LMD 100 Q&A

JOHN KEELLS HOLDINGS

Q: What is the role of corporates in Sri Lanka’s economic revival?

A: The government has taken many difficult – yet, necessary – measures to rebuild Sri Lanka’s fiscal position and overcome its macroeconomic crisis. Although some measures are likely to impact corporate performance in the short term, all corporates must continue to actively engage with the authorities; and raise awareness amongst all employees and stakeholders to ensure these policy reforms are implemented expeditiously to achieve a sustainable economic recovery.

Given the contractionary and non-populist nature of some reforms, it’s vital to ensure policy consistency is maintained until implementation – and sustained beyond that – for the realisation of benefits to accrue so that the general populace will witness the positives from these measures.

Equally importantly, policy makers should be held accountable for the implementation of reforms, and there should be increased calls for and pressure on enhanced transparency, better governance, and the sharing of an equitable burden between the private and public sectors, which will increase the chances of acceptability – and therefore, success.

Q: How can Sri Lanka improve its ease of doing business and competitiveness?

A: Efficiency in reform implementation, unambiguous regulations and consistent policies are the necessary cornerstones to foster investment and boost business confidence, particularly amongst foreign investors.

Sri Lanka should clearly develop and articulate its core competitiveness and strategy in attracting foreign investments first, taking a holistic view in identifying the entire ecosystem and value chains required to attract particular industries. Thereafter, the necessary regulations and related policy measures need to complement this strategy.

Some of the key drawbacks are a lack of consistent policy, availability of land and bureaucratic challenges. These need to be addressed by successive governments as investors look for continuity despite political transitions. The independence of the Central Bank and management of the country’s debt will be important in achieving stability in monetary policy.

Being a small island nation with limited land availability, the identification of targeted industries, and productive use of lands and the ecosystem, are imperative – this is the starting point. The investment agency also needs to be a true ‘one stop shop’ where investors can coordinate and obtain all approvals and permits to commence operations.

Q: What measures have been taken to grow your group in the past 12 to 18 months?

A: Over the past few years, the group has invested in both tangible expansion of our businesses and the building of soft skills, which are of equal importance. Despite two challenging and unprecedented years, these investments have continued steadfastly, maintaining the depth and breadth of our long-term investment strategy, which has now come to fruition.

Investments in recent years have focussed on a refurbished portfolio of leisure properties and the acquisition of a long-term lease on a new hotel in the Maldives. The group has also doubled its store footprint in the supermarket business over the last few years while investing heavily in building its brand value, and enhanced its capacity and capability in the frozen confectionery and insurance businesses.

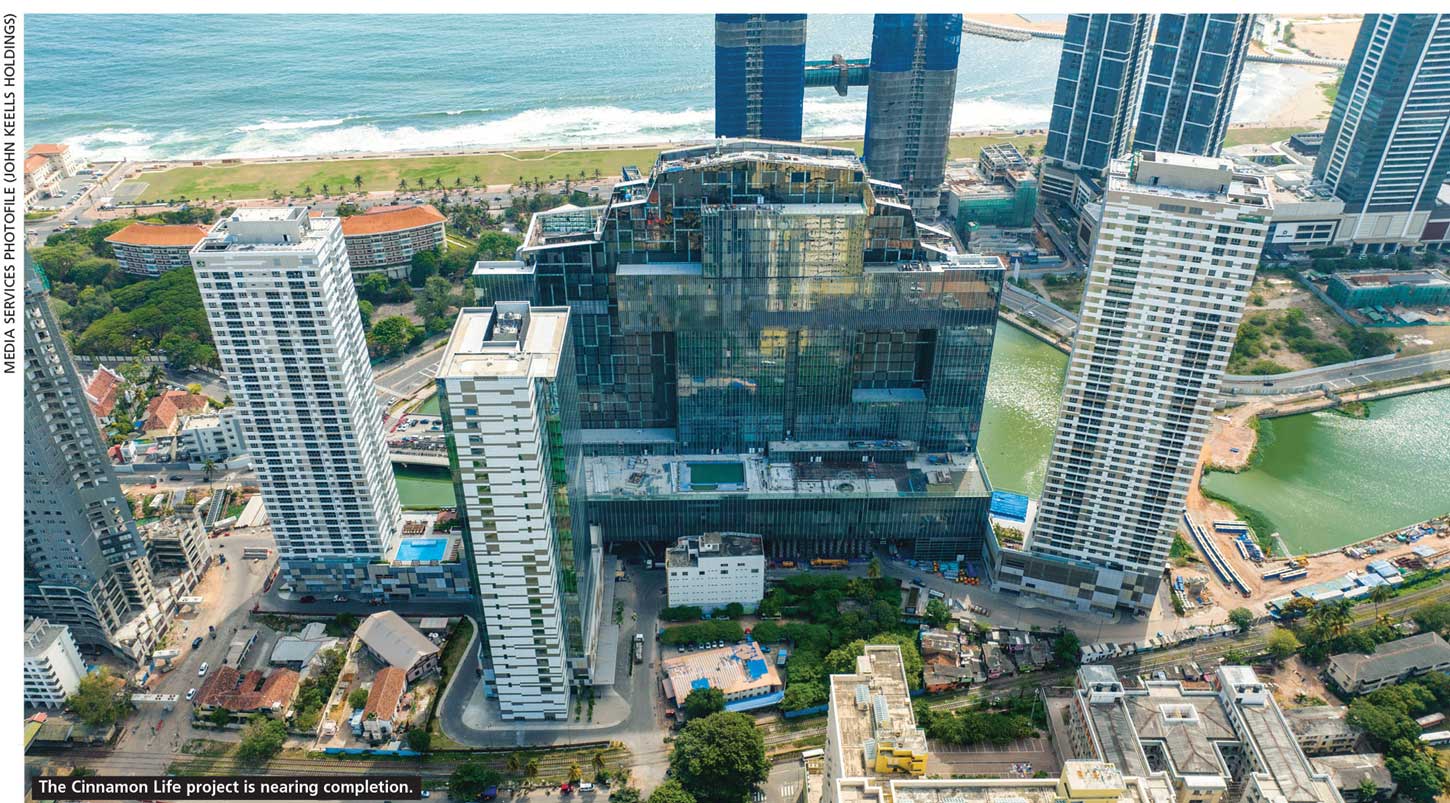

And the most significant investment in our portfolio ‘Cinnamon Life’ is nearing completion. Similar to the experience with integrated resorts in other Asian countries, particularly with the regularising of gaming, Cinnamon Life has the potential to transform Colombo as a destination for leisure and entertainment, and lead to substantial foreign exchange earnings for the country.

The West Container Terminal (WCT-1) in the Port of Colombo is envisaged to spearhead the group’s next phase of growth – as witnessed in the past through our investment in the South Asia Gateway Terminal (SAGT). WCT-1, which entails an annual handling capacity of approximately 3.2 million twenty-foot equivalent units (TEUs), will augment the port’s strategic proposition and address long overdue capacity constraints.

Additionally, the group’s investments aimed at building soft skills, fostering a data analytics transformation journey and inculcating analytical capabilities to drive a culture of data driven decision making are also progressing well.

Q: How are labour market dynamics impacting your group?

A: Deteriorating macroeconomic conditions, coupled with rising costs of living, have resulted in increased migration – particularly, in the younger cadre – to which the group has been no exception. Cognisant of the economic hardships faced by employees, we provided a one-off, uniform financial care package in the form of an ex gratia payment in April.

Our group continues to implement various initiatives and programmes in the form of nonfinancial and indirect financial support including awareness sessions and webinars on managing personal finances in the current economic climate, emotional support with counsellors and employee supplier catalogues, to name a few.

The more informed and socially conscious younger talent pool has expectations of workplace inclusivity and flexibility in working arrangements. The group’s early adoption of progressive policies is a strong contributor to attracting talent, encouraging and unlocking new talent pools, and adopting new ways of working.

Deputy Chairperson

Group Finance Director

Ensuring a greater degree of employee involvement and flexibility in work arrangements is also envisaged to help increase retention and motivation of existing employees while expanding the talent pool and its diversity.

We continue to ensure equity and inclusion through our initiatives under ‘ONE JKH’ such as the introduction of 100 days of equal parental leave.

The group will continue to focus on initiatives to retain our critical talent by empowering these individuals, reviewing our compensation philosophy in line with evolving trends and focusing on our employer value proposition.

Q: Do organisational performance and environmental sustainability go hand in hand?

A: Yes, and this is a factor that’s strongly ingrained in our DNA. The group has a well entrenched sustainability and risk management framework – to ensure that sustainability considerations remain an integral part of all business operations.

This framework guides us in integrating financial performance alongside nonfinancial elements through practices such as conservation of natural resources, reduction of our carbon footprint, emissions management and responsible waste disposal, ensuring the best standards of product stewardship, conducting operations to the highest ethical standards and supporting our supply chain partners to better their own sustainability performances, among others.

Telephone 2306000 | Email jkh@keells.com | Website www.keells.com