COVER STORY

SRI LANKAN OF THE YEAR

SRI LANKAN OF THE YEAR

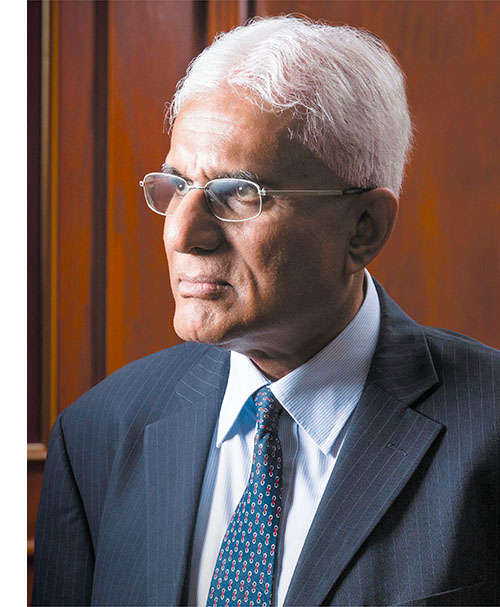

Dr. Indrajit Coomaraswamy

THE PROFESSIONAL

The chief figure of the island’s monetary authority

stands in good stead, with decades of relevant

experience and a steadfast loyalty to the nation

The Central Bank of Sri Lanka (CBSL) has been the subject of increased scrutiny over the last year and more, to a degree unseen in the decades gone by. One can hardly ignore the fact that while the nation’s monetary authority is expected to act independently, politics and mismanagement have weaselled their way into the bank’s modus operandi, with no less than the former governor of the esteemed institution coming under the spotlight for alleged wrongdoing.

This sorry state of affairs led to calls by sections of civil society and the media for the ex-governor to vacate his seat of authority – appeals that inexplicably fell on deaf ears for too long, even as public confidence in the Central Bank and the coalition government was eroding at every turn of the saga that unfolded.

However, the urgency of a plausible solution to the apparent impasse came to the forefront, when the term of Arjuna Mahendran – who took over from his predecessor Nivard Cabraal in January last year – ended on 30 June.

So in July, following high-level discussions between members of the nation’s political top brass and in the face of growing opposition to the reappointment of the incumbent, Dr. Indrajit Coomaraswamy was installed as Sri Lanka’s 14th Governor of the Central Bank.

The appointment led to a collective sigh of relief in media circles, and among businesspeople and many of those who call the shots in political circles these days, because it averted a potential leadership vacuum at CBSL.

In addition, the largely unexpected choice of the then advisor to the President was a welcome move in restoring confidence in the monetary authority, whose image had been tarnished by the allegedly heedless acts of not one but two of its immediate predecessors.

It was a matter of utmost consequence for Sri Lanka’s financial system that confidence be restored in the nation’s highest fiscal authority.

Given his impeccable professional credentials – including a 16-year stint at CBSL and a posting at the Commonwealth Secretariat in London – and a perceptibly apolitical persona, Coomaraswamy was considered a natural fit for the arduous job at hand.

At the time of assuming office, he stated: “The Monetary Law Act established some very specific responsibilities for the Central Bank. And it is up to us to fulfil those responsibilities in a very technocratic, objective and free way.”

Coomaraswamy also acknowledged that “the Central Bank of Sri Lanka is one of the great institutions in this country,” adding that he was “acutely aware that a primary responsibility, arguably the primary responsibility, of the Governor is to uphold its reputation and credibility.”

And a mere five months into his tenure as CBSL’s Governor, all indications are that Coomaraswamy’s appointment has resulted in a welcome change to Sri Lanka’s country image. And this has proven to be so in finance, banking and economic circles.

In fact, on a recent edition of our twice-monthly TV programme Benchmark, the Managing Director of JB Securities Murtaza Jafferjee expressed his view that in terms of monetary policy stability, with the new Central Bank Governor being instated, “confidence will return and we will see a better market next year.”

And if snippets in the press about a rumoured meeting with the nation’s Commander-in-Chief are even half true, right-minded citizens of our precious land will take their hats off – because apparently, the new CBSL Governor said he has been troubled by “some political sections.”

He was told something along these lines, it has been reported: “You hail from a respectable family. I hope you are quite capable of safeguarding the honour of your illustrious family and that of the institution you are in charge of. We are with you… Take decisions without fear.”

If such a one-on-one took place, the CBSL’s incumbent chief must’ve been relieved – for he has stated his firm belief that independence (presumably to a practicable extent) sans politics is essential for him to fulfil his duties as the head of the nation’s monetary authority.

It is for this reason – and dare we say, in the hope that he will continue to inspire his peers and others in positions of high authority to maintain the sense of professionalism, integrity and stability we’ve witnessed thus far – that Dr. Indrajit Coomaraswamy is being conferred LMD’s Sri Lankan Of The Year (SLOTY) award for 2016.

He is LMD’s 22nd SLOTY, and joins a line-up of illustrious men and women who have done the country proud over this magazine’s lifetime.

And it goes without saying that Coomaraswamy epitomises the calibre of public servants that Sri Lanka so desperately needs to take the country forward.

– LMD

WEARING MANY HATS

Dr. Indrajit Coomaraswamy has donned many a cap during what has been

an illustrious career as a highly regarded economist and dashing sportsman

Zulfath Saheed profiles LMD’s 2016 SLOTY

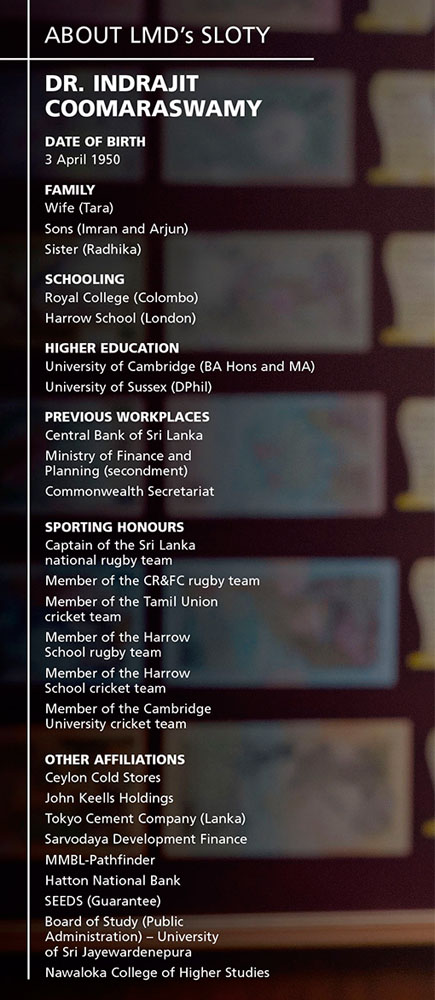

Earlier on in life, having been educated at Royal College, Harrow School, University of Cambridge (BA Hons and MA) and University of Sussex (DPhil), Dr. Indrajit Coomaraswamy gained an enviable reputation in the sporting arena.

He has played rugby football for CR&FC and Sri Lanka, captaining the national side in 1974, as well as cricket for the Tamil Union. Previously, in his college and university years, Coomaraswamy represented Harrow School’s rugby team, and played cricket for both Harrow and Cambridge.

Coomaraswamy’s professional credentials reflect a background as a prominent Sri Lankan economist and former Director Economic Affairs of the Commonwealth Secretariat in London. This included more than a decade at the Central Bank of Sri Lanka (CBSL) – in its Economic Research, Statistics and Bank Supervision Divisions – as well as a stint with the Ministry of Finance and Planning.

Moreover, even prior to his recent appointment as Governor of the Central Bank, Coomaraswamy continued to engage in and offer insights on the economic and political discourse of the country.

CORPORATE RESPONSE The Ceylon Chamber of Commerce – the oldest and arguably the most influential business chamber in Sri Lanka – welcomed Coomaraswamy’s appointment as CBSL’s chief. The corporate body extended its best wishes as he commenced his six-year term, describing Coomaraswamy as “a much-respected economist with a stellar track record both in Sri Lanka and overseas” who is “eminently qualified for this position.”

“He brings to this position a unique mix of skills and perspectives, given his previous positions at the Central Bank, Ministry of Finance and Commonwealth Secretariat, and on the boards of leading corporate entities as well as civil society organisations,” the chamber noted.

Its statement continued: “The new Central Bank Governor is recognised for his ability to communicate complex economic issues to non-expert audiences, distil the effects of international economic events to their relevance for Sri Lanka, and provide an informed perspective of the opportunities and challenges emerging for the Sri Lankan economy.”

“Coomaraswamy’s integrity, international experience and formidable intellect are invaluable, at a time when Sri Lanka seeks to expand its global footprint and is exposed to international capital markets more than ever before,” it added, while affirming that “his appointment will help restore public confidence in the country’s monetary authority.”

ECONOMIC OVERVIEW In an in-depth interview featured in the September edition of LMD, Coomaraswamy offered exclusive unique insights on the state of Sri Lanka’s economic affairs.

ECONOMIC OVERVIEW In an in-depth interview featured in the September edition of LMD, Coomaraswamy offered exclusive unique insights on the state of Sri Lanka’s economic affairs.

Highlighting the priorities that need to be addressed for the country to set out on a sustained and accelerated growth path, he posited that Sri Lanka’s economic imperatives boil down to three needs: “The first is the need for fiscal discipline and consolidation… Second, there is the need to attract foreign direct investment… The third is increasing exports.”

Coomaraswamy also touched on that most contentious topic of maintaining a balance between politics and economics, noting that “it is not possible to eliminate politics from economic decision-making… However in Sri Lanka, as in some other countries, politics has dominated economics.”

“A toxic combination of populist politics and a deeply entrenched entitlement culture has been a major drag on our development prospects. In general, resource allocation has been suboptimal in the post-independence period and as a country we have been living beyond our means. This could have been different if there was a better balance between economics and politics,” he argued at the time.

DEBT DRAWDOWN More recently, he has called for a streamlining of Sri Lanka’s burgeoning debt burden, going as far as to suggest that the estimated US$ 1.3 billion revenue generation from public-partnerships to operate the Hambantota Port and Mattala Airport – in collaboration with Chinese business partners – be utilised to reduce debt and strengthen the nation’s reserves.

Quite rightly, he said that his focus was on easing Sri Lanka’s debt repayment schedule, which has put its coffers under enormous pressure in recent years.

Coomaraswamy has also put a positive spin on the International Monetary Fund’s (IMF) assistance to Sri Lanka – which has come under the spotlight in some quarters, particularly in the wake of the IMF-induced Value Added Tax (VAT) hike – by stating that it has been useful in building international confidence, easing external finances and providing breathing space to revive the national economy.

RELEVANT TRAINING And on 3 November, during his speech at the inauguration of the 28th anniversary Convention of the Association of Professional Bankers – Sri Lanka, Coomaraswamy said he hopes that the recent economic policy statement by the Prime Minister, presentation of the 2017 budget proposals and a successful review by the IMF would recalculate how the private sector will risk its appetite and work with customers to drive the economy to the next level or phase of growth.

For this to happen, he added, the country must align education, training and skills with the needs of emerging dynamic sectors of the economy. “And this requires us to be far more disciplined in order to break the vicious cycle we have had in the past,” he urged.

STATE INTERVENTION Coomaraswamy has been equally candid about the fact that it is important to achieve political consensus on the role of the state in the economy.

STATE INTERVENTION Coomaraswamy has been equally candid about the fact that it is important to achieve political consensus on the role of the state in the economy.

He explained in LMD’s September Cover Story that “there have been some periods in recent history when public sector recruitment has been quite substantial, while in certain other periods, it was completely ceased. During some periods, certain public corporations were privatised; whereas in others, privatised institutions were taken over by the government.”

As for CBSL’s ability to play an independent and transparent role in the country’s economic development, Coomaraswamy noted that “within the Central Bank, we are establishing better systems, and making constant improvements to analytical tools and operations; and from outside the Central Bank, it would be beneficial if fiscal discipline is improved. The dialogue between the Central Bank and the media and general public must also continue, with an increased focus on policies.”

FUTURE OUTLOOK Speaking at a Monetary Policy Review press briefing in September, following the Central Bank’s decision to leave policy rates unchanged, the state-owned Daily News reported the Governor’s affirmation that “this year, Sri Lanka will be able to maintain a growth rate of five percent and this will further increase by next year.”

“If the COPE report finds some fault on the side of the Central Bank, there should be an inquiry; but in my view, it should be an external inquiry. If the Central Bank has done something wrong, it should not be the Central Bank that looks into it; somebody from outside the bank should do it. For that, there must be evidence that the Central Bank has done something wrong,” he reportedly remarked on newsfirst.lk, commenting on investigations pertaining to the bond scandal that has engulfed the Central Bank for well over a year.

Weeks later in early November, Coomaraswamy reiterated his pledge when the Monetary Board met to discuss the on-site report prepared by CBSL. “My understanding of the Monetary Board is that they want to follow the evidence as it comes out, in an objective way,” he said at the time.

Indeed, Coomaraswamy has been able to offer a measured response even in the face of the challenges with which the island’s monetary authority has grappled, both internally and externally.

His professional conduct thus far has been one befitting a dedicated civil servant of the highest quality, and the hope is that aspiring economists and policy experts will follow in his footsteps. He is after all, first among 22 equals in LMD’s hall of fame – this magazine’s 22nd Sri Lankan Of The Year.

Leave a comment