LMD 100 Q&A

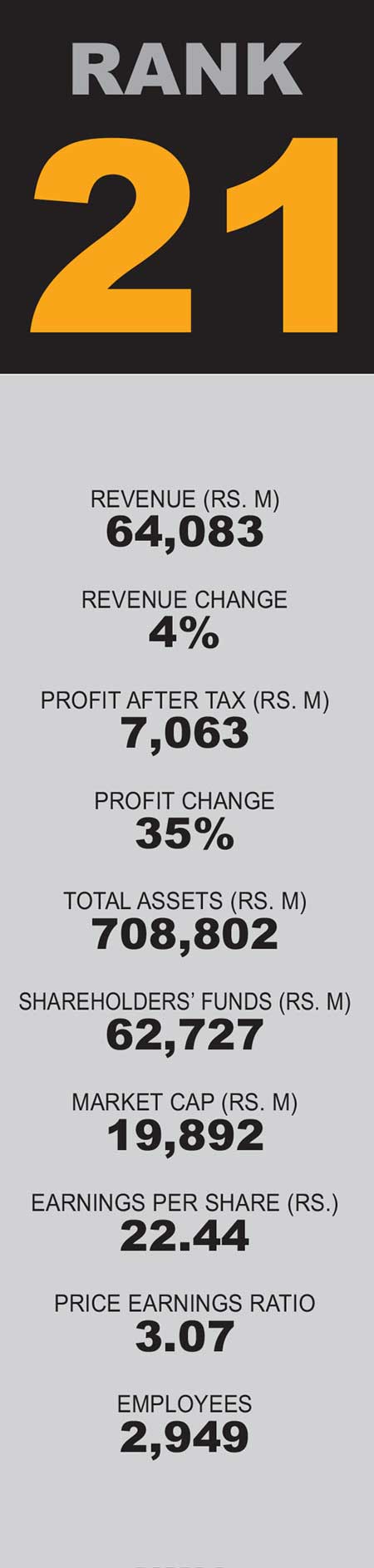

NATIONAL DEVELOPMENT BANK

Q: How has the role of banking customers changed in the face of economic turmoil in Sri Lanka?

A: Customers (depositors and borrowers) are equally affected. Depositors predominantly dependent on interest income are facing challenges as the real value of their interest income – despite the increase in interest rates – is now eroded at exponential inflation rates.

For borrowers, high interest rates mean larger sums of funds to be allocated for debt servicing amidst already reduced disposable income – again, attributable to inflation. In the case of businesses, there is limited or no upside in business growth from investment of borrowed funds or incremental revenue.

In such a context, we as a responsible bank make enormous efforts to support them in maintaining their financial resilience and health. One key development is the embracing of digital solutions. At NDB, over 85 percent of our transactions now take place digitally.

Q: How is your bank faring under existing macroeconomic conditions?

A: The collective experience of over four decades has afforded us the agility and nimbleness to adapt swiftly to evolving conditions. Our investments in technology and digitalisation have stood us in good stead.

Whilst focussing on preserving asset quality and maintaining strong liquidity, we have also deployed a number of tactical strategies including cost rationalisation and process enhancements, which will also support our profitability. We also continue to strengthen our staff through learning and development, and ensure their welfare.

Q: What is the level of technology integration in your bank?

A: In recent years, NDB has been driven on market leading digital transformation. This transformation is dual pronged, covering customer solutions and internal process, and has resulted in delivering seamless client experiences, building an agile and responsive workplace and a lean operating model.

NDB has deployed some of the latest technology in customer experiences through NEOS, becoming the first bank to launch virtual KYC, enabling account opening from any corner of the world, and have a dedicated mobile app to SMEs and launch ‘digi-loans’ facilitating the end-to-end loan process digitally (for personal loans).

The bank has also used workflow solutions and robotic process automation (RPA) widely with remarkable increase in productivity as reflected in our cost to income ratio, which has continually improved and is below the 30 percent mark.

We are currently on the last lap of migrating our core banking system to its latest version, and we’ve also deployed data analytic tools such as AI and Power BI in integrating technology driven capabilities into our decision making.

Q: Should organisational performance and environmental sustainability go hand in hand?

A: Yes, absolutely. The bank has a strong commitment to contributing towards the United Nation’s Sustainable Development Goals (SDGs) with many of our corporate sustainability initiatives directly contributing to those of Climate Action and Life on Land.

Our flagship reforestation initiative ‘Let’s Grow’ saw 3,000 trees planted across five hectares at Himbiliyakada in Matale with plans to extend this to a further 10 hectares. An extension to this project was the removal of invasive plants across five hectares, currently extended to a further five in Pitawala Pathana in the Knuckles Mountain Range.

We also partner the youth wing of the Wildlife and Nature Protection Society (WNPS) and Biodiversity Sri Lanka (BSL) in their respective initiatives.

As a financier, we are well cognisant of how our lending and investments can contribute to climate change. Hence, we have robust governance mechanisms to ensure that we do not lend to any activities that contribute to climate change and environmental degradation.

We have a board approved Environmental and Social Management Systems (ESMS) policy, which drives such action and was developed as per global standards with professional consultation of our foreign investors and lenders, such as Norwegian Investment Fund for Developing Countries (Norfund) and International Finance Corporation (IFC).

Our financing of renewable energy also augments our environmentally-friendly existence – with over 30 percent of the country’s renewable energy generation capacity funded by NDB.

As a financier, we are well cognisant of how our lending and investments can contribute to climate change – hence, we have robust governance mechanisms

Telephone 7448448 | Email contact@ndbbank.com | Website www.ndbbank.com