BUSINESS SENTIMENT

INDEX GAINS PROVE SHORT-LIVED

Biz confidence fails to maintain momentum amid persisting worries following 4/21

The Central Bank of Sri Lanka (CBSL) recently announced that the country’s gross official reserves reached US$ 8.9 billion at the end of June. This followed the receipt of two billion dollars through the issuance of International Sovereign Bonds (ISBs), which provided import cover of a little over five months, according to the monetary authority.

The Central Bank of Sri Lanka (CBSL) recently announced that the country’s gross official reserves reached US$ 8.9 billion at the end of June. This followed the receipt of two billion dollars through the issuance of International Sovereign Bonds (ISBs), which provided import cover of a little over five months, according to the monetary authority.

Moreover, it’s been noted that the issuance of the ISBs in June is a reflection of investors’ sustained confidence in Sri Lanka’s growth prospects over the medium term.

In the meantime, the welcome contraction of the trade deficit and proceeds from the ISBs, as well as the continuance of the IMF’s Extended Fund Facility (EFF) programme, are thought to have relieved some pressure on the Sri Lankan Rupee.

With respect to other current account inflows, earnings from tourism did suffer a setback in the aftermath of the Easter Sunday terror attacks while workers’ remittance inflows have been moderate.

Furthermore, CBSL observed that a substantial downward adjustment in market lending rates can be expected in the short term whereas a pickup in private sector credit may materialise towards the end of the year.

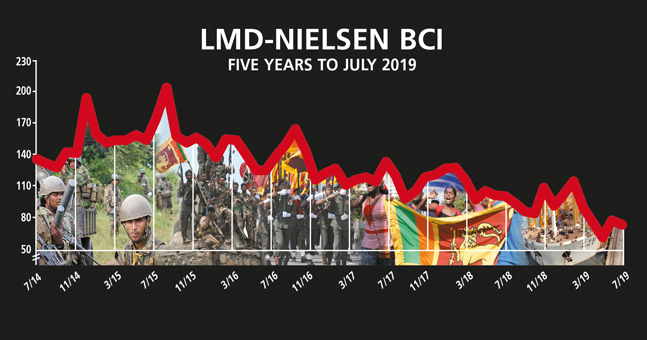

Meanwhile, the results of the latest LMD-Nielsen Business Confidence Index (BCI) survey – which was carried out in the first week of July – reflect a retreat in the wake of ever-present concerns relating to the state of the nation as well as the broader economy.

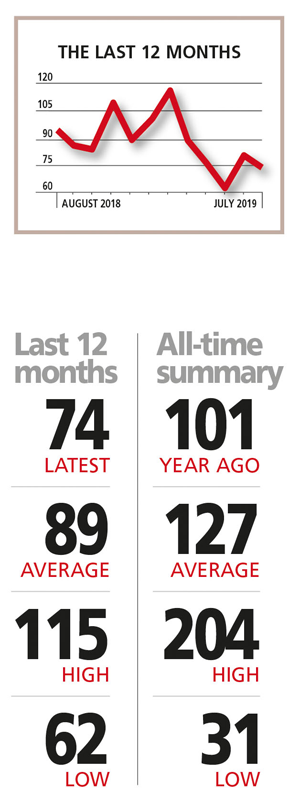

THE INDEX The BCI, which scaled back up to 81 basis points in June, dropped to 74 in July; and it remains below its 12 month (89) as well as all-time (127) averages.

According to Nielsen’s Managing Director Sharang Pant, “the repercussions of the Easter Sunday bombings continue to be on people’s minds and the country has already begun preparing for the presidential election due at the end of the year.”

“The uncertainty around the result of the [forthcoming] election is reflected in business sentiment,” he adds.

SENSITIVITIES Political uncertainty emerges as the chief national issue while the economy comes second. Corporates also seem to fear that ‘ethnic clashes’ could flare up at any point. And at the same time, taxes are identified as the foremost concern for business.

PROJECTIONS Last month’s uptick in biz sentiment was a welcome sign but we did voice concern about what the future may hold – and we surmised that it would be an overreaction to expect the survey results in June to herald sustained gains in the index in the coming months.

And indeed, the turnaround has been short-lived with ongoing legal disputes and a state of disarray dominating the landscape of what feels like a heightened state of emergency. This could mean that barring the introduction of genuine confidence building measures by the powers that be, an improvement in sentiment falls within the realms of a utopian fantasy!

The hope however, is that sanity will prevail in what multiple travel guides continue to cite as a must-visit destination this year – thankfully, that hasn’t changed.