CORPORATE SECTOR

Compiled by Shirley Candappa

BURNING QUESTIONS GALORE!

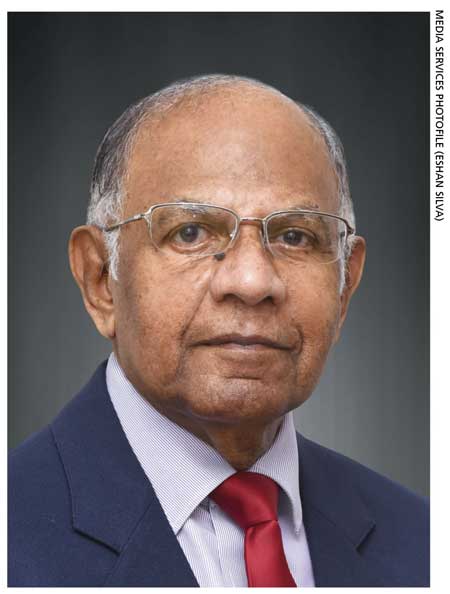

Lal Saranapala laments the perilous state of a crisis ridden SME sector

Q: As a result of the economic crisis here in Sri Lanka, inflation has been rising rapidly until recently. From a businessperson’s point of view, what are the most important steps that must be taken to manage this phenomenon?

A: We must first understand why our country faced galloping inflation. One of the main reasons for this is the fact that we invested in unplanned development projects without taking into consideration potential returns on investment (ROI).

An example of such shortsighted policy actions was the construction of the international airport in Mattala, in the vicinity of Hambantota, at a cost of almost Rs. 37 billion. This investment hardly provided a return on the money spent on it.

Though the expected annual passenger capacity of the Mattala Rajapaksa International Airport (MRIA) is one million, a mere 91,747 passengers arrived at the airport in the five years up to December last year – and only 2,396 flights used the airport during this period.

Instead of an airport, we should have invested the money spent on MRIA to develop products and services for export to earn much needed foreign currency. Even with a low crop yield for example, Sri Lanka earned US$ 882 million from tea exports in the first eight months of 2022.

Furthermore, we should have used our resources to develop the plantations, as well as help local farmers to increase the production of vegetables, rice and other food crops, rather than depending on the importation of these essential produce.

Q: Since imports have been greatly reduced, small and medium enterprises (SMEs) are struggling due to the scarcity of goods and raw materials. In your assessment, what steps need to be taken to redress this situation?

A: Imports were greatly reduced because Sri Lanka faced a severe shortage of foreign exchange. The government should permit the import of raw materials and necessary spares to keep these SMEs functioning and in business.

Data from the IFC affirms that SMEs account for a large share of Sri Lanka’s economy – in fact, the International Finance Corporation notes that over one million small and medium enterprises accounted for approximately 75 percent of all businesses in the country.

These organisations operate in all sectors of the economy and the IFC estimates that they account for about 45 percent of Sri Lanka’s employment.

Q: Sri Lanka is struggling to extricate itself from the economic crisis. What role do you envision for the corporate sector in supporting a recovery at this time?

A: For Sri Lanka to recover from the economic crisis, the corporate sector will have to increase exports to earn more foreign exchange. And to reach this level of exports, we will need a massive injection of capital, which the country does not have at the moment.

The government should offer the corporate sector lines of credit, as well as incentives such as tax concessions and exemptions on raw materials that are needed for the expansion of export oriented industries in the island.

Q: Do you believe that increasing taxes alone will be sufficient to get the national economy back on track?

A: Sri Lanka has one of the lowest tax to GDP ratios in the world, which hovers at around the eight percent mark. Instead of bringing government expenditure in line with revenue collection, our politicians have preferred to subsidise products and borrowed heavily as a result.

However, increasing taxes alone will not help get Sri Lanka’s economy back on track. Rather, the country needs to offer incentives to exporters to increase exports and earn more hard currency.

Q: Could you outline the main challenge faced by various industries and sectors in the present environment? And what steps would you suggest the government take to revive businesses that are struggling against this backdrop?

A: The main challenge faced by industries and sectors at the moment is the difficulty of importing raw materials and spare parts. To address this, the government should ban the import of finished products, and encourage industries and sectors to produce locally wherever possible.

Q: In a rapidly evolving global landscape, industrialists face fresh challenges and need urgent solutions. How can the banking sector help industrialists to keep pace with demand, in your view?

A: The banking sector can help businesses by reducing interest rates and supporting exporters in keeping pace with the market demand so as to maintain their competitiveness.

Q: What recommendations would you make to overcome the prevailing macroeconomic challenges facing the country in a bid to revive the national economy?

A: Underinvestment in infrastructure, the nationalisation of industries and a paternalistic bureaucracy have resulted in excessive government centralisation, and control over the commanding heights of the national economy.

These factors in turn have undermined economic growth. To meet the prevailing economic challenges, we need to devise ways and means to produce goods and services at reasonable prices to compete in the world market. In addition to this, we need to emphasise the importance of manufacturing high quality products.