ECONOMIC OUTLOOK

THE PAST SETS THE STAGE

Shiran Fernando points to last year as the national economy forges ahead in 2020

As the end of the first quarter of 2020 approaches, the full year economic data for 2019 is also coming into view. And despite the uncertainty following the Easter Sunday terrorist attacks and presidential election in November, the economy has weathered these storms without being impacted to too great an extent.

This was mirrored by the performance of the Sri Lankan Rupee, which appreciated by one percent against the US Dollar in 2019, having depreciated by around 20 percent in the previous year.

Nevertheless, there is cause for concern when considering some of the data released towards the end of last year.

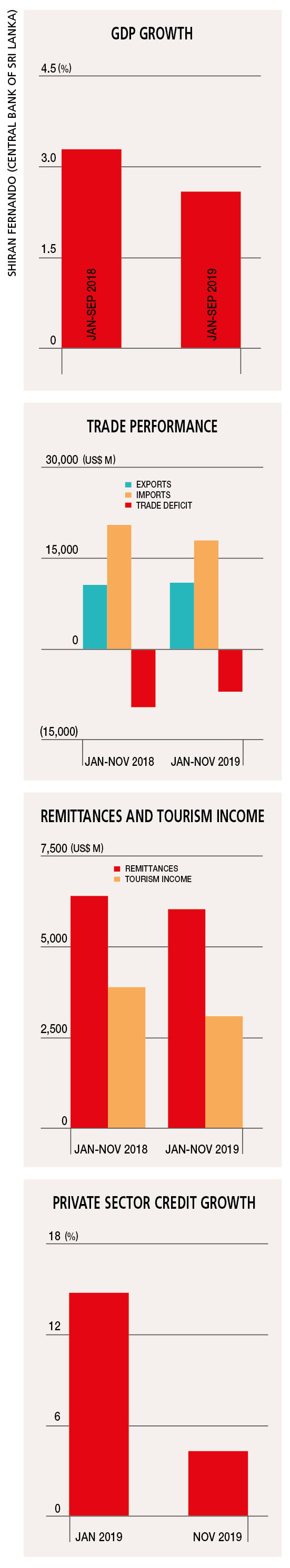

ECONOMIC GROWTH The first nine months of 2019 witnessed GDP growth of 2.6 percent, which is the slowest for a nine month period over the last eight years. Although this was expected given the post-4/21 economic environment, it also highlights the fact that Sri Lanka is unable to recover rapidly in response to such shocks.

The World Bank projects that the economy will grow by only 3.3 percent this year, which would make Sri Lanka the nation with the third slowest growth rate in South Asia. This is not ideal for a country that’s also facing debt refinancing risks.

POLICY REACTION In this context, the government has looked at measures to prop up growth in the short term. It has resorted to tax revisions, debt relief and other schemes, to provide a reprieve for the public and SMEs.

Given that about 70 percent of Sri Lanka’s GDP relates to consumption, such measures may boost growth in the short term. In both 2011/12 and 2015, similar growth conditions were experienced prior to fiscal stimulus being announced.

Apart from providing a fiscal boost, the Central Bank of Sri Lanka (CBSL) has adopted a policy of monetary easing with two rate reductions in 2019 and further rate cuts in January, followed by measures to reduce the prime lending rate. This too is providing a monetary boost for the economy.

The impact of these measures is yet to be seen as growth in credit to the private sector reached a record low of 4.4 percent in November. While credit growth is positive in absolute terms, it’s inadequate to stimulate economic acceleration at present.

Moreover, inflation increased towards the end of last year, mainly due to rising food and beverage prices as a result of unfavourable weather conditions. This will need to be monitored when considering further monetary easing.

EXTERNAL SECTOR There was a narrowing of the trade deficit in 2019 with imports contracting and exports rising in most months. This resulted in the trade deficit declining by 25 percent in the first 11 months of the year.

Exports, which were growing on a year by year basis, declined from July onwards – a cause for concern that led to flat growth in 2019.

With a drive for consumption led growth amid the above-mentioned fiscal and monetary measures, imports could rise this year. Therefore, set against a backdrop of rising imports and declining exports, the trade deficit could come under pressure in 2020.

Workers’ remittances also declined, recording a six percent year on year contraction in the first 11 months of 2019. This is a trend observed over the last five to six years with remittance inflows hovering between US$ 6.5 and US$ 7 billion. So growth in this segment has stagnated and cannot be leveraged on to balance deficits in the external account.

Tourist arrivals recovered in the fourth quarter of last year, and approached a normalised level. Despite the initial shock in the months following the 21 April attacks, the overall drop in arrivals was only 18 percent year on year in 2019, highlighting some degree of resilience in the tourism industry.

At present, there is concern over developments in terms of tensions in the Middle East and the coronavirus outbreak, which will impact global tourism including in Sri Lanka. The tourism industry will need to monitor these risks while from a macro perspective, it would have to sustain the deficits.

MOVING FORWARD Once growth picks up in 2020, it needs to be sustained through structural reforms. This will require reforms in the public sector, state-owned enterprises and digital connectivity or services.

The Sri Lankan Rupee is likely to come under pressure as global and local developments unravel, with debt repayments and the trade deficit also coming into focus.

The second half of the year is likely to see an interim budget as well with the formation of a new government. Meanwhile, a continuation of the IMF programme would send a signal to foreign investors vis-à-vis the country’s reform agenda and assist in raising sovereign bond proceeds.

In summary, 2019 has set the stage for 2020, which may engender a stable macroeconomic environment.