LEADING BRANDS PROFILES

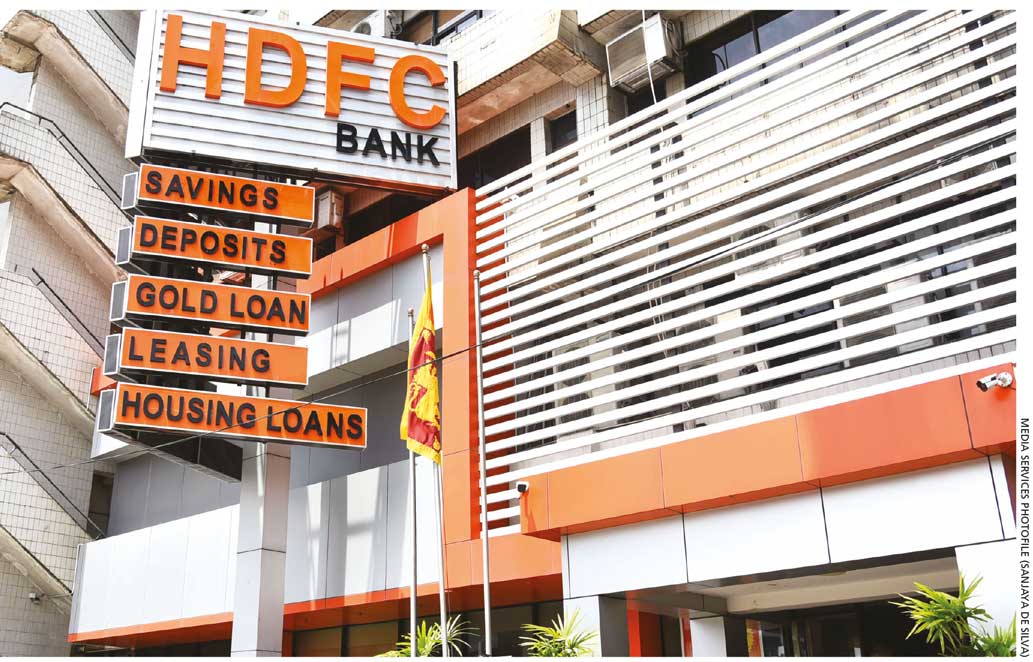

HDFC Bank

Q: How has HDFC Bank grown since its inception?

A: It was incorporated as a building society in 1984, converted to a state corporation in 2000 and became a licensed specialised bank listed on the Colombo Stock Exchange (CSE) in 2005 to offer housing loans. In 2014, we began diversifying our portfolio beyond housing finance.

A: It was incorporated as a building society in 1984, converted to a state corporation in 2000 and became a licensed specialised bank listed on the Colombo Stock Exchange (CSE) in 2005 to offer housing loans. In 2014, we began diversifying our portfolio beyond housing finance.

Being co-owned by the government and private shareholders, the Housing Development Bank of Sri Lanka – better known as HDFC – is a key player in the banking and finance sector today, with a Fitch Rating of ‘BB+’ and branch network covering 39 locations across the island.

Q: What is your assessment of the impact of the pandemic on branding – especially in the banking sector?

A: COVID-19 has adversely impacted our sector with regard to the nonpayment of loans, resulting in negative cash flows. Due to serving the lower end of the income spectrum, the main impact on HDFC has been the inability of customers to repay loans during the pandemic.

The Central Bank of Sri Lanka introduced a relief programme where eligible borrowers could request a moratorium period. The bank complied efficiently by accepting requests over the telephone, emails, the website and even WhatsApp, to ensure speed and efficiency.

We appointed a special 15 member task force to report to work and process around 23,000 requests for moratoriums amounting to over Rs. 17 billion worth of loans.

Managing liquidity was vital and we employed a strategy to mobilise retail deposits from individual customers, and ended the year with a net growth of 4.7 billion rupees. This has also made our deposit portfolio more granular and robust.

Q: How does the brand look to use technology in its operations?

A: Last year, we implemented a dual linkage to our wide area network (WAN) to ensure a speedy and reliable internet connection, and provide redundancy if one link fails.

This enabled us to introduce a paperless loan application process whereby staff in our branches can scan and upload applications to our Loan Originating System quickly, conveniently and safely.

Q: What innovations has HDFC adopted to cater to customers in recent times?

A: HDFC was incorporated to cater to lower income earners. We are now looking at including the upper middle-income segment to our customer pool. This will be a paradigm shift for the brand; therefore, we’re implementing it incrementally without losing sight of our main focal point, which comprises low income earners. We’re presently training staff to cater to this new segment and also changing our approach to technology given that these new customers will demand digitally enabled solutions.

A: HDFC was incorporated to cater to lower income earners. We are now looking at including the upper middle-income segment to our customer pool. This will be a paradigm shift for the brand; therefore, we’re implementing it incrementally without losing sight of our main focal point, which comprises low income earners. We’re presently training staff to cater to this new segment and also changing our approach to technology given that these new customers will demand digitally enabled solutions.

Additionally, we relaunched our internet banking proposition with new features and a better user interface, and enabled our core banking system to transact with mobile apps. We are also launching an international ATM card in partnership with LankaPay.

The higher income segment is more likely to demand better interest rates. Therefore, we’ve introduced risk-based pricing where we will assess clients’ risks and offer more competitive rates.

Q: In what ways does HDFC measure its customer lifetime value?

A: For HDFC, the customer lifetime value is quite literal and we have products that cover the entire spectrum of their lives.

Beginning with children’s savings accounts such as Thilina through to retirement plans like Vishrama Rekewarana, we ensure that customers have viable options with our brand throughout their lives.

Q: How does social media influence brand building?

A: HDFC is shifting its focus to social media when it comes to brand communication – especially advertisements. We have upgraded our Facebook page and a lot of new material is being posted more frequently, and our followers have doubled in the last six months.

Q: Could you outline the brand’s plans for the rest of this year?

A: HDFC is looking at standardising its brand communications to increase brand recognition and recall. We have designed new name and product boards to be put up in all locations together with an internal advertising campaign. We’ll also be redesigning our website so that it becomes more relevant.

Our primary focus will be HDFC’s ‘Five-year strategic plan: 2021-2025,’ which incorporates a 360 degree improvement in business, skill sets, risk management, governance standards and compliance standards. This has been cascaded down to 21 departmental level plans to ensure that the entire organisation contributes to the achievement of our strategic plan.

website: www.hdfc.lk

General Manager

CEO