INFLATION OUTLOOK

ON PRICE TRENDS

Shiran Fernando highlights the key concerns for policy makers in regard to the inflation outlook

While most macroeconomic indicators such as gross official reserves are heading in the right direction, inflation doesn’t seem to be moving in the same fashion. This appears to be the case when one observes the movement of headline inflation in both the national and Colombo based indices. However, the core inflation trend does not paint as worrying a picture.

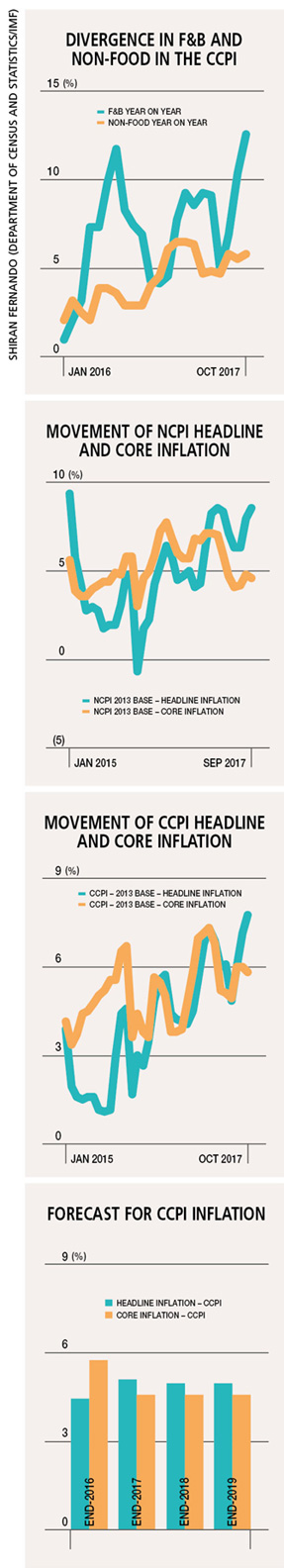

The Colombo Consumers Price Index (CCPI) has remained above five percent for most of the period from January to October. In recent months, specifically from August to October, inflation has edged up consistently, closing towards eight percent by October. A similar trend comes to light when analysing the National Consumer Price Index (NCPI) as well.

MAJOR DRIVERS One of the key drivers of this upward trend this year has been the rise in the food and non-alcoholic beverage (F&B) category. By October, this sub-index was up 12.6 percent on a yearly basis.

This is the highest level of the F&B category since January 2015. And the rise has been due to the impact of the drought on supply conditions – in particular, for items such as rice and vegetables.

NON-FOOD GROWTH Although rising in recent months, non-food items captured in the inflation basket have moderated compared to growth in most months during the first half of 2017.

Changes in taxes in the second half of 2016 and certain price administrated amendments have contributed largely to the rise in the non-food category. While non-food inflation remains at single digit levels, it has veered from the highs witnessed in the first half of 2017.

CORE INFLATION However, when considering movements in core inflation, one may feel less concerned about inflation.

Core inflation does not capture volatile items in the basket such as F&B, energy and transport. This is important given that the trend in overall inflation (as generally reported in media headlines) has largely been impacted by supply conditions and price or tax changes.

The overall concern for monetary policy that the rise in inflation is demand driven is less intense when analysing the trend in core inflation. By October, core inflation of the CCPI was 5.8 percent, which is lower than the seven percent registered in January.

This declining trend is corroborated by the national index: NCPI core inflation in September was 4.6 percent, down from 7.1 percent in January.

IMF CONCERNS While Sri Lanka reached a staff-level agreement on the third review of the Extended Fund Facility programme, the IMF staff once again reiterated concerns over inflation.

The IMF statement mentioned that the Central Bank of Sri Lanka (CBSL) should be responsive to potential upward pressures from both inflation and credit growth. In its second review staff report, the IMF forecast headline inflation of the CCPI to be 5.1 percent by December.

Given the trend in recent months and seasonal demand impact towards the end of the year, it remains to be seen if inflation will moderate in line with this forecast.

KEY BENCHMARK CBSL is in the process of developing a road map for flexible inflation targeting. A flexible exchange rate regime has also been identified as a new structural benchmark under the programme.

According to the IMF, this is to establish price stability as a primary objective in monetary policy while guiding the public on forward inflation targets.

This process has been discussed for a few years and will be a good move if the transition towards such a regime takes place systematically. The Vision 2025 document as well as the economic policy statement delivered by the prime minister in late October highlighted the shift to a flexible inflation targeting regime as well.

POLICY IMPACTS Currently, the economic environment is one of low growth, higher levels of headline inflation (primarily supply driven) and a relatively high level of credit growth. Such a mix presents a monetary policy dilemma – in particular with the IMF recommending that CBSL remain cautious over pressures stemming from credit and inflation growth.

CBSL has kept a close watch on inflation after the hike in its monetary policy review in March. While keeping one eye on inflation and credit growth, the central bank will also not want to tighten interest rates in an environment where there’s pressure on growth as well.

It will have to weigh the fiscal impacts of Budget 2018 to identify whether there will be any knock on effects on inflation. While domestic pressures like adverse weather conditions have taken centre stage, policy makers will also need to factor in potential external risks such as a steady rise in commodity prices.