FISCAL OUTLOOK

SHIFT IN MONETARY POLICY

Shiran Fernando gauges policy responses to growth and the external trade outlook

The Central Bank of Sri Lanka (CBSL) cut key policy rates for deposits and lending by 0.5 percent at the end of May. Two reasons could be cited for the easing of monetary policy – viz. overall growth concerns in relation to the national economy and a global trend of easing interest rates.

This warrants further exploration of the rationale behind the shift in monetary policy and how things may play out in the remainder of this year.

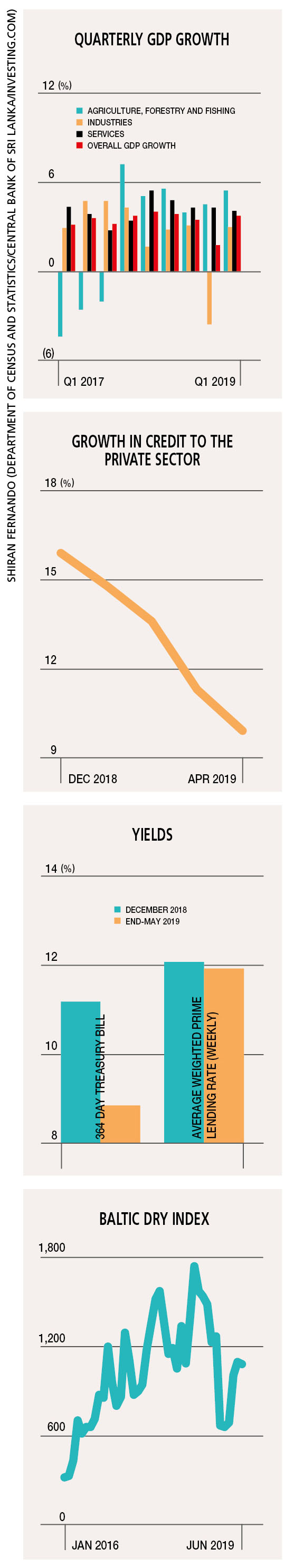

QUARTERLY GROWTH Sri Lanka’s GDP grew by 3.7 percent year on year in the first quarter of 2019. While this represents the highest quarterly growth on record since the second quarter of last year, it remains below the four percent growth registered in the first quarter of 2018.

Continued growth in agriculture and a recovery in the industry sector (following a contraction in the fourth quarter of 2018) supported GDP growth in the first quarter of this calendar year. Below par economic growth has been of concern to CBSL over the last 12 months. Moreover, the expectation for the second quarter (i.e. from April to June) of 2019 is of a slowdown in GDP, which is due to the impact of the 21 April terrorist attacks on economic and business activity.

This in turn could drag overall growth down in 2019 compared to what was predicted by many forecasters including the Central Bank. A statement issued by CBSL in reviewing its monetary policy notes that “although normalcy is gradually returning to economic activity, a lower than initially projected growth could be anticipated during 2019.”

This growth projection is further compounded by the prospect of elections later in the year.

GLOBAL PICTURE The global economic landscape has changed over the last 12 to 15 months. This is due to a variety of reasons such as international trade tensions, weaker than expected demand and a slowdown in world economic growth.

The Purchasing Managers’ Indexes (PMIs) indicate trends in manufacturing and services. A global composite index of PMIs compiled by J. P. Morgan hit a three year low in May. Further, the New Orders PMI dropped to below 50 (a level above 50 denotes an expansion) for the first time since 2012.

Similar trends are being observed in trade indicators. For instance, the Baltic Dry Index (BDI) – a leading shipping benchmark – fell to a three year low in February.

POLICY RESPONSE All of this has led to a shift on the part of central banks across the world that anticipated the Fed to continue raising policy rates. The European Central Bank and Bank of Japan have also signalled that they may opt for easing measures when it comes to rates.

Furthermore, the central banks of India and Russia are cutting interest rates too. Other emerging markets are expected to follow suit in order to realign themselves with the shift in global monetary policy, which the CBSL also appears to have taken cognisance of.

LENDING RATES While yields on government securities such as Treasury bonds came off lower prior to the rate cut at the end of May, other borrowing rates haven’t fallen at the same pace.

As such, the Central Bank imposed maximum interest rates on deposit products in April with the apparent intention of reducing lending rates and thereby increasing the flow of credit to the economy. It is believed that the CBSL expects a ‘swift and sizeable’ downward trend in lending rates with the latest policy move.

Private sector credit, which was growing at 15.9 percent year on year at the end of 2018, witnessed an increase of only 9.9 percent in April this year.

RUPEE PRESSURE The Central Bank would have been encouraged by the relatively strong performance of the Sri Lankan Rupee compared to the US Dollar. Having depreciated by close to 20 percent against the dollar in 2018, the rupee had strengthened by over three percent in the year to date in mid-July.

The global environment, coupled with an easing of Sri Lanka’s import expenditure (including a 17.4% year on year decline in imports in the first four months of 2019), has supported this movement in the rupee.

FUTURE DEVELOPMENTS There is a low probability of a rate cut in the second half of 2019. In the lead up to elections, fiscal easing measures could be implemented, which would support growth further and overstimulate the economy should interest rates be reduced as well.

The Central Bank would have to monitor GDP growth, any reduction in lending rates and more importantly, the global monetary policy environment prior to taking a decision vis-à-vis its policy rates.