INSURANCE SECTOR

LIFE COVER

Compiled by Yamini Sequeira

BRIDGE THE PROTECTION GAP

Thushara Ranasinghe shares lessons learnt by insurers during the pandemic

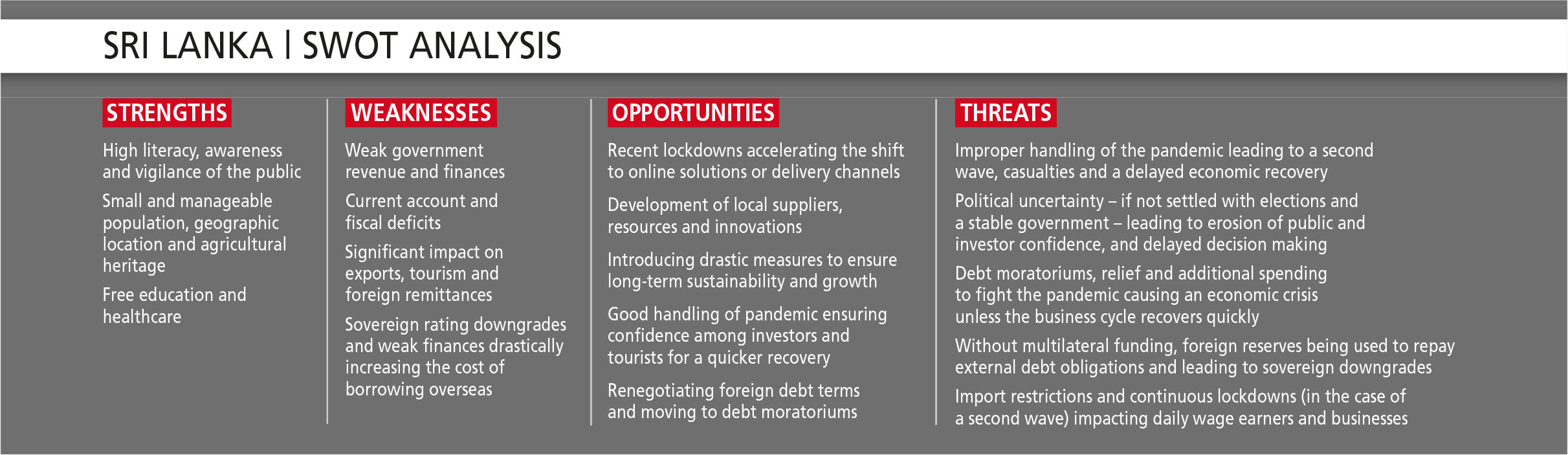

As the world fights COVID-19, the impact is being felt across economic segments with Sri Lanka’s insurance sector also adjusting to the ‘new normal.’ Thushara Ranasinghe states that “perhaps today, in the wake of a global pandemic, we’re more aware of the uncertainties associated with our lives and the urgency that we feel to secure the future of loved ones against any mishap that may befall us in the future.”

“Proactive policies of the Central Bank of Sri Lanka, government and other regulators helped avoid a hard landing for the economy,” he adds.

Ranasinghe quotes Sir Winston Churchill in the aftermath of World War II on the need for insurance: “If I had my way, I would write the word ‘insurance’ over the door of every cottage and upon the blotting book of every public man because I am convinced that for sacrifices which are inconceivably small, families can be secured against catastrophes which otherwise would smash them up forever.”

Further quoting Churchill, he notes that “it is our duty to arrest the ghastly waste, not merely of human happiness, both of national health and strength – this follows when, through the death of the breadwinner, that frail boat in which the fortunes of the family are embarked flounders, and the women and children are left to struggle helplessly on the dark waters of a friendless world.”

PANDEMIC SURVIVAL Although severely affected by the curfew in its initial stages, insurance was declared an essential service by the government.

Commenting on how his company responded to the new normal, Ranasinghe explains that it conformed to health guidelines with employees encouraged to use their own mode of transport to provide an uninterrupted service to customers.

Furthermore, working from home (WFH) facilities were enabled for employees who handled critical operations to ensure the smooth functioning of operations. A daily meeting was held digitally to iron out operational issues that cropped up, as well as to work on the way forward.

Moreover, the regulator directed the insurance sector to grant a three month grace period for policyholders. Ranasinghe adds: “Although we use many distribution channels to sell life insurance, the agency force remains the main distribution channel and premium collection was seriously hampered due to the crisis.”

“We devised customer educational videos on how to make online payments and launched several sales competitions to increase direct payment methods including online payments,” he reveals.

In the process, he says, they discovered interesting aspects to WFH including considerable cost cutting in routine functions, an increased focus and engagement of employees, and time savings since meetings were held on digital platforms.

“Some of these measures will be incorporated into daily operations to be practised in the long term,” Ranasinghe discloses.

Referring to the structure of the insurance sector today, he reflects on the legislation changes of 2015: “Composite insurance companies were required to segregate as separate life and general insurance companies. Today, only two composite companies remain, which are state owned or affiliated to government. This does not augur well for the sector as it doesn’t provide a level playing field.”

LIFE INSURANCE The segregation enabled companies to have greater focus and this is reflected in long-term insurance sector growth rates, which increased considerably after 2015.

“In recent years, the sector growth rate has stabilised to around 10 percent due to increased competition particularly in the health insurance segment,” Ranasinghe maintains.

Sharing his views on the potential for life insurance, he says: “There is a huge gap between the required and actual levels of life insurance in Sri Lanka. This is called the protection gap. One main contributing factor is the lack of knowledge about life insurance concepts among the general public. This resulted in life insurance being put on the back burner when faced with competing priorities.”

According to Ranasinghe however, “with COVID-19, this may change as people are more concerned about their health; there’s a need among middle-class families to secure the future of their families in the case of an adverse event. It is up to the life insurance sector to capitalise on the need created for life and health insurance solutions, and try to cover the protection gap in a systematic manner.”

As for key strategies to drive the life insurance sector, he believes that apart from conventional distribution channels such as insurance agents, alternative methods are being opened for life insurance such as bancassurance, online policies, group insurance and mobile platforms.

“In Sri Lanka, although many people research online for life insurance solutions, they continue to prefer to buy offline. It is my view that so far, a breakthrough digital product has not been launched to cater to the needs of the middle and upper income tiers in Sri Lanka,” Ranasinghe asserts.

HEALTH INSURANCE People would pay much more for vehicle insurance than to ensure the future protection of their family, Ranasinghe acknowledges. This calls for a change in public perceptions about life insurance and reasonableness of its pricing.

“On the other hand, in the wake of the COVID-19 pandemic, people are much more tolerant of and open to buying online, and through other digital platforms, which could lead to lower rates for life insurance solutions sold online due to less acquisition and distribution costs involved,” he points out.

Health insurance is a growing segment in life insurance. Ranasinghe observes: “There was an increased focus on health insurance as an avenue for growth even before the pandemic.”

He elaborates: “For middle-class families, if a need arises for urgent cardiac surgery and they opt for a private healthcare provider, their life savings will be wiped out. Therefore, there’s increased interest among the upper income tiers and middle-class families for health cover.”

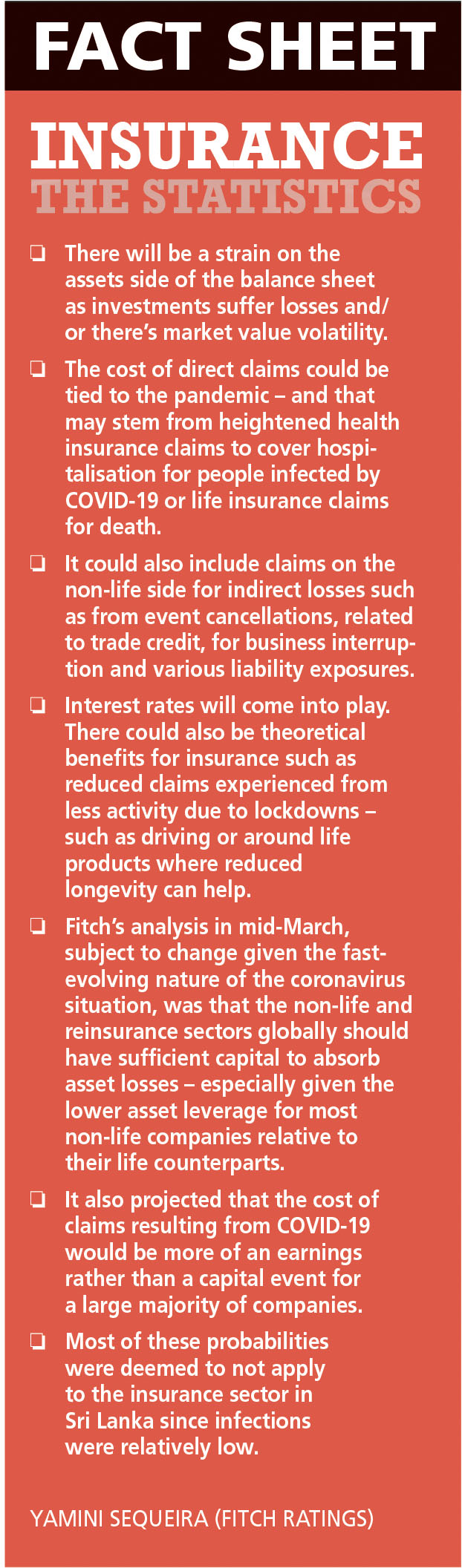

COVID-19 IMPACT Talking about the impact on insurance companies, he believes that companies with balanced growth and optimal capital adequacy ratios have emerged unscathed even under stressful conditions.

The pandemic has opened opportunities for the life insurance sector in the spheres of health related life insurance solutions, selling life insurance solutions through digital platforms and prompting customers to convert to direct payment methods including making online payments.