BUSINESS SENTIMENT

INDEX STUMBLES ON BUDGET FEARS

Panic ahead of the 2019 budget leads to a retreat in business confidence in March

A recent communiqué by Fitch Ratings asserts that Sri Lanka is taking steps to reduce fiscal and economic risks while also restoring policy certainty following the disruption caused by political upheaval late last year.

However, it cautions that “there remain risks to the government’s fiscal projections, which would rise if the approach of presidential election due by end-2019 triggers renewed political tensions.”

The rating agency highlights Sri Lanka’s agreement with IMF staff’s fifth review and extension of its programme together with the recent budget targeting medium-term fiscal consolidation.

It states that “the agreement with IMF staff to extend a three year Extended Fund Facility that began in 2016, if eventually approved by the Executive Board, would give the Sri Lankan authorities more time to complete the agreed economic reform agenda.”

As for the measures announced in Budget 2019, Fitch states: “Hitting these targets will be challenging as it will require sharper deficit reduction over the next two years than we had expected and would be more aggressive compared with the government’s 2018 budget.”

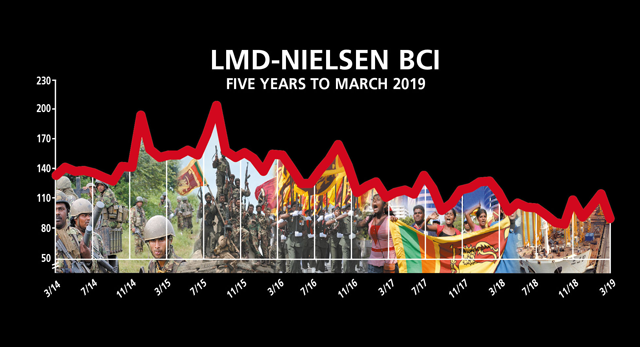

Meanwhile, the outcome of the latest LMD-Nielsen Business Confidence Index (BCI) survey, which was conducted before Budget 2019 was presented in parliament, reflects muted sentiment among corporates.

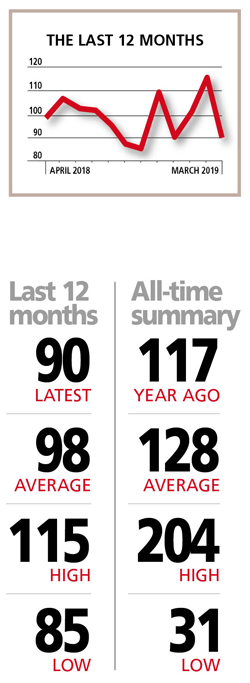

THE INDEX Despite recording two months of impressive gains, the BCI declined by as much as 25 basis points – the highest fall since December 2016 – to register 90 in March compared to 115 in the previous month. The index has also fallen below its 12 month average of 98 and is a massive 27 points short of where it stood a year ago.

Commenting on the latest survey results, Nielsen’s Managing Director Sharang Pant says that anxiety seemed to be setting in ahead of Budget 2019; the country was waiting on what the budget would have in store – “a good economic budget or an expected political budget.”

“Unlike in previous years when sentiment usually improved before the budget presentation, the BCI for March dropped,” he notes.

SENSITIVITIES Respondents cite high taxes as a major issue impacting their business performance as well as consumer demand. Meanwhile, the other key corporate concerns include inflation and political interference.

To this end, a member of the business community notes that “production costs, taxes, and the cost of goods and services are high – and people’s income levels aren’t increasing in line with this.”

PROJECTIONS Whereas the previous month’s BCI may have pointed to a renewed sense of optimism about both business prospects and the national economy, the latest survey affirms that corporate sentiment is as volatile as ever here in Sri Lanka.

Granted, the prospect of the budget was a likely cause of apprehension among respondents who may now have time to digest the government’s fiscal policy proposals. At the same time, pertinent questions have been raised about the feasibility of achieving the targets set out in Budget 2019.

With the budget done and dusted so to speak, one may expect sentiment to nudge upwards in the months ahead until of course, politics takes sway with a presidential poll due before the year ends.