DEBT MANAGEMENT

ENTER DEBT TRAP DIPLOMACY

Samantha Amerasinghe describes the looming debt crisis in emerging markets

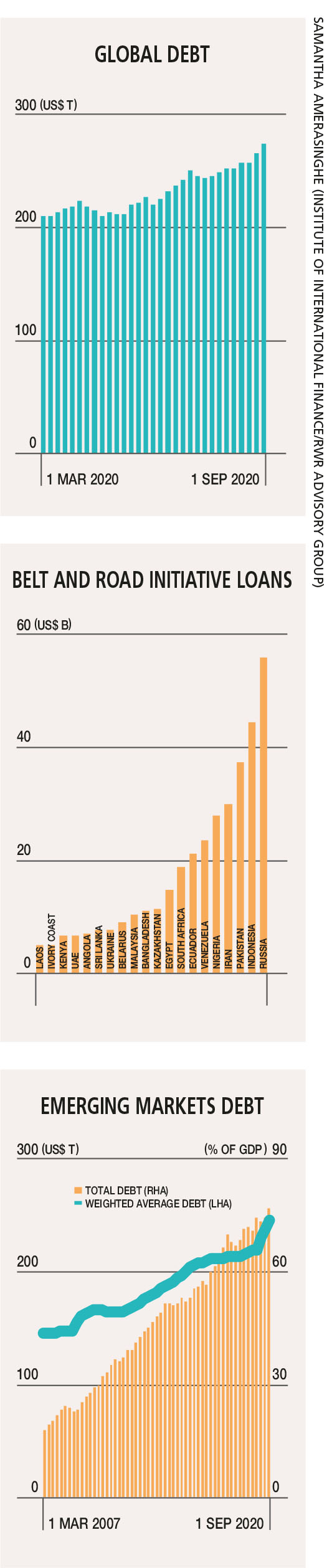

Governments are confronting the double whammy of COVID-19 and a prolonged global recession, with every possible monetary and fiscal tool at their disposal. Nevertheless, as the pandemic continues, it is increasingly likely that policy makers may be forced to come to grips with the looming debt crisis in emerging economies.

As the deepening global economic downturn threatens poorer nations’ ability to service sovereign debt, the imminent emerging market debt crisis could be at the centre of ‘debt trap diplomacy.’

China’s Belt and Road Initiative (BRI) is under increasing scrutiny while the US is under pressure to counter its agenda by pushing harder for debt restructuring by governments, multilateral institutions and private lenders. This could be the next front in the conflict between the world’s two largest economies.

Following the pandemic induced economic downturn, US$ 100 billion in capital fled emerging economies while remittances from wealthy countries fell by another 100 billion dollars last year, according to the IMF. These dynamics have caused interest rates at which poorer countries can borrow to skyrocket and raised concerns over a debt crisis in emerging markets.

The fear is that weaker local currencies, lower government revenues, dwindling foreign reserves and a global recession will make it more difficult for developing countries to meet their foreign debt payments.

An emerging market debt crisis, the likes of which we have not seen since 1982, would be a setback for billions who have benefitted from decades of strong economic growth and rising prosperity. It would raise the prospect that some countries could fall behind on the development ladder, wiping out gains that have helped sustain the world economy since the global financial crisis of 2007/08.

The IMF estimates that total emerging and frontier market debt rose from roughly 75 percent of GDP to more than 100 percent in 2020. Compared to the end of 2019, it projects average debt ratios for this year to increase by 20 percent of GDP in advanced economies, 10 percent in emerging markets and about seven percent in low income countries.

The past decade h as seen the largest, fastest and most broad-based debt increase in emerging markets and developing economies in the last 50 years. Since 2010, their total debt rose by 60 percent of GDP to a historic peak of over 170 percent in 2019 – although China accounted for the bulk, in part due to its sheer size.

as seen the largest, fastest and most broad-based debt increase in emerging markets and developing economies in the last 50 years. Since 2010, their total debt rose by 60 percent of GDP to a historic peak of over 170 percent in 2019 – although China accounted for the bulk, in part due to its sheer size.

Inevitably, as these economies continue to respond to the pandemic, their debt will be pushed to new heights.Preventing an emerging market debt crisis could be the difference between a lost decade and rapid recovery that puts countries on a sustainable growth trajectory.

So what can be and is being done to help nations with debt obligations?

While the IMF’s decision to provide immediate grants to eligible low income countries to service debt commitments has provided some breathing space (more than 100 countries have sought assistance), the list of emerging markets in distress is growing. For some, only exceptionally low global interest rates may delay the reckoning.

Many poorer countries have had no choice but to seek relief through a G20 debt moratorium initiative. The G20 stepped in to freeze loan repayments on bilateral loans with China, which initially signed on to the pledge but later, stated that loans issued by its Export-Import Bank (effectively the lender for the BRI) should be exempt. That said, China’s signing – having previously resisted joining multilateral debt relief efforts – is a step in the right direction.

Meanwhile, the previous US administration put pressure on Chinese institutions to renegotiate developing countries’ underlying debt without a political quid pro quo, alleging that BRI loans are not based on economic considerations alone but for political leverage, calling it debt trap diplomacy.

Nonetheless, others argue that the BRI programme is a benign effort to boost China’s economic growth and most of the deals are mutually beneficial.

Advocates argue that it serves low income countries’ development aspirations – those in Asia alone require infrastructure investments of about US$ 1.7 trillion a year to maintain growth, reduce poverty and mitigate climate change.

The pandemic could be a moment of truth for the BRI. China is trying to ensure that the programme – which has driven at least 350 billion dollars in infrastructure loans to poorer nations – isn’t threatened.

Even if attributed to COVID-19, some of these countries’ inability to repay Chinese loans could be seen as legitimising the US’ position that they’re not driven by market principles and merely serve Beijing’s strategic power play. China is anxious to avoid this.

It’s imperative that China’s leaders grasp the economic and political dangers of a developing country debt crisis. This is the moment to prove that recent heavy lending to poorer countries was not motivated by debt trap diplomacy as some claim.

A multilateral solution that works for both borrowers and lenders would be the best way forward. Even so, more should be done by US led institutions as well.

Leave a comment