MONETARY POLICY

GLOOMY OUTLOOK PERSISTS

Shiran Fernando tracks movements in debt yields and their implications for the future

Global debt yields fell to record lows in August amid less than favourable news on the international front. In addition, a marked shift was observed with global investors moving to higher quality financial instruments.

According to Bank of America Merrill Lynch, US$ 155 billion flowed into such high quality bond funds in the period from June to August. This is attributed to expectations of an economic slowdown and lower than anticipated inflation. Furthermore, the US Federal Reserve (the Fed) cut interest rates in July for the first time in almost 11 years, raising concern over economic growth in the US.

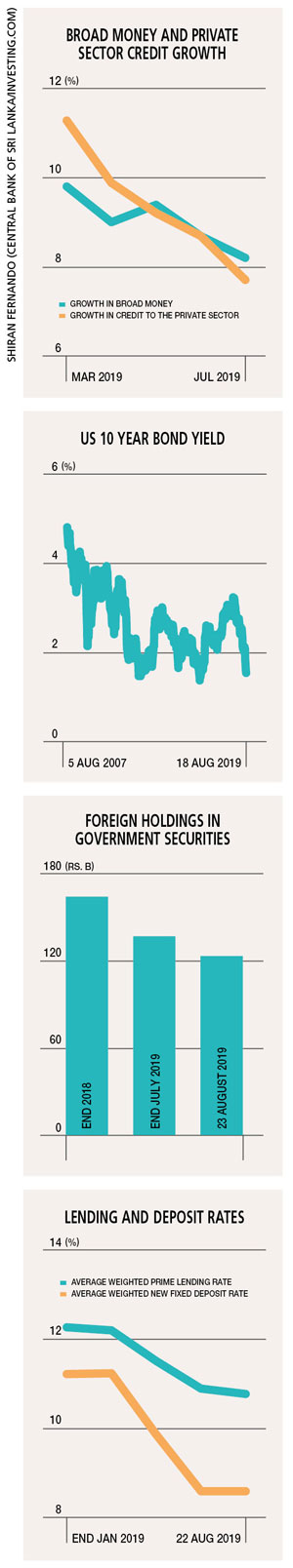

YIELD CURVE INVERSION August witnessed another notable occurrence that may signal a recession with US Treasury bond yields inverting for the first time since 2007 amid the two-year bond yield rising above its 10 year equivalent.

In the past, an inversion of long and short-term bond yields has indicated the prospect of a recession in the US. Uncertainty in the overall economy may result in investors channelling funds into more short-term bonds compared to long-term instruments.

ONGOING TRADE WAR Even as commentators believe that progress has been made in terms of negotiations between the US and China with regard to trade imbalances, there’s a new twist in the tale standing in the way of its resolution.

As a result, volatility has returned to global financial markets. This is reflected in the currency market with the Chinese Yuan weakening in August to its lowest level in more than 11 years. Moreover, it comes on the back of President Donald Trump labelling China as a “currency manipulator.”

GLOOMY OUTLOOK The global environment is somewhat unsteady; this mirrors the policy uncertainty in Sri Lanka over recent years. The expected uplift in global growth hasn’t occurred and the challenge of mitigating downside risks has come into play.

As the President and Chief Executive Officer of the Federal Reserve Bank of St. Louis James Bullard states in the UK Financial Times, “something is going on and that’s causing, I think, a total rethink of central banking and all our cherished notions about what we think we’re doing … We just have to stop thinking that next year, things are going to be normal.”

He highlights the thinking that monetary policy tools used before the financial crisis may not be as reliable. Additionally the United States cannot be viewed as a stable player when it comes to economic or trade policy. And this uncertainty will continue until the November 2020 presidential election in the US.

GROWTH FORECASTS Other emerging and developing economies have also trimmed their growth forecasts due to the knock on effects of recent global developments – in particular, the impact of the Sino-US trade war.

This has also resulted in countries such as India and Indonesia resorting to interest rate cuts with a view to stimulating growth. They are guided by the notion that the Fed will reduce interest rates once more this year, thereby providing the policy space to manipulate domestic rates.

INTEREST RATES Although the reasons for weak demand differ from other economies, the Central Bank of Sri Lanka (CBSL) has cut policy rates twice this year with a 0.5 percent reduction of key deposit and lending rates in May and August.

In August, CBSL noted the need to trim rates further, citing the need to revive the economy amidst below par growth expected this year.

The Central Bank went a step farther in stating that it will look to implement a cap on lending rates if they do not decline in line with lower interest rates on deposits. In such a situation, Sri Lanka risks experiencing outflows from its government securities – as witnessed in the week ended 23 August when an outflow of Rs. 12 billion was recorded amid the rupee’s depreciation against the dollar.

GLOBAL IMPACT If the international outlook worsens and forecasts of a recession globally or stateside materialise, it could adversely impact the likes of Sri Lanka whose export dependence on the US and EU may imply hard times for the country’s exports should demand from these markets contract.

Furthermore, Sri Lanka may not be able to enter international capital markets at favourable rates to refinance its debt if sentiment among investors is risk averse and there’s a shift towards ‘safe haven assets’ such as gold.

TREND REVERSAL The global outlook has the potential to reverse its course provided there’s a quick resolution of the trade, tech and investment disputes between America and China.

In addition, if other trade and investment related concerns such as Brexit are resolved, it would provide greater clarity and guidance for investors to perceive growth in a more positive light.