COVID-19 IMPACT

THE GREAT LOCKDOWN

Shiran Fernando reviews the economic forecasts in the light of the pandemic

In its release of the World Economic Outlook for April 2020, the IMF coined the current period the world is facing amid the COVID-19 pandemic as the ‘Great Lockdown.’ Across the world, countries have employed lockdowns to curb the spread of the coronavirus.

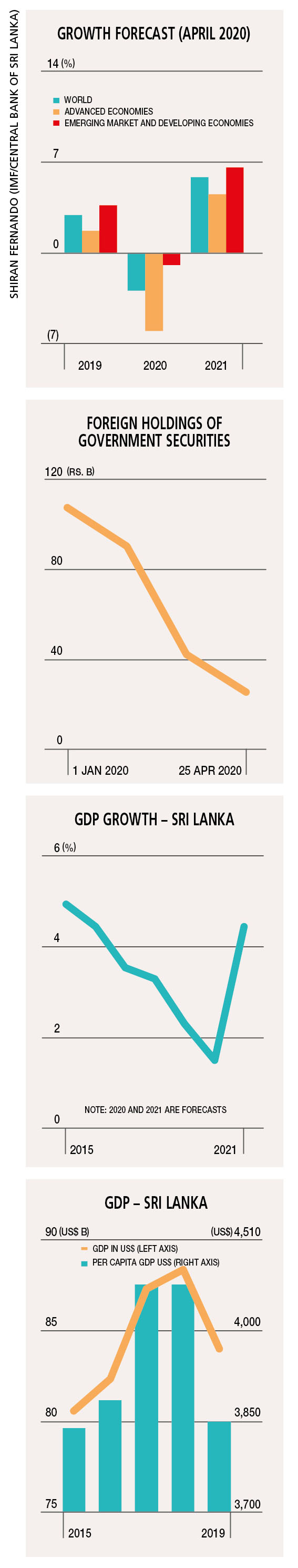

While the focus is on saving lives, the impact on livelihoods is beginning to take a toll. According to the IMF, global GDP growth is expected to decline by three percent in 2020 while the WTO forecasts trade growth to fall by between 13 percent and 30 percent during the year.

In Sri Lanka as well, the impact on working people, low income families and businesses is significant. It is estimated that the country has about 1.9 million daily wage earners. The lockdown or curfew has no doubt led to a loss of incomes and this will have a ripple impact on the demand side of the economy.

ECONOMIC IMPACT The impact for Sri Lanka is even more severe given the weak and fragile macroeconomic situation the country was in before COVID-19.

Year 2020 was expected to be one where post-election, major reforms would be prioritised and implemented to bring about macro stability. This has changed completely; and 2020 could be another year that will be written off in terms of economic development.

In 2019, Sri La nka’s economy grew by only 2.3 percent due to the impact of the Easter Sunday attacks. The slowdown in growth has also meant that the economy shrank from US$ 88.4 billion to 84 billion dollars last year.

nka’s economy grew by only 2.3 percent due to the impact of the Easter Sunday attacks. The slowdown in growth has also meant that the economy shrank from US$ 88.4 billion to 84 billion dollars last year.

In per capita GDP, Sri Lanka has fallen below 2016 levels with a decline from US$ 4,079 in 2018 to 3,852 dollars last year. Worse still, growth projections for 2020 are bleak with a recession anticipated by some forecasters.

The IMF expects the Sri Lankan economy to contract by 0.5 percent this year while the World Bank forecasts growth to be between 0.5 percent and a three percent contraction. In its Annual Report for 2020, the Central Bank of Sri Lanka states that its expectation is for growth to register 1.5 percent.

While it is too early to capture the impact of COVID-19 on the economy, there’s an expectation that it will head into a recession in 2020 with the potential for recovery the following year if appropriate stimulus measures are implemented.

RATING DOWNGRADE The fragile macro fundamentals have caused rating agencies to view Sri Lanka’s creditworthiness in a negative light. Fitch Ratings downgraded Sri Lanka by one notch citing the stress the economy would face in terms of external debt risks due to the impact of COVID-19.

Debt servicing is at a point where there’s likely to be a decline in dollar inflows due to the impact on tourism, key exports such as apparel and worker remittance inflows.

Sri Lanka will also find it difficult to access international capital markets this year given the high premium demanded at this point in time; it will therefore, have to resort to bilateral loans, currency swaps and debt moratoriums.

A potential programme with the IMF or facility under its Rapid Financing Instrument will provide the country with some leeway in navigating the uncertain external environment.

Moody’s Investors Service also signalled that the COVID-19 pandemic would further stress government liquidity and external risks amid a widening budget deficit. It has placed Sri Lanka’s sovereign credit rating under review.

POSITIVE IMPACT The positive impact of the present situation is the steep fall in oil prices. West Texas intermediate (WTI), which is a US benchmark, fell below zero for a short period due to excess supply in the market and a lack of storage for produced oil. The Brent oil price – a benchmark more relevant to countries such as Sri Lanka – has declined by more than 50 percent during the year so far.

This would provide Sri Lanka with relief of between US$ 1.5 and 2 billion in 2020 should low price levels persist. The negative side of oil prices being low refers to the impact of remittances given that more than half of the inflows are from oil exporting countries in the Middle East.

Sri Lanka also witnessed sharp foreign outflows from its local bond market. There has been a decline of over Rs. 83 billion in foreign holdings of local bonds, bringing the outstanding amount to less than 25 billion rupees by the fourth week of April. Presently, there’s limited downside risk of further outflows given the outstanding amount. This would limit the pressure on the currency as well with limited outflows expected.

Beyond Sri Lanka, the prevailing pandemic requires a global effort to curb the rate of infection, collaboration on trade and services, and in the development of a vaccine. The lack of a coordinated and united global response to the pandemic could have negative implications for economic recovery in countries such as Sri Lanka that have major export, remittance and service linkages.