APPAREL INDUSTRY

GARMENT GLORY

Compiled by Yamini Sequeira

A RETURN TO THE PINNACLE

Ramya Weerakoon eyes opportunities for apparel to reassert its dominance

Sri Lanka’s apparel industry has been a mainstay of the economy for many years, standing strong amidst various economic and political challenges faced by the country over the last four decades or so.

It was one of the first industries to grasp the opportunities presented by Sri Lanka’s open economic policy in the 1970s. And the late President Ranasinghe Premadasa is largely credited with the rise of the apparel industry, for he launched the 200 garment factories programme to provide employment to youth and decentralise the industry.

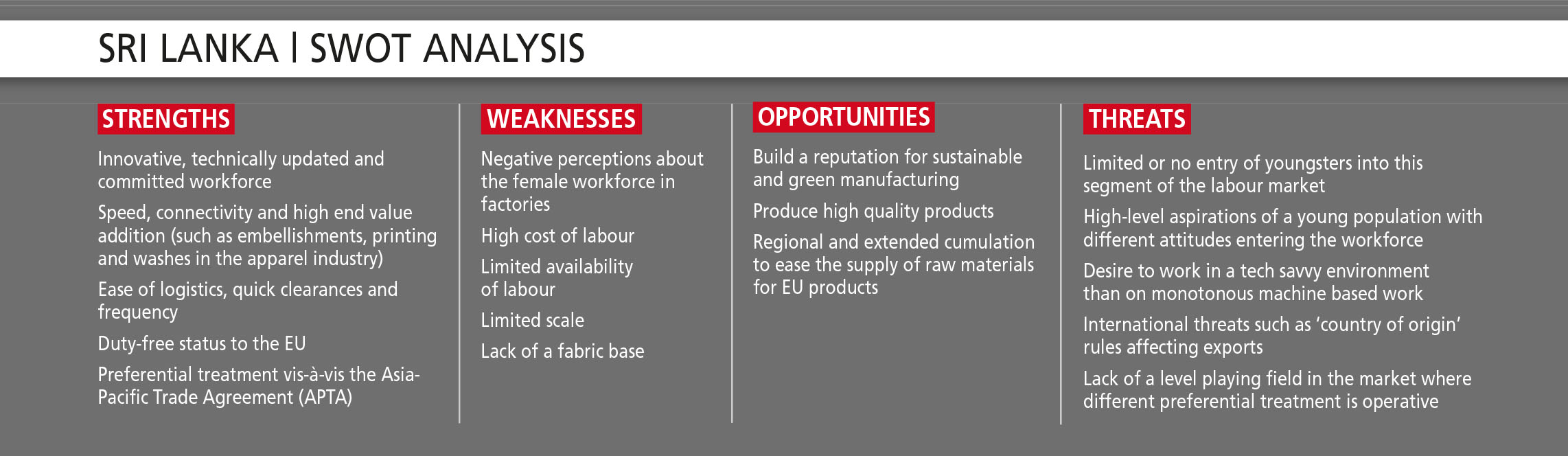

AGAINST ALL ODDS Ramya Weerakoon contends that “unfortunately, the 200 factory programme did not fully achieve its objective. This is because some unscrupulous companies took advantage of loopholes in the law to participate in this programme only to avail themselves of quotas and duty-free benefits.”

“Many simply took advantage of perks and incentives that came with the programme. Today, those companies aren’t functional,” she adds.

Although the phasing out of the quota in 2005 was expected to be catastrophic, Weerakoon believes that it offered the right checks and balances for the industry to recalibrate itself.

“I believe that the phasing out of the quota system was beneficial as it sifted the chaff from the grain and left behind only those manufacturers who were committed to enhancing Sri Lanka’s status as a superior garment manufacturing destination,” she opines.

Once the quotas were phased out, local apparel manufacturers had to leverage on their relationships with buyers, and obtain orders on the basis of capability – and not because they had access to quotas.

Weerakoon notes that “before the phasing out, capable manufacturers without quotas suffered; but now they could compete on a more even playing field. Although some garment manufacturers did close down, their factories were taken over by larger players and many workers were absorbed by them. This lessened the impact.”

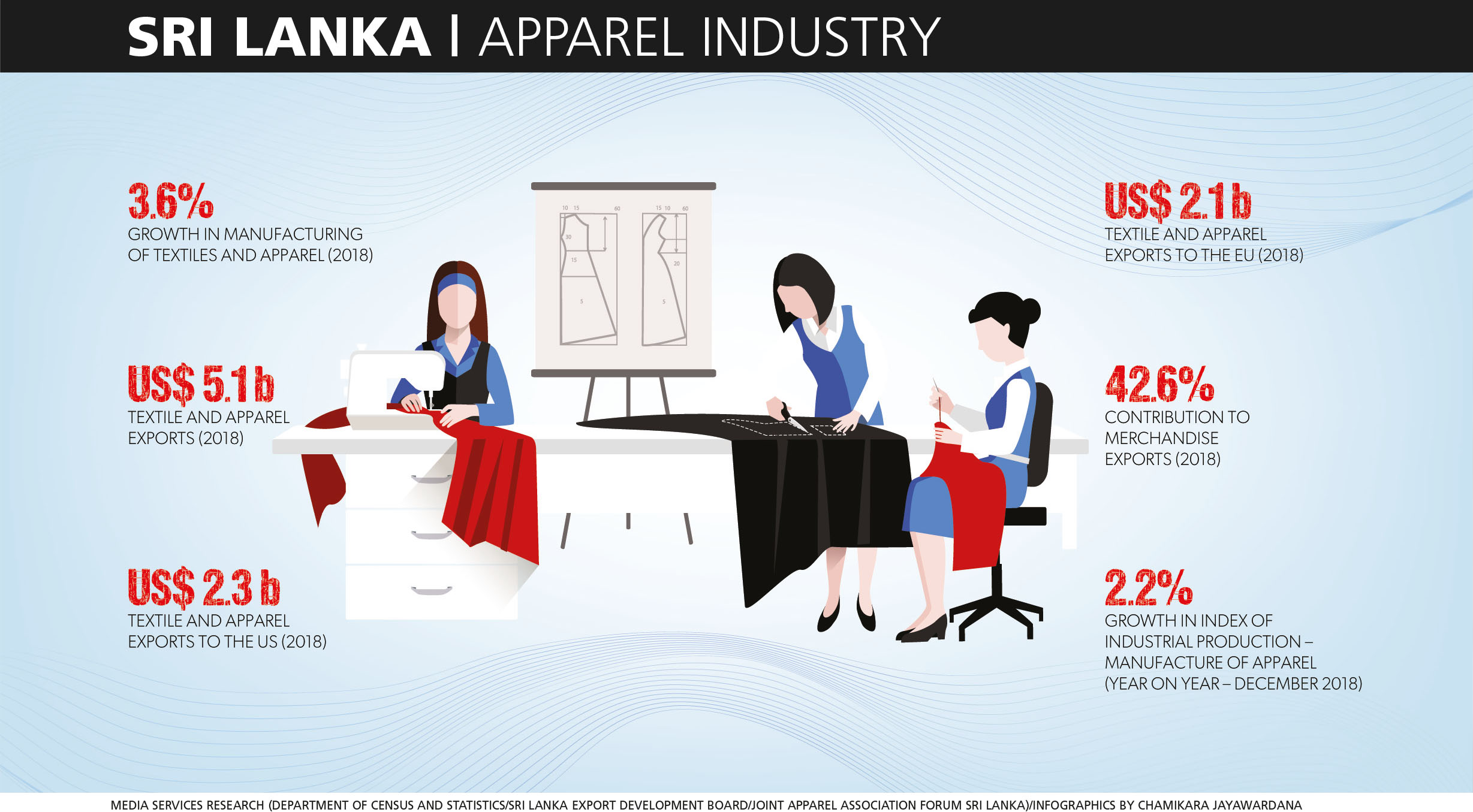

RESURGENT INDUSTRY Today, Sri Lanka’s textile and apparel industry employs nearly 350,000 workers directly and twice as many indirectly. Employment is made up primarily of females who are estimated to represent approximately 15 percent of the nation’s eligible workforce.

The contribution of the industry to GDP stands at around six percent. Surpassing the US$ 5 billion mark for the first time, export earnings from textiles and garments – which account for about 44 percent of total exports – contributed to an increase in industrial exports. The industry has enjoyed high growth levels over the past four decades and accounts for 52 percent of industrial product exports.

Despite the decline in the first half of 2017, earnings from textile and garment exports on a cumulative basis increased by three percent to reach 5,176 million dollars in that year. Of this, the EU’s share was US$ 2,024 million – this, amid improved demand from the EU market following the restoration of the Generalised Scheme of Preferences Plus (GSP+) facility in May 2017.

Sri Lanka benefitted from the GSP+ facility in 2017, gaining from schemes offered by several developed markets including the EU, the US, Australia, Canada, Japan, Russia and Turkey. However, the apparel industry receives preferential treatment only in the EU. In 2017, exports under the EU and US GSP schemes contributed substantially to exports under preferential agreements.

Earnings from garment exports to the US increased by 1.7 percent. Meanwhile, garment export income from nontraditional markets including Australia, India, Canada, Hong Kong and Mexico rose by 3.9 percent in 2017.

ADDING VALUE Sri Lanka’s apparel industry embraced the green concept early in the piece and it showcases the best of technology – including the world’s first eco-friendly ‘green garment factory’ that cut energy usage in half and water consumption by 70 percent. These factories have achieved business sustainability through the practice of lean manufacturing with lower overheads and a quicker return on investment.

Sri Lanka also abides by the regulations of the WTO. A socially responsible and preferred destination for apparel sourcing, it is the only outsourced apparel manufacturing country in Asia to ratify all 27 ILO conventions.

The island’s apparel industry is free of discrimination, sweatshops and child labour – and the guiding force behind this commitment to ethical business and manufacturing is the homegrown ‘Garments without Guilt’ code, which exceeds leading industry compliances.

Weerakoon believes that the apparel industry is more tech savvy today, and equipped with high technology and enhanced technical skills to manufacture high end products. “We are competing in the global market and need to keep reinventing ourselves to remain relevant,” she asserts.

Sri Lanka cannot compete in a high volume, low price segment; but it can specialise in high end manufacturing. Weerakoon emphasises that “countries such as Vietnam and Bangladesh can manufacture high volumes at low prices because their cost of production is much lower than Sri Lanka’s.”

She elaborates: “These governments offer incentives to their apparel industries. Despite that, Sri Lanka’s apparel industry was the number one foreign exchange earner last year and this clearly indicates that we’re on the right track.”

The high cost of production is a reality because of higher wages and ever-increasing utility charges.

Since Sri Lanka doesn’t have a large textile industry, fabric has to be imported and this adds to production costs.

THE OUTLOOK Weerakoon is relieved about official assurances that whether there’s Brexit or not, GSP+ export orders to the UK will not be affected.

“The apparel industry was apprehensive about the fallout from Brexit but officials have assured us that there will be no change to the GSP concessions as far as the UK is concerned. Ultimately, the sustainability of our businesses will depend on the quality of our relationships with buyers, technology adoption and how we move up the value chain to provide end-to-end services,” she points out.

With time, some of the larger apparel companies will rely more on automation and lean manufacturing processes to reduce human labour. And technology such as 3D printing, nanotechnology, robotics and AI will bring about change, as will e-commerce and compliance with green standards.

The outlook remains bright for the apparel industry as it forges ahead to achieve its target of US$ 8 billion by 2025.

Meanwhile, Weerakoon says that “women can write their own success story in any business they choose but perhaps we need to see more female representation on corporate boards.”