ECONOMIC REFORM

BUILDING BROKEN BRIDGES

Shiran Fernando discusses how Sri Lanka’s economic reforms can be streamlined

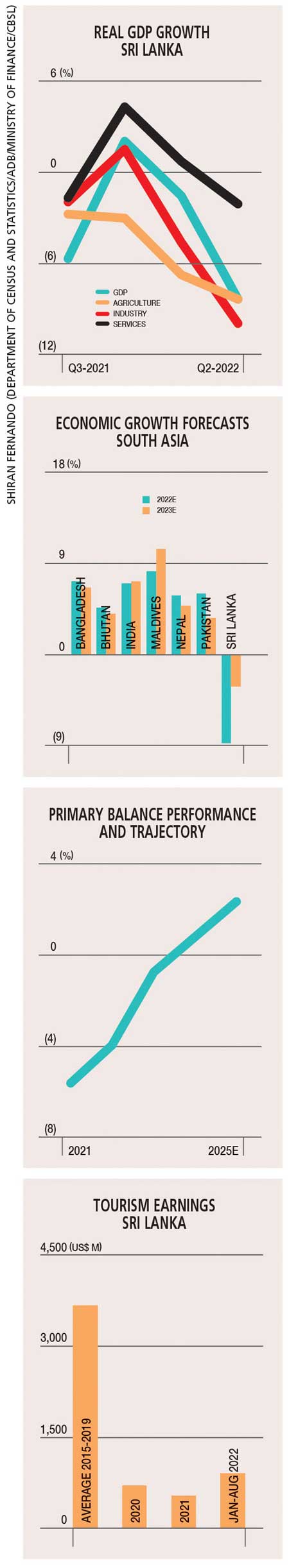

The economic contraction continued from the first quarter of this year into the second (April-June). This was the period when Sri Lanka was going through political, social and economic crises.

As a result of this – and in particular, the disruption caused by energy-related issues and supply chain shortages – the economy contracted by 8.4 percent compared to the same quarter in 2021. It is likely that the economy will continue to contract in the third quarter with a brief recovery in the last three months of the year.

The implications of a slowdown in economic growth and developments related to debt restructuring are widespread.

THE FORECAST A consensus by forecasters for 2022 seems to suggest that the economy will contract by about eight percent.

This is quite significant as it will mean that the economy, which was worth US$ 88.9 billion at the end of last year (based on the revised GDP base), could fall to between 75 and 80 billion dollars.

The economic slowdown and rupee depreciation in 2022 will drive this fall. A concerning factor is that most agencies such as the Asian Development Bank (ADB) believe the economy will contract 3.3 percent in 2023 as well.

From a regional perspective, Sri Lanka stands out in terms of the slowdown. Based on the ADB’s perspective, Sri Lanka will be the only country to contract in both 2022 and 2023. The island nation also has the highest rate of inflation in the region.

And from a sector point of view, the industry sector saw the highest contraction (10%) in the second quarter due to a slowdown in activity as a result of fuel and raw material shortages, and electricity outages.

Businesses couldn’t operate at optimal levels even though industries that are export oriented continued to do well with a growth of 14 percent in the first half of 2022. This has largely been driven by apparel exports, and was reflected in a GDP growth of 28 percent in the manufacture of textiles, wearing apparel and leather-related products.

These and other export sectors may come under pressure with demand slowing due to the deceleration of economic growth in key markets.

The agriculture and services sector fell by 8.4 percent and 2.2 percent respectively in the second quarter.

On a quarter on quarter basis, the situation with regard to agriculture is concerning. It’s expected that with the importation of agricultural inputs ahead of the Maha season however, the food supply will improve and be better than it was in the past six to 12 months. This will also ease inflation concerns.

Services that contracted in the second quarter were expected to do better in the second half of 2022 with higher tourist arrivals in particular in the last quarter of this year.

REFORM PERIOD Sri Lanka and the IMF agreed on a staff level agreement in August, which is the first step to securing a reform programme worth US$ 2.9 billion over a four year period.

A cornerstone of this programme will be to improve Sri Lanka’s fiscal trajectory and move the primary surplus (i.e. its budget deficit minus interest expenditure) from a negative 4.4 percent in 2022 to a surplus of 2.3 percent by 2025.

This turnaround will require a sharp increase in revenue – in terms of either tax revenues, or proceeds from sale or lease of state owned enterprises (SOEs) and assets – or a reduction in government expenditure.

The government is likely to announce a beefed up tax regime with increases in rates both at personal and corporate tax levels. This could impact growth from a consumer perspective since disposable incomes will be reduced and corporates may see a slowdown in activity in particular investments.

It will be important for the country to reset its fiscal targets and implement reforms that will drive growth.

EXPORT GROWTH The low level of reserves, dependence on imports and weak industrial base have often led to the belief that Sri Lanka should focus on export led investment growth.

While many governments have paid lip service to this, both macro and micro reforms that are needed to enable the private sector to do so have been limited.

Sri Lanka should develop a tariff structure that will promote exports and encourage investors to think of the country as a base in relation to competitor nations. The country must also ensure policy consistency so that regulations don’t change from one administration to another.

As such, policy makers need to consider the ‘IMF plus’ reform programme, which focusses on all the reforms that will be required. The government is focussing on improving the ease of doing business by establishing eight task forces to look into various aspects of the subject.

It is important that these initiatives identify bottlenecks that can be addressed and unlock growth. Instruments such as the National Export Strategy (NES) will need to be reviewed and updated in keeping with future plans.

Leave a comment