands for, which helps us to maintain their trust.

BOC’s stakeholder profile extends to international affiliations, which is evident in the bank being named as one of the ‘Top 1000 Banks’ in the world and the top ranking Sri Lankan bank by The Banker, UK.

Q: How important are reputation and integrity for organisations?

A: Reputation and integrity are built over a considerable time period – with consistency and a deliberate consideration of quality to build stakeholder relationships and loyalty. In turn, this brings opportunities for brand expansion and enhancing financial capacity.

Leveraging on its longstanding reputation and integrity, BOC has risen to become the No. 1 banking brand in the country for over 15 years in a row, for its innovative spirit and quality of delivery.

Telephone 2204444 | Email boc@boc.lk | Website www.boc.lk